You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Do not have statistics yet, but when those fire show amaizing results and end up usually with an opposit pattern as I have seen so far. Paulselvan might give more insight, he has very good eyes for the dragons as I have seen his dragons so far.

Till then check this reference out:

The Dragon Pattern Forex Trading System - Forex Strategies - Forex Resources - Forex Trading-free forex trading signals and FX Forecast

I am hunting dragons on the back line so far, never tried other levels....chin, and the developing pattern BAMM could be other attractive options.

The bullish bats are very likely there on this pair.I've never read any clear explanation about the dragon pattern before. As the author mentions it's based on structure I guess. Jason Stapleton uses a similar pattern called "2-618". I will more attention to the dragon pattern.

Geonai, not clear what you want to do on this pair and when.

This is what I see and how I intrpret it:

Correction is possible but HTF and current TF trend are nicely up, neither I see an expressed supply zone in this area.

Chart AUDUSD, D1, 2014.04.06 22:29 UTC, HF Markets Ltd, MetaTrader 4, Demo - MetaTrader Trading Platform Screenshots

Sorry mistake and correction, B is not reaching 38,2 ret of XA, that is true I do not see it in the spec as a requirement for a shark.

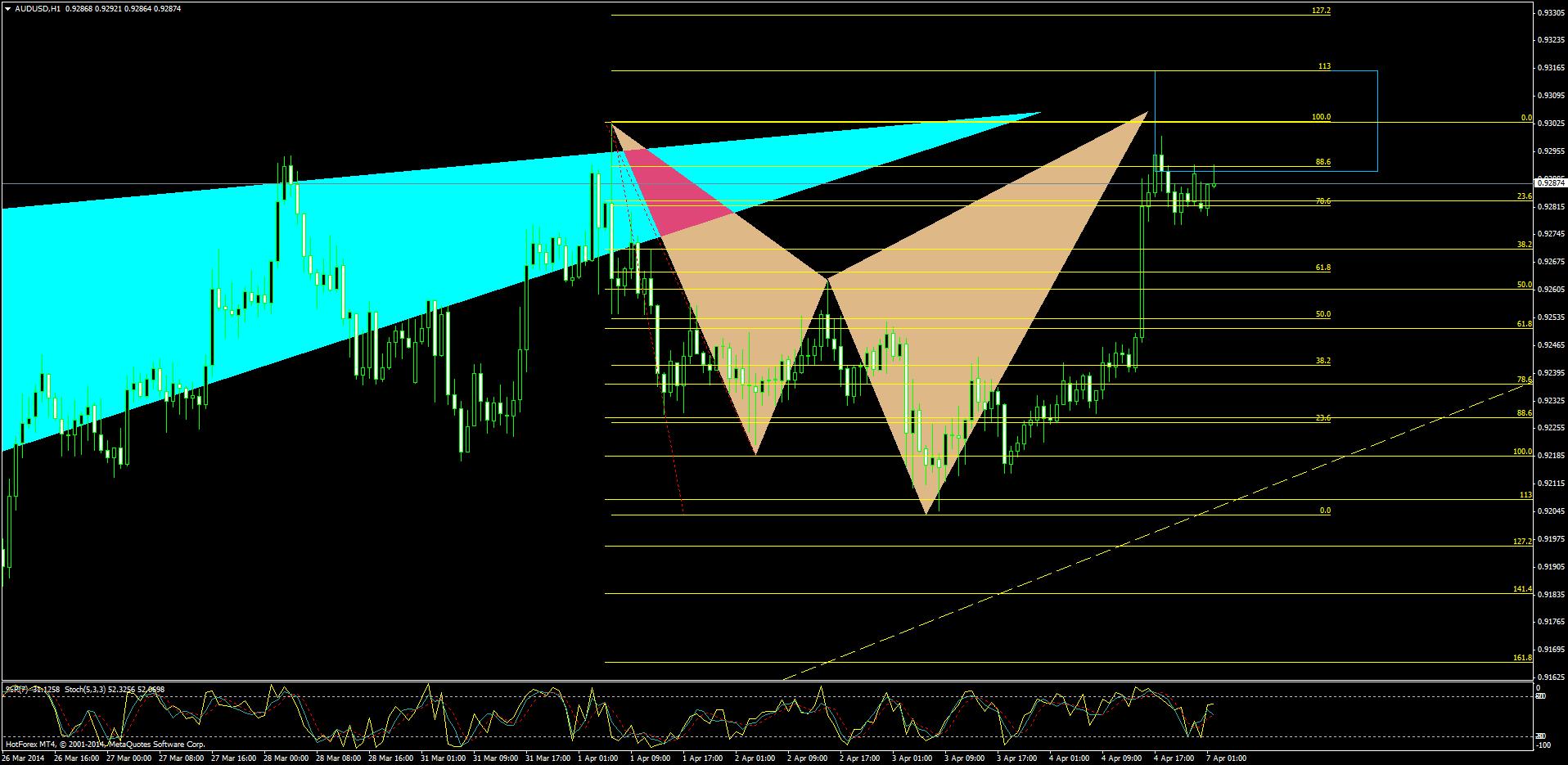

The small one in the corner, no doubt current bear shark on H1:

Chart AUDUSD, H1, 2014.04.06 23:33 UTC, HF Markets Ltd, MetaTrader 4, Demo - MetaTrader Trading Platform ScreenshotsSeems like the shark on H1 you found worked out. Did you trade it?

Lobo, take a look at CADJPY and find two bullish dragons.

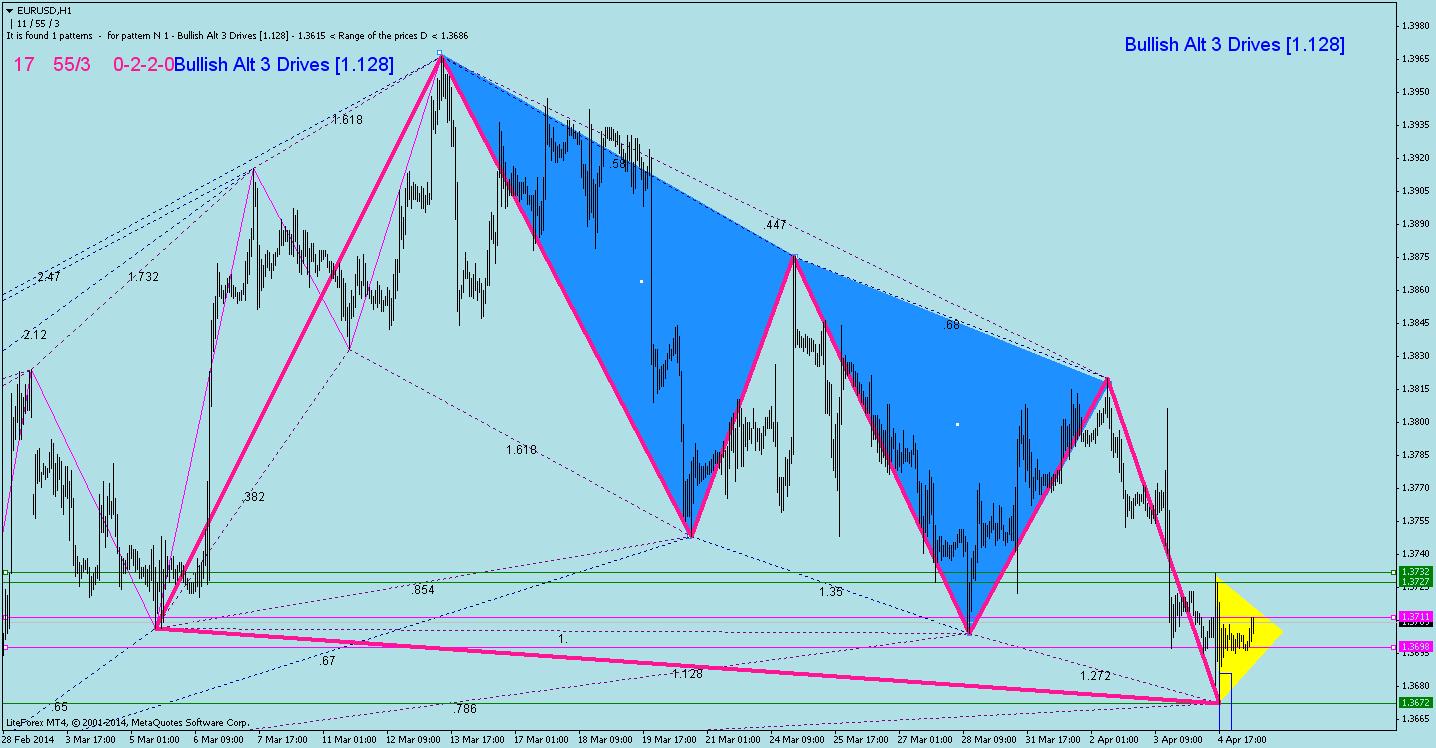

EU Н1-Н4 3 drives + D1-H4 IBHi poruchik, it worked very nicely, thanks.

Concerning the post and the graph:

What does IB mean?

I do not think I have seen before the "range of the prices G xxxx" message in the left top corner, what setting is it in the indi

Did you draw the yellow triangle or is it indi? If indicator, what setting is it?

Same questions for the horizontal lines (green and purple around the PRZ)

Thanks.

Rules are written on the page of Alfonso.... "in a nutshell"

1st page is the homework...takes a while.

I cannot say more than that, definitely nothing shorter. By applying (trying to) apply those rules I pick the zones.How long have you used the method? ans how has it worked for you? If you combine the method with harmonic patterns, please explain why do you combine those.

haven't posted in awhile,

since I am not using harmonics anymore, I use S&D with PA, still noticing patterns and drawing fibs just because it's addicting but no entries based on that.

I entered this short 4h GBPCHF around market open saw the engulfing candle from last friday

if you want harmonics then you can see big bat pattern on H4, and butterfly on the H1

my final target is 1.45

How long have you used the method? ans how has it worked for you? If you combine the method with harmonic patterns, please explain why do you combine those.

I first came across the method around Nov 2013. Ever since learning and applying.

Some say it can be applied with no additional confirmation, but I need confidence in it which I do not yet have, however obviously working.

Alfonso started out with set and forget, i.e.

1. take HTF trend and draw trend lines (by the rule book from the page)

2. Identify HTF Sup/Dem zones and the price % in between those

- trade in the direction of HTF trend

- do not trade when close to opposit zone (might consider counter trend in the opposing zone if your plan allows), but wait either to pull back to prev zone, or break through that to trend trade)

- Take only zones where RR>2 preferably 3

3. When HTF is trending and above TL there is a LTF zone trade it if

- RR>2 or 3

- it is original

- it is fresh

This is the nutshell within the nutshell, do not ask from me neither shorter, nor more I will not be able to comply

I will not be able to comply  as you know by now.

as you know by now.

This complements very well with the methods you are and were using, similar to sup/res and THV kinda.

I guess one has to decide which one is the primary setup, and which one is the confirmation one.

Sup/Dem people claim you do not need any other stuff besides sup/dem

HP people were always using Sup/Res, oscillators and other confluences...this is why I picked this method with HPs.

But I dunno yet.

What do you think?

Lobo, I meant how YOU indentified those. WHY did YOU consider those zones as supply? What is your rule?

Rules are written on the page of Alfonso.... "in a nutshell" .

.

1st page is the homework...takes a while.

I cannot say more than that, definitely nothing shorter. By applying (trying to) apply those rules I pick the zones.

Looked up some other sites in this topic, some of those you might already know:

Sam Seiden | FXStreet

Ratios & Harmonics: a Different Way to Trade @ Forex Factory

Trading Articles

21pips.com | Forex, the bouncing zones 1

Looks like an obvious topic, still very extensive, so no way I try to describe it briefly as a student . Sorry for that.

. Sorry for that.

if you want a bit different view, practice your English and smile on expressions here is one more :

:

https://www.youtube.com/channel/UCg0eWnYo-Wh50Z_3uZDOhZw/videos

I first came across the method around Nov 2013. Ever since learning and applying.

Some say it can be applied with no additional confirmation, but I need confidence in it which I do not yet have, however obviously working.

Alfonso started out with set and forget, i.e.

1. take HTF trend and draw trend lines (by the rule book from the page)

2. Identify HTF Sup/Dem zones and the price % in between those

- trade in the direction of HTF trend

- do not trade when close to opposit zone (might consider counter trend in the opposing zone if your plan allows), but wait either to pull back to prev zone, or break through that to trend trade)

- Take only zones where RR>2 preferably 3

3. When HTF is trending and above TL there is a LTF zone trade it if

- RR>2 or 3

- it is original

- it is fresh

This is the nutshell within the nutshell, do not ask from me neither shorter, nor more I will not be able to comply

I will not be able to comply  as you know by now.

as you know by now.

This complements very well with the methods you are and were using, similar to sup/res and THV kinda.

I guess one has to decide which one is the primary setup, and which one is the confirmation one.

Sup/Dem people claim you do not need any other stuff besides sup/dem

HP people were always using Sup/Res, oscillators and other confluences...this is why I picked this method with HPs.

But I dunno yet.

What do you think?the pros Alfonso has good rules for using supply and demand,but the cons is he adding too many pips to the risk which so many of his trades become 1:2 - 1:3 sometimes he just need to skip a trade because he added 25 pips to the stoploss. also he skip so many good trades because a zone has been "tested" once,

sometimes that's what happened, price is manipulated and a zpne need to be tested more than once to shake all retailers that got good entries and took position into B/E.

anyway, that's how he sees the market and if it's working for him that's good enough.

I've never read any clear explanation about the dragon pattern before. As the author mentions it's based on structure I guess. Jason Stapleton uses a similar pattern called "2-618". I will more attention to the dragon pattern.

I managed to catch some which are really amazing. Most often though I catch them late, that is why I suggested to ask Paulselvan who really seem to have very good eyes for these.

My view: it would be called as an agressive C if it was within the 88.6 C limit, or as you mention, the 2618 of Jason if it was rather the real dragon near a W or M (DT/DB) configuration.