You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

China's net forex purchases slow in February (based on marketwatch article)

China's central bank and financial institutions bought a net 128.25 billion yuan ($20.75 billion) of foreign currency in February, compared with a net purchase of CNY437.37 billion in January, according to calculations by Dow Jones based on central bank data issued late Monday.

February was the seventh-straight month of net purchases, suggesting continuing capital inflows into the country.

The banking system's foreign-currency purchase position totaled CNY29.20 trillion at the end of February--slightly higher than CNY29.07 trillion at the end of January, People's Bank of China data showed.

The data include purchases and sales by commercial banks and other financial institutions, but mostly reflect transactions by the central bank.

Most analysts view the figures as a proxy for inflows and outflows of foreign capital as most foreign currency entering the country is generally sold to the central bank.

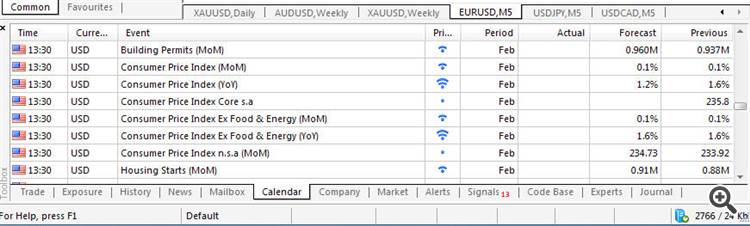

Trading the News: U.S. Consumer Price Index (based on dailyfx article)

A slowdown in the headline reading for U.S. inflation may prompt further declines in the dollar as it dampens the interest rate outlook for the world’s largest economy

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) is widely expected to discuss another $10B taper in March, the central bank remains poised to introduce a ‘qualitative approach’ for monetary policy, and a dovish twist to the forward-guidance may heighten the bearish sentiment surrounding the reserve currency as Fed Chair Janet Yellen remains reluctant to halt the zero-interest rate policy (ZIRP).

However, U.S. firms may raise consumer prices amid the pickup in wage growth along with the resilience in private sector spending, and a stronger-than-expected inflation print may generate a near-term bounce in the greenback as it puts increased pressure on the Fed to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: Consumer Prices Slow to 1.2% or Lower

- Need to see green, five-minute candle following the release to consider a short dollar trade

- If market reaction favors a long EURUSD position, sell pair with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable objective

Bullish USD Trade: Inflation Beats Market Forecast- Need red, five-minute candle to favor a long dollar trade

- Implement same setup as the bearish USD trade, just in reverse

Potential Price Targets For The ReleaseEURUSD M5 : 22 pips price movement by USD - CPI news event :

2013-03-18 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

if actual > forecast = good for currency (for EUR in our case)

==========

German ZEW Economic Confidence Weakens Sharply

Economic expectations for Germany worsened in March burdened by Crimea crisis, survey data from the Centre for European Economic Research/ZEW revealed on Tuesday.

The economic confidence index dropped more-than-expected to 46.6 in March from 55.7 in February. The score was forecast to fall to 52.

Meanwhile, experts' assessment of the current economic situation improved to 51.3 points from 50 a month ago. Nonetheless, it stayed below the expected level of 52.

Economic expectations for the Eurozone declined by 7 points to 61.5 threshold. By contrast, the indicator for the current economic situation gained 3.5 points to minus 36.7 points in March.

2013-03-18 12:30 GMT (or 13:30 MQ MT5 time) | [CAD - Manufacturing Sales]

if actual > forecast = good for currency (for CAD in our case)

==========

USD/CAD extends slide after strong manufacturing sales

The Canadian dollar continues recovering, and this time it got a boost from a stronger than expected rise in manufacturing sales for January, despite a downwards revision for December. Sales advanced by 1.5%, better than 0.6% expected. However, this came on top of a bigger drop of 1.5% in December, worse than 0.9% originally reported.

U.S. Stocks Rise on Housing Data, Putin Crimea Comments

“We’ve got a more congenial Russian message this morning and we got better economic reports here in the States,” John Augustine, chief market strategist at Cincinnati-based Fifth Third Bancorp, said in a phone interview. His firm oversees $28.2 billion. “The building permits report was very bullish for the spring and summer housing season. Today, we move back to better economic reports and focusing on the Fed.”

The S&P 500 rallied 1 percent yesterday for its biggest increase in almost two weeks as a measure of industrial production grew more than forecast. The gauge dropped 2 percent last week, the most since January, amid mounting tension in Ukraine and signs of an economic slowdown in China.

EURUSD Technical Analysis (based on dailyfx article)

Trading the News: U.K. Jobless Claims Change (based on dailyfx article)

- U.K. Jobless Claims to Contract for Sixteen-Consecutive Month

- ILO Unemployment Rate to Hold at 7.2% for Second Month

Another 25.0K decline in U.K. Jobless Claims may prompt a meaningful rebound in the GBPUSD as it raises the Bank of England’s (BoE) scope to normalize monetary policy sooner rather than later.Why Is This Event Important:

However, the BoE Minutes may limit the market reaction should the central bank shift its tone for monetary policy, and the British Pound may face a larger correction over the near-term if the developments coming out of the U.K. drag on interest rate expectations.

How To Trade This Event Risk

Bullish GBP Trade: Jobless Claims Decline 25.0K+, Unemployment Falls Back to 7.1%

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors buying sterling, long GBPUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: U.K. Job Growth DisappointsPotential Price Targets For The Rate Decision

GBPUSD M5 : 100 pips price movement by GBP - Claimant Count Change news event :

2013-03-18 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Trade Balance]

if actual > forecast = good for currency (for JPY in our case)

==========

Japan Trade Deficit Y800.3 Billion

Japan posted a merchandise trade deficit of 800.309 billion yen in February, the Ministry of Finance said on Wednesday - sliding into the red for the 19th consecutive month.

The headline figure missed forecasts for a shortfall of 600.9 billion yen following the downwardly revised record deficit of 2,791.7 billion yen in January (originally 2,789.97 billion yen).

Exports were up 9.8 percent on year - also shy of expectations for 12.5 percent following the 9.5 percent increase in the previous month.

Exports to China surged 27.7 percent on year to 1,074.853billion yen, while exports to all of Asia were up 12.5 percent on year to 3,102.072billion yen.

Exports to the United States added 5.6 percent on year to 1,063.575 billion yen, while exports to the European Union climbed an annual 13.9 percent to 609.548 billion yen.

Imports added an annual 9.0 percent versus forecasts for 7.2 percent following the 25.1 percent spike a month earlier.

Imports from Asia gained 772 percent on year to 2,749.544 billion yen, while imports from China alone collected an annual 5.72 percent to 1,185.620 billion yen.

Imports from the United States jumped 20.8 percent on year to 579.923 billion yen, while imports from the European Union jumped 15.4 percent to 646.886 billion yen.

The adjusted trade balance registered a deficit of 1,133.2 billion yen, missing forecasts for a shortfall of 907 billion yen following the upwardly revised 1,763 billion yen deficit in January (originally 1,818.8 billion yen).

EURUSD Fundamentals 19.03.2014 (based on dailyfx article)

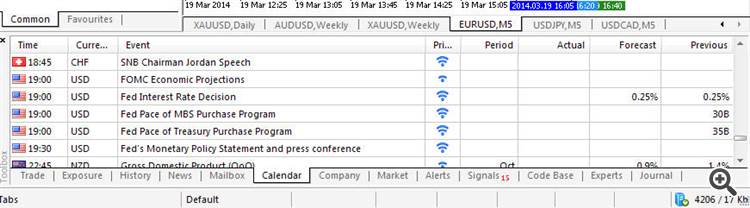

Trading the News: Federal Open Market Committee Meeting

Indeed, the Federal Open Market Committee (FOMC) is widely anticipated to reduce its asset-purchase by another $10B in March, but the market reaction may not be as clear cut as the previous rate decisions as market participants expect a material shift in the policy outlook.

Why Is This Event Important:

Indeed, a growing number of Fed officials have highlight a new ‘qualitative’ approach for monetary as the jobless rate approaches the 6.5% threshold for unemployment, while a dovish twist to the central bank’s forward guidance may heighten the bearish sentiment surrounding the greenback as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: FOMC Cuts Another $10B & Sees Greater Scope to Normalize

Bearish USD Trade: Fed Implements Dovish Twist to Forward Guidance

XAUUSD M5 : 1953 pips price movement by USD - Federal Funds Rate news event :

AUDUSD by USD - Federal Funds Rate news event :

EURUSD by USD - Federal Funds Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video June 2013

newdigital, 2013.06.20 00:12

What is FOMC Meeting

Stocks were mixed in early trading Wednesday ahead of the outcome of the Federal Reserve's first policy meeting under its new chief.

The Dow Jones industrial average was up 0.1% to 16,354 and the Standard & Poor's 500 index gained 0.1% to 1,874. The S&P 500 is inching back up toward its record high close of 1878.04. The Nasdaq composite index dropped 0.1% to 4,331.

The U.S. Federal Reserve is scheduled to issue a statement at 2 p.m. ET Wednesday and hold a press conference after the end of its two-day policy meeting. It is the central bank's first policy meeting since Janet Yellen replaced Ben Bernanke as chair.

Most analysts expect the Fed to continue to reduce its monetary stimulus at the speed it has already set, trimming its monthly bond purchases by another $10 billion. It is also expected to revise its economic forecasts.

Wall Street will also be closely watching to see if the Yellen-led Fed adjusts its "forward guidance" as it relates to when it will start hiking short-term interest rates, which are currently targeted around 0%.

The Fed had been using a 6.5% unemployment rate as its 'threshold" to start the process, or at least kick off the debate, about raising rates. However, with the jobless rate now at 6.7% and the rate itself viewed as a flawed measure of the actual health of the job market, the Fed is expected to start phasing out the numerical threshold.

"Forward guidance will be the most closely watched aspect of the meeting," says market strategist Andrew Busch of The Busch Update.