You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Technical Targets for AUD/USD by United Overseas Bank (based on the article)

AUD/USD: intra-day bullish ranging near bearish reversal

H4 price is located near and above 200 period SMA (200 SMA) for the bullish ranging near bearish reversal. The price is on ranging within the following key s/r levels:

United Overseas Bank is considering AUD/USD price to be on ranging market condition:

"While shorter-term downward momentum has improved somewhat, it is premature to expect a sustained down-move in AUD. The neutral phase that started 2 days ago is still clearly intact and we continue to expect AUD to trade within a broad 0.7260/0.7460 range for now."

GBP/USD Intra-Day Fundamentals: U.K. Jobless Claims and 34 pips price movement

2016-06-15 08:30 GMT | [GBP - Claimant Count Change]

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Claimant Count Change] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

==========

GBP/USD M5: 34 pips price movement by U.K. Jobless Claims news event

Pay Attention to These Words and Dots: Fed Decision (based on the article)

Labor Market vs. Growth"...labor market conditions have improved further even as growth in economic activity appears to have slowed." -- April 27 FOMC statement

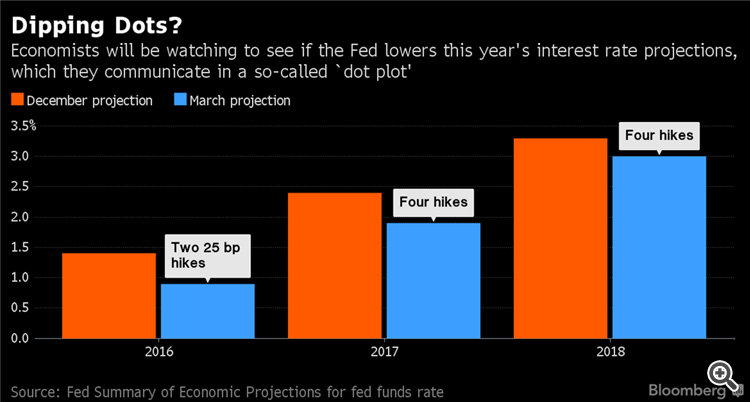

The Dots"The Fed’s so-called “dot plot,” released alongside the statement with quarterly economic forecasts, shows the pace of interest-rate increases that central bank officials expect will be warranted. In March, the median projection fell to two quarter-point hikes this year, versus a prior expectation for four."

Brexit Outlook"The Committee continues to closely monitor inflation indicators and global economic and financial developments." -- April 27 statement

Inflation Expectations

"Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months." -- April 27 statement

Actual Inflation

"Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further." -- April 27 statement

USD/CAD Intra-Day Fundamentals: Canada's Manufacturing Shipments and 18 pips range price movement

2016-06-15 12:30 GMT | [CAD - Manufacturing Sales]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Manufacturing Sales] = Change in the total value of sales made by manufacturers.

==========

==========

USD/CAD M5: 18 pips range price movement by Canada's Manufacturing Shipments news event

Trading News Events: Federal Open Market Committee Interest Rate Decision (adapted from the article)

===

EURUSD D1: secondary correction to the possible ranging bearish reversal. The daily price is located above 200 SMA for the bullish market condition: the price is breaking 100 SMA together with 61.8% Fibo support level at 1.1203 to below to be reversed from the primary bullish to the ranging market condition. The bearish reversal level is 1.1070 located near 200 SMA so if the price breaks this level to below - the bearish reversal will be started. Alternative, if the price breaks 1.1415 resistance to above so the bullish trend will be resumed.

Anyway, the RSI indicator is estimating the secondary correction to be continuing for the price to the ranging zone.

U.S. Commercial Crude Oil Inventories news event: intra-day ranging bullish within 100 SMA/200 SMA reversal area

2016-06-15 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.9 million barrels from the previous week."

==========

Crude Oil M5: ranging bullish. The price broke 100 SMA/200 SMA area to above to be reversed to the primary bullish market condition. The price was bounced from Fibo resistance at 49.64 for the ranging to eb started within the following support/resistance levels:

Crude Oil H4: ranging within narrow 100 SMA/200 SMA levels. The price is located within 100 SMA/200 SMA area and near above 200 SMA for the ranging bullish market condition.

If the price breaks Tuesday high at 50.02 to above so the bullish trend for intra-day price movement will be resumed.

If the price breaks 48.80 support level to below so the reversal of the price movement to the primary bearish condition will be started.

If not so the price will be moved within the channel for ranging.

EUR/USD Intra-Day Fundamentals: Federal Funds Rate and 33 pips range price movement

2016-06-15 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EUR/USD M5: 33 pips range price movement by Federal Funds Rate news event

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 57 pips range price movement

2016-06-16 01:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

==========

AUD/USD M5: 57 pips range price movement by Australian Employment Change news event

Traders are left to wonder how many times the Fed may hike rates in 2016, if at all (adapted from the article)

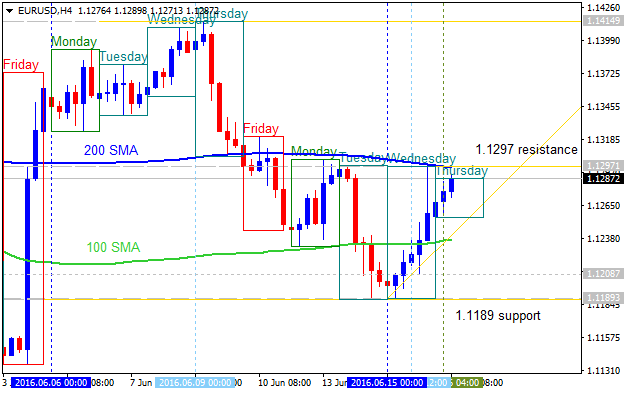

From the technical points of view - the EUR/USD H4 price was bounced from 1.1189 bearish support level by 100 SMA level breaking to above: the price is testing Tuesday's high at 1.1297 to be reversed to the bullish market condition.

If the price breaks 1.1297 resistance on close H4 bar so the reversal of the intra-day price movement from the bearish to the primary bullish market condition will be started.

if the price breaks 1.1189 support to below so the primary bearish trend will be resumed.

If not so the price will be ranging within 100 SMA/200 SMA ranging reversal area for direction.

"The U.S. Consumer Price Index (CPI) increased an annualized 1.1% in April following the 0.9% expansion the month prior, while the core rate of inflation narrowed to 2.1% from 2.2% during the same period. A deeper look at the report showed transportation costs climbing another 0.7% on the back of higher energy prices, which was accompanied by a 0.2% rise in food costs, while prices for apparel slipped 0.3% in April. The U.S. dollar struggled to hold its ground following the slowdown in core inflation, with EUR/USD bouncing back from the 1.1300 handle to end the day at 1.1309."

What’s Expected:

EUR/USD H4: bearish ranging near bullish reversal. The H4 price is located inside Ichimoku cloud for the ranging market condition waiting for the direction of the trend to be established. Ascending triangle pattern was formed by the price to be crossed to above for the possible bullish reversal, and Absolute Strength indicator together with Trend Strength indicator are estimating the possible bullish trend to be started in the near future.

If H4 price breaks 1.1298 resistance level to above so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started: the price will cross uppper Senkou Span line to below.

If H4 price breaks 1.1188 support level to below so the primary bearish trend will be resumed.

If not so the price will be on bearish ranging condition.