EURUSD Technical Analysis 2016, 06.11 - 13.11: bear market rally to the bullish reversal or to the bearish retracement

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.05 11:16

Weekly EUR/USD Outlook: 2016, November 06 - November 13 (based on the article)

EUR/USD managed to recover as November began. Updated EU forecasts and some German data stand out, as Americans go to the polls. Volatility is going to be high. Here is an outlook for the highlights of this week.

- Eurogroup meetings: Monday, with the wider Ecofin on Tuesday. European finance ministers convene to discuss business. Comments come out throughout the day.

- German Factory Orders: Monday, 7:00. A rise of 0.2% is on the cards.

- Retail PMI: Monday, 9:10. A similar figure is likely now.

- Sentix Investor Confidence: Monday, 9:30. A tick up to 8.7 is on the cards.

- Retail Sales: Monday, 10:00. A slide of 0.3% is expected.

- US elections: Tuesday, with the first results coming on Wednesday at 00:00 GMT and into the early hours of the morning. Markets usually prefer Republican pro-business, pro-market presidents, but Donald Trump is a different kind of candidate. The self-proclaimed billionaire is seen as extremely erratic and anti-trade. His rival, Hillary Clinton, is unexciting but cannot be characterized as anti-market per-se. Fear of a Trump victory hurt the US dollar while better chances for a Clinton victory helped the greenback. The race has tightened recently, pushing the dollar lower against the euro, but the euro is not a classic safe-haven currency, therefore it could join commodity currencies in losing and not the yen in winning upon a Trump victory. A Clinton victory is not fully priced in, but the reaction will not be as strong as a Trump victory.

- German Industrial Production: Tuesday, 7:00. A slide of 0.4% is predicted.

- German Trade Balance: Tuesday, 7:00. A wider surplus of 23.4 billion euros is on the cards.

- French Trade Balance: Tuesday, 7:45. Contrary to Germany, France has a deficit. A more narrow deficit of 4.1 billion euros is projected.

- EU Economic Forecasts: Wednesday, 10:00. The European Commission releases updated forecasts three times a year.

- French Industrial Production: Thursday, 7:45. A correction could come now but economists expect +0.3%.

- German inflation data: Friday, 7:00. The Wholesale Price Index (WPI) is expected to rise by 0.2% after 0.4% last time.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.06 08:21

Week Ahead On Wall Street: Markets Brace For Election Results (based on Forbes article)

Monday

"British lawmakers will debate the implications of Brexit, after the High Court said that Parliament must give its approval before the country can move forward with its split from the European Union."

Tuesday

"It’s election day. Billionaire Elon Musk has begun campaigning for the merger of SolarCity and Tesla and last week promised that the tie-up would yield big financial benefits for Tesla investors."

Wednesday

"Goldman Sachs is expected to announce which of its top employees have achieved partner status. It does this every two years and in 2014 named 78 people to the position. The partnership ranks are tough to break into and represent fewer than 2% of the firm’s workers."

Thursday

"Starbucks CEO Howard Schultz, activist investor Bill Ackman, Goldman Sachs CEO Llyod Blankfein and others will speak at The New York Times’ Dealbook conference."

Friday

"Bond markets are closed for Veteran’s Day. The stock market will keep its normal hours."

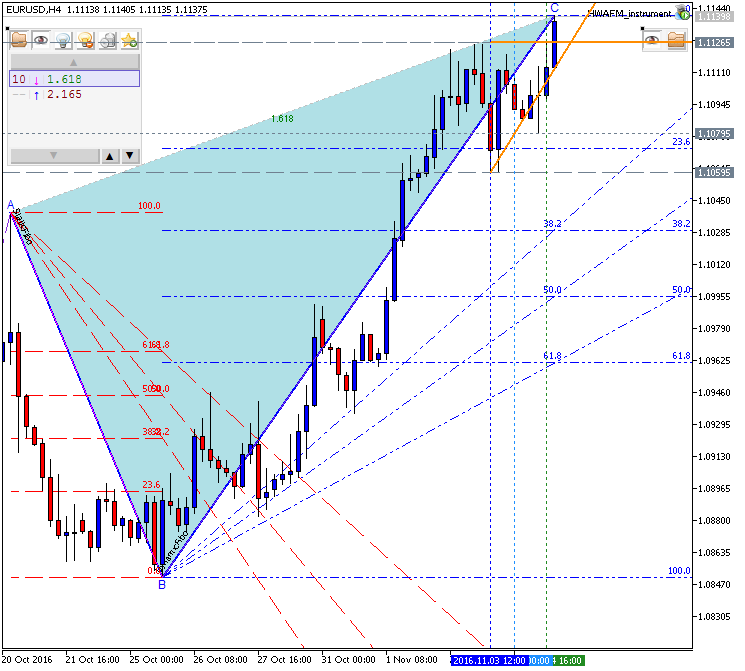

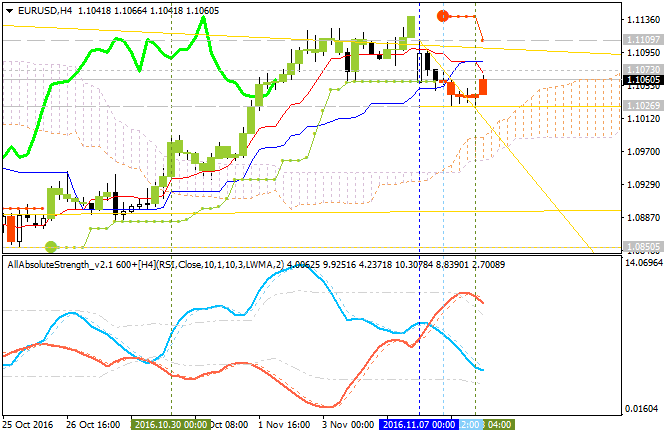

The some interesting situation is going on for H1 timeframe. As we know, the this "something" is always started from lower timeframe to the higher ones so please find the explanation on the charts below:

And if we look at H4 timeframe so we can see that Chinkou Span line of Ichimoku indicator is ready to go everywhere: on breakout or breakdown. It means: we can expect big price movement to the any direction today:

Market is waiting for direction of the good price movement.

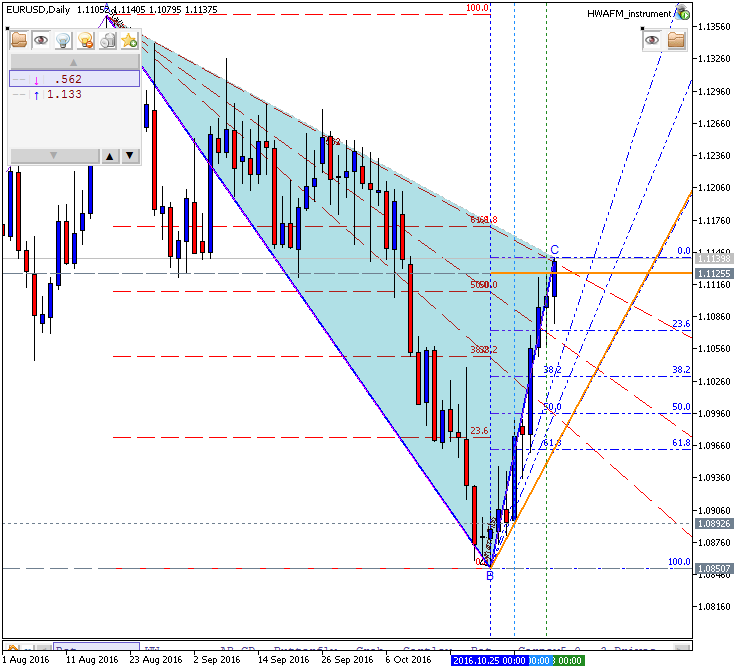

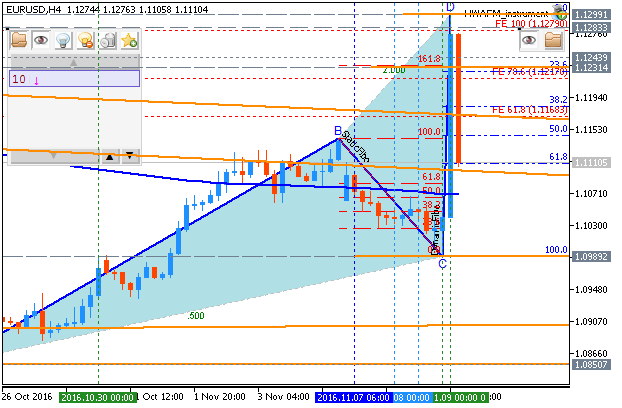

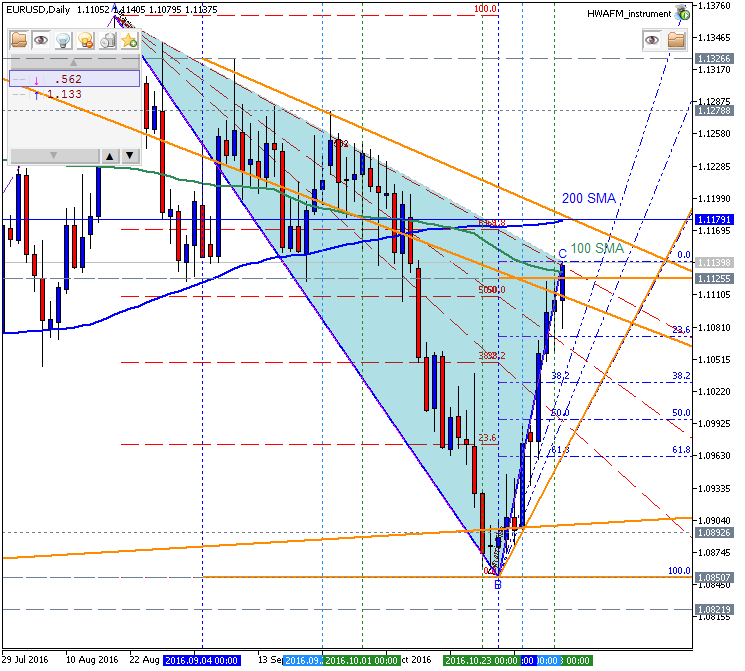

H4 price: the price was on breakout for 1.13 resistance level to be testing for the bullish breakout to be continuing. For now, the price was bounced from 1.13 resistance to below for the secondary correction to be reversed back to the bearish market condition by 1.11 support level to be testing.

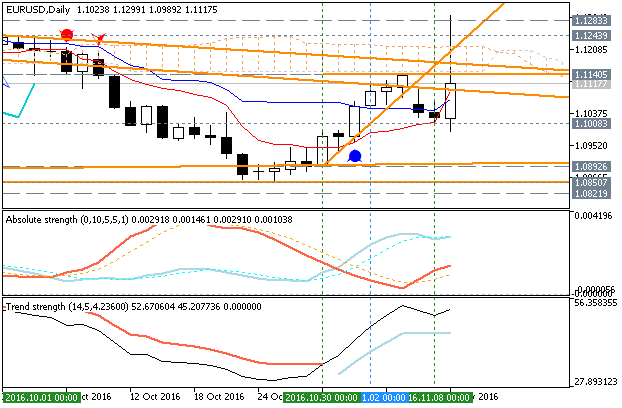

If we look at the daily chart sothis is ranging condition is still going on: the price is on ranging within the following key support/resistance levels:

- 1.1283 resistance level for the daily bullish reversal to be started if broken to above;

- 1.08 support levels for the daily bearish trend to be resumed if broken to below.

Chinkou Span line of Ichimoku indicator is located below the price to be ready for good breakout with bullish reversal, Trend Strength indicator is estimating the bullish trend to be started in the near future, and Absolute Strength indicator is evaluating the market condition as the ranging bearish for now.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.10 15:24

Trump Wins: EUR/USD A 'Confusing Story' - What's Next? - SocGen (based on the article)

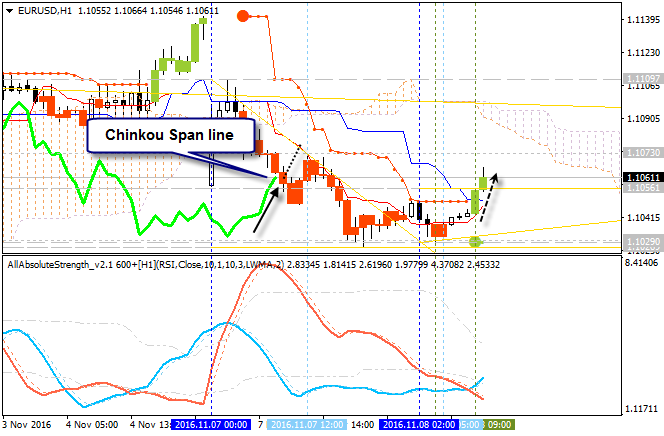

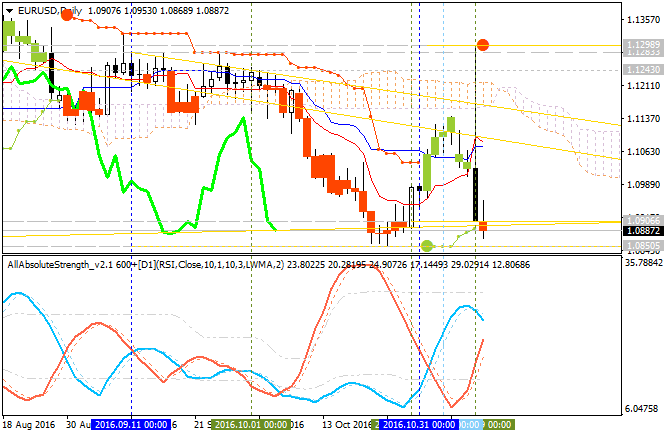

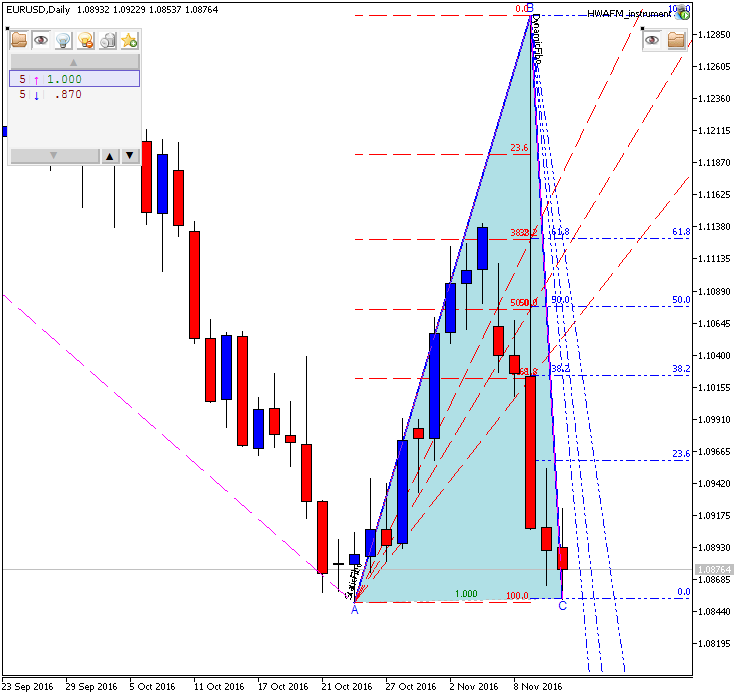

Daily price is located below Ichimoku cliud and below Senkou Span line which is the virtual border between the primary ebarish and the primary bullish trend on the chart. The price is on bearish ranging within the following support/resistance levels:

- 1.1243 resistance level located above Ichimoku cloud in the bullish trend to be started, and

- 1.0850 support level located far below Ichimoku cloud in the primary bearish area of the chart.

Chinkou Span line of Ichimoku are evaluating the future trend as the bearish, and Absolute Strength indicator is estimating the trend as the ranging bearish in the near future.

"EUR/USD by contrast is a more confusing story. Relative real yields aren’t moving significantly in support of the dollar here, but pretty much every meeting I have been in today has seen clients express concern about the spread of populism to European voters in the months ahead, starting with the Italian referendum.. My hopes of EUR/USD testing the upper end of its current range before that vote on 4 December are taking a battering."

If D1 price breaks 1.1243 resistance level on

close bar from below to above so we may see the reversal of the daily

price movement from the ranging bearish to the primary bullish market

condition with 1.1298 nearest bullish target to re-enter.

If not so the price will be on bearish ranging within the levels.

- Recommendation for long: watch close D1 price to break 1.1243 for close bar for possible buy trade

- Recommendation to go short: watch D1 price to break 1.0850 support level on close daily bar for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 1.1243 | 1.0850 |

| 1.1298 | N/A |

SUMMARY: bearish

TREND: ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.11 09:02

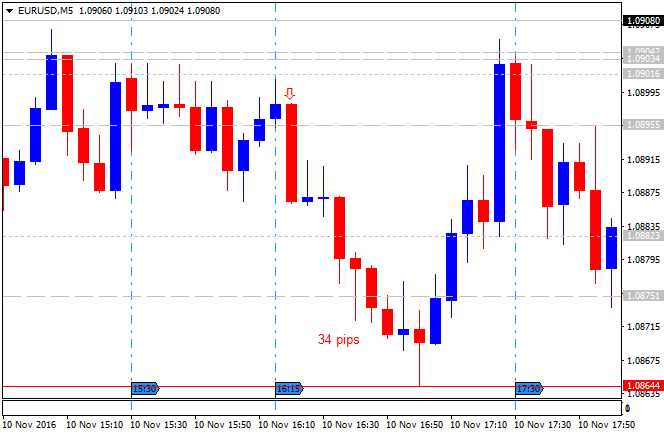

EUR/USD Intra-Day Fundamentals: FOMC Member Bullard Speaks and 34 pips price movement

2016-11-10 14:15 GMT | [USD - FOMC Member Bullard Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member Bullard Speaks] = Speech about the US economic outlook at the Commerce Bank conference, in St. Louis.

==========

From RTT News article: ECB's Coeure Says Too Early To Say If Trump Win Would Impact December Decision

- "Donald Trump winning the U.S. presidential election is a major event, but it is too early to say if that would affect the policy decision in December, European Central Bank Executive Board member Benoit Coeure said. "It is not for the ECB to assess the political consequences," Coeure said in an interview to the newspaper Le Progrès de Lyon and other French newspapers, published Friday. "But it holds a lesson for Europe: in a world where shocks are increasing, Europe must keep control of its destiny.""

- "Excessive volatility must be avoided. Looking ahead, we will assess the consequences of Mr Trump's election for the global economy and for the euro area."

==========

EUR/USD M5: 34 pips price movement by FOMC Member Bullard Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.11 13:03

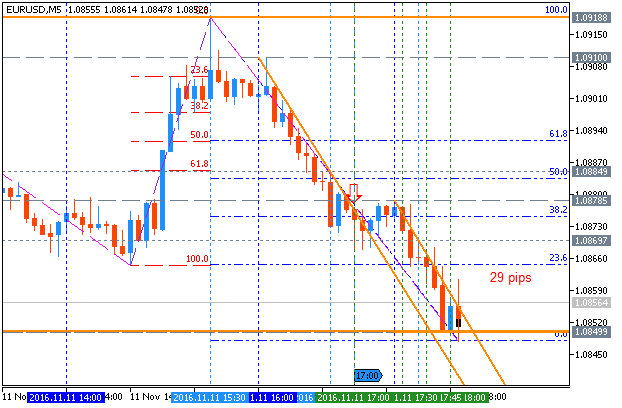

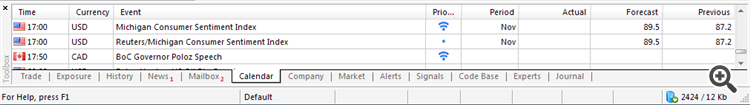

Trading News Events: University of Michigan Consumer Sentiment (adapted from dailyfx)

- "A rebound in the U. of Michigan Confidence survey may spark a bullish reaction in the U.S. dollar and fuel the recent selloff in EUR/USD should the data print highlight an improved outlook for growth and inflation."

- "The Federal Open Market Committee (FOMC) looks poised to deliver a December rate-hike as ‘the Committee judges that the case for an increase in the federal funds rate has continued to strengthen,’ and Chair Janet Yellen and Co. may continue to normalize monetary policy in the year ahead as the central bank sees a ‘moderate’ recovery going forward. However, another unexpected decline in household sentiment may dampen the appeal of the greenback and drag on interest-rate expectations as central bank officials continue to warn ‘market-based measures of inflation compensation have moved up but remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.’"

Bullish USD Trade: U. of Michigan Confidence Survey Climbs to 87.9 or Greater

- "Need red, five-minute candle following the report to consider a short EUR/USD trade."

- "If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is met, set reasonable limit."

- "Need green, five-minute candle to favor a long EUR/USD trade."

- "Implement same strategy as the bullish dollar trade, just in reverse."

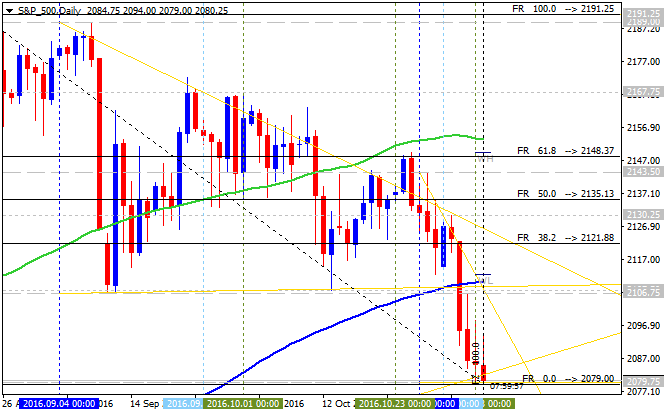

Daily price

is bloke 200-day SMA to below to be reversed to the primary ebarish market condition. Developing retracement bearish pattern was formed by the price together with descending triangle pattern for the bearish trend to be continuing.

- If the price will break 1.1129

resistance level on close daily bar so the reversal to the primary bullish market condition may be started.

- If price will break 1.0853

support on close daily bar so the primary bearish trend will be continuing.

- If not so the price will be ranging within the levels.

EUR/USD M5: 29 pips price movement by UoM Consumer Sentiment news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located below 200-day SMA in the bearish area of the the chart. The price is on local uptrend as the bear market rally since 26 of October this year: 100-day SMA at 1.1139 is going to be broken by the price for open daily bar for now to be reversed to the ranging area of the chart located within 100 SMA/200 SMA area, and with 200 SMA level at 1.1179 as a nearest bullish reversal target in this case.

If D1 price breaks 1.0850 support level on close bar so the primary bearish trend will be resumed with 1.0821 bearish target.If D1 price breaks 1.1179 resistance level on close bar from below to above so the reversal of the daily price movement from the ranging bearish to the primary bullish market condition will be started.

If not so the price will be on bearish ranging within the levels.

SUMMARY: bearish

TREND: bear market rally