You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Brent Crude Oil 4-month high at 50.83 to be testing to above for the bullish trend to be continuing (adapted from the article)

Daily price is located above 100 SMA/200 SMA reversal area for the bullish market condition. The price is testing 4-month high at 50.83 for the bullish trend to be continuing. Alvernative, if the price breaks 47.56 support level to below so the secondary correction will be started up to 43.30 support level as the bearish reversal target.

- Recommendation

to go short: watch the price to break 43.30 support level for possible sell trade

- Recommendation

to go long: watch the price to break 50.83 resistance level for possible buy trade

- Trading Summary: bullish

TREND : daily bullishEUR/USD Intra-Day Fundamentals: ISM Manufacturing PMI and 23 pips price movement

2016-06-01 14:00 GMT | [USD - ISM Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

"The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The May PMI® registered 51.3 percent, an increase of 0.5 percentage point from the April reading of 50.8 percent. The New Orders Index registered 55.7 percent, a decrease of 0.1 percentage point from the April reading of 55.8 percent."

==========

EUR/USD M5: 23 pips price movement by ISM Manufacturing PMI news event

AUD/USD Intra-Day Fundamentals: Australia's International Trade in Goods and Services and 21 pips price movement

2016-06-02 01:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

==========

AUD/USD M5: 21 pips price movement by Australia's International Trade in Goods and Services news event

Trading the News: ECB Minimum Bid Rate (based on the article)

Daily price is on bearish for the ranging near bullish reversal within narrow support/resistance levels:

If the price breaks 1.1242 level on close daily bar so the bullish reversal of the price movement will be started on the secondary ranging way. If not so the price will be continuing on the bearish ranging within the levels.

M30 price is located above 200 period SMA for the bullish market condition within 1.1219 resistance and 1.1190 support levels.

If the price breaks 1.1190 support level to below so the secondary correction within the primary bullish condition will be started.

If the price breaks 1.1149 support level so we may see the bearish reversal of the price movement.

If the price breaks 1.1219 resistance so the intra-day bullish trend will be continuing.

EUR/USD Intra-Day Fundamentals: ECB Minimum Bid Rate and 10 pips price movement

2016-06-02 11:45 GMT | [EUR - Minimum Bid Rate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Minimum Bid Rate] = nterest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

==========

"At today’s meeting, which was held in Vienna, the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively."==========

EUR/USD M5: 10 pips price movement by ECB Minimum Bid Rate news event

EUR/USD Intra-Day Fundamentals: FOMC Member Powell Speaks and 42 pips range price movement

2016-06-02 12:35 GMT | [USD - FOMC Member Powell Speaks]

[USD - FOMC Member Powell Speaks] = speech about the role of regulation in the banking system at the Prudential Regulation Conference, in Washington DC.

==========

EUR/USD M5: 42 pips range price movement by FOMC Member Powell Speaks news event

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-06-02 15:00 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.4 million barrels from the previous week."

==========

Crude Oil H4: bullish ranging within 4-month high at 50.83 and 10-day low at 47.56. The price is on ranging to be above 200-period SMA and 100-period SMA for the bullish market condition within the following support/resistance levels:

If the price breaks 50.83 resistance level so the intra-day primary bullish trend will be continuing.If the price breaks 47.56 support so the reversal of the H4 price movement from the primary bullish to the primary bearish market condition will be started (in case of daily price - the secondary correction within the primary bullish trend will be started).

If not so the price will be on ranging within the levels.

USD/CNH Intra-Day Fundamentals: Caixin Services PMI and 20 pips price movement

2016-06-03 01:45 GMT | [CNY - Caixin Services PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"Caixin China Composite PMI™ data (which covers both manufacturing and services) pointed to a further increase in total Chinese business activity during May. However, the Composite Output Index posted 50.5, down from 50.8 in April, to signal the slowest rate of expansion in the current three-month sequence of growth. May survey data indicated that overall Chinese business activity growth weakened for the second month in a row, as services activity expanded at a slower rate and manufacturers reported a fractional fall in production for the second consecutive month. Furthermore, it was the weakest increase in service sector business activity since February, with the Caixin China General Services Business Activity Index registering 51.2 in May, down from 51.8 in the previous month."==========

USD/CNH M5: 20 pips price movement by Caixin Services PMI news event

Bullish USD Trade- "Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD."

- "If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

Bearish USD TradeDaily price is located near and above SMA with period 200 (200 SMA) for the bullish market condition with the ranging within the following support/resistance levels:

RSI indicator is estimating the secondary correction to be continuing up to the possible bearish reversal on the secondary ranging way.

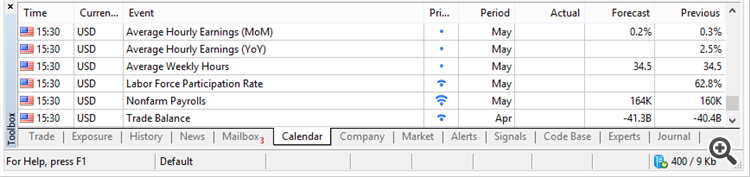

EUR/USD Intra-Day Fundamentals: U.S. Non-Farm Payrolls and 180 pips price movement

2016-06-03 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"The unemployment rate declined by 0.3 percentage point to 4.7 percent in May, and nonfarm payroll employment changed little (+38,000), the U.S. Bureau of Labor Statistics reported today. Employment increased in health care. Mining continued to lose jobs, and employment in information decreased due to a strike."

==========

EUR/USD M5: 180 pips price movement by U.S. Non-Farm Payrolls news event