You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Here is the news about unemployment rate of US.

: Employers in U.S. Add 38,000 Workers, Fewest in Almost Six Years

This is about ISM Non-Manufacturing PMI.

May 2016 Non-Manufacturing ISM Report On Business

Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY, AUD/USD, and GOLD (based on the article)

Dollar Index - "Chairwoman Yellen’s speech Monday is the last opportunity to realign the market to a probability of a near-term hike. She is the only person – and event – with the authority to change market sentiment. After that, the Fed’s blackout of media silence pre-FOMC starts Wednesday. She not likely to refute skepticism of a June hike. However, if she doesn’t offer perspective to line up a July possibility, the Dollar will certainly have further premium to bleed."

EUR/USD - "The ECB’s inflation target is 2%, like many other major, developed economies. But their inflation projection for 2018 currently sits at 1.6%; a considerable margin away from their own 2% target. These projections do not include measures that have yet to be enacted, such as ECB purchases of Corporate Bonds, or the rebated loans to banks; and each of which could bring huge impacts to markets. Both of these policies come with gigantic question marks as this is the first time we’ve seen a developed economy get this level of assistance from a Central Bank; so, it’s difficult to tell what the end-of-day impact might ultimately be, although the ECB is fairly confident that they’re on the right track."

GBP/USD - "A series of disappointing data prints may further undermine bets for two Fed rate-hikes in 2016 as the central bank remains ‘data-dependent,’ and the fresh batch of central bank rhetoric from Cleveland Fed President Loretta Mester, Boston Fed President Eric Rosengren and Fed Chair Janet Yellen may dampen the appeal of the greenback should the 2016 voting-members adopt a more dovish outlook for monetary policy. With Fed Funds Futures now highlighting a less than 10% probability for a rate-hike at the June meeting, the greenback may continue to trade on a weaker tone next week amid waning expectations for higher borrowing-costs."

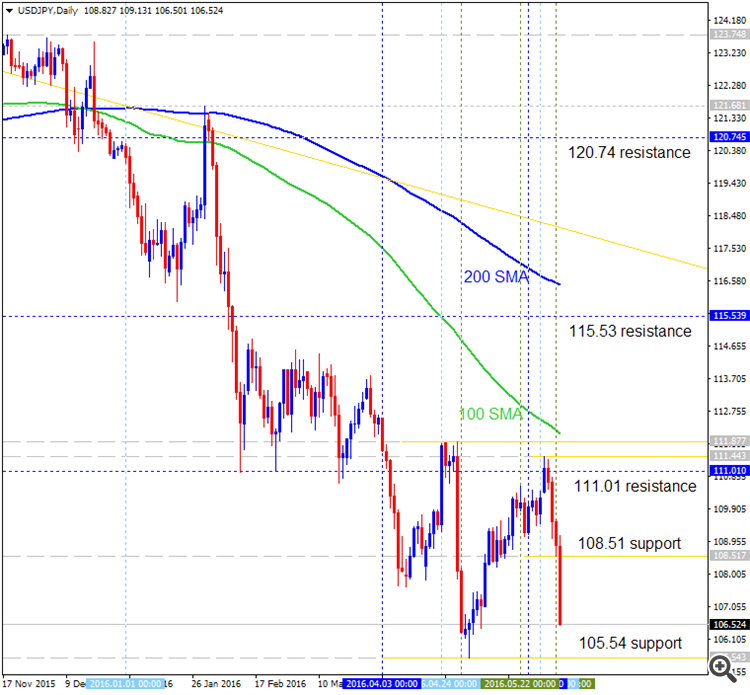

USD/JPY - "Lower US interest rates and unchanged Japanese monetary policy should push the USD/JPY lower with one major caveat: dramatic Yen appreciation could force a strong policy response and potential FX market intervention from the Japanese Ministry of Finance. It is worth noting much the same was said through early May when the USD/JPY last traded near ¥106. A strong statement from the US Treasury Secretary on currency intervention put some of that speculation to rest. Yet caution is warranted on sharp USD/JPY declines—it seems unwise to chase the pair lower on the risk of intervention."

AUD/USD - "Falling back on the long-standing commitment to “data dependency” is likely to be seen as dovish and boost the Aussie. Alternatively, comments suggesting the Fed sees the May number as an anomaly and intends to look through it when deciding whether to hike rates over the next two months – a conceivable outcome considering one-off distortions such as the massive Verizon strike that skewed last month’s payrolls reading – AUD may find itself under pressure along with other anti-USD majors."

GOLD (XAU/USD) - "Heading into next week, the near-term focus remains higher while above Friday’s low. Initial resistance is eyed at 1250 where the 50% retracement of the May decline converges on basic trendline resistance off the yearly high. A breach here would suggest a more meaningful reversal is underway with subsequent topside objectives eyed at the upper median-line parallel, currently around ~1270/71. Note that daily RSI is approaching a resistance trigger and if compromised, would further reinforce the topside near-term outlook. Bottom line: looking for a pullback to stretch into an exhaustion high next week- likely to offer favorable short entries."

Forex Weekly Outlook June 05 - June 12 (based on the article)

The dollar eventually crashed on the NFP in a week that was tense until this big event. More losses for the greenback? Speeches by Janet Yellen and Mario Draghi, Australian and New Zealand’s rate decisions stand out now. These are the market movers for this week.

Intra-Day Fundamentals: Signals from Federal Reserve chair Janet Yellen about the US central bank's next rate-hike after payroll data shocks

2016-06-06 16:30 GMT | [USD - Fed Chair Yellen Speaks]

[USD - Fed Chair Yellen Speaks] = Speech about the economic outlook and monetary policy at the World Affairs Council of Philadelphia's luncheon.

==========

==========

Credit Agricole:

==========

Live blog and video of Janet Yellen’s speech in Philadelphia:

"The overall labor market situation has been quite positive. In that context, this past Friday’s labor market report was disappointing. Payroll gains were reported to have been much smaller in April and May than earlier in the year, averaging only about 80,000 per month. And while the unemployment rate was reported to have fallen further in May, that decline occurred not because more people had jobs but because fewer people reported that they were actively seeking work."

==========

EUR/USD M5: 68 pips range price movement by Fed Chair Yellen Speaks news event

==========

USD/JPY M5: 72 pips range price movement by Fed Chair Yellen Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Md. Shahadat Hossain, 2016.06.06 13:19

i think mkt is manipulated by this brixt news, gbp has no force to move but with this breixit issue few news es published suddenly and create big movements for gbp.

Hallo

How to open a mql5 real account

greeting

Hallo

How to open a mql5 real account

greeting

Read this article for more information: MetaTrader 5 - More Than You Can Imagine!

Gold Prices Recovery Friday’s NFP report: daily bullish resumed; intra-day rally to the bullish reversal (based on the article)

"We looked at the precipitous fall in Gold prices on the back of a more hawkish Federal Reserve that spent much of the month of May talking up the prospect of higher rates in the United States. This prospect of higher rates was a huge change-of-pace for markets, which had built-in the expectation for the Fed to be extremely dovish after the risk-aversion that put up sizeable moves at the beginning of the year. And that inferred dovishness was hugely helpful to Gold prices, along with Equities and Commodities, as global markets appeared to be operating under the assumption that the Fed would do what they’ve been doing for the past six years by being dovish and passive with extremely loose monetary policy."

"But that about-face in May brought on a huge change of pace to the US Dollar, and this had an enormous impact on Gold prices. After tagging the $1,301 resistance level in the early portion of the month, Gold prices fell all the way back to the $1,200.41 Fibonacci level, which is the 61.8% retracement of the 45-year move in Gold prices, taking the 1968 low of $34.95 to the 2011 high at $1,920.80. Coming into June, Gold was continuing to dwindle near support at $1,207.69, which is the 38.2% retracement of the most recent major move."

"Friday’s NFP report provided a dose of cold water to those June rate hike expectations, as an abysmal print gave the appearance of a weaker US economy than initially hoped, and this brought in a significant bout of USD-weakness across the currency spectrum. Gold caught a significant bid, rallying all the way into a prior zone of support at $1,245.83, which is also the 23.6% retracement of the most recent major move, taking the January 2015 high to the December 2015 low. Since running into that resistance, price action has built-in to a box formation on the 4-hour chart, and this can be used to further help traders looking to set up the short-side position. Traders can look for a quick break of near-term price action support to denote down-side continuation potential. Should this break take place, traders can then begin to look to trigger the short position by looking for a price action reversal at resistance around current support of ~ $1,240."

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 64 pips price movement

2016-06-07 04:30 GMT | [AUD - RBA Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - RBA Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

==========

AUD/USD M5: 64 pips price movement by RBA Cash Rate news event