Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.29 19:13

This is interesting indicator which can be very usefull for the technical analysis for example.

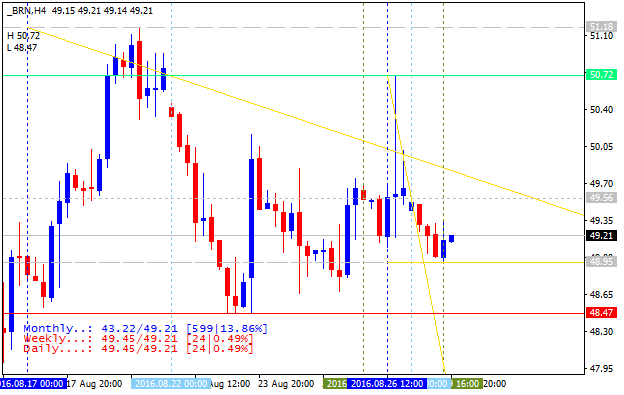

Percentage - indicator for MetaTrader 4This is Brent Crude Oil (as we see - the oil price was increased by 13.86% for this month):

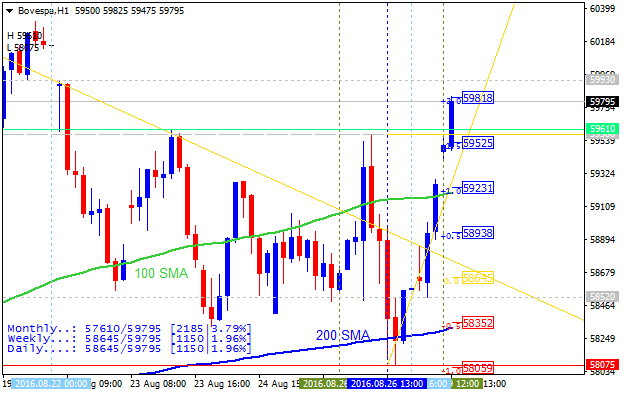

Bovespa Index was increased by 3.79% in a month and by 1.96% for the week:

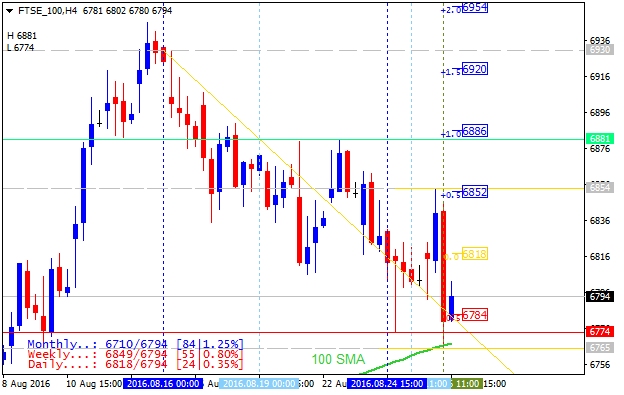

FTSE 100 index :

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Bovespa Index - Long-Term Forecast: monthly breakout for the long-term bullish

Monthly price is located inside Ichimoku cloud for the breakout with the bullish reversal to be started on open monthly bar for now:

Absolute Strength indicator is estimating the long-term bullish trend in the near future.

SUMMARY : breakout

TREND : possible bullish reversal