You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

H4 price is located near and below 200 period SMA (200 SMA) for the bearish ranging near bullish reversal. The price is on ranging within the following key s/r levels:

Bullish reversal level for H4 timeframe is 1.1168, and if the price breaks this level to above so the reversal of the price movement from the ranging bearish to the primary bullish trend will be started

Daily price. United Overseas Bank is considering for EUR/USD to be on the bearish market condition with 1.0813 key support level:

"The current short-term consolidation/correction phase is taking longer than expected as EUR continues to hold above the 1.1095/00 support. Downward momentum is beginning to show signs of slowing but as long as 1.1210 is intact, we are not giving up on our bearish view just yet. That said, the prospect for a sustained down-move has clearly dimmed and EUR has to move and stay below 1.1095 within these couple of days or the risk of an interim low would continue to increase."

H4 price is located below 200 period SMA (200 SMA) for the bearish area of the chart for the ranging within narrow support/resistance levels:

Daily price. United Overseas Bank is considering for GBP/USD to be on the bearish market condition with 1.3000 key psy support level:

"GBP spent another day trading in a relatively narrow range and the strong downward momentum after Brexit is showing further signs of slowing. That said, another leg lower to the 1.3000 target cannot be ruled out just yet."

Brexit: pessimism among British businesses nearly doubled after the June 23rd referendum (based on the article)

The Confederation of Business Industry, the British Chambers of Commerce, the Federation of Small Businesses, the Institute of Directors, and EEF are promosed the immediate action to end the uncertainty facing EU nationals living and working in the country, and progress on long-planned infrastructure projects:

China revises GDP calculation method (based on the article)

EUR/USD Intra-Day Fundamentals: U.S. Factory Orders and 25 pips price movement

2016-07-05 14:00 GMT | [USD - Factory Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Factory Orders] = Change in the total value of new purchase orders placed with manufacturers.

==========

U.S. factory orders fall, but unfilled orders increase :

==========

EUR/USD M5: 25 pips price movement by U.S. Factory Orders news event :

USD/CAD Technical Analysis - daily bearish ranging near 200-day SMA reversal area (adapted from the article)

Daily price is located near and below SMA with period 200 (200 SMA) in the bearish area of the chart for the ranging within 1.3472 "bullish reversal" resistance level and 1.2654 "bearish continuation" support level:

If the price will break 1.3472 resistance level so the reversal of the daily price movement to the primary bullish market condition will be started.

If price will break 1.2654 support so the bearish trend will be continuing.

If not so the price will be on bearish ranging within the levels.

SUMMARY : ranging

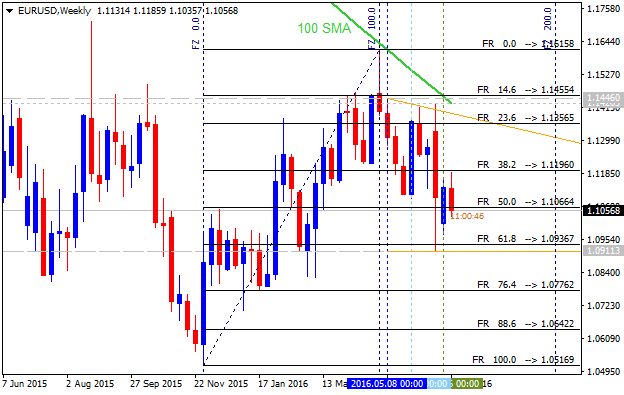

TREND : bearishBank of America Merrill Lynch - "We now expect EUR/USD to end 2016 at 1.05" (adapted from the article)

Bank of America Merrill Lynch predicted for EUR/USD price to be around 1.05 by 2016 year end, and at 1.10 by by the end of 2017:

"We revised our projections following the UK referendum. We now expect EUR/USD to end 2016 at 1.05, from 1.08 before, appreciating to 1.10 by the end of 2017, from 1.15 before. These projections will still keep the Euro undervalued, but not substantially, compared with our equilibrium EUR/USD estimate of 1.16. In our view, a much weaker Euro would affect the Fed’s policy reaction function, as the US data remains mixed, recently losing momentum."

If we look at the weekly chart so the price is located on the bearish market condition with the ranging within 1.1455 resistance level and 1.0936 support level. Breaking the resistance at 1.1455 will lead to the ranging bearish condition by the bear market rally up to the possible weekly bullish reversal. Alternative, if the price breaks 1.0936 support to below on close weekly bar so the primary bearish trend will be continuing up to 1.0516 support level as a the end-year bearish target.

Most likely scenario for the long-term price movement for this pair is the following: ranging bearish market condition will be continuing within 1.11/1.05 ranging area.EUR/USD Intra-Day Fundamentals: U.S. Trade Balance and 17 pips price movement

2016-07-06 12:30 GMT | [USD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

==========

EUR/USD M5: 17 pips price movement by U.S. Trade Balance news event :

USD/CAD Intra-Day Fundamentals: Canadian Trade Balance and 28 pips price movement

2016-07-06 12:30 GMT | [CAD - International Merchandise Trade]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - International Merchandise Trade] = Difference in value between imported and exported goods during the reported month.

==========

"Canada's exports fell 0.7% to $41.1 billion in May. Export volumes declined 2.3% and prices were up 1.6%. Imports decreased 0.8% to $44.4 billion, as volumes were down 0.9% and prices edged up 0.2%. As a result, Canada's merchandise trade deficit with the world in May was virtually unchanged compared with April at $3.3 billion."==========

USD/CAD M5: 28 pips price movement by Canadian Trade Balance news event :

EUR/USD Intra-Day Fundamentals: ISM Non-Manufacturing PMI and 35 pips price movement

2016-07-06 14:00 GMT | [USD - ISM Non-Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.5 percent in June, 3.6 percentage points higher than the May reading of 52.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 59.5 percent, 4.4 percentage points higher than the May reading of 55.1 percent, reflecting growth for the 83rd consecutive month, at a faster rate in June. The New Orders Index registered 59.9 percent, 5.7 percentage points higher than the reading of 54.2 percent in May. The Employment Index grew 3 percentage points in June after one month of contraction to 52.7 percent from the May reading of 49.7 percent. The Prices Index decreased 0.1 percentage point from the May reading of 55.6 percent to 55.5 percent, indicating prices increased in June for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in June."

==========

EUR/USD M5: 35 pips price movement by ISM Non-Manufacturing PMI news event :