You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD Intra-Day Fundamentals: BoE Gov Carney Speaks and 185 pips range price movement

2016-06-30 15:00 GMT | [GBP - BoE Gov Carney Speaks]

[GBP - BoE Gov Carney Speaks] = The speech at the Bank of England, in London.

==========

Uncertainty, the economy and policy - speech by Mark Carney :

==========

GBP/USD M5: 185 pips range price movement by BoE Gov Carney Speaks news event :

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 50 pips price movement

2016-07-01 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

==========

USD/CNH M5: 50 pips price movement by Caixin Manufacturing PMI news event :

Weekly Outlook: 2016, July 03 - July 10 (based on the article)

Markets continued to wobble in the post-Brexit week, with recoveries seen in many currencies. The first full week of July features the buildup to the US Non-Farm Payrolls, the Fed’s meeting minutes and key speeches among other events. These are the market movers on forex calendar.

AUD/USD Intra-Day Fundamentals: Australian Building Approvals and 25 pips price movement

2016-07-04 01:30 GMT | [AUD - Building Approvals]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

==========

AUD/USD M5: 25 pips price movement by Australian Building Approvals news event :

EUR/USD Intra-Day Fundamentals: Spanish Unemployment Change and 16 pips range price movement

2016-07-04 07:00 GMT | [EUR - Spanish Unemployment Change]

if actual < forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Spanish Unemployment Change] = Change in the number of unemployed people during the previous month.

==========

==========

EUR/USD M5: 16 pips range price movement by Spanish Unemployment Change news event :

USD/CNH Price Action Analysis - ranging within 6.70 'bullish continuation' resistance and 6.50 'bearish reversal' support (adapted from the article)

Daily price is located above 200 period SMA and 100 period SMA for the primary bullish with secondary ranging between Fibo support level at 6.5015 and Fibo resistance level at 6.7005:

If daily price breaks Fibo support level at 6.5015 to below together with 200 period SMA so the reversal of the price movement from the bullish to the primary bearish market condition will be started with 6.4698 possible target.

If daily price breaks Fibo resistance level at 6.7005 from below to above so the primary bullish trend will be continuing with good possible breakout of the price movement.

If not so the price will be on bullish ranging within the levels.

SUMMARY : ranging

TREND : bullishGBP/USD Intra-Day Fundamentals: U.K. Construction PMI and 44 pips range price movement

2016-07-04 08:30 GMT | [GBP - Construction PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

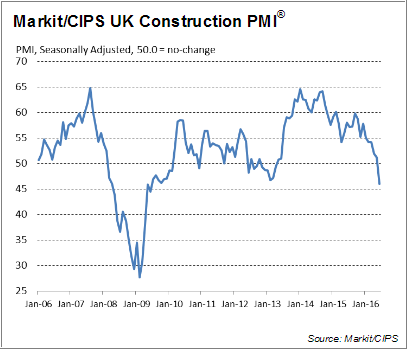

[GBP - Construction PMI] = Level of a diffusion index based on surveyed purchasing managers in the construction industry.

==========

"At 46.0 in June, down from 51.2 in May, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) dropped below the neutral 50.0 threshold for the first time since April 2013. The latest reading pointed to the weakest overall performance for exactly seven years, but the rate of contraction was much slower than seen during the 2008/09 downturn."

==========

GBP/USD M5: 44 pips range price movement by U.K. Construction PMI news event :

M5 intra-day price broke 100 SMA/200 SMA to below for the primary bearish breakdown: the price made 44 pips to below and it was bounced from 1.3243 support level to above for the ranging condition within 100 SMA/200 SMA ranging area.

If the price breaks 1.3243 support level to below on close M5 bar so the primary bearish trend will be continuing.

If the price breaks 1.3300 resistance level to above on close M5 bar so the reversal to the primary bullish will be started on this timeframe.

If not so the price will be on ranging within the levels waiting for direction.

EUR/USD Weekly Outlook: 2016, July 03 - July 10 (based on the article)

EUR/USD wobbled in the post-Brexit week, but basically did not go too far. More PMIs as well as the postponed ECB meeting minutes are eyed. Will EUR/USD choose a new direction? Here is an outlook for the highlights of this week.

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 41 pips price movement

2016-07-05 04:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

The Sydney Morning Herald article:

==========

AUD/USD M5: 41 pips price movement by RBA Cash Rate news event :

USD/CNH Intra-Day Fundamentals: Caixin Services PMI and 35 pips price movement

2016-07-05 01:45 GMT | [CNY - Caixin Services PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"Latest data signalled a further slowdown in over all Chinese business activity, with the rate of expansion slowing to the weakest in the current four-month sequence. There were differing trends at the sector level, however, with services companies reporting a stronger expansion of business activity in June, while manufacturing output declined at the sharpest pace since February. Notably, it was the quickest increase in services activity in 11 months, with the Caixin China General Services Business Activity Index posting 52.7, up from 51.2 in May."==========

USD/CNH M5: 35 pips price movement by Caixin Services PMI news event :