Join our fan page

- Views:

- 3309

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

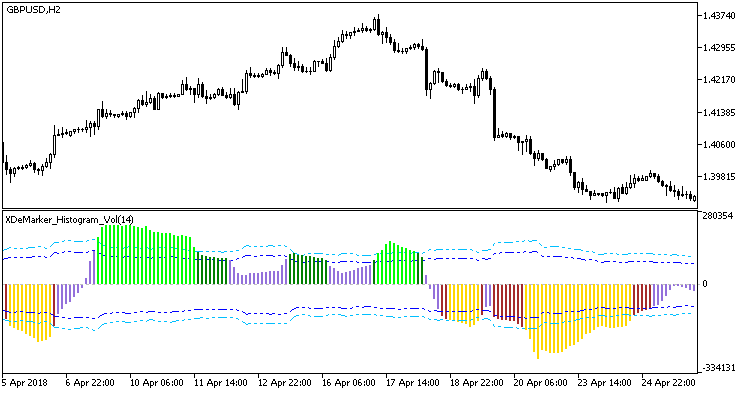

DeMarker_Histogram_Vol indicator with additional averaging of the resulting histogram. A similar averaging is applied to dynamic overbought/oversold levels as well.

//+-----------------------------------------+ //| INDICATOR INPUT PARAMETERS | //+-----------------------------------------+ input uint DeMarkerPeriod=14; // indicator period input ENUM_APPLIED_VOLUME VolumeType=VOLUME_TICK; // volume input int HighLevel2=+20; // overbought level 2 input int HighLevel1=+15; // overbought level 1 input int LowLevel1=-15; // oversold level 1 input int LowLevel2=-20; // oversold level 2 input Smooth_Method MA_SMethod=MODE_SMA_; // Averaging method input uint MA_Length=12; // Smoothing depth input int MA_Phase=15; // parameter of the first smoothing, //---- for JJMA within the range of -100 ... +100, it influences the quality of the transition process; //---- for VIDIA it is a CMO period, for AMA it is a slow average period input int Shift=0; // Horizontal indicator shift in bars

The indicator uses SmoothAlgorithms.mqh library classes (copy it to <terminal_data_folder>\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

Fig. 1. XDeMarker_Histogram_Vol

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/22002

Breadandbutter2

Breadandbutter2

Trading system based on iADX (Average Directional Movement Index, ADX) and iAMA (Adaptive Moving Average, AMA) indicators. The system works on a new bar only.

NeuroNirvamanEA 2

NeuroNirvamanEA 2

The trading system is based on a simple neural network.

TP SL Trailing

TP SL Trailing

Stop loss and take profit initial setting. Trailing.

SSL_NRTR

SSL_NRTR

NRTR type trend indicator based on exiting the channel formed by averaging High and Low of the price series