Join our fan page

- Views:

- 5586

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

KDJ Averages oscillator defines when it is necessary to search for market entry conditions. Unlike KDJ, it is calculated using standard smoothing methods. In case of the default settings, its J line is slightly faster.

It has six input parameters:

- KDJ period - KDJ indicator calculation period;

- K period - K line calculation period;

- K method - K line calculation method;

- D period - D line calculation period;

- D method - D line calculation method;

- Threshold - signal line.

Calculation:

K = MA(RSV, KPeriod, KMethod) D = MA(K, DPeriod, DMethod) J = 3.0*D - 2.0*K

where:

RSV = ((Close – Lowest Low) / (Highest high – Lowest low)) * 100

Lowest Low, Highest High - the lowest and highest prices within the Period interval.

Possible interpretation options: J line crossing the Threshold level. Up - search the possibility for selling, down - search for the appropriate moment to buy.

After J line crosses the Threshold level, wait till J line is crossed by K and D lines. Crossing direction = market entry direction.

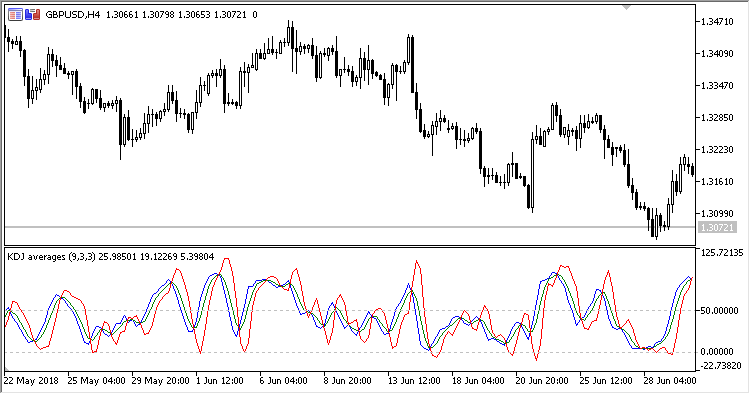

Fig. 1. KDJ Averages

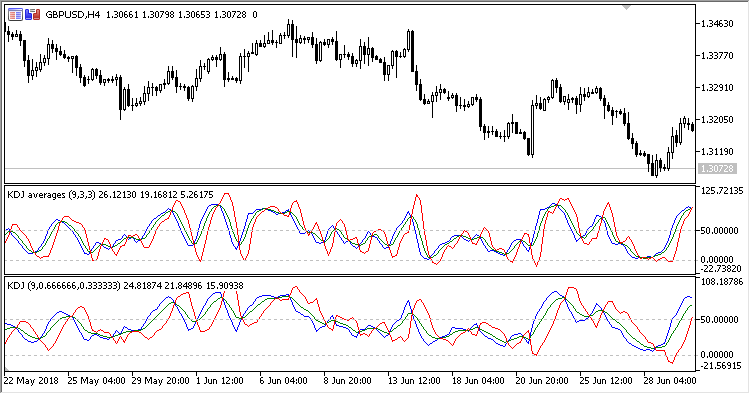

Fig. 2. KDJ Averages compared with KDJ

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/21531

KDJ

KDJ

KDJ oscillator defines when it is necessary to search for market entry conditions.

IdeaTrend

IdeaTrend

IdeaTrend is meant for checking a trend defining idea.

MA_Lag_Reduce

MA_Lag_Reduce

MA Lag Reduce indicator is an SMA with the ability to set the delay elimination factor.

Momentum_Signal

Momentum_Signal

The signal indicator based on Momentum, CCI, ATR, RSI and ADX.