Join our fan page

- Views:

- 4823

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Oscillator Adaptable RSI, unlike standard RSI, allows you to select a method to calculate intermediate data that is calculated in standard RSI by the SMMA method only.

It has five configurable parameters:

- Period - calculation period

- Method - intermediate data calculation method

- Applied price - calculation price

- Overbought - overbought level

- Oversold - oversold level

Calculations:

ARSI = 100.0-100.0/(1.0 + MA_Gain/MA_Loss)

where:

MAGain = MA(Gain, Period, Method) MALoss = MA(Loss, Period, Method)

- If diff > 0

Gain = diff

- Otherwise

Gain = 0

- If diff < 0

Loss = -diff

- Otherwise

Loss = 0

diff = Price - PrevPrice Price = MA(Applied price, 1)

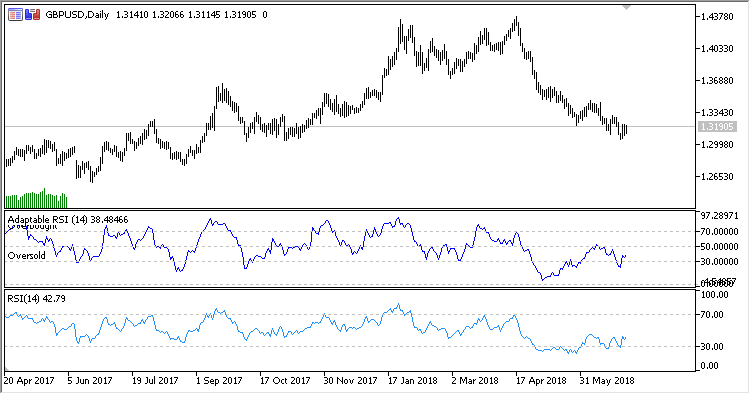

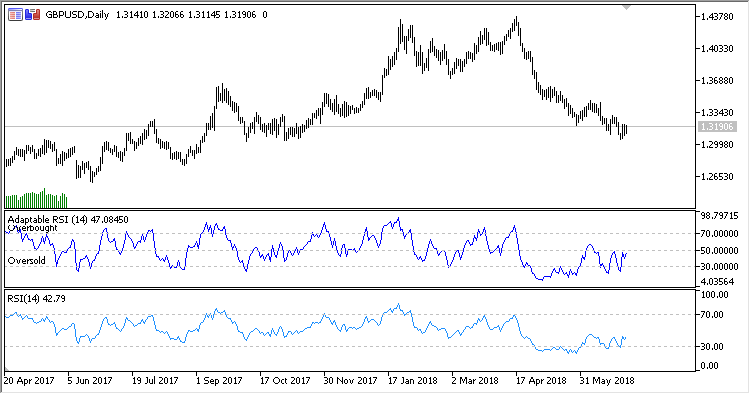

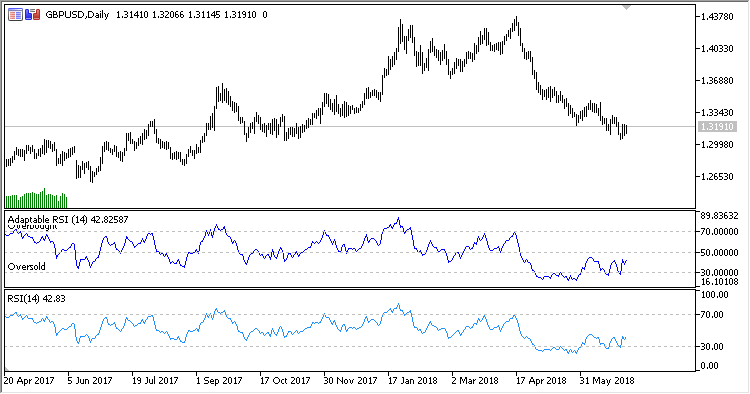

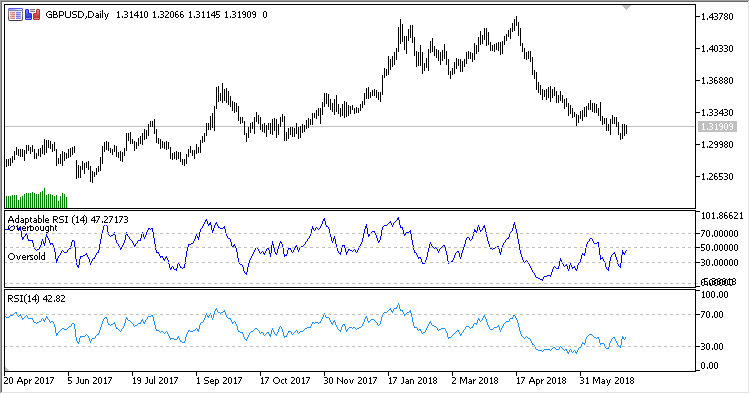

In figures below, the Adaptable RSI is shown as compared to standard RSI:

Fig 1. Period 14, method SMA

Fig. 2. Period 14, method EMA

Fig. 3. Period 14, method SSMA

Fig. 4. Period 14, method LWMA

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/21314

AATR

AATR

Indicator Average Average True Range

AbsolutelyNoLagLwma_Range_Channel

AbsolutelyNoLagLwma_Range_Channel

A channel formed by two moving averages AbsolutelyNoLagLwma based on averaged High and Low timeseries

Bears_Bulls_Impuls

Bears_Bulls_Impuls

An indicator of bull/bear power

DiffMA

DiffMA

Two moving averages on the range of one-direction candlesticks