Join our fan page

- Views:

- 5676

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

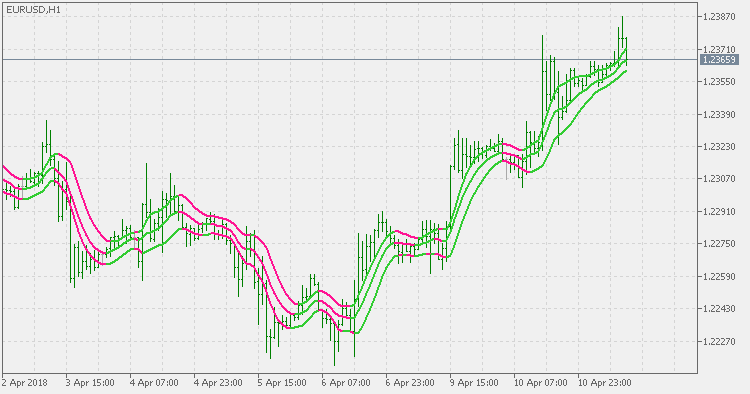

Variation of the "triple" series of indicators.

Basic version of "triple" indicators is using Hull Moving Average. One possible disadvantage of using Hull Moving Average is that Hull Moving Average is tending to overshoot in some situations.

This version uses double smoothed EMA instead of using Hull average, and since double smoothed EMA is never overshooting, that issue is solved. Being a very smooth average too, double smoothed EMA is really a good filter/average to be used in the "triple" series.

As a reminder: triple indicator is using 3 values - average of high, low and close to determine the overall trend direction and and ranging zone (when the price is between high and low average).

Double Smoothed EMA

Double Smoothed EMA

Unlike the similar attempts of smoothing existing indicators, the Double smoothed EMA indicator is not lagging when compared to "regular" EMA.

Glitch Index

Glitch Index

Glitch Index represents the percentage move price has made above or below the detrended SMA.

Stochastic of Hull

Stochastic of Hull

Hull average is used prior to stochastic calculation thus filtering the prices before they are used in the stochastic calculation. This method is used since it adds much less lag than if the smoothing of the already calculated stochastic value would be used.

Dsl - RSI of average

Dsl - RSI of average

This indicator is using filtered prices for RSI (instead of using "raw" prices) and is using Discontinued Signal Line for trend assessment (instead of using slope or fixed levels).