Join our fan page

- Views:

- 4501

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

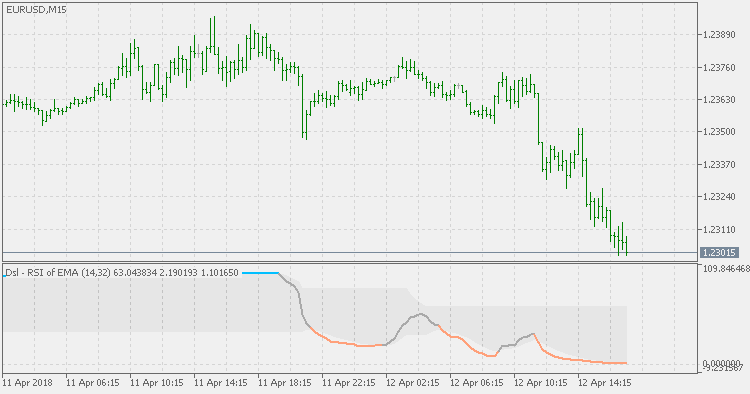

This indicator is using filtered prices for RSI (instead of using "raw" prices) and is using Discontinued Signal Line for trend assessment (instead of using slope or fixed levels).

Price filtering prior to RSI calculation helps in making less false signals without adding significant lag.

Discontinued Signal Lines are helping in making the significant levels a sort of dynamic levels - instead of using fixed levels, indicator is adjusting itself to market (and RSI) changes - thus making it a sort of an adaptive indicator (i.e. instead of adapting the RSI value, significant levels are adapted, and that effectively makes this indicator adaptive).

PS: usual set of built in averages is supported for prices filtering. Setting the average period to 1 makes it equal to "regular" RSI.

Stochastic of Hull

Stochastic of Hull

Hull average is used prior to stochastic calculation thus filtering the prices before they are used in the stochastic calculation. This method is used since it adds much less lag than if the smoothing of the already calculated stochastic value would be used.

Triple DSEMA

Triple DSEMA

This version uses double smoothed EMA instead of using Hull average, and since double smoothed EMA is never overshooting, that issue is solved. Being a very smooth average too, double smoothed EMA is really a good filter/average to be used in the "triple" series.

Vortex

Vortex

Two lines representing positive and negative directional movement. These will intersect and cross during a change of trend and diverge wider and wider as the strength of the trend increases.

Polychromatic Momentum

Polychromatic Momentum

Polychromatic momentum takes an weighted average of all significant lookback periods for the tradable.