Join our fan page

- Views:

- 8770

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Usually most brokers do not provide M1 data over 3 months in MetaTrader 4, but they provide M1 data over 3 years in MetaTrader 5. So we can use this tool to obtain the M1 data in MetaTrader 5 tester and save the data into .hst file for MetaTrader 4 backtesting.

How to use it?

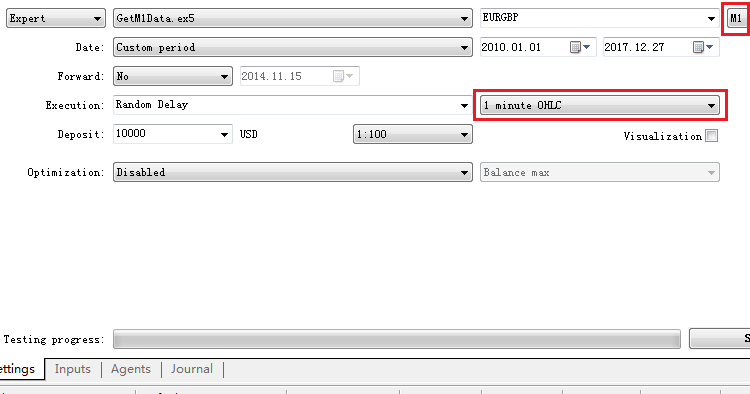

- Test EA in MetaTrader 5, select M1 time frame and 1 minute OHLC.

- After testing finish, the .hst file is saved in tester folder, copy it to your MetaTrader 4 history folder.

- Use period converter script to convert M1 .hst to other timeframes. https://www.mql5.com/en/code/19839.

Inverse Fisher RVI

Inverse Fisher RVI

The Inverse Fisher Transform normalizes the values in the desired range (-1 to +1 in this case) which helps in assessing the overbought and oversold market conditions.

Fisher RVI

Fisher RVI

This indicator has an addition of Fisher Transform to the RVI. The Fisher Transform enables traders to create a nearly Gaussian probability density function by normalizing prices. In essence, the transformation makes peak swings relatively rare events and unambiguously identifies price reversals on a chart. The technical indicator is commonly used by traders looking for extremely timely signals rather than lagging indicators.

Stochastic RVI

Stochastic RVI

Stochastic and RVI (Relative Vigor Index) - both indicators measure overbought and oversold area of the market movement. This indicator combines them both in one single indicator - Stochastic of Relative Vigor Index.

DSL - DEMA MACD

DSL - DEMA MACD

Variation of a long known and useful MACD indicator using DEMA (Double Exponential Moving Average) instead of using EMA (Exponential Moving Average) for MACD calculation, and DSL (Discontinued Signal Lines) and instead of using one signal line uses two. That way it sort of introduces levels as well as signal lines and, judging from tests, it seems to be better in avoiding false signals and it can be used in (short term) reversals detection.