Join our fan page

- Views:

- 8125

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

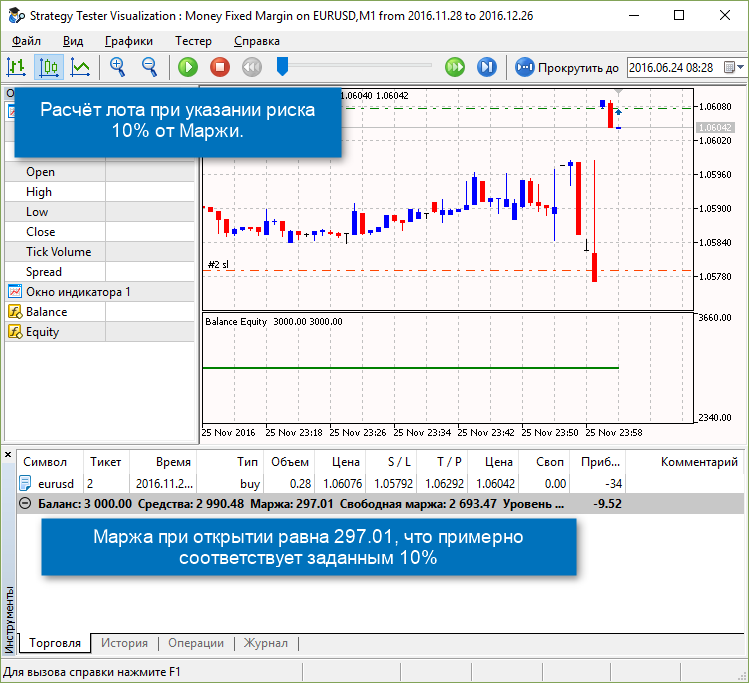

An example for calculating the lot value with a fixed margin level. That is, if you specify 10%, a position with the margin equal to 10% of free margin will be opened.

Input Parameters:

- StopLoss (in pips) — the stop loss level

- % risk — margin for a position as % of free margin

The following loop is implemented to simulate trading:

if(count%980==0) // we pass 980 tics

{

//--- getting lot size for open long position (CMoneyFixedMargin)

Initial value count=-21 is set to "warm up" the strategy tester. Then the remainder after devision of count by 980 (this number was chosen randomly) is calculated. It means that every 980 ticks lot calculation cycle is started, in which lot is calculated taking into account the risks per trade.

The lot calculation cycle depending on risk per trade (calculation for the Buy position):

Step one

double sl=0.0;

double check_open_long_lot=0.0;

//--- variant #1: StopLoss=0.0

sl=0.0;

check_open_long_lot=m_money.CheckOpenLong(m_symbol.Ask(),sl);

Print("sl=0.0",

", CheckOpenLong: ",DoubleToString(check_open_long_lot,2),

", Balance: ", DoubleToString(m_account.Balance(),2),

", Equity: ", DoubleToString(m_account.Equity(),2),

", FreeMargin: ", DoubleToString(m_account.FreeMargin(),2));

//--- variant #2: StopLoss!=0.0

sl=m_symbol.Bid()-ExtStopLoss;

check_open_long_lot=m_money.CheckOpenLong(m_symbol.Ask(),sl);

Print("sl=",DoubleToString(sl,m_symbol.Digits()),

", CheckOpenLong: ",DoubleToString(check_open_long_lot,2),

", Balance: ", DoubleToString(m_account.Balance(),2),

", Equity: ", DoubleToString(m_account.Equity(),2),

", FreeMargin: ", DoubleToString(m_account.FreeMargin(),2));

if(check_open_long_lot==0.0)

return;

Then the calculated lot value for a Buy position taking into account StopLoss is received to the check_open_long_lot variable using the CheckOpenLong method of the CMoneyFixedMargin class:

The following parameters are printed to the Experts journal: StopLoss, calculated lot value in accordance with the risk per trade, trade account balance at the time of calculation, margin at the moment of calculation.

If the calculation returns "0.0", exit:

return;

Step two

Then we receive the lot value of the Buy position for which we have sufficient funds; the value is received to the chek_volime_lot variable using the CheckVolume method of the CTrade class. The following parameters are passed here: m_symbol.Name() — symbol name, check_open_long_lot — position volume we want to open (this parameter was calculated earlier):

double chek_volime_lot=m_trade.CheckVolume(m_symbol.Name(),check_open_long_lot,m_symbol.Ask(),ORDER_TYPE_BUY);

Step three

If the CheckVolume method returns a value other than "0.0", then we check the condition: do we have enough money to open a position with the lot calculated in accordance with the risk.

if(chek_volime_lot>=check_open_long_lot)

m_trade.Buy(chek_volime_lot,NULL,m_symbol.Ask(),m_symbol.Bid()-ExtStopLoss,m_symbol.Bid()+ExtStopLoss);

else

Print("CMoneyFixedRisk lot = ",DoubleToString(check_open_long_lot,2),

", CTrade lot = ",DoubleToString(chek_volime_lot,2));

If we have enough money, open the position, if not — the lot value calculated in accordance with the risk per trade (DoubleToString(check_open_long_lot,2)) and the lot value for wich we have enough funds (DoubleToString(chek_volime_lot,2)) are printed to the Experts journal.

AN example of opening a Buy position with 10% of free margin:

The following was printed to journal:

Money Fixed Margin (EURUSD,M1) 2016.11.28 00:03:24 sl=1.05792, CheckOpenLong: 0.28, Balance: 3000.00, Equity: 3000.00, FreeMargin: 3000.00

Trade 2016.11.28 00:03:31 instant buy 0.28 EURUSD at 1.06076 sl: 1.05792 tp: 1.06292 (1.06042 / 1.06076 / 1.06042)

Trades 2016.11.28 00:03:31 deal #2 buy 0.28 EURUSD at 1.06076 done (based on order #2)

Trade 2016.11.28 00:03:31 deal performed [#2 buy 0.28 EURUSD at 1.06076]

Trade 2016.11.28 00:03:31 order performed buy 0.28 at 1.06076 [#2 buy 0.28 EURUSD at 1.06076]

Money Fixed Margin (EURUSD,M1) 2016.11.28 00:03:31 CTrade::OrderSend: instant buy 0.28 EURUSD at 1.06076 sl: 1.05792 tp: 1.06292 [done at 1.06076]

Note that when calculating the lot depending on the risk of free margin, StopLoss does not matter.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/17282

21hour

21hour

The Expert Advisor places two pending orders at a certain time.

Lucky

Lucky

A tick Expert Advisor. It compares the price on the previous tick and the current price.

RSI EA

RSI EA

RSI EA - trading based on overbought/oversold zones determined by the iRSI (Relative Strength Index, RSI) indicator.

MA Reverse

MA Reverse

Trading by Moving Average. Checking for sufficiency of funds.