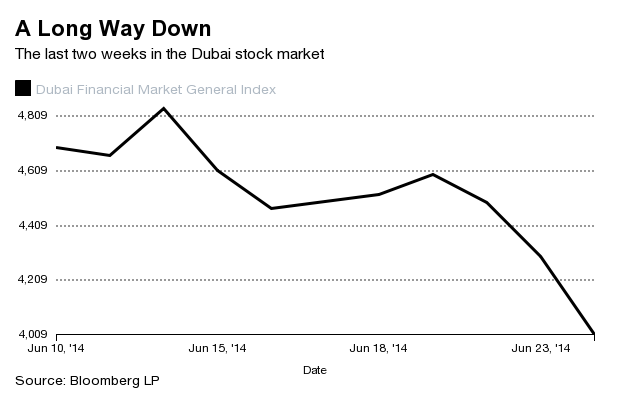

The Dubai Financial Market has been taking a beating for weeks, and news of firings at Arabtec (ARTC:UH), the United Arab Emirates’ largest listed builder, caused a new round of panic yesterday. Shares in the stock exchange fell 6.7 percent, to 4,009.01, leaving them down 25 percent from their May peak. It was the end of a long bull market: Since June 2012, shares in the emirate had climbed 250 percent.

Dubai has been looking like a property bubble for a little while now. The emirate has led consulting firm Knight Frank’s Global House Price Index for 12 months, and while growth has slowed in the past quarter, it still was up 27.7 percent for the year ended in March. Reuters reported that real estate deals in Dubai “jumped 38 percent in the first quarter to some 61 billion dirhams ($16.6 billion).”

If the symbol of the last boom, which ended brutally in 2008, was a network of islands built out of dredged sand in the shape of a world map—still unoccupied—the symbol of this one is a plan, announced in 2012, to build a complex that includes the world’s largest mall, along with 100 hotels (especially since a different mall in Dubai already holds the title of world’s biggest).

Computer-generated image of how The World in Dubai would look after completion

The UAE government has taken steps to try to cool the market: among other things, imposing a cap last fall on mortgages for second homes and investment properties at 60 percent of the purchase price. And yet Dubai’s Land Department has also insisted that the housing market is broadly healthy.

So how much should we read into the most recent recent selloff? The fundamentals of the Dubai housing market remain risky, but analysts interviewed by Bloomberg see purchase opportunities. Paradoxically, the instability elsewhere in the Arab world is part of what’s driving growth and rising real estate prices in Dubai: There aren’t many stable places for Arab investors to put their money. Compared with civil war and marauding jihadis, a potentially overheated property market seems pretty unthreatening.