Catching a trend reversal at its very beginning is always a stroke of luck. Such trades have a huge risk-to-reward ratio, which can exceed 10 or even 20. This is achieved through a tight stop and the great potential of the emerging trend.

Today, I'll show you a counter-trend entry method based on traders' dashed hopes. This system has been repeatedly tested in practice and has a logical basis for gaining an advantage.

Login logic

We identify the point where most people will decide to buy more following the trend. Our entry point will be located where their stop-losses are. We'll ride their pain.

How do we determine such a point and what does Moving Averages have to do with it?

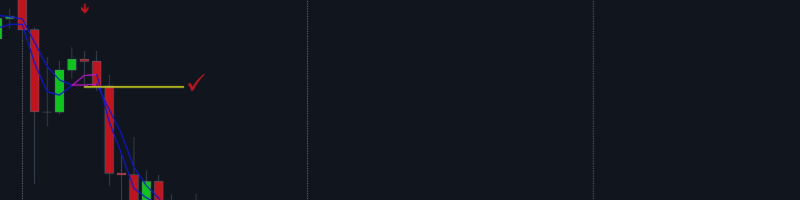

Example for SELL transactions

- We need a situation with a fairly strong uptrend.

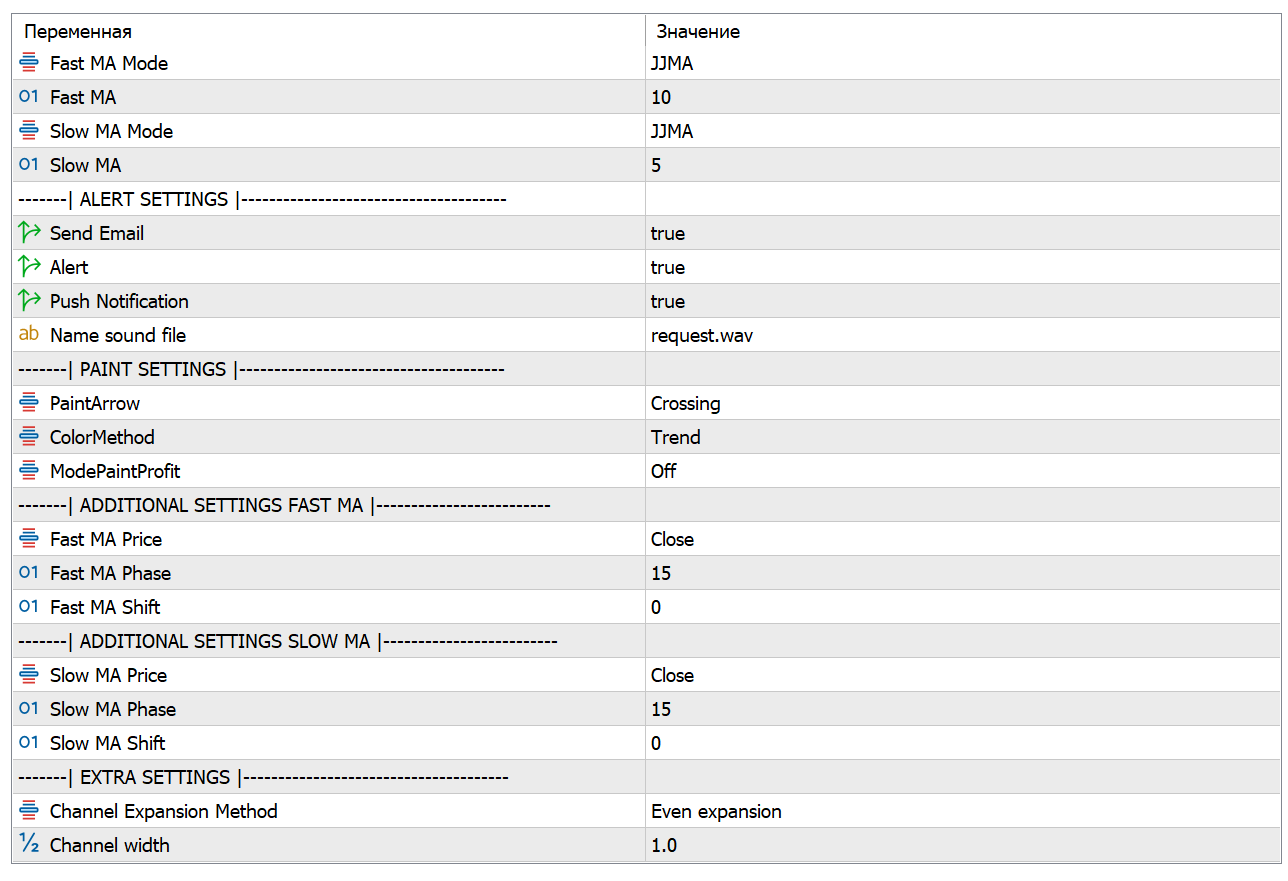

- Let's take two moving averages with the JJMA (adaptive JMA smoothing algorithm) averaging method. We'll use periods of 5 and 10. I recommend downloading the free Moving Average Cross Signal indicator.

- When the fast moving average crosses the slow moving average from below, buyers will enter the market. We will open our position at the low of this bar.

- A stop-loss can be placed slightly above the high of the bar that formed the moving average crossover, or at the previous fractal.

Example for the XAUUSD (Gold) H1 chart. Indicator The Moving Average Cross Signal allows you to reverse the signal arrows for convenience. Note that only one sell signal was triggered.

Right now, a sell signal has appeared for Gold and there is already a profit in the amount of twice the stop loss.

Settings for the Moving Average Cross Signal indicator used in the previous screenshots.

Summary: The "Riding the Wave of Others' Stop-Losses" Strategy

The presented method is not just another moving average crossover strategy. It's a tactical approach based on market psychology that allows you to find entry points with low risk and high profit potential. Its key idea is to take advantage of the moment when most trend traders' stop orders are triggered and enter against them, anticipating a correction or change in momentum. .

Key findings from the method description:

-

Logical advantage : The strategy's strength lies in its psychological underpinning. It purposefully seeks out areas where stop-loss orders are most likely concentrated (in the example given, just above the high of the bullish "signal" bar). Entering at these "exit" levels provides a tight stop and can lead to a rapid move in your favor, providing a high risk/reward ratio. .

-

The Role of JJMA Moving Averages : Using adaptive moving averages (JJMA) with periods of 5 and 10 makes the indicator more sensitive to current price movements compared to simple SMAs, allowing you to identify moments of crowd enthusiasm (or panic) earlier. Their intersection serves as a clear signal to the majority that the trend is continuing—this is when you take a counter position. .

-

Practical implementation :

-

A trend is a must . The strategy only works in a strong, clearly defined trend, as demonstrated by the XAUUSD example. .

-

The signal is a trigger, not an entry point . The intersection of the fast and slow JJMAs marks the point where most people's hopes will be dashed. The entry itself occurs not at the intersection, but at the low of that bar.

-

Risk management . A stop-loss is placed just above the signal bar's high (or on the previous fractal), which logically protects against a situation where a reversal doesn't occur and the trend continues. .

-

-

Limitations and risks :

Final recommendation : This strategy is a powerful tool in the arsenal of a trader who understands that price movements are driven by emotions and the actions of other market participants. Its successful application requires discipline, strict adherence to money management rules, and the ability to distinguish a true strong trend from a corrective move. Like any method, it should first be thoroughly tested on historical data and a demo account to get a feel for its nuances in various market conditions.