Reverse trading is a powerful technique used by professional traders.

It allows trades to be copied automatically in the opposite direction.

With reverse mode enabled, BUY trades are executed as SELL orders.

SELL positions are instantly duplicated as BUY trades.

This feature is widely used for hedging and risk diversification.

Traders can protect capital during unstable market conditions.

Reverse trading is ideal for aggressive or high-risk strategies.

It allows exposure control without modifying the original system.

Many traders use reverse mode for drawdown recovery strategies.

Loss-heavy systems can be transformed into profitable counterparts.

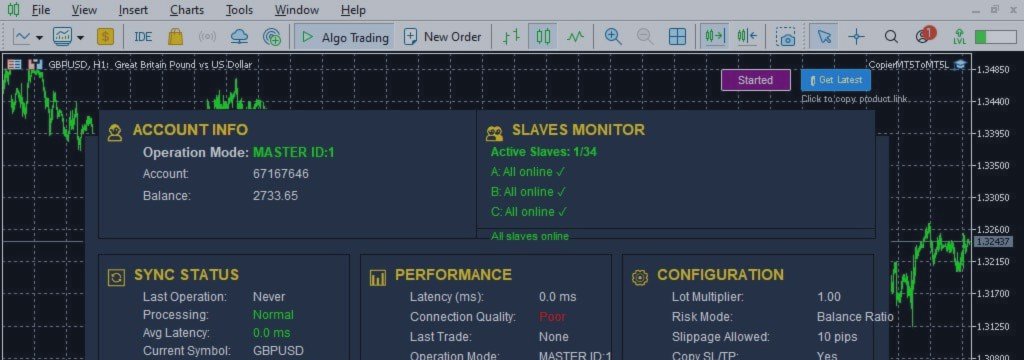

Reverse execution works seamlessly between Master and Slave accounts.

All operations remain synchronized in real time.

Traders can enable or disable reverse mode at any moment.

No changes are required on the Master strategy.

This feature is extremely useful for strategy testing.

The same system can be evaluated in both market directions.

Reverse trading supports Forex, Crypto, indices, and commodities.

Weekend trading is fully supported on brokers open on Saturday and Sunday.

Crypto traders can benefit from high volatility during weekends.

System stability remains strong even during news events.

Reverse trade copying increases flexibility and adaptability.

Professional traders gain full strategic control.

A modern forex trade copier must support reverse trading.

It turns market uncertainty into opportunity.

Copier MT5 To MT5:

You can watch the video demonstration of this copier here:

Copier MT4 To MT4:

You can watch the video demonstration of this copier here:

Copier MT5 To MT4:

You can watch the video demonstration of this copier here:

Copier MT4 To MT5:

You can watch the video demonstration of this copier here: