Delta Fusion Pro – Delta Divergences: How to Anticipate Market Reversals with Order Flow

Delta Fusion Pro – Delta Divergences: How to Anticipate Market Reversals with Order Flow

Introduction to Divergences

Divergences represent one of the most powerful tools in a professional trader's arsenal. They occur when the price movement of an asset moves in the opposite direction compared to an underlying technical indicator, suggesting a possible trend change or imminent market reversal.

In the context of Delta Fusion Pro, divergences are identified by analyzing the discrepancy between price action and Net Delta (the difference between buy and sell volume). This order flow-based approach provides more reliable signals compared to traditional divergences based on standard oscillators.

Divergences represent one of the most powerful tools in a professional trader's arsenal. They occur when the price movement of an asset moves in the opposite direction compared to an underlying technical indicator, suggesting a possible trend change or imminent market reversal.

In the context of Delta Fusion Pro, divergences are identified by analyzing the discrepancy between price action and Net Delta (the difference between buy and sell volume). This order flow-based approach provides more reliable signals compared to traditional divergences based on standard oscillators.

Types of Divergences

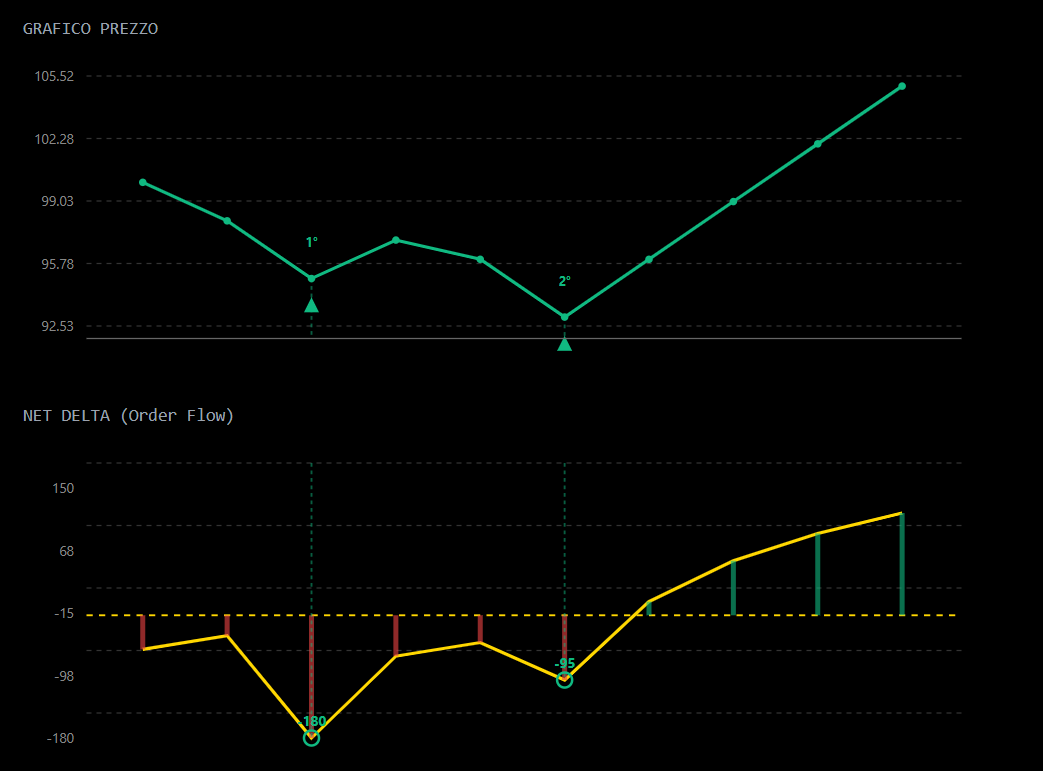

Bullish Divergence

A bullish divergence occurs when:

- Price forms a lower low compared to the previous low

- Net Delta forms a higher low compared to the previous low

This signals that, despite the price declining, selling pressure is decreasing and buyers are starting to accumulate positions. It's a signal of potential upward reversal.

Practical example: Imagine a stock that drops from €100 to €95, forming a first low. Subsequently, the price drops further to €93, but Net Delta shows that selling volume is significantly lower compared to the first low. Sellers are exhausting and buyers are entering: a bounce is likely.

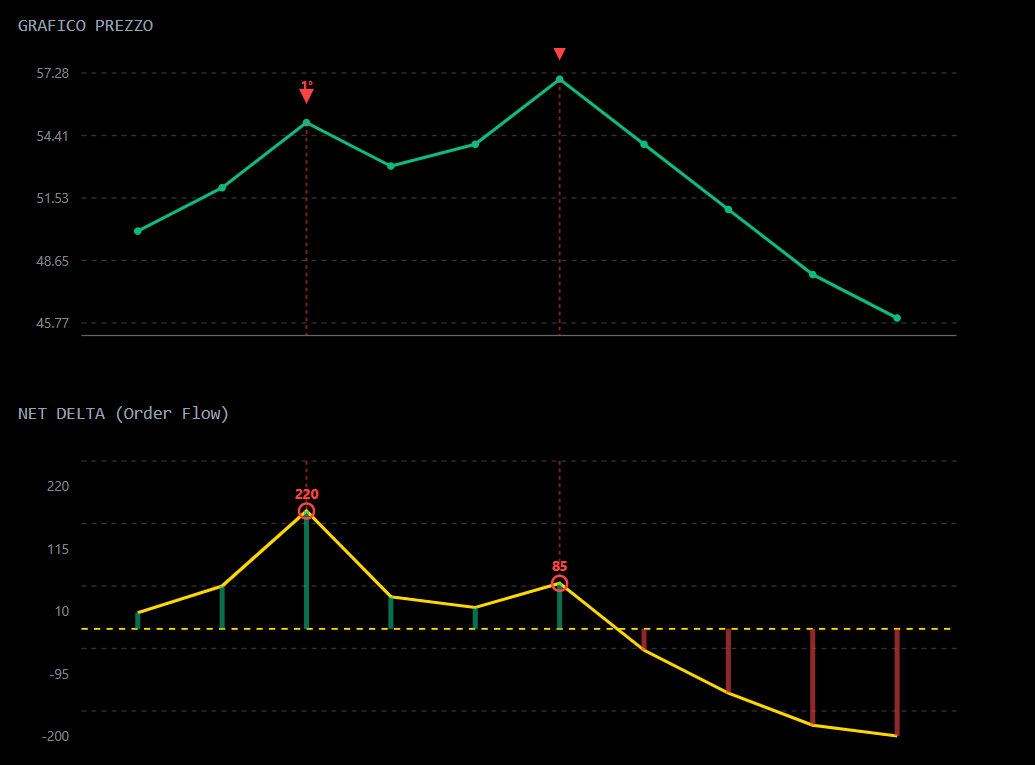

Bearish Divergence

A bearish divergence is the opposite:

- Price forms a higher high compared to the previous high

- Net Delta forms a lower high compared to the previous high

This indicates that, despite the price continuing to rise, buying pressure is decreasing. Buyers are losing strength and sellers are positioning for a downward reversal.

Practical example: A stock rises from €50 to €55 with strong buying volume. Then continues to rise to €57, but Net Delta shows significantly lower buying volume. The rally is exhausting and it might be time to take profits or open short positions.

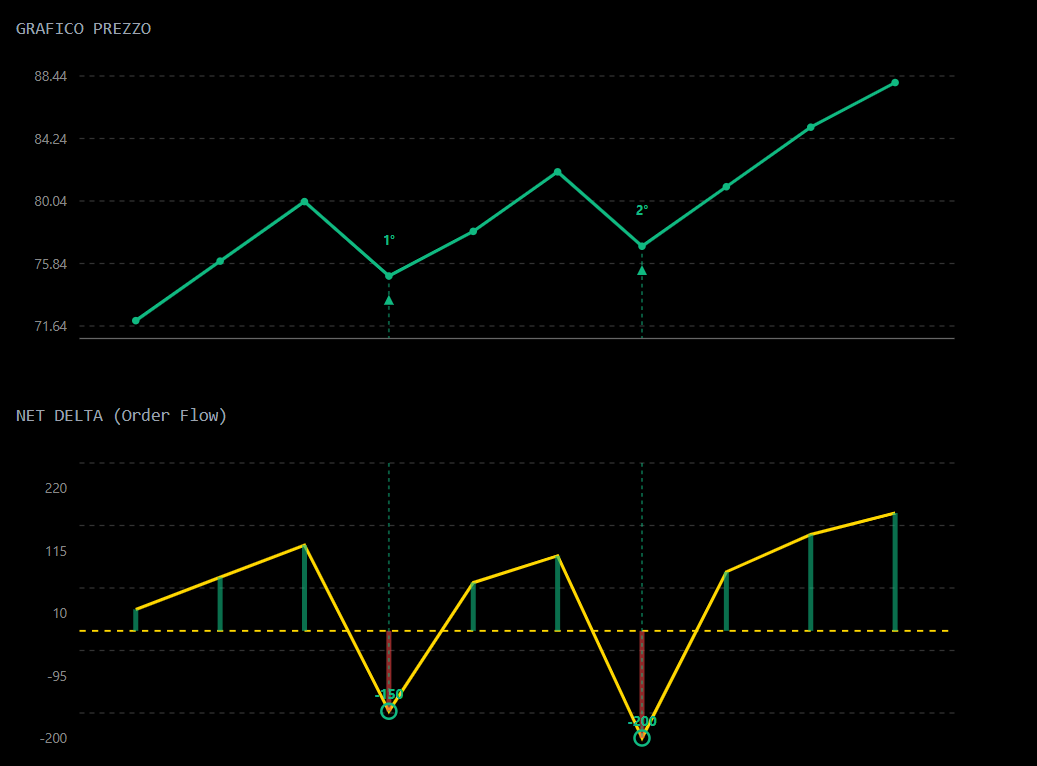

Hidden Divergences

The Delta Fusion Pro system also includes detection of hidden divergences, which confirm the continuation of an existing trend rather than a reversal:

- Hidden Bullish: Price forms a higher low while Net Delta forms a lower low (confirms bullish trend)

- Hidden Bearish: Price forms a lower high while Net Delta forms a higher high (confirms bearish trend)

Hidden Bullish example: During a consolidated uptrend, price corrects from €80 to €75, then corrects again but only to €77 (higher low). However, Net Delta shows more aggressive selling in the second correction. This suggests that smart money is accumulating during pullbacks and the trend will continue.

Strength Classification System

A distinctive feature of Delta Fusion Pro is the automatic strength classification of divergences, which allows distinguishing high-probability signals from less reliable ones.

STRONG Divergences

Characterized by:

- Buy Color: Bright Aqua

- Sell Color: Magenta

- Arrow Size: 4 (the largest)

Strong divergences occur when:

- Net Delta difference exceeds the "Strong Threshold" (default 100.0)

- Price difference is significant (greater than 50 pips)

- Time distance between the two swings is contained (less than double the Swing Length)

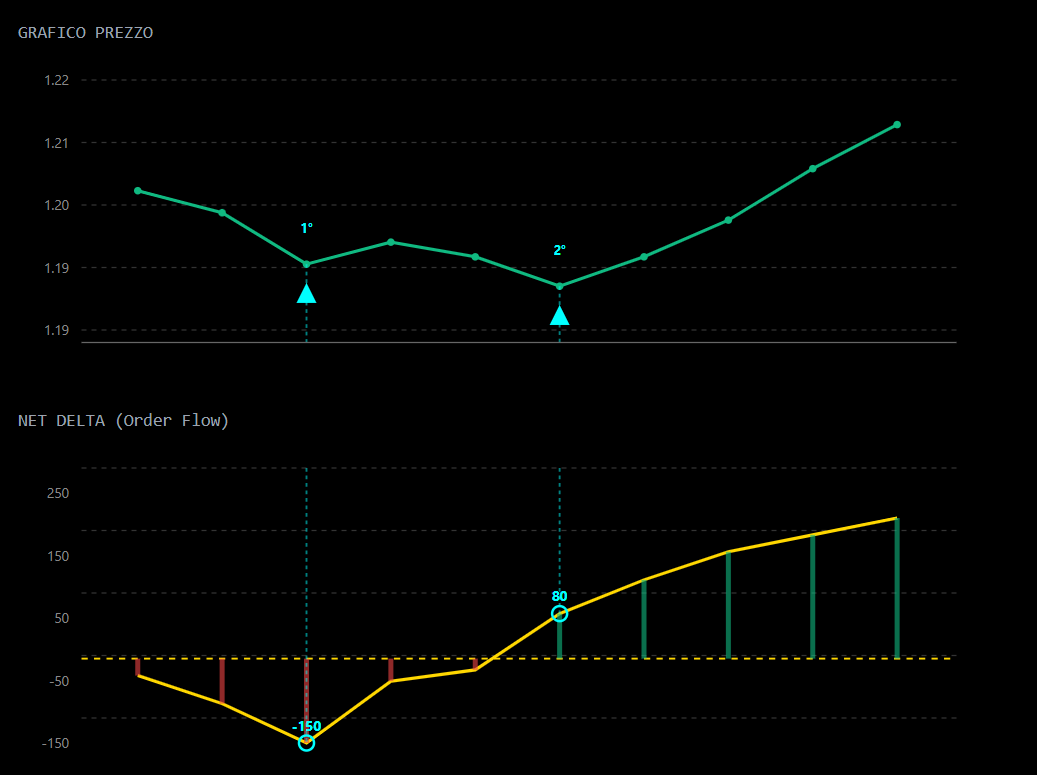

Example: Price drops from 1.2000 to 1.1950 in a first movement, then from 1.1960 to 1.1920 in a second. Net Delta goes from -150 at the first low to +80 at the second. The delta difference (230) far exceeds the strong threshold, the price movement is significant and the two lows are close together: this is a STRONG divergence with very high probability of bullish reversal.

MEDIUM Divergences

Characterized by:

- Buy Color: Dodger Blue

- Sell Color: Orange Red

- Arrow Size: 3

Medium divergences have:

- Delta greater than 1.5x the "Min Div Delta" but lower than "Strong Threshold"

- Good validity but might require additional confirmations

Example: A pattern similar to the previous one but with a delta difference of 75 points instead of 230. It's still significant (exceeds 60, which is 1.5x40), but not enough to be classified as strong. Worth attention but it might be appropriate to wait for confirmation from other indicators.

WEAK Divergences

Characterized by:

- Buy Color: Light Steel Blue

- Sell Color: Light Coral

- Arrow Size: 2 (the smallest)

Weak divergences:

- Barely exceed the minimum "Min Div Delta"

- Can be valid signals but require caution

- Ideal as early warning but not as standalone signal

Example: Price forms two almost identical lows while Net Delta shows a slight difference of 45 points (just above the minimum of 40). The divergence exists but is marginal. It could be an early warning, but it would be risky to trade based solely on this signal.

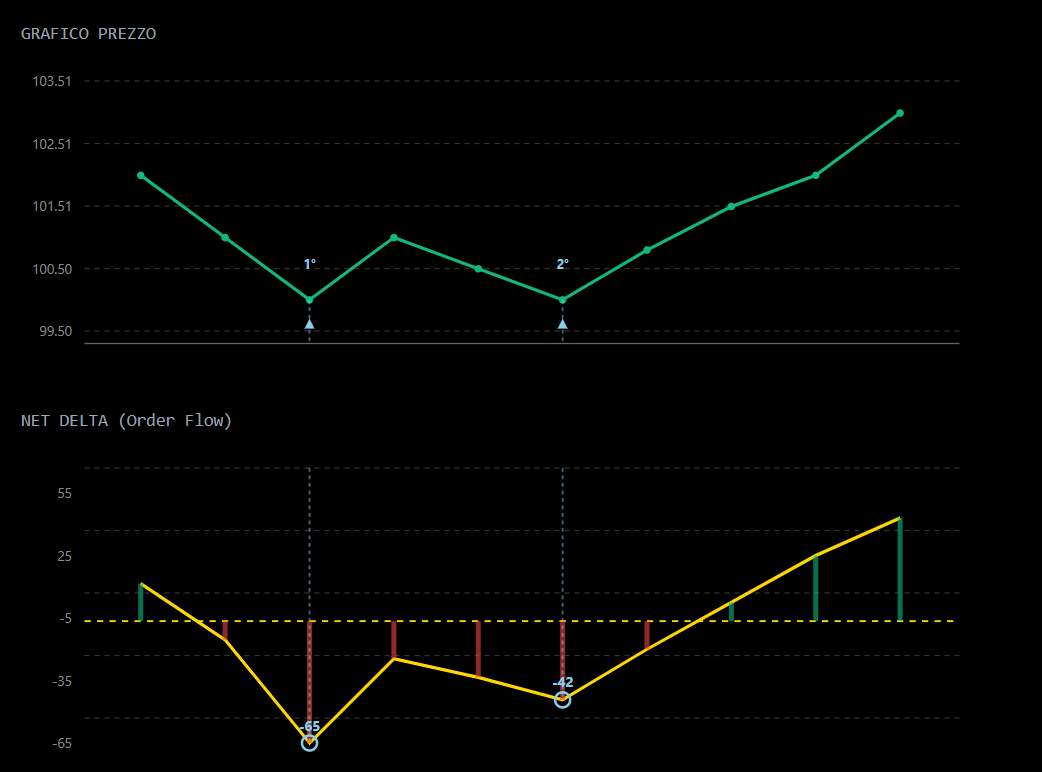

Two almost identical lows (€100), Net Delta shows slight improvement from -65 to -42 (Δ=23, just above the 20 threshold). Early warning but needs confirmation:

Manual Configuration Parameters

Delta Fusion Pro offers granular control through several parameters that can be manually adjusted to adapt to your trading style.

Swing Length (SwingLen)

Default: 10

Recommended Range: 5-50

Defines the lookback period to identify significant highs and lows.

- Low values (5-8): More sensitive, identifies divergences on short timeframes. Ideal for scalping and day trading on M1-M5

- Medium values (10-15): Balanced, suitable for swing trading on M15-H1

- High values (20-50): Captures only long-period divergences, ideal for position trading on H4-D1

Practical example: With SwingLen=5 on an M5 chart, the system will identify divergences developing over 25 minutes. With SwingLen=30 on H1, it will look for patterns developing over 30 hours (more than a trading day).

Min Div Delta (MinDivDelta)

Default: 40.0

Typical Range: 20-200

The minimum Net Delta difference required to consider a divergence valid.

- Low values (20-50): More signals but risk of false positives. Suitable for liquid Forex markets

- Medium values (50-100): Balance between sensitivity and reliability

- High values (100-200): Only very pronounced divergences. Ideal for volatile crypto

Example: On Bitcoin with high volatility, setting MinDivDelta=150 will filter noise and show only when there's a clear discrepancy between price and volume, reducing false signals but capturing major reversals.

Min Signal Gap (MinSignalGap)

Default: 3

Recommended Range: 2-10

The minimum number of bars that must separate two consecutive divergence signals, to avoid redundant signals.

- Low values (2-3): Allows more frequent signals

- High values (5-10): Filters aggressively, only well-spaced divergences

Example: With MinSignalGap=5 on an M15 chart, after detecting a bullish divergence, the system won't signal another divergence (neither bullish nor bearish) for at least 75 minutes (5 bars x 15 minutes).

Div Volume Confirm

Default: Activated (true)

Multiplier: 1.2

When activated, requires that volume on the divergence bar be at least 20% higher than the average of recent bars.

Example without volume confirmation: Price forms a double bottom with increasing Net Delta, but both lows occur with anemic volumes. The divergence is signaled but could be unreliable.

Example with volume confirmation: Same situation but the second low shows 140% volume compared to average. This confirms there's real market participation and the divergence is more reliable.

Div Filter By Trend

Default: Activated (true)

Trend Period: 50

Filters divergences based on the underlying trend:

- Bullish divergences favored in downtrend

- Bearish divergences favored in uptrend

- Hidden divergences favored in presence of trend

Example: During a strong uptrend, a traditional bearish divergence might be just a normal correction. The trend filter reduces the weight of this signal. Conversely, a hidden bearish that confirms the trend will get greater visibility.

Strong Threshold (Div_StrongThreshold)

Default: 100.0

Threshold to classify a divergence as STRONG instead of MEDIUM or WEAK.

- Calm markets: Lower to 60-80 to capture more strong signals

- Volatile markets: Increase to 150-200 to avoid strong signal inflation

Example: In Forex during the Asian session (low volatility), a delta difference of 80 might be exceptional and deserve strong classification. During NFP release (very high volatility), differences of 200+ might be needed to distinguish true strong signals from noise.

Auto-Tuning System: Adaptive Intelligence

The true innovation of Delta Fusion Pro is the Auto-Tuning system, which automatically adjusts all parameters based on the characteristics of the current instrument and timeframe.

How It Works

Auto-Tuning analyzes:

- Instrument type: Crypto, Forex, Indices, Commodities, Stocks

- Normalized volatility: ATR% relative to price

- Average volume: Market participation patterns

- Timeframe: From M1 to MN

Adaptations by Instrument

Cryptocurrency (Bitcoin, Ethereum):

- MinDivDelta increased by 50-80% to handle high volatility

- SwingLen reduced to capture rapid movements

- Imbalance Ratio reduced (more sensitive) for high crypto trader aggressiveness

Forex (EUR/USD, GBP/USD):

- Balanced baseline parameters

- Moderate MinDivDelta (standard 20-40 range)

- SwingLen adapted to timeframe with conservative multipliers

Indices (S&P 500, DAX):

- MinDivDelta increased by 15-20%

- Higher Strong Threshold to reduce false positives in wide movements

Commodities (Gold, Oil):

- Intermediate parameters between Forex and Crypto

- Emphasis on volume confirmation for the discontinuous nature of commodity trading

Adaptations by Timeframe

Scalping (M1-M5):

- Base SwingLen: 3-5

- Reduced MinDivDelta to capture micro-divergences

- Minimum Signal Gap (2-3)

Intraday (M15-H1):

- Base SwingLen: 8-12

- Balanced parameters

- Moderate Signal Gap (3-5)

Swing Trading (H4-D1):

- Base SwingLen: 18-35

- MinDivDelta and Strong Threshold significantly increased

- Extended Signal Gap (5-8)

Auto-Tuning Examples in Action

Scenario 1: Bitcoin on M5

- Detected instrument: Crypto (high volatility ~4%)

- Timeframe: M5

- Auto-Tuning applies:

- SwingLen: 5 (sensitive to rapid movements)

- MinDivDelta: 68.0 (40 base × 1.7 for crypto volatility)

- Signal Gap: 2 (high frequency for scalping)

- Strong Threshold: 129.0 (68 × 1.9)

Scenario 2: EUR/USD on H1

- Detected instrument: Forex (medium volatility ~0.8%)

- Timeframe: H1

- Auto-Tuning applies:

- SwingLen: 12 (standard period for H1)

- MinDivDelta: 28.0 (20 base + volatility adjustment)

- Signal Gap: 4 (medium filter)

- Strong Threshold: 70.0 (28 × 2.5)

Scenario 3: S&P 500 on Daily

- Detected instrument: Index (low volatility ~1.2%)

- Timeframe: D1

- Auto-Tuning applies:

- SwingLen: 35 (extended lookback for daily)

- MinDivDelta: 52.0 (increased base for indices)

- Signal Gap: 7 (significant distance required)

- Strong Threshold: 143.0 (52 × 2.75)

Advanced On-Chart Visualization

In addition to signals in the indicator window, Delta Fusion Pro can display divergences directly on the price chart.

Colored Arrows by Strength

- Strong Buy: Bright aqua arrow (↑) large, below the low

- Medium Buy: Standard blue arrow (↑) medium

- Weak Buy: Light blue arrow (↑) small

- Strong Sell: Magenta arrow (↓) large, above the high

- Medium Sell: Orange-red arrow (↓) medium

- Weak Sell: Light coral arrow (↓) small

Informative Tooltips

Hovering over an arrow displays a tooltip indicating:

- Direction (BUY/SELL)

- Divergence type (Regular/Hidden)

- Strength (STRONG/MEDIUM/WEAK)

This allows quick assessment of signal quality without having to consult the indicator window.

Best Practices for Trading with Divergences

1. Don't Trade Isolated Divergences

Divergences are alert signals, not immediate execution signals. Always seek confirmations:

- Break of key structures (support/resistance)

- Reversal candlestick patterns

- Confirmation from other order flow indicators (Imbalance, Infusion)

2. Prioritize STRONG Divergences

Statistically, divergences classified as STRONG have a significantly higher success rate. If you must choose, focus on these.

3. Consider Market Context

- In a strong trend, favor hidden divergences (continuation)

- In range or congestion, regular divergences (reversal) are more reliable

- Avoid divergences against the main trend on higher timeframes

4. Manage Risk

Even the best divergences can fail:

- Always use stop loss

- Size positions appropriately

- Consider that WEAK divergences have a higher failure rate

5. Combine Timeframes

Multi-timeframe strategy:

- Identify STRONG divergence on main timeframe (e.g., H1)

- Look for confirmation on lower timeframe (e.g., M15)

- Enter on lower timeframe with tighter stop

- Target based on main timeframe

Complete example: On EUR/USD H1 a STRONG bullish divergence forms. On M15 you wait for a MEDIUM bullish divergence or a reversal pattern. You enter long on M15 with 20 pip stop, 100 pip target based on H1 structure. Better timing with reduced risk.

Recommended Configuration for Beginners

If you're starting out, use these settings:

Div_AutoTune = true (let the AI work)

Div_RequireVolumeConfirm = true (reduces false signals)

Div_FilterByTrend = true (increases probability)

Div_ClassifyStrength = true (essential for prioritizing)

Div_UseHiddenDivergence = false (initially focus on regular)

Start by observing only STRONG and MEDIUM divergences on H1 or higher timeframes. As you gain experience, you can:

- Activate hidden divergences

- Move to lower timeframes

- Consider WEAK divergences as early warning too

- Manually customize parameters

Conclusion

Divergences represent a privileged window into market psychology, revealing when buying or selling pressure is exhausting before the price clearly reflects it. The system implemented in Delta Fusion Pro takes this concept to a higher level through:

- Intelligent classification of signal strength

- Adaptive auto-tuning that eliminates hours of manual optimization

- Clear visualization that enables quick decisions

- Advanced filters that drastically reduce false signals

Whether you're a scalper looking for micro-reversals on M1 or a swing trader seeking multi-day setups, Delta Fusion Pro's divergence system automatically adapts to your style, providing reliable and actionable signals.

Remember: divergences are a powerful tool, but like all technical tools, they work best when combined with a solid understanding of market context, rigorous risk management, and execution discipline.

Start by observing, then practice in demo, finally operate with confidence. Divergences await you at every corner of the market: now you have the tools to recognize and exploit them.

Good Trading