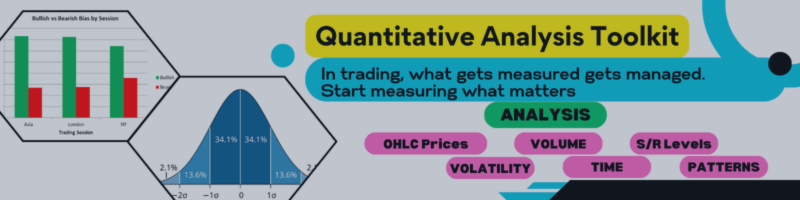

Quantitative Trading Analysis Toolkit : Stop guessing, start measuring

Transform Your Trading From Guesswork to Data-Driven Decisions

Most traders rely on intuition, chart patterns, or market rumors. The result? Inconsistent performance and avoidable mistakes. Professional institutions, on the other hand, rely on quantitative analysis — measuring, testing, and managing risk with hard data.

The good news? You no longer need a team of quants or access to a trading desk to apply these methods. With the Quantitative Trading Analysis Template, any trader can unlock the power of professional-grade analytics directly inside Excel.

💡 “In trading, what gets measured gets managed. Start measuring what matters.”

This toolkit is original, copyrighted, and built for traders who want to understand market behavior, volatility, liquidity, and trading opportunities at a deeper level. It connects seamlessly with MetaTrader 5 (or any OHLCV data source) and turns raw market data into actionable insights — with just a few clicks.

Link to MT5 version : https://www.mql5.com/en/market/product/150569

Download Free Quant Level Indicator : https://www.mql5.com/en/market/product/151184

MQL5 Channel (share updates, analysis and requests) : https://www.mql5.com/en/channels/quantrading

Why Quantitative Analysis Matters

This toolkit is based on the same approach investment banks teach their first-year analysts: stop guessing, start measuring. It’s the essential first step in professional trading education — learning to read markets through data, not speculation.

What’s Inside the Toolkit

🔑 1. Multi-Source Data Integration

-

Works with any timeframe and market (FX, Indices, Commodities, Crypto).

- Direct OHLCV export from MetaTrader 5.

-

Compatible with external data sources (websites, other platforms).

-

Recommended for H1 and Daily data for best accuracy.

📈 2. Advanced Quantitative Analysis

-

Instant distribution analysis with histograms.

-

Automatic return calculations for every candle/bar.

-

Risk metrics: volatility, standard deviation, and behavioral insights.

-

One-click professional reporting.

⏰ 3. Session Volatility & Strategy Bias

-

Identify the most bullish/bearish sessions.

-

Strategy guidance: breakout vs. range trading by session.

-

Best and worst trading hours for profitability.

-

Weekly and daily time-based trading tendencies.

4. Time-Based Price Behavior

-

Bullish/bearish tendencies by hour of the day.

-

Strong trend days vs. quiet, low-volatility days.

-

Volatility comparison by month and potential seasonality cycles.

💧 5. Volume & Liquidity Analytics

-

Real broker volume integration (futures or FX).

-

Liquidity maps by hour and day.

-

Volume–price correlation: how volume impacts returns.

-

Volume–volatility relationship to spot strong momentum.

⚡ 6. Advanced Support & Resistance Engine

-

Two proven quantitative methods to calculate S/R levels:

-

Range Division Theory.

-

Volume-Weighted Levels.

-

-

Levels automatically exported to MT5 via a free included indicator.

-

Filters to focus on only the most significant levels.

🕯️ 7. Candlestick Pattern Analysis

-

Automatic detection of 20+ major candlestick formations.

-

Historical success rates & average returns per pattern.

-

Market-specific performance insights.

-

Reversal vs. continuation signal detection.

Why Traders Choose This Template

✅ Built by a market professional with years of trading and research experience.

✅ Makes bank-level quantitative methods accessible to both beginners and pros.

✅ Simple, clear tables and charts — no coding needed.

✅ Helps traders replace intuition with statistical evidence.

What’s Included

-

📊 Main Excel Template with all analysis tools.

-

📥 MT5 Data Export Script.

-

🎯 Free MT5 Indicator to visualize support/resistance levels.

-

🔄 Lifetime updates & improvements.

Licensing & Protection

To keep this tool exclusive, it uses a secure licensing system. Traders provide their MT5 account number and Windows username to activate their copy. This ensures full protection against unauthorized sharing.

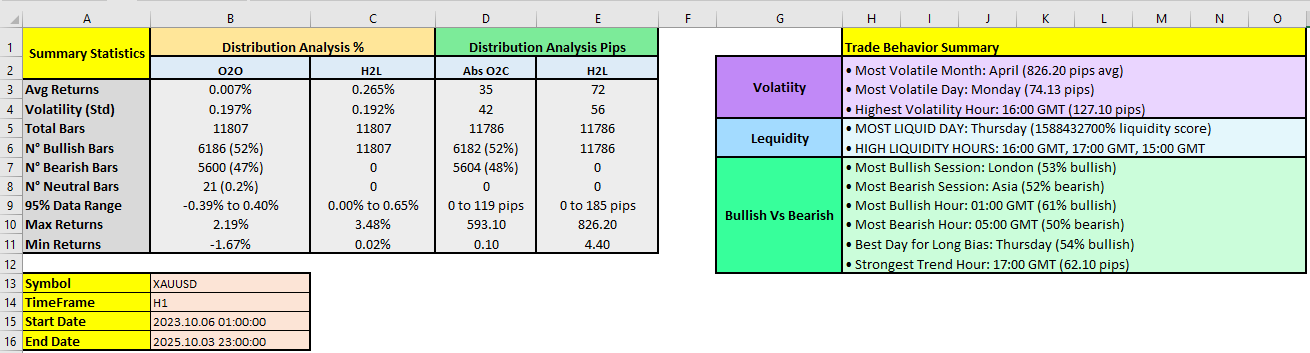

Update to v1.1

We added Summary Analysis

- Get a quick overview of your quantitative performance, including descriptive statistics, distributions, volatility, liquidity, time, and Baie analysis — all in one place.

- Easily compare results across different markets for faster insights and decision-making.

EURUSD H1 Last 2 Years, Quant summary