Automatic generation of potentially profitable, free advisors for MetaTrader in a public Telegram channel.

In this post, I want to share my development with everyone who's interested. Before you is the first of its kind automated factory for daily production of advisors, which operates autonomously and without my participation. The entire process is managed by my servers and additional software. This development is unique.

The goal of this development is to supplement a very important section for portal users with free and efficient advisors, which will significantly expand your arsenal in trading.

Why did I decide to create such a resource and what is its benefit?

I have been on the portal for a long time and noticed that free solutions are very popular. And the thing is that a lot of beginners come here. They want to first try something simpler, before buying any advisor. Such an opportunity exists on the portal, but the quality of such solutions leaves much to be desired. Moreover, I believe that there are quite few of them. My advisor production factory raises the bar of quality of such products. We constantly provide retraining of advisors on fresh quotes, which saves the user from constant optimization and, on the contrary, frees up their time, freeing from routine tasks. This allows to focus on the selection of an already optimized product, which has increased chances for profit in the future. Despite the obvious advantages that many will appreciate when exploring advisors, I didn't aim to outdo the Market section with free advisors. I just want to supplement it with a fresher solution, which, I am sure, many portal inhabitants will appreciate.

How the hell does all this work?

In general, everything is quite simple. Everything starts with the export of quotes from the MetaTrader 5 terminal using an additional, auxiliary, custom advisor. These quotes are constantly kept fresh and closest to the current market, which allows to constantly release advisors who have been trained on the freshest market data. This simultaneously allows to regularly release fresh advisors and maintain channel activity, look for new settings, working timeframes and provide maximum variety of trading instruments for completely different users. Both tasks are important.

Exported quotes go to my machine learning modules that try to find patterns on the selected chart. Having found a pattern, it turns into a ready and optimized advisor and gets into the channel. All you have to do is to check it in the tester before using it on a real account or demo account. All advisors are initially profitable in the tester, which greatly simplifies and reduces your time, which you would spend on selection.

Someone likes to trade ordinary currency pairs, and someone may want to try themselves in American stocks or cryptocurrency. All these sectors are analyzed in our system. The system tries to provide you with the widest range of instruments and strategies.

Features of advisors that you will find in the channel

Essentially, all these advisors are built upon a single template. This is done for convenience and ease of use. Once you've dealt with one advisor, the rest will make complete sense. Here is what their graphical interface will look like.

In each such advisor at the code level, the instrument's name to which it trades and the target timeframe of the chart on which it needs to be hung are embedded. Additionally, a rule for naming advisors has been adopted that also implements this principle, so that the user understands which advisor is for what, to avoid confusion. The advisor works exclusively with the instrument and timeframe specified in it. It is possible to examine its work on other timeframes and even on other instruments, but this is at the user's discretion. Sometimes universal strategies are obtained.

Settings for the general template (based on which advisors are created)

Group "Volumes":

- Auto Lot: Using automatic volume control of the lot (proportional to the deposit).

- Lot: Specifies the volume of the lot. If auto lot is off, trade the specified volume. If on, such a lot is used for deposits below.

- Deposit For Auto Lot: Defines the deposit when using automatic control of the lot's volume. The advisor calculates relative to this value, by how much to multiply the lot.

"Mode of sitting out losses" group:

- Linearization: Enabling or disabling the hold mode. If a position has a drawdown, the robot will try to hold it until it is closed in plus.

- Minutes Hold For Linearization: It determines the maximum time to hold a position in minutes when the hold mode is on.

"Miscellaneous" section:

- Magic Number: A unique transaction number that allows the advisor to work only with its orders and does not interfere with other advisors or manual trades.

- Stop Loss Points: The stop-loss value in points. If set to 0, stop losses aren't placed and are disabled.

- Take Profit Points: The profit value in points. If set to 0, take profits aren't placed and are disabled.

- Time Shift Hours: Allows to set time shift in hours. As a rule, all brokers have the same time and the variable is unlikely to be useful.

MAX Spread Points: Maximum spread value in points.

- Orders Comment: Allows you to add a comment to positions.

"Combat with outdated settings" group:

- Days To Future: Determines the number of days, starting from the date of the end of optimization, during which the advisor has the right to open new positions. Old positions can be closed.

Example of an adviser from the channel

In order for any beginner to quickly, easily and instantly start using advisers, one of the advisers can be examined. To do this, you first need to understand which tools are where and on which broker. In my logic everything is divided into sectors. There are 4 sectors. Here they are:

- Currency pairs

- American stocks

- Cryptocurrency

- Metals and exotic currencies

Not every sector is present at this or that broker, but after all, these are not our problems but their problems first of all, I think no one would argue with me. In this regard, it is necessary to cite examples of at least some brokers that contain a certain sector of instruments, before considering one of the advisers. For example:

- RoboForex (full presence of currency pairs, American stocks, and partially metals)

- FxPro (full presence of cryptocurrency, currency pairs, metals, exotic currencies)

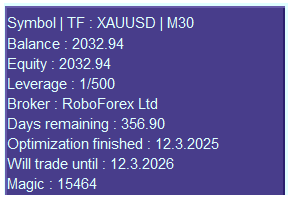

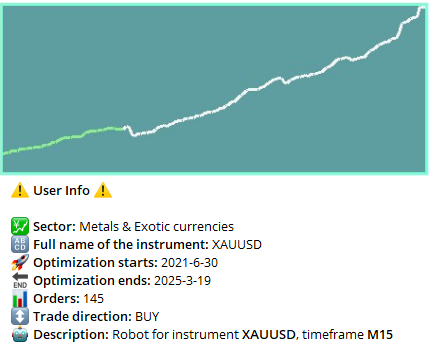

Now let's take this adviser for example, download it and test it in the MetaTrader 5 tester. Using the post data we see:

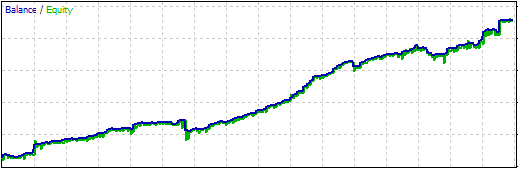

We will conduct a backtest in the strategy tester and compare the picture and the results:

As we can see, the backtest in the tester matched the infographic in the post. This is an additional auxiliary control element of the advisers at the preliminary stage, to immediately weed out questionable advisers. But in most cases, backtests will match.

Afterword

My task is to make your job easier to make money using additional tools and further improve algorithms. Your task is just to use advisers and share them with your acquaintances and friends or use on your own. I have made the selection task easier for you. Use, combine, explore, trade.