Welcome to the FX Volume FAQ!

This guide is your comprehensive resource for understanding, setting up, and leveraging FX Volume to its fullest potential. Whether you’re new to FX Volume or a seasoned trader, this guide will address your questions and help you get the most out of this powerful tool.

If you have any additional questions, don’t hesitate to reach out. We’re here to support you every step of the way!

![]()

1. Why FX Volume?

Your Edge in the Forex Market

FX Volume is not just another indicator—it’s your competitive advantage. By providing real trading volumes (long and short positions) aggregated from brokers worldwide, FX Volume delivers actionable insights into market sentiment. With FX Volume, you can:

- Spot trends early and act with confidence.

- Confirm or challenge price action with real data.

- Avoid the pitfalls of retail trading traps.

Trade Smarter: Align with Institutional Perspectives

Did you know that over 70% of retail traders lose money? FX Volume flips the perspective, showing you how the institutional players (the “big boys”) view the market. When retail sentiment is 80% bullish, FX Volume reflects this as 80% bearish—helping you trade smarter and align with informed market positions.

Understanding Tick Volume vs. Real Trading Volume

In MT4/MT5, tick volume counts the number of price changes within a specific time frame but lacks information on trade direction and size. This metric varies significantly between brokers, leading to inconsistent indicator results and unreliable data for trading strategies.

In contrast, FX Volume provides real retail trading volume data, including trade direction and size, offering consistent and actionable insights across all terminals and brokers.

For a detailed analysis, read our article on Real Volume vs. Tick Volume.

Key Insights from Volume Trends

- Rising Volume: Indicates market stability and confidence, reinforcing trends.

- Falling Volume: Suggests market instability, signaling caution.

Practical Example

- Bullish Signal: GBP long ratio rises by +5%, with increasing GBP volume—indicating a supported upward move.

- Bearish Signal: GBP long ratio drops by -5%, with increasing GBP volume—indicating a likely downward trend.

Get started with FX Volume today!

![]()

2. Simple Setup, Seamless Operation

Install SI Connect EA and Get Started Quickly

To access real-time data, install the SI Connect EA. It’s quick, simple, and ensures smooth operation.

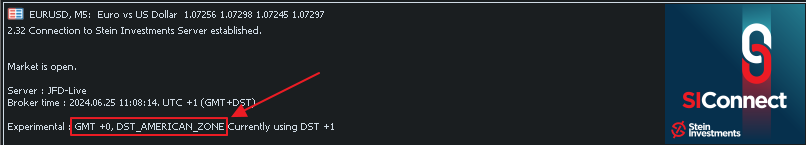

Time Settings Made Easy

When the market is open, FX Volume automatically determines and applies the correct GMT and DST settings, ensuring perfect alignment with your broker’s data. SI Connect also displays your terminal’s active GMT/DST settings in its status panel for reference.

However, for weekends or backtesting, FX Volume users need to set these parameters manually in the indicator settings, as the market is closed, and automatic detection isn’t possible during these times.

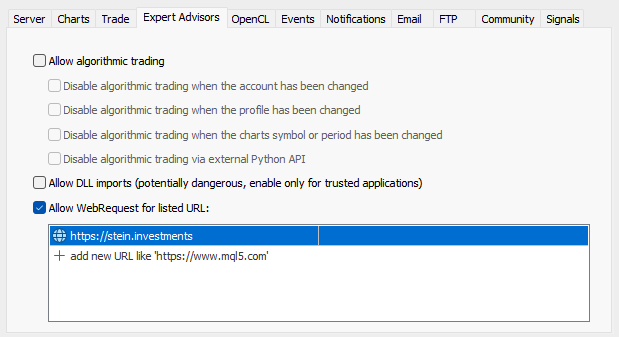

Allow Data Access

Add https://stein.investments to the list of allowed URLs in your Metatrader terminal properties. This quick step ensures uninterrupted data flow, keeping your charts live and accurate.

![]()

3. Real-Time Insights: Trade with Confidence

Stay Updated, Always

FX Volume runs on servers that record data 24/7. Even if your terminal is offline, the latest data syncs seamlessly to your charts once you reconnect.

Real-Time Advantage Over Weekly Reports

Unlike COT reports, which provide weekly summaries, FX Volume updates in real-time. This makes it ideal for intraday and day trading strategies where speed and precision matter.

Customizable Alerts

Tailor alerts to fit your schedule using FX Volume’s alert scheduler. Stay informed without unnecessary interruptions.

Custom Chart Templates

Enhance your analysis with our ready-to-use chart templates for the Volume Power Trading System. Download them here.

![]()

4. How FX Volume Works: Behind the Scenes

Market Data Collection

FX Volume aggregates data from multiple brokers worldwide, summarizing millions of trades into clear, actionable insights. This anonymous data reveals:

- How retail traders are positioned.

- Which currencies are actively traded.

- Whether volume trends support or contradict price movements.

Why Volume Data Matters

FX Volume uses live data combined with historical trends to give a complete market picture. By comparing long and short positions across currencies, it shows whether a market trend is truly supported by volume.

![]()

5. Use FX Volume to Spot Opportunities

Combine Volume and Price Action for Better Decisions

- Rising GBP long ratio (+5%) with increasing GBP volume → Bullish signal.

- Falling GBP long ratio (-5%) with increasing GBP volume → Bearish signal.

Can FX Volume Help Identify Low-Risk Opportunities?

While no strategy is completely risk-free, FX Volume provides real-time insights into retail trading volumes, helping you spot strong volume trends across currency pairs. These trends can indicate market-driven movements, offering opportunities to trade with tighter stop-loss levels and reduced risk. For a detailed example, read our article on minimizing trading risk with FX Volume.

Divergence Trading Simplified

FX Volume is an excellent tool for divergence strategies, helping you identify optimal entries. Learn more here.

How to Interpret FX Volume Data After News Events

FX Volume can reveal critical insights into market behavior following news events. Market-driven movements often indicate genuine trends, while news-driven reactions may signal potential reversals or corrections. For a detailed breakdown of interpreting volume data in such scenarios, read our article on FX Volume and Post-News Analysis.

Sentiment Analysis with Net Long Volume

Net Long Volume shows the balance between long and short positions, helping you quickly gauge market sentiment and potential direction.

Understanding the Net Long Delta in FX Volume

The Net Long Delta provides a historical view of net long positions for each symbol, calculated using the net long data of the underlying currencies. This ensures maximum accuracy and helps traders track shifts in market sentiment over time. For more details and practical examples, read our article on leveraging the Net Long Delta.

![]()

6. Advanced Tools for Developers

Fully EA-Compatible

FX Volume integrates seamlessly with your Expert Advisors. Use iCustom to fetch real-time data and calculate metrics like percentage changes for automated strategies.

string FXV = "::Indicators\Market\FX Volume.ex4"; double TotalVolumeNow = iCustom(_Symbol, PERIOD_M1, FXV, ..., 9, 0);

double TotalVolume8HoursBefore = iCustom(_Symbol, PERIOD_M1, FXV, ..., 9, 480);

double ChangeInPercent = (100 * TotalVolumeNow / TotalVolume8HoursBefore) - 100;

Testing in MT4 Strategy Tester

Want to test FX Volume in a controlled environment? Follow these steps:

- Open your MT4 data folder.

- Copy the SI Lab folder from MQL4\Files .

- Paste it into tester iles .

- Start your strategy test to analyze results.

![]()

7. FAQs: Your Questions Answered

Do I Lose Data When My Terminal is Closed?

No. FX Volume servers store data 24/7. When you reconnect, your terminal automatically syncs with the latest updates.

How Is FX Volume Different from COT Reports?

COT reports provide weekly data for long-term strategies. FX Volume updates in real-time, making it perfect for intraday and day traders.

Can Institutional Volume Data Be Accessed?

Institutional data is prohibitively expensive ($200K/year for a 1-hour delay). FX Volume focuses on retail market data, offering reliable insights at an accessible price.

Can I Combine Alerts for Volume Changes?

Absolutely! FX Volume already comes with powerful alert options, but if you want to take things further—combining multiple instances, analysis periods, or different types of volume data analysis—Custom Alerts is the ideal solution.

- Combine Multiple FX Volume Analyses: Integrate data from several FX Volume instances or analysis periods into unified alerts.

- Access Strategy-Specific Alerts: Get tailored notifications for various trading strategies, simplifying the process for new users.

- Enjoy Complete Customization: Adjust settings to match your trading preferences and strategy, ensuring you receive only relevant information.

Custom Alerts enhances the capabilities of FX Volume, making it easier to monitor complex analyses and implement trading strategies effectively—all while simplifying the entry for traders new to volume analysis.

Need Help?

We’re here to make your trading journey as smooth as possible. If you have any questions, need assistance with setup, or want to explore trading strategies, don’t hesitate to reach out to us.

Your success is our priority!

Why Choose FX Volume?

At Stein Investments, we’re passionate about empowering traders with the tools and insights needed to succeed.

FX Volume offers real-time data, reliable market sentiment analysis, and user-friendly features, helping you trade with confidence and precision.

Take charge of your trading today—install FX Volume and experience the difference!