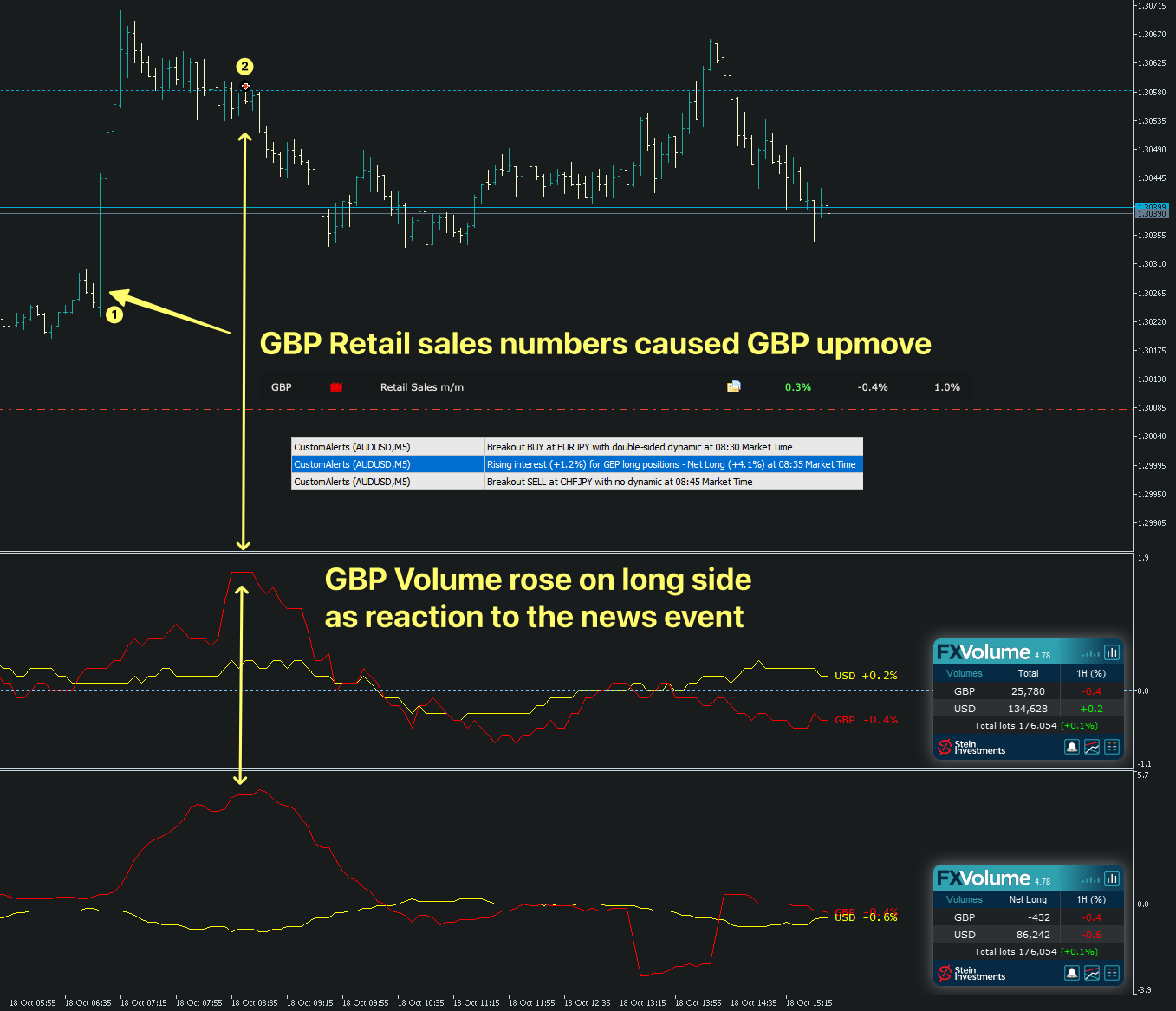

Friday began with a massive bullish move for the GBP, and the reason for this was the better than expected Retail Sales data. Another news event that moved the market.

And again, about 90 minutes later, I got a notification that the interest in GBP positions is greater than 1% and the GBP net long volume has risen sharply.

But this time I learned from it and traded against this clear GBP long trend and it worked. But why?

Because there are obviously two different scenarios in terms of retail volume.

1. In the first case, the market is free from external influences such as news. Then, for whatever reason, there is more interest in a currency and this results in a nice trend movement. Let's call it a spontaneous movement, and in this case volume indications are extremely reliable because they tell you what the market is interested in.

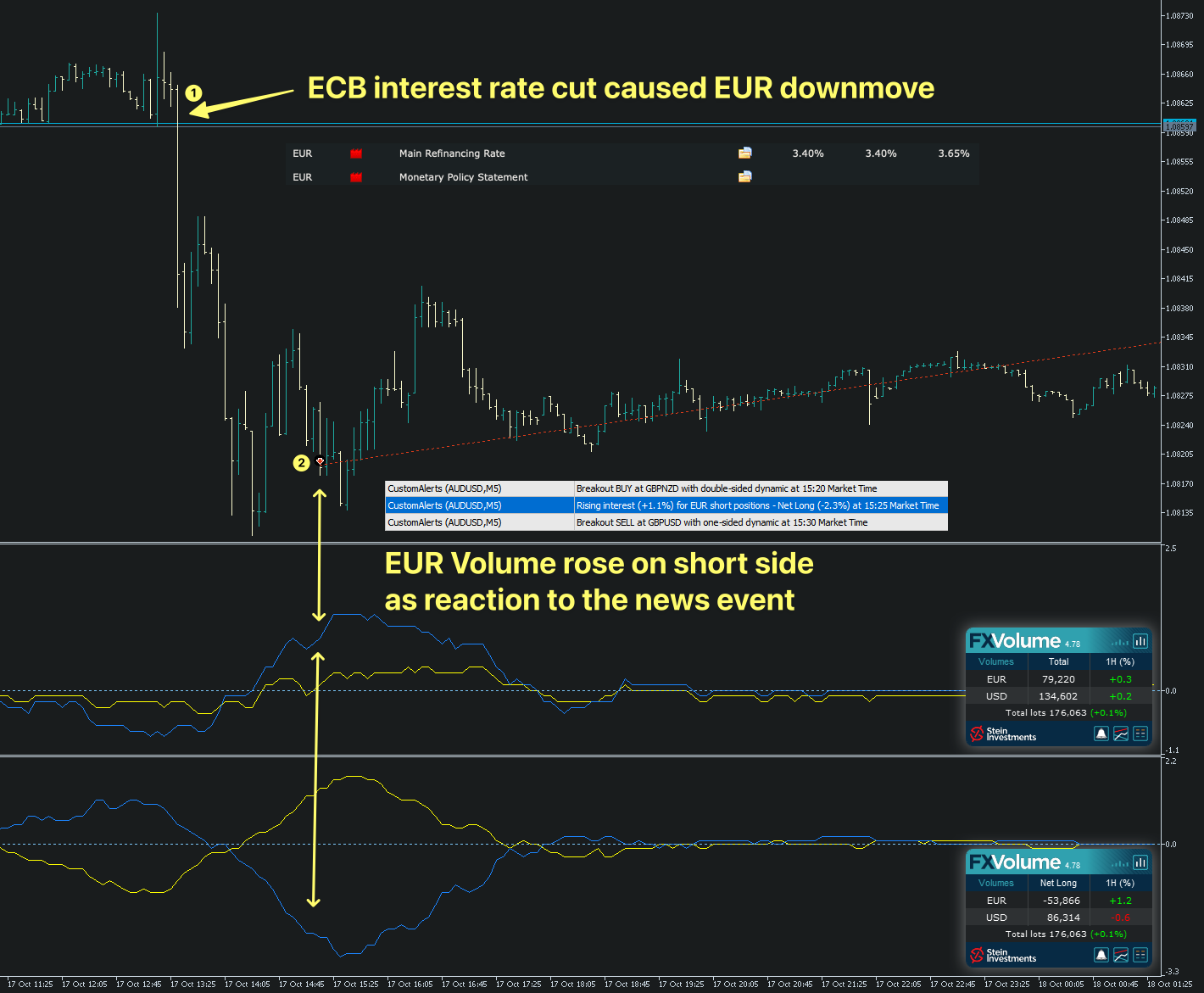

2. In the second case, as in these two examples, the trend movement is caused by an external event and retail volume lags behind. It tries to catch up with what the market has already anticipated, and by the time it does, the market has already turned in the other direction. In this case, the volume indicator must be interpreted as a contrary indicator and traded against.

To summarize briefly:

Is there an external cause for rising interest in a currency? If not, go with the trend; if there is, go against it.

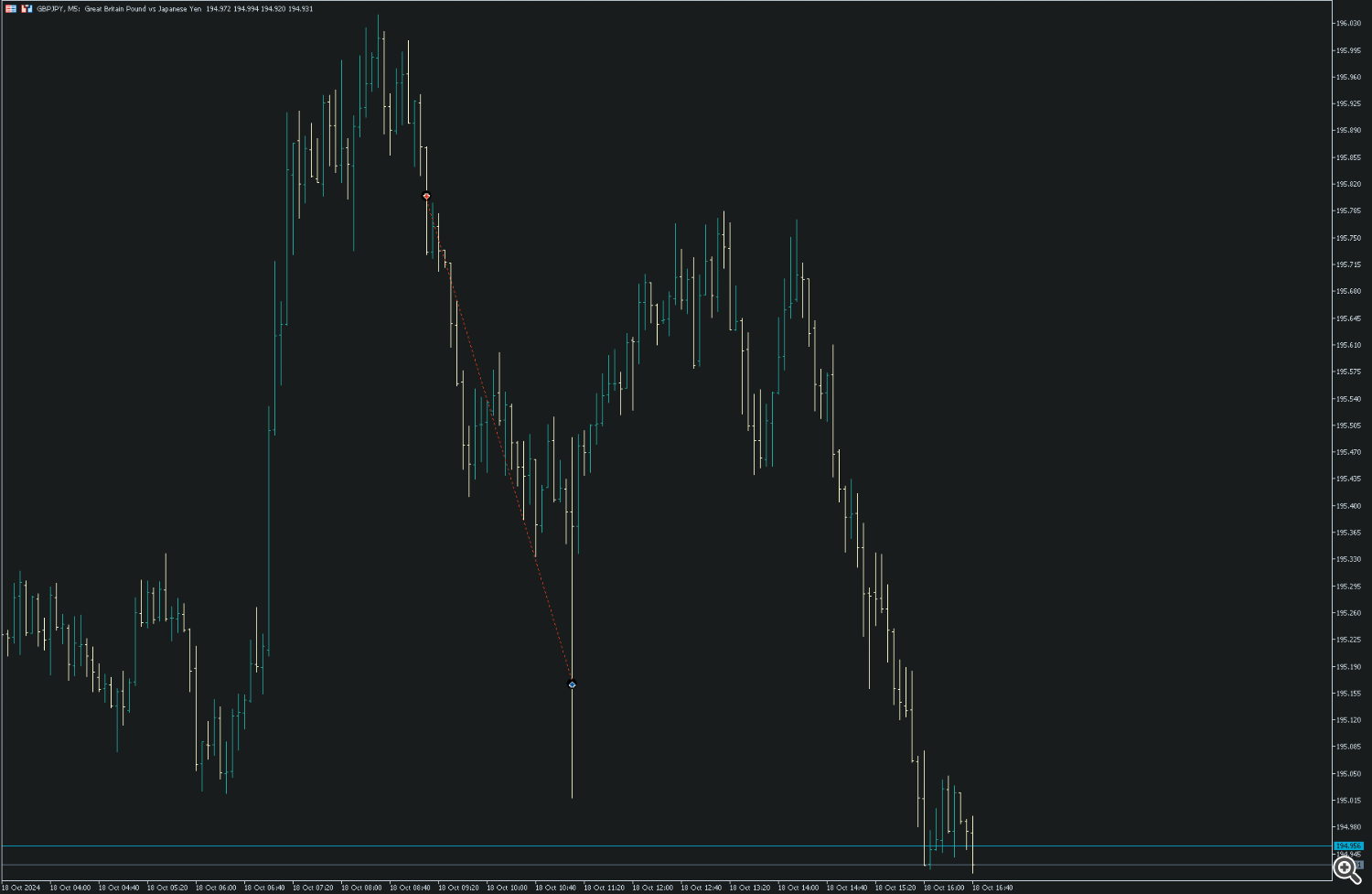

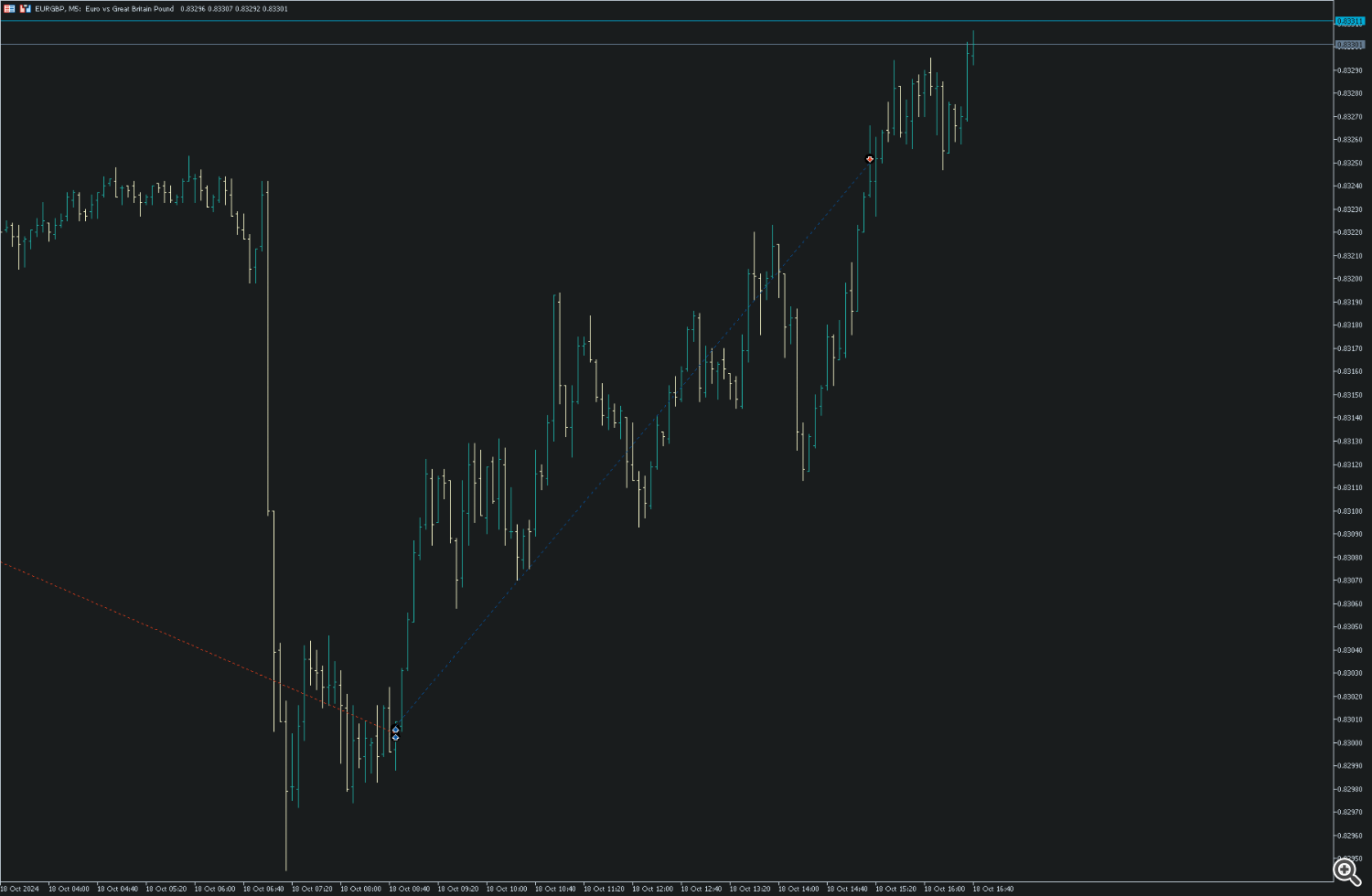

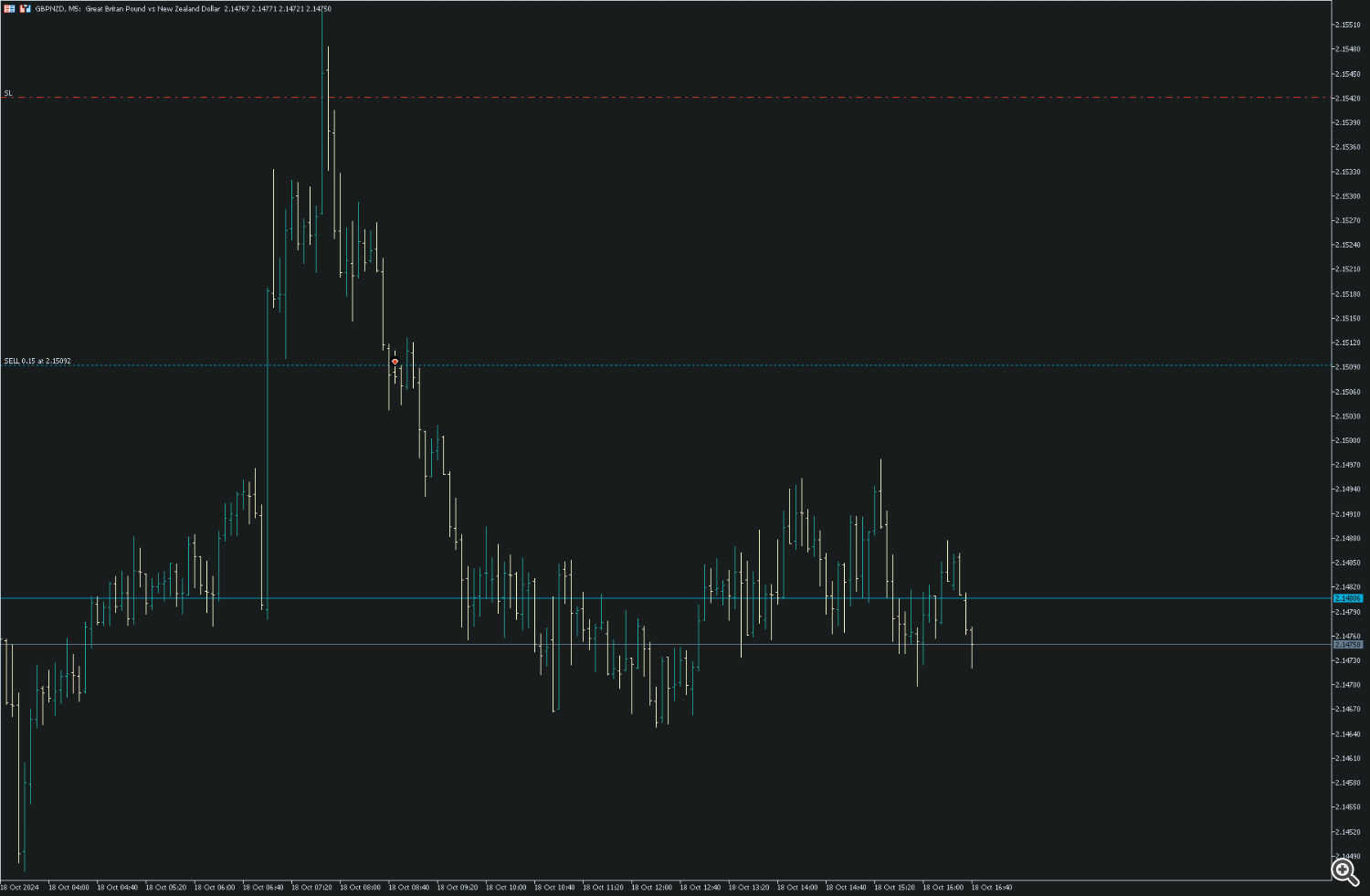

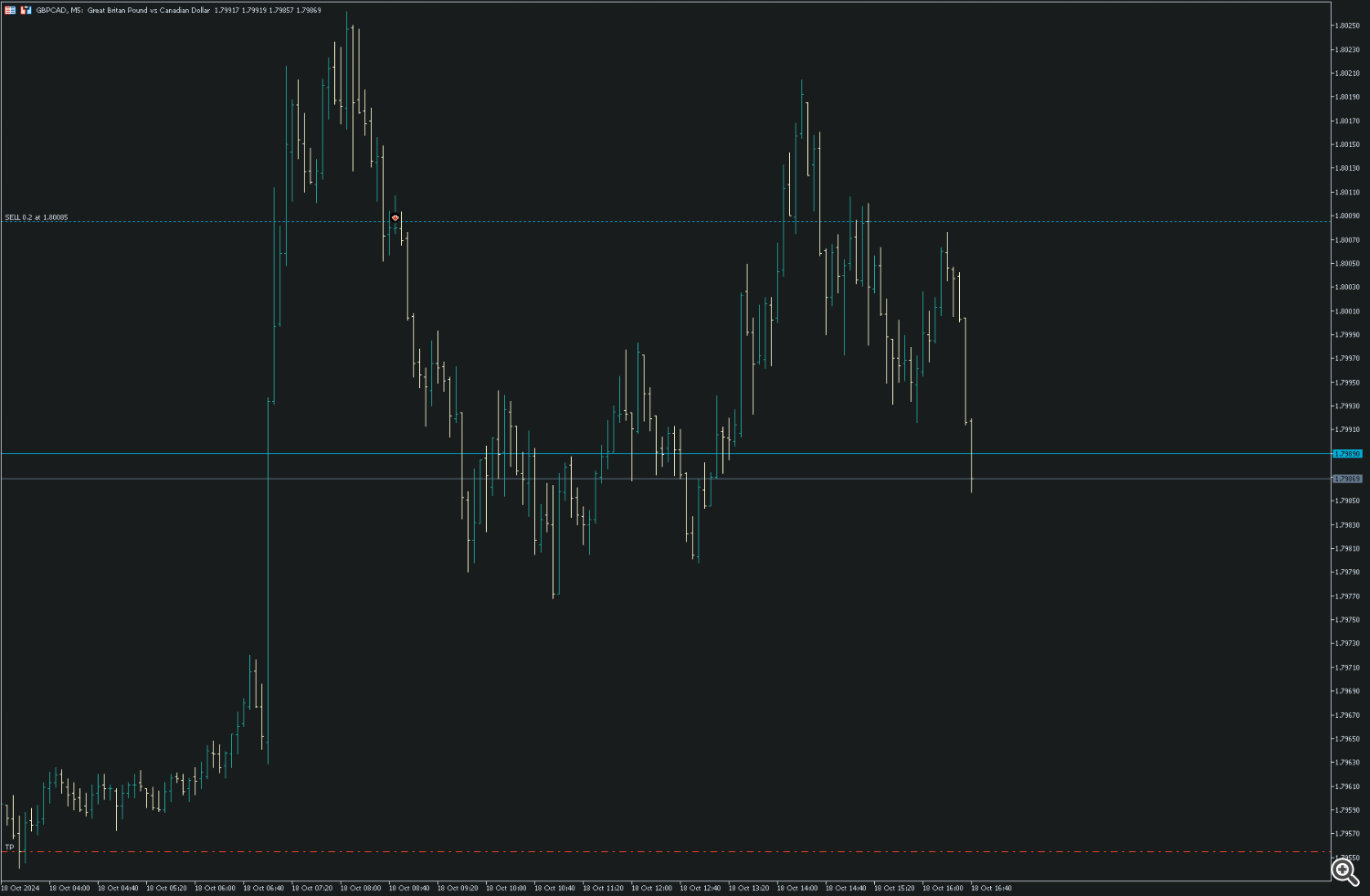

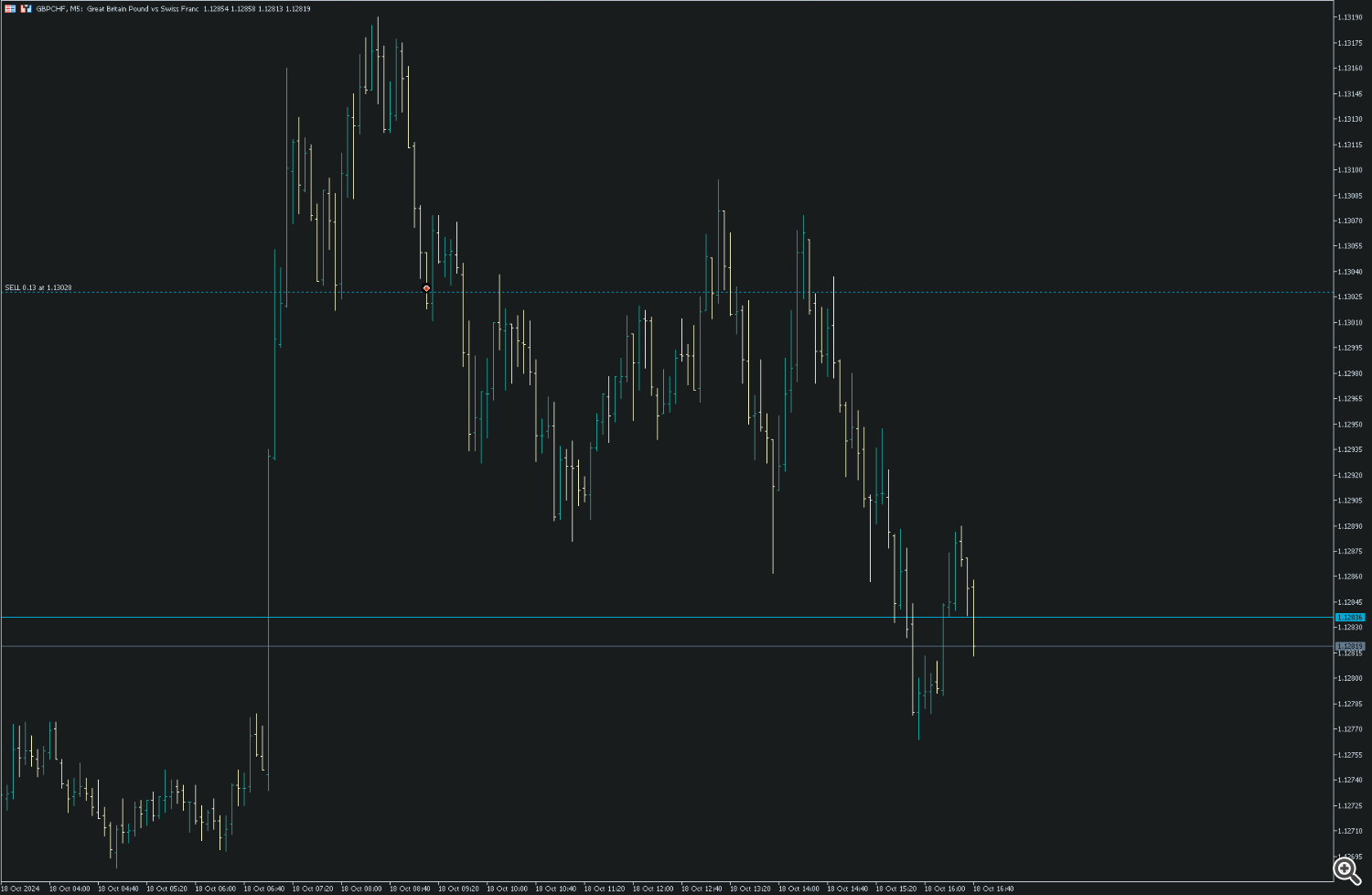

These are all GBP trades from this Friday, taken at the same time.

You'll find all tools used for these trades at our Stein Investments Welcome Page at https://www.mql5.com/en/blogs/post/755375