# ATAI-Powered Trading: A User-Friendly Approach

## Introduction: Getting Started with an AI Trading Bot

Before we dive into the exciting world of AI in trading, let's look at what it takes to set up and run an AI-powered trading bot like the one we're exploring. You might be pleasantly surprised to find that it's more accessible than you think!

### What You'll Need:

1. **MetaTrader 5 (MT5) Platform**: This is the main software you'll use. It's free and easy to download from your broker's website.

2. **A Trading Account**: You'll need an account with a broker that supports MT5 and automated trading.

3. **The AI Trading Bot File**: This is usually a file with a .ex5 extension that you'll add to your MT5 platform.

4. **Basic Computer Skills**: You don't need to be a tech wizard, but comfort with basic computer operations is helpful.

### Easy Setup Process:

1. **Install MetaTrader 5**: Download and install MT5 from your broker's website. It's a straightforward process, much like installing any other program.

2. **Add the Trading Bot**: Once you have MT5 installed, you'll need to add the AI trading bot file to the right folder. Usually, this is as simple as dragging and dropping the file into a specific MT5 directory.

3. **Set Up the Bot**: Open MT5 and find the bot in your Navigator window. Double-click it to open the settings.

4. **Configure Website Access**: One unique aspect of this bot is that it needs to connect to a specific website to function. In the MT5 settings, you'll need to add the website address that the bot uses. This is a simple step that allows the bot to access its AI capabilities.

5. **Adjust Trading Parameters**: In the bot's settings, you can adjust things like how much money it can trade with (lot size) and what hours it should operate.

6. **Start Trading**: Once everything is set up, you can switch the bot on and let it start trading. Always start with a demo account to make sure everything is working as expected before using real money.

### Important Notes:

- **No Complex APIs**: Unlike some advanced trading systems, this bot doesn't require you to set up any complex APIs or data feeds. Everything it needs is already built-in.

- **Real-Time Operation**: This bot operates in real-time on live market conditions. It doesn't have a backtesting feature, which means it learns and adapts as it trades in the actual market.

- **User-Friendly Design**: While the technology behind the bot is complex, it's designed to be user-friendly. You don't need to understand the intricacies of AI or programming to use it.

- **Monitoring is Key**: Even though the bot does the trading for you, it's important to regularly check its performance and adjust settings if needed.

Setting up this AI-powered trading bot is much simpler than traditional algorithmic trading systems. It's designed for traders who want to benefit from AI technology without needing a deep technical background. However, it's still crucial to understand the risks involved in automated trading and to use the bot responsibly.

Now, let's explore how AI is changing the world of trading and what makes these smart systems different from older types of trading bots.

# The Power of AI in Algorithmic Trading: A New Frontier

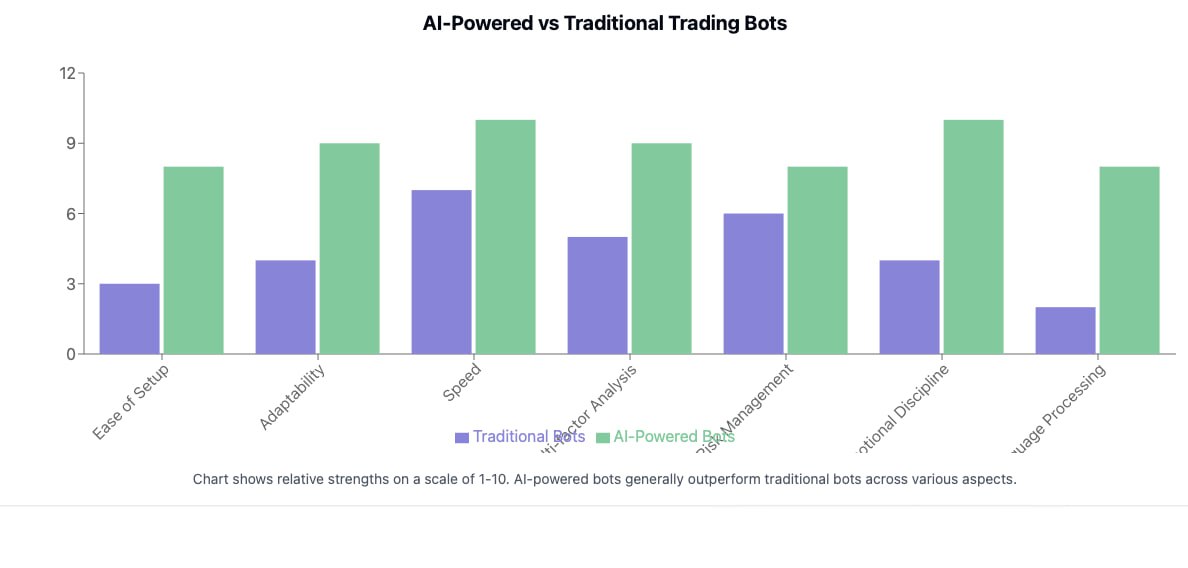

In recent years, artificial intelligence (AI) has revolutionized countless industries, and the world of financial trading is no exception. AI-powered trading systems are increasingly outperforming traditional algorithmic trading bots, offering a new level of sophistication and adaptability in the fast-paced world of financial markets.

## Beyond Rule-Based Systems

Traditional trading bots operate on predefined rules and parameters. While these can be effective in certain market conditions, they often struggle to adapt to the ever-changing dynamics of financial markets. AI trading systems, on the other hand, can analyze vast amounts of data in real-time, identifying patterns and correlations that might be invisible to human traders or traditional algorithms.

## Learning and Adaptation

One of the key strengths of AI in trading is its ability to learn and adapt. Machine learning algorithms can continuously analyze market data, news feeds, and even social media sentiment to refine their trading strategies. This allows AI systems to evolve with the market, potentially staying ahead of shifts in trends and market dynamics.

## Multi-factor Analysis

AI trading systems can simultaneously consider a wide array of factors that influence market movements. This might include traditional technical indicators, fundamental analysis, macroeconomic data, geopolitical events, and more. By weighing these multiple factors, AI can make more nuanced trading decisions than simpler rule-based systems.

## Emotional Discipline

While human traders can be swayed by emotions like fear and greed, AI systems maintain strict emotional discipline. They execute trades based on data and predefined objectives, without being influenced by psychological factors that can lead to poor decision-making.

## Rapid Decision Making

In the world of high-frequency trading, speed is crucial. AI systems can analyze market conditions and execute trades in microseconds, far faster than any human trader. This speed can be a significant advantage in capturing fleeting market opportunities.

## Risk Management

Advanced AI systems can incorporate sophisticated risk management strategies. They can dynamically adjust position sizes, set stop-losses, and manage overall portfolio risk based on current market conditions and historical performance.

## Natural Language Processing

Some cutting-edge AI trading systems incorporate natural language processing (NLP) capabilities. These systems can analyze news articles, earnings reports, and social media in real-time, gauging market sentiment and potentially predicting short-term price movements based on this information.

## Backtesting and Simulation

AI can perform extensive backtesting and market simulations much more quickly and thoroughly than traditional methods. This allows for the rapid development and refinement of trading strategies, testing them against historical data under various market conditions.

## Challenges and Considerations

While AI offers tremendous potential in trading, it's not without challenges. These systems require significant computational resources and expertise to develop and maintain. There's also the risk of "overfitting" - where an AI system becomes too specialized for historical data and fails to generalize well to new market conditions.

Additionally, as AI trading systems become more prevalent, there's the potential for them to influence market dynamics in ways we don't yet fully understand. This could lead to new forms of market volatility or unexpected behaviors.

## The Future of AI in Trading

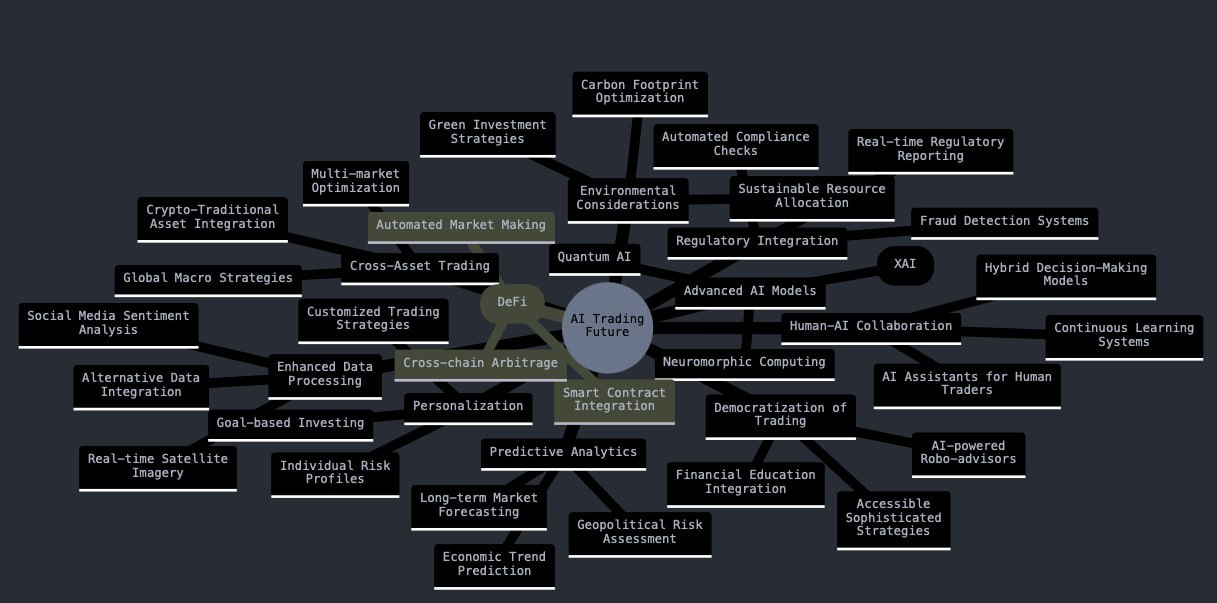

As AI technology continues to advance, we can expect to see even more sophisticated trading systems emerge. These might incorporate quantum computing for even faster processing, or advanced forms of AI that can explain their decision-making process, providing traders with insights alongside automated execution.

The integration of AI in trading represents a significant leap forward in the evolution of algorithmic trading. While it offers exciting possibilities for enhanced performance and risk management, it also requires careful implementation and ongoing monitoring. As the financial landscape continues to evolve, AI is likely to play an increasingly central role in shaping the future of trading.