Alligator EA for Prop Firms - Presentation, Manual and Presets

ALLIGATOR EA FOR PROP FIRMS

Presentation and guide

Hello and welcome to the presentation of Alligator EA for Prop Firms. Here you will find all the information you need to understand how this EA works and how to best use it.

Link to product page → https://www.mql5.com/it/market/product/86825

This product is part of a collection of EAs developed specifically for passing challenges, all with different strategies but with the same concept. You can find them all here: https://www.mql5.com/it/users/riccardoborello01/seller

Where can I use it?

As the name says, this EA is specially developed to pass challenges. In particular, the backtests were performed on MyForexFunds historical data, but it works the same way on other prop firms as long as they have similar rules. It works only on MetaTrader 5.

What strategy does he use?

The strategy is based on William's Alligator, EMA and ATR indicators, which tell the EA when to open positions and where to set the stop loss.

What assets does it work on?

It works on all forex pairs and all timeframes, but I'll advise you where to use it.

What does it do for challenges?

- Daily anti-drawdown control: if the daily drawdown set in the inputs is reached, the EA immediately closes the current trades

- Total drawdown (useful for backtesting): allows you to discard an input set in the optimization phase if this drawdown is reached

- Profit target: if it is reached during a trade, the current operations are automatically closed and no others will be opened for the current month

I bought the EA, now how do I proceed?

First of all, make sure you are using a 24/7 VPS.

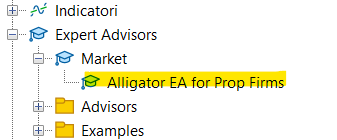

Now, you will find the EA on the MT5 navigator and by clicking on it you can attach it to the open chart of the suggested forex pair and timeframe (you can find it in the Backtest paragraph) and set the parameters as follows.

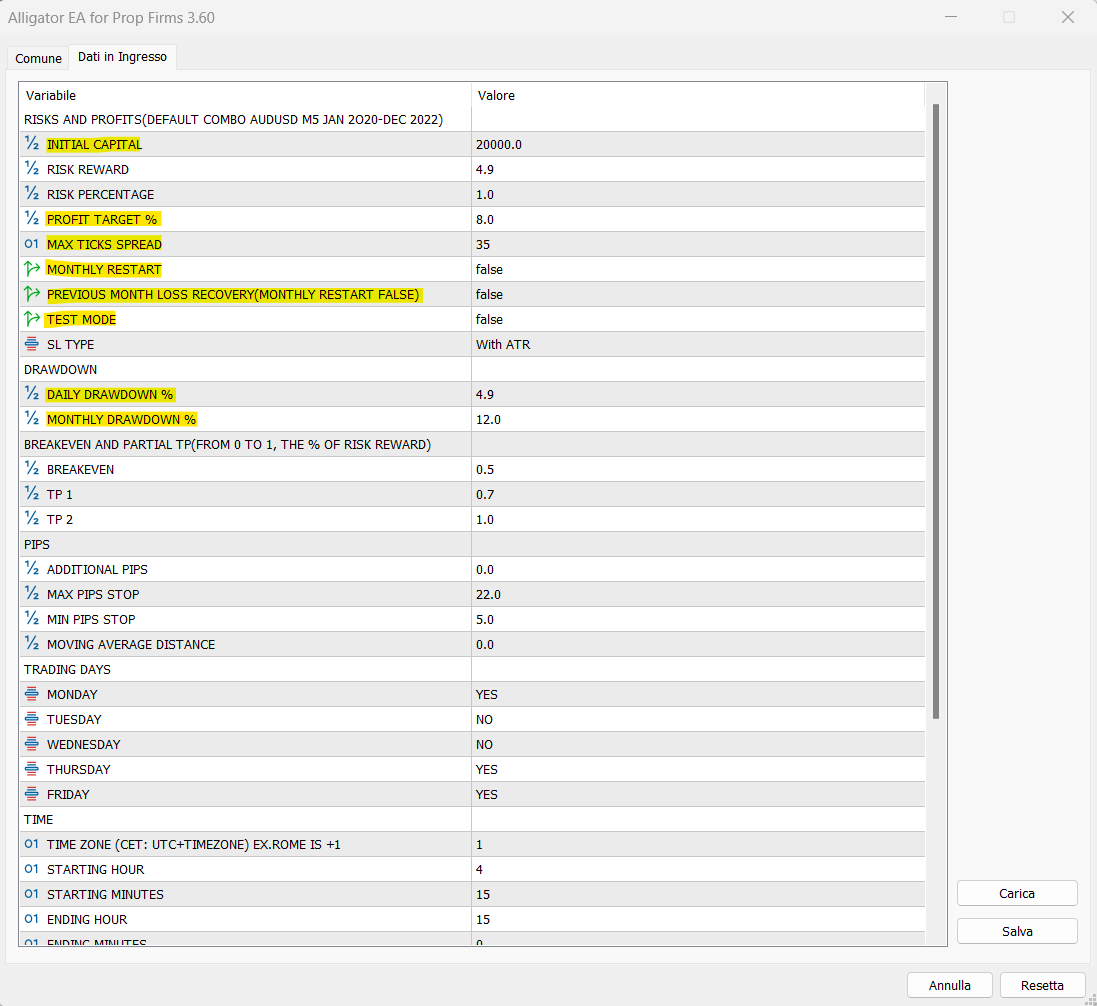

There are two possibilities: either you are using the default parameters to pass a first challenge phase, or you are using a set of settings that I sent you. In each of these cases, you will need to modify only these inputs:

- Initial capital → the initial budget of the challenge. If you are starting a 20k challenge then enter 20000, if you are starting a 50k challenge enter 50000 and so on. This will help open trades with the right lot size, so if you get it wrong, the bot may open positions that are too big or too small.

- Profit target → as the name implies, it is the percentage of the initial capital at which all operations will be closed. Then enter 8 if you are doing a first phase, 5 if you are doing a second phase, or any target you want to reach if you already have the founded account. When the account equity reaches this target, no more trades will be opened in the current month in case of founded account, and in general if you are in challenge

- Max Ticks Spread → is the maximum number of spread ticks with which to open a trade. If the current spread is higher than this number, no trade will be opened even if there is confirmation from the indicators.

- Monthly Restart → it's only useful for backtesting, so if you're using the bot on any account, keep this option false. The explanation on how it works is in the "backtest" paragraph.

- Test mode → keep this option false if you are using the bot on any account, set it to true if you are only backtesting it

- Daily Drawdown → the maximum daily drawdown imposed by the rules of the prop firm you are doing. Advice: keep it slightly lower than the rule to have some margin in case of fast price movements (Ex: if the prop imposes a 5% daily dd, set this option to max 4.9).

- Monthly drawdown → the maximum drawdown imposed by the challenges which is usually between 10% (FTMO) and 12% (MyForexFunds). If you already have a founded account, this is the maximum drawdown that can be reached in a month.

All other inputs can be changed at will, but it is preferable not to do so to improve the performance of the EA a lot.

Explanation of other input parameters

- Risk Reward → is simply the risk-reward ratio that each trade will have

- Risk Percentage → this is the percentage of your initial capital that will be risked on each trade. Based on this value the struggle of each trade is calculated. Usually 1% is risked to have a high chance of passing the challenges

- SL type → how the stop loss is calculated: using only ATR or ATR and Alligator

- Breakeven → this value indicates at what percentage of the trade, it will be set to breakeven. For example, if breakeven = 0.5 and the risk reward = 5, when the trade reaches half of its risk reward (therefore 2.5) it will be set to breakeven. If breakeven = 0 or breakeven = 1, then breakeven is disabled.

- TP1 & TP2 → for the partial tp the same applies to the breakeven. They are active only if they have a value between 0 and 1 excluded. The TP2 is active only if it is higher than the tp1. Also, keep in mind that if both partials are active, each will close out one third of the trade, leaving the last third open until the final TP. If instead only TP1 is active, it will close half of the trade. So, here are some examples:

- TP1 = 0 and TP2 = 1 → both disabled

- TP1 = 0.5 and TP2 = 0.7 → TP1 will be withdrawn at 50% of the operation and TP at 70%

- TP1 = 0.6 and TP2 = 0.2 → TP1 will be picked up at 60% of the trade, while TP2 is disabled

- TP1 = 0.3 and TP2 = 1 → TP1 will be withdrawn at 30% of the trade, while TP2 is disabled

- Additional pips → stop loss pips added to those already calculated through the indicators. Usually this value is between 0 and 1

- Maximum and minimum stop in pips → Stop loss pips limits. If the indicators signal to open a trade with too large or too small a stop loss, it is not opened

- Moving Average Distance → minimum distance of the price from the moving average for a trade to be opened

- Trading days → operational days, set to YES to enable possible operations for each day

- Hours → opening hours, each trade will be opened only within this time range

- Indicators → input parameters for various indicators, such as period or shift

I activated the bot two days ago and it still hasn't opened trades, is this normal?

Yes, if you have set everything up correctly it's normal, because this EA works on timeframes like M5, M6 and M10 and therefore it doesn't necessarily have to open every day. Also, it is developed to only open one trade at a time, so don't worry if maybe a week has gone by and the bot has only opened for example 3 trades. There is always at least one month for the challenges, and this bot can pass them either on the first day or after 3 weeks. So just be patient.

BACKTESTING

If you want to try a different challenge than the classic ones like FTMO and MyForexFunds, that's no problem: you can optimize the bot yourself to get the combinations of input parameters suitable for the challenge you want to start.

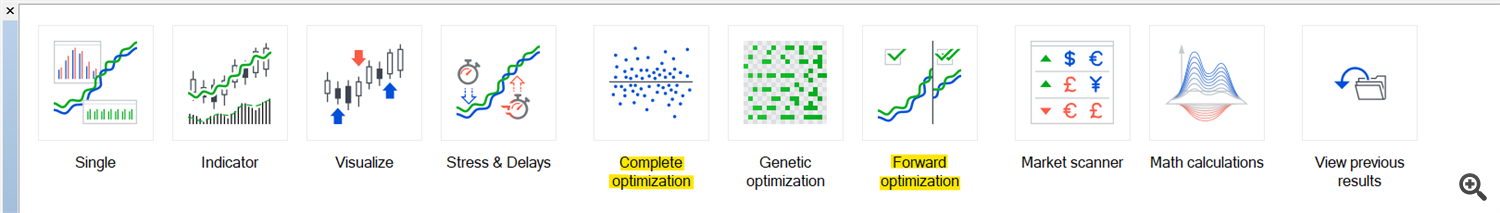

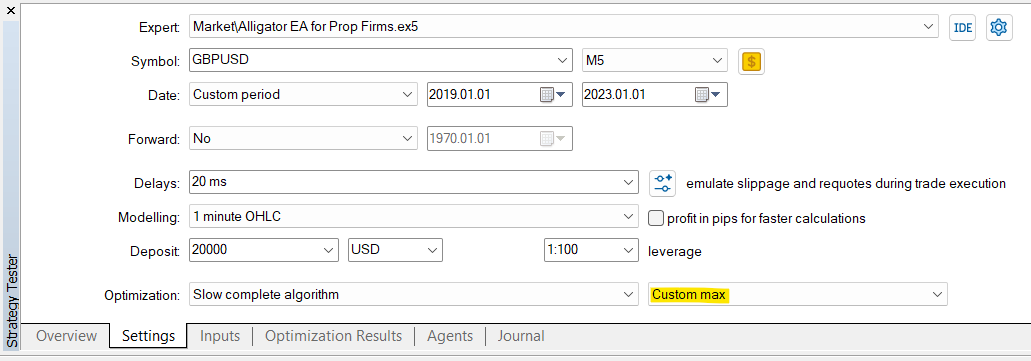

First of all open the MT5 strategy tester (CTRL+R), and then select "optimization".

Now select the forex pair, timeframe and period of time you want to test.

For "modelling" you can keep "1 minute OHLC" for fast optimizations. Once the optimization is complete, it is recommended to test them with "every tick" to see if the results are the same. They may change, but only slightly, as the EA waits for the candle to close before opening trades. On "Optimization" set "custom max" (reason explained later).

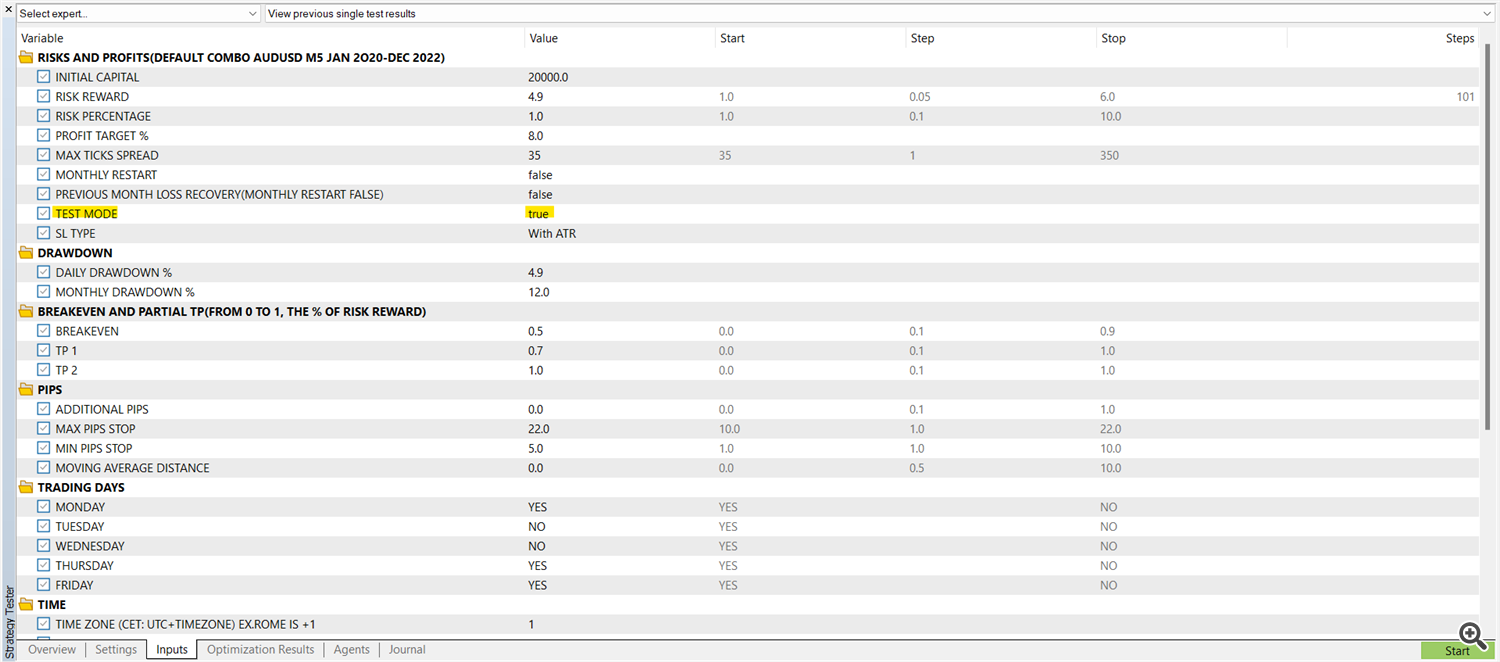

Now click on "Inputs" and select the parameters you want to optimize by clicking on the tick to the left of each one. Turn on test mode by setting it to true.

Not all parameters need to be optimized: those that must remain fixed for each test (therefore relating to the rules of the challenge or the funded account) must be set in the right way before starting the optimization (such as initial capital, profit target and drawdown).Monthly Restart: This is a useful feature for backtesting and optimizations, in particular for the first phase, given that the time to pass it is usually 1 month. If activated, it will reset profits and losses at the end of each month, but only if no drawdown has occurred.

If deactivated however, when the following month begins it will consider any losses from the previous month in the case of a negative streak, therefore if the drawdown is reached after 2 months or more, it will be detected.

Previous Month Loss Recovery: If the Monthly Restart is disabled, then this function can be useful, which allows you to count the month following the negative one as a target month only if the loss is also recovered

Example → at the end of January 2020 the EA is -5%:

- Monthly restart true → in February 2020 the backtest will not consider the January loss and the drawdown will be counted only if it drops to -12% from the beginning of February

-

Monthly restart false, Previous Month Loss Recovery true → in February 2020 the loss of January will be considered, and if it drops to -7% in January, a drawdown will be signaled. Furthermore, if the target is 8%, in February it will have to recover the -5% of January and therefore make a +13% to be considered a target month.

-

Monthly restart false, Previous Month Loss Recovery false → in February 2020 the loss of January will be considered, and if it drops to -7% in January, a drawdown will be signaled. Furthermore, if the target is 8%, in February it will have to do +8% to be considered a month on target, without having to recover the loss of January

Optimization through custom max

This feature is useful for getting the number of months the challenge was passed during the backtest period.

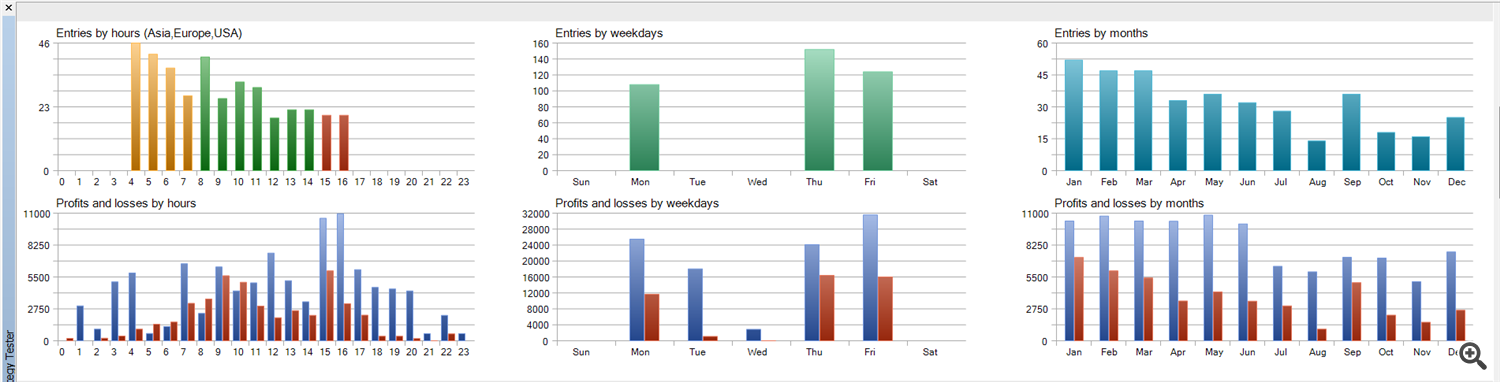

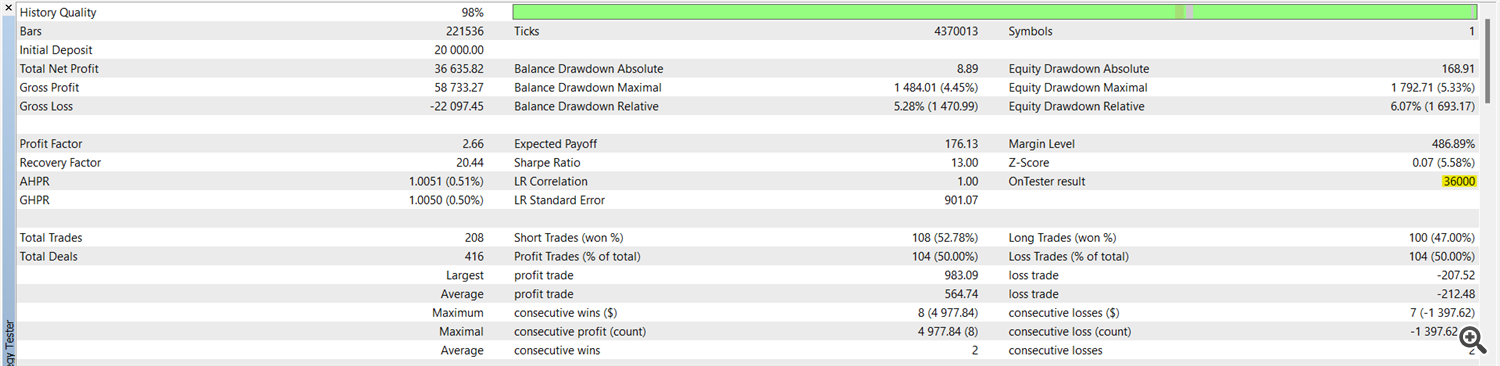

At the end of the optimization, you will see a screen that looks like this:

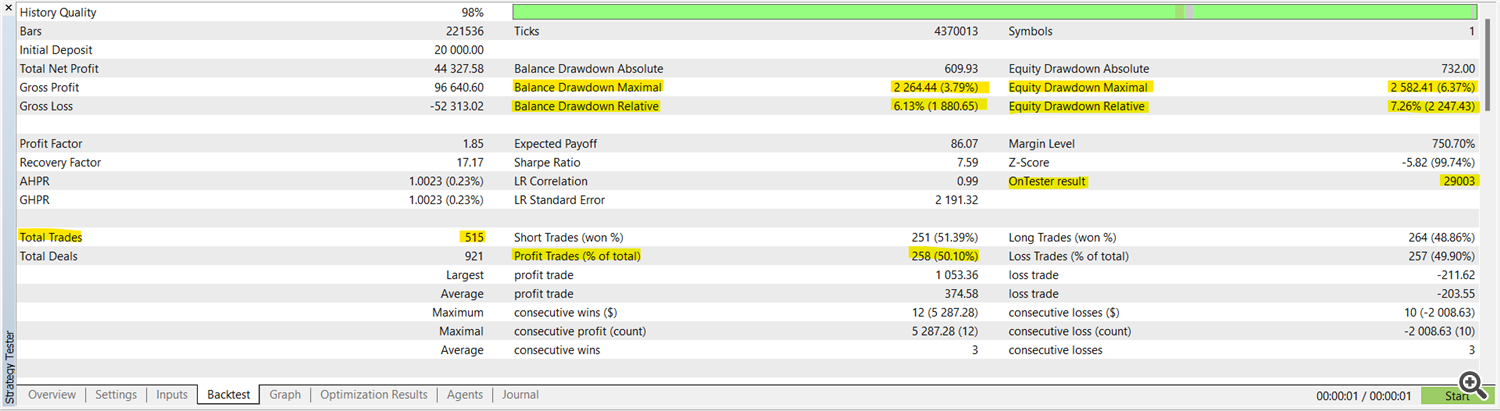

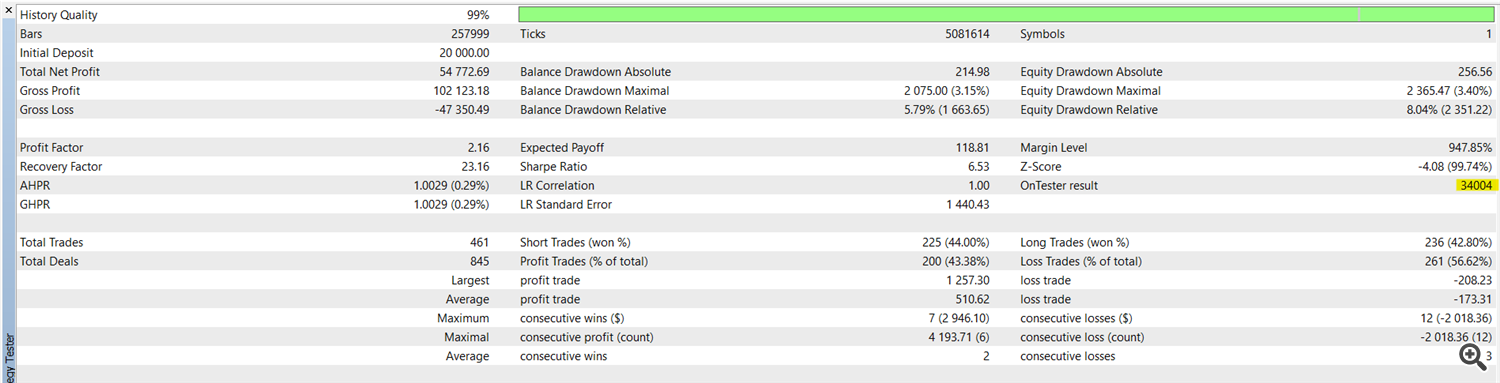

Result → By optimizing through custom max, here you will find the count of the months with challenge passed and free retry (i.e. month closed in positive but without reaching the target).

This value is calculated in order to distinguish the months with the target achieved and the positive months without the target achieved: in fact, in the example photo you see values such as 30005, 29005 etc., here they are explained:

30005 = 30 months of target achieved + 5 positive months. Therefore, if the backtest period was 36 months, only 1 month was closed in the negative.

Also, if at any point in the backtest period the drawdown is reached, this value will be set equal to 0 to cause the parameter set to be automatically discarded. So, we just order the input parameter combos by custom max to get the best combos for our challenge!

Now, let's analyze the best combo we found by double clicking on it:

- Total trades → it gives us an indication of the amount of open trades. In fact, knowing that the period in this case is 36 months, we obtain that on average this combination of parameters opens 14 trades per month.

- OnTester result → it is the value of the custom max, therefore the number of months of challenge passed and those closed in positive (as explained above)

Default parameters combination

As mentioned above, you can optimize the EA yourself and find the input sets you prefer, but you can save time by directly using the ones I already found (I remind you that my tests were performed on historical data from MyForexFunds, so if you are using a different broker you may get slightly different data from mine), here are some of them (you can download the preset files at the end of the page):

Challenge Phase 1 (Target 8%, Daily DD 5%, Total DD 12%)

Characteristics:

- Period: Jan 2020 – Jun 2023 (41 months)

- AUDUSD M5

- RR 1:6.3

- Risk Percentage: 1%

- BE: 0.4

- TP1: 0.8

- Pips: 6 (min) – 20 (max)

- Trading days: Monday, Thursday, Friday

- Time (UTC+1): 03.00-15.45

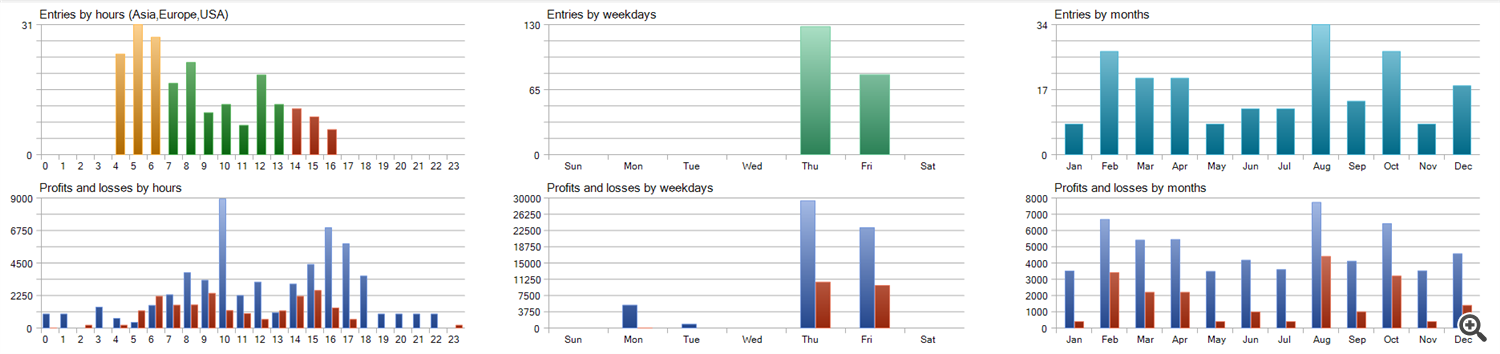

Challenge Phase 2 (Target 5%, Daily DD 5%, Total DD 12%)

- Period: Jan 2020 – Dec 2022 (36 months)

- AUDUSD M5

- RR 1:4.9

- Risk Percentage: 1%

- BE: 0.5

- Pips: 1 (min) – 17 (max)

- Trading days: Thursday, Friday

- Time (UTC+1): 03.30-16.00

If you already have a funded account or want to use the EA to make a profit every month, you can optimize yourself using the preset provided at the bottom of the page. Set the profit target as you like and find your combo!

To obtain profitable long-term input sets and avoid losing live accounts, it is recommended to optimize with profit targets that are not too high (for a funded account, I recommend not going beyond 3%) and over a period of time of several years , with the monthly restart set to false to avoid drawdowns over consecutive months.

In any case, I will add additional parameter sets here that I will find from now on for any type of account.