Opening Range Breakout EA V2 Backtesting Results & Set Files

BACKTESTING RESULTS AND HOW THEY WERE ACHIEVED:

This page contains set files for the opening range breakout EA available on the marketplace:

MT4 - https://www.mql5.com/en/market/product/90502

MT5 - https://www.mql5.com/en/market/product/91232

The strategy is available here: https://www.mql5.com/en/blogs/post/751229

The full manual for the EA detailing all inputs is here: https://www.mql5.com/en/blogs/post/751352

There are a lot of inputs in this EA and backtesting all of them would produce millions of potential combinations so testing is being done gradually but as the EA is predominently designed to be used on Indices so the focus is on the DAX, NASDAQ and DOW at the open. Multiple tests are run over a year to get the initial results for robustness and then you can test these over longer periods and out of sample periods to verify results are either at least breakeven or profitable on those periods too.

When backtesting I have run the EA in the strategy tester in MT4 with the optimizer. This give multiple runs of the EA to prove that it is robust with lots of settings. On a typical run of 1000 variations of any one input perameter the EA will achieve 80-90% of the settings being profitable. This gives us confidence that whatever you use as an input (within reason) you should get a profitable return and an edge supplied by the EA.

There are many tests that can be performed in the optimizer like percentage targets, individual trade targets, just taking one breakout, using add-on trades or not, trailing stop levels, breakeven levels, amount of risk and so on...Not all have been tested but as more results come in from users or further testing is done by my these will also be added here. Also the EA can be used on other instruments and timetrames too which there will be profitable settings for no doubt. These are just to give you a taster for what is possible and show you some initial set files that will work. I would encourage you to try your own backtesting and optimization to find more that work for you.

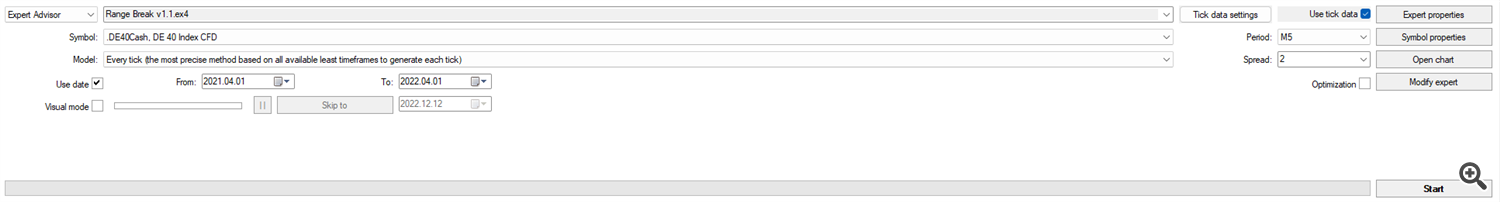

1. Tests all conduced using tick level data provided by Dukascopy to provide accuracy of 99.9%.

2. Test all using a fixed risk amount per trade to ensure compounding does not scew results.

3. Initial testing to prove strategy concept profitable is carried out over 1 year from 2021-04-01 - 2022-04-01.

4. System perameters permutaion test to check multiple variations of settings like stop loss, take profits, breakevens to ensure the strategy will work safely with many variations of the inputs.

5. Fixed pip spreads (2 pips) are used although on most indices you can get better.

6. Run on the M5 timeframe only.

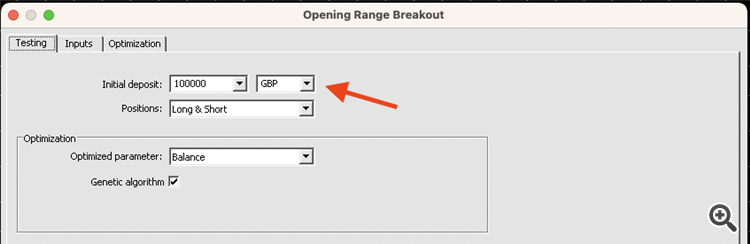

Below you can see the actual test settings used, the DAX is shown here but the date ranges, time frame and spread settings are identical for all indices.

NOTE: As shown above is the development name of the EA

STARTER SET FILES:

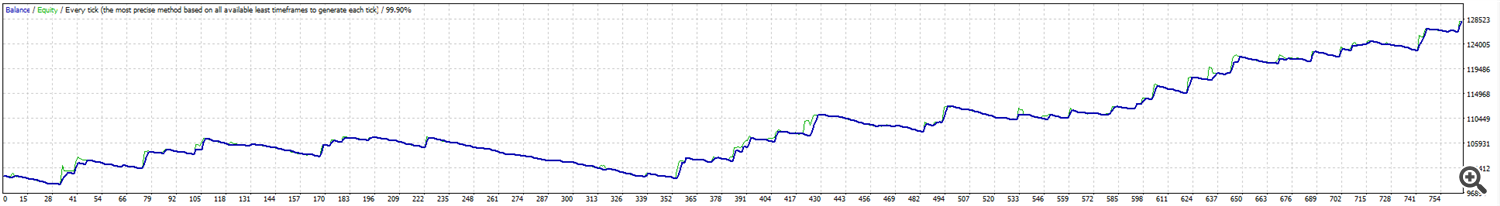

Initial testing of the EA has been done to find set files that work and are robust.

These set files perform well on the tested indices but may not suit the risk appetite of all so I would encourage you to test for yourself too. Wit the majority of the tests you can simply adjust the risk amount input which will then reduce or enlarge the profit and drawdown accordingly.

IMPORTANT NOTE ABOUT THIS EA AND THE STRATEGY IT TRADES TO BEAR IN MIND WHEN VIEWING THESE RESULTS AND SET FILES!

This is a trend breakout EA. It is designed to take advantage of trend days ideally where price breaks out at the open and runs for a session/day. Therefore like all other breakout and trend strategies it is designed to get "home run" wins and not strive for accuracy or a high strike rate. Strike rates of 20-30% are typical in these types of strategies and the focus is on minimising drawdown when breakouts fail, not getting the trade right al the time. Large paydays, delivered consistently over a year is the edge this EA is producing. You will experience stagnation in profits when range bound activity is present for days on end so pairing this EA with a mean reversion strategy would mitigate those periods nicely.

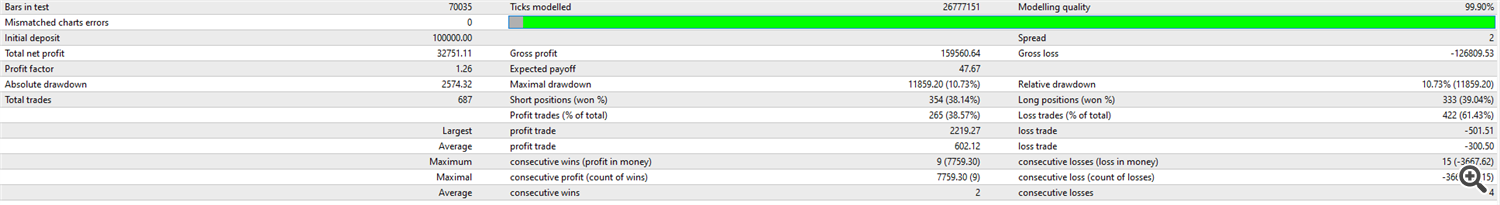

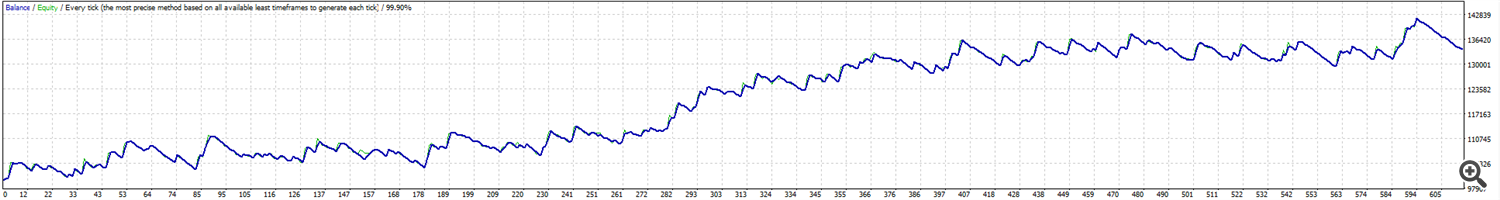

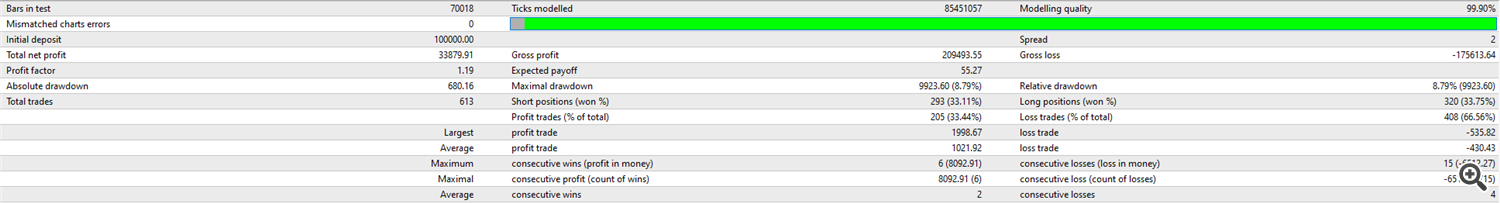

DAX:

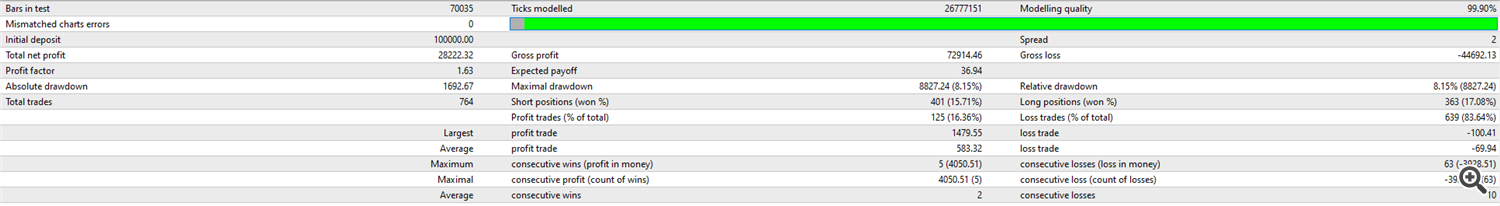

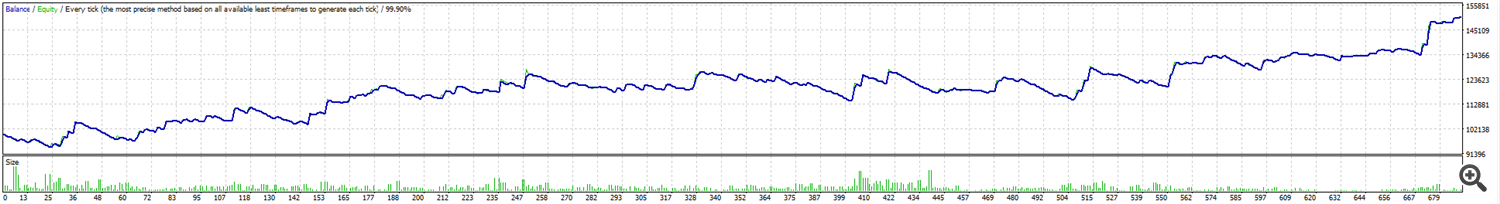

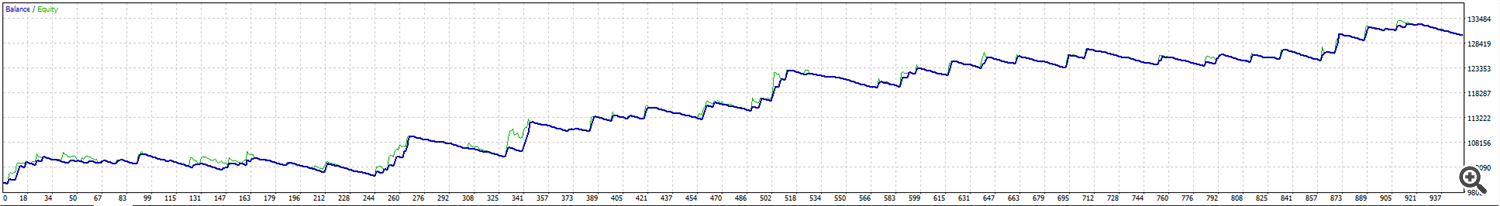

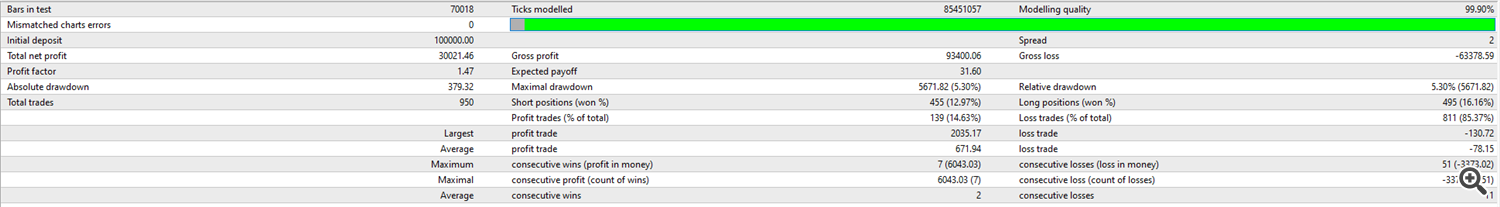

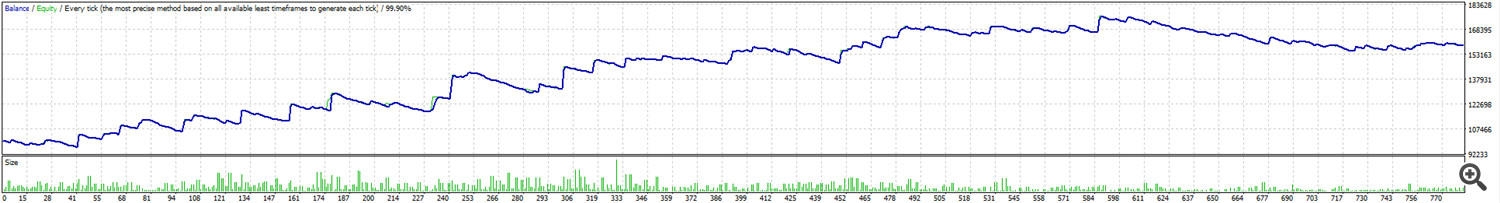

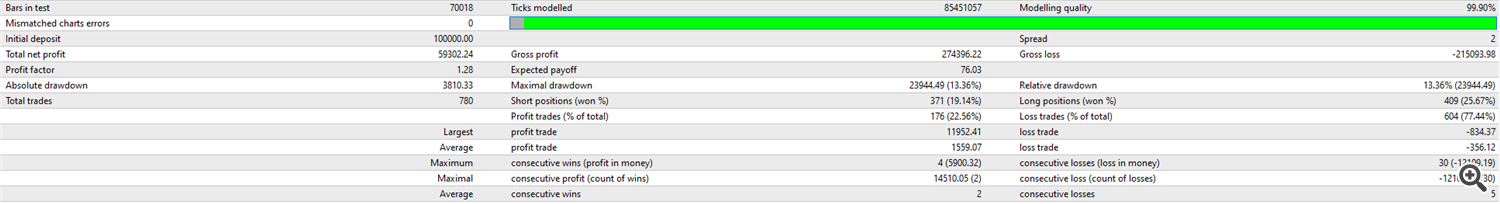

DAX - 2 - Percent.set - Return on Drawdown = 2.76

Test Conditions:

Initial risk used: $500 per trade

Account size: $100k

Frankfurt Open trading DAX - open at 10:00, Breakouts at 10:05, 10:10, 10:15 + closing pending orders at 11:30

All other settings are in the set file you can download at the bottom of this blog post.

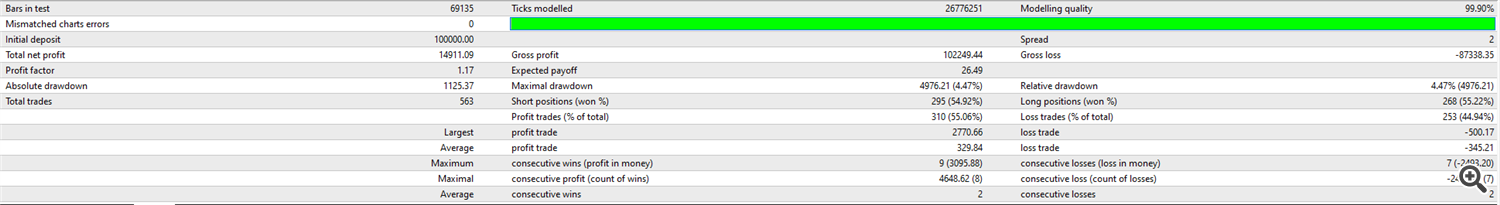

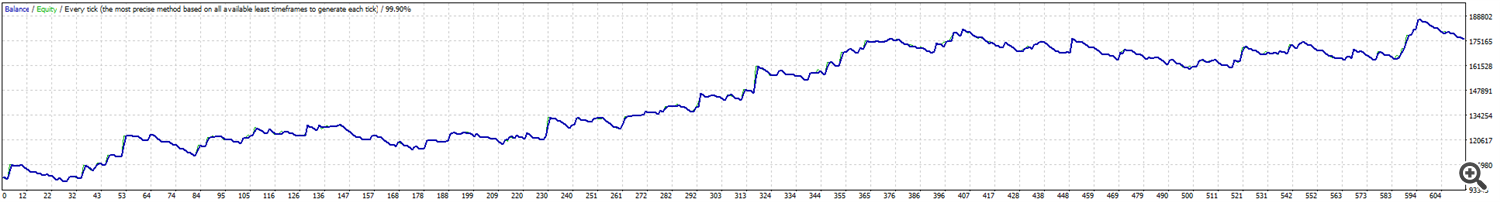

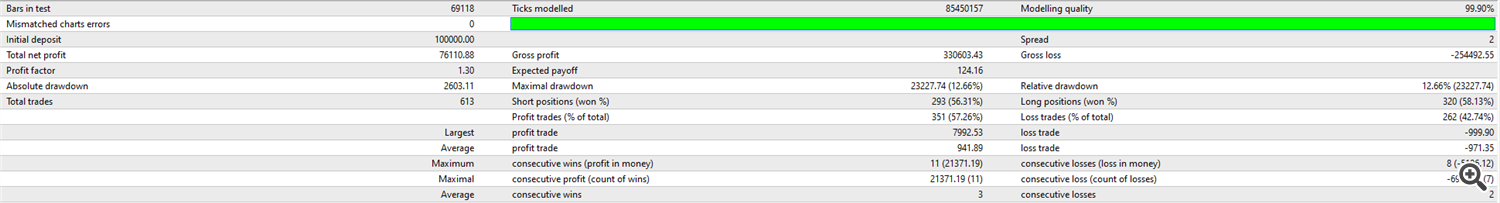

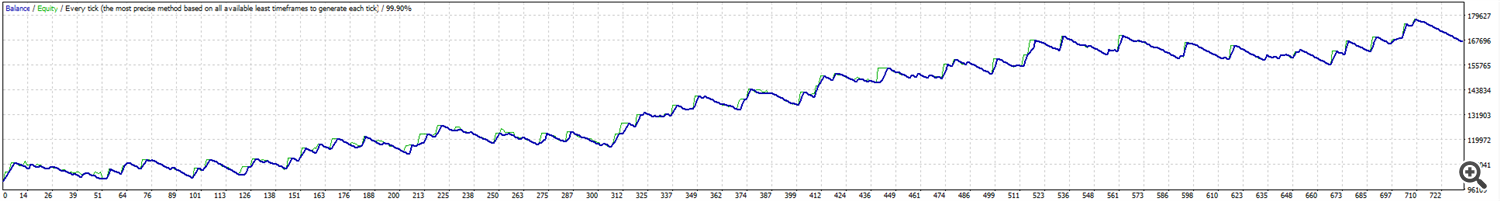

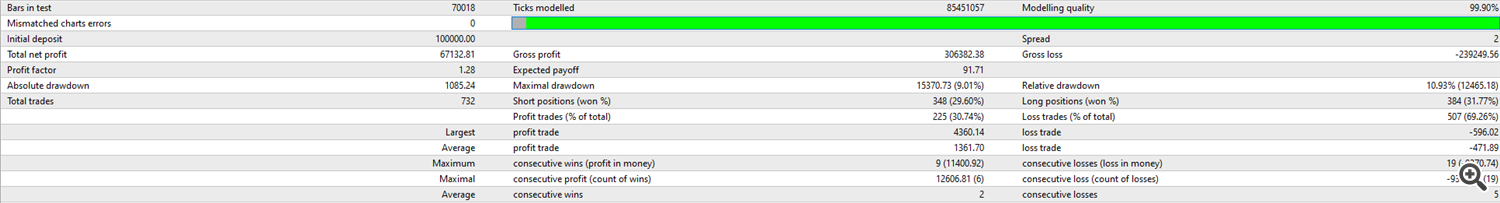

DAX - 3 - 5 and 15 TP.set - Return on Drawdown = 3.00

Test Conditions:

Initial risk used: $500 per trade

Account size: $100k

Frankfurt Open trading DAX - open at 10:00, Breakouts at 10:05, 10:10, 10:15 + closing pending orders at 11:30

All other settings are in the set file you can download at the bottom of this blog post.

DAX - 5 - AM Addon.set - Return on Drawdown = 2.82

Test Conditions:

Initial risk used: $100 per trade

Account size: $100k

Frankfurt Open trading DAX - open at 10:00, Breakouts at 10:05, 10:10, 10:15 + closing pending orders at 11:30

All other settings are in the set file you can download at the bottom of this blog post.

DAX - 6 - 15 Min Pre.set - Return on Drawdown = 3.42

Test Conditions:

Initial risk used: $500 per trade

Account size: $100k

Frankfurt Open trading DAX - open at 09:45, Breakouts at 10:00, 10:05 + closing pending orders at 11:30

All other settings are in the set file you can download at the bottom of this blog post.

DAX - 7 - 5 Min Only.set - Return on Drawdown = 2.50

Test Conditions:

Initial risk used: $600 per trade

Account size: $100k

Frankfurt Open trading DAX - open at 10:00, Breakouts at 10:05, 10:10, 10:15 + closing pending orders at 11:30

All other settings are in the set file you can download at the bottom of this blog post.

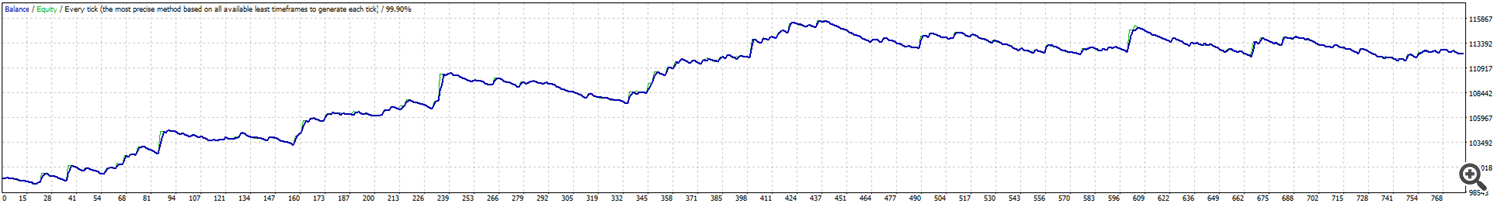

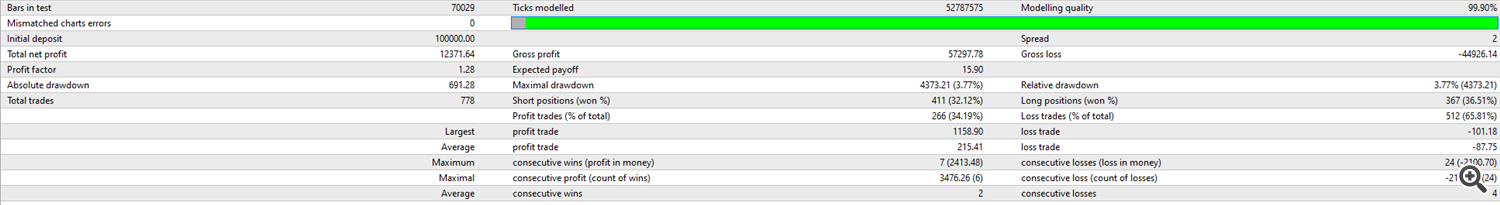

NASDAQ:

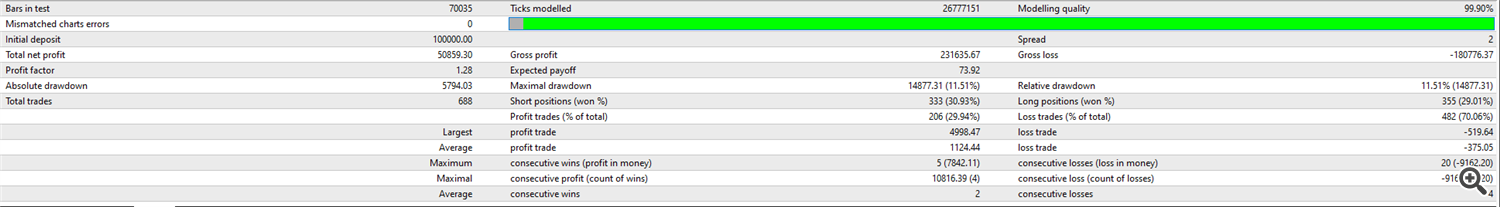

NAS - 1 - PM Addon.set - Return on Drawdown = 4.52

Test Conditions:

Initial risk used: $100 per trade

Account size: $100k

US Session open trading DOW & NASDAQ - open at 16:30, Breakouts at 16:35, 16:40, 16:45 + closing pending orders at 18:00

All other settings are in the set file you can download at the bottom of this blog post.

NAS - 2 - 5 and 15 Tight.set - Return on Drawdown = 5.11

Test Conditions:

Initial risk used: $1000 per trade

Account size: $100k

US Session open trading DOW & NASDAQ - open at 16:30, Breakouts at 16:35, 16:40, 16:45 + closing pending orders at 18:00

All other settings are in the set file you can download at the bottom of this blog post.

NAS - 3 - 15 Min Pre.set - Return on Drawdown = 2.64

Test Conditions:

Initial risk used: $500 per trade

Account size: $100k

US Session open trading DOW & NASDAQ - open at 16:30, Breakouts at 16:35, 16:40, 16:45 + closing pending orders at 18:00

All other settings are in the set file you can download at the bottom of this blog post.

NAS - 5 - Percent.set - Return on Drawdown = 4.37

Test Conditions:

Initial risk used: $500 per trade

Account size: $100k

US Session open trading DOW & NASDAQ - open at 16:30, Breakouts at 16:35, 16:40, 16:45 + closing pending orders at 18:00

All other settings are in the set file you can download at the bottom of this blog post.

NAS - 6 - 5 and 15.set - Return on Drawdown = 3.41

Test Conditions:

Initial risk used: $500 per trade

Account size: $100k

US Session open trading DOW & NASDAQ - open at 16:30, Breakouts at 16:35, 16:40, 16:45 + closing pending orders at 18:00

All other settings are in the set file you can download at the bottom of this blog post.

DOW JONES:

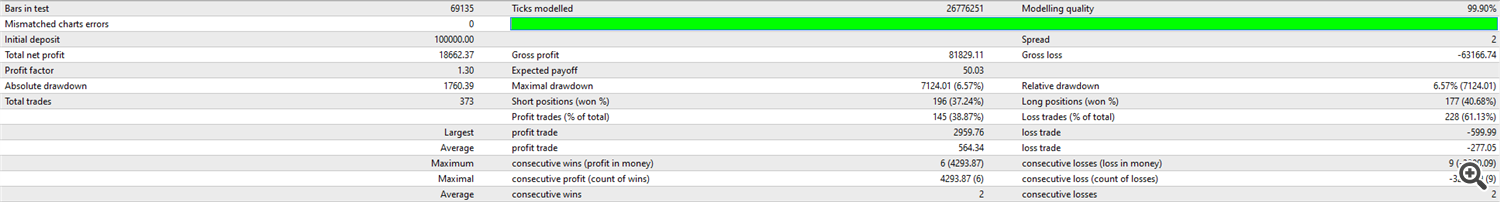

DOW - 1 - PM Addon.set - Return on Drawdown = 2.83

Test Conditions:

Initial risk used: $100 per trade

Account size: $100k

US Session open trading DOW & NASDAQ - open at 16:30, Breakouts at 16:35, 16:40, 16:45 + closing pending orders at 18:00

All other settings are in the set file you can download at the bottom of this blog post.

DOWNLOAD THE SET FILES:

The set files are all available in a zip folder you will see just under this text at the bottom of the blog post.