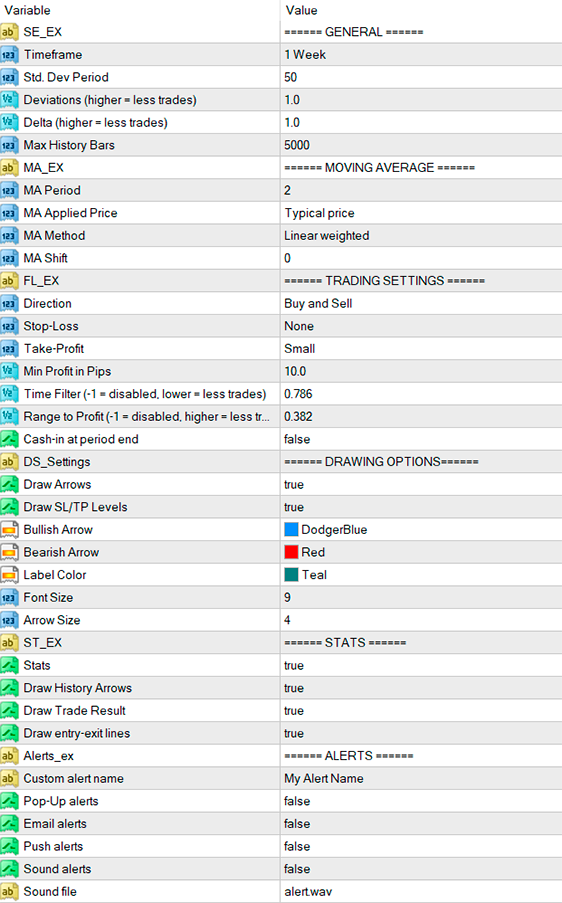

- Timeframe: The timeframe from which the moving average (mean) is calculated. It must be a higher timeframe from the current chart.

- Std. Dev Period: The standard deviation period to calculate the typical price band around the mean.

- Deviations: The multiplier of the typical price band. A higher value will create a wider price band and decrease the trading frequency. In some cases, it can make sense to decrease it, for instance, if you are trading long trades only against a moving average calculated using low prices only.

- Delta: Represents the multiplier for the trend channel calculated from a higher timeframe. A lower value will increase the trading frequency.

- Max History Bars: The amount of past bars analyzed when the indicator loads. A lower value will decrease the load time.

- MA Period: The moving average period used to calculate the mean.

- MA Applied Price: The price applied for the moving average.

- MA Method: The moving average method used for the moving average.

- MA Shift: The shift of the moving average used as a mean.

- Direction: This parameter allows you to find only long trades, short trades or both. This can be useful depending in your market analysis or the moving average applied price selected. For instance, you might trade buy only against a moving average calculated using low prices, or sell only against a moving average calculated using high prices only.

- Stop-Loss: The indicator can plot an optional stop-loss, which can be "tight" or "normal". For mean reversion, stop-losses are usually not used and instead, losses are accepted when the price returns to the typical price band or the mean.

- Take-Profit: The indicator plots a take-profit, which can be "small", "regular" or "large". Each represents a different price point of the typical price band.

- Min Profit in Pips: The indicator will filter out any trades that offer a profit in pips below this value. Useful for trading small timeframes.

- Time Filter: The indicator can filter out trades that have no or little chance of reverting to the mean during the next few bars. It does so by calculating the typical price movement per bar in the reference period. A higher value will produce more trades and a lower value will discard more trades. To disable this feature, enter "-1".

- Range to Profit: The range to profit ratio compares the profit target of a a potential trade against the distante to the highest/lowest of the day. A higher value will produce less but more profitable trades. If the stop-loss feature is not in use, it makes sense to disable this filter by typing "-1" as its value.

- Cash-in at period end: The indicator can close trades, at any profit, before the period ends. If enabled, this feature will decrease the variance in the trading results.

- Draw Arrows: Enable or disable the signal arrows in the chart.

- Draw SL/TP Levels: Display or hide the SL and TP levels in the chart.

- Stats: Perform and fisplay self-analyzing statistics on the chart.

- Draw History Arrows: Display tester-like entry-exit arrows in the chart. Visible only in bar charts.

- Draw Trade Results: Display trade result in pips for all past signals.

- Draw Entry-Exit Lines: Connect entry-exit points with lines, tester-like.

- Alerts: Enable or disable alerts of all kinds.