| Metatrader Expert Advisor Guides | |

|---|---|

| For Information on Downloading and Testing Expert Advisor Demos | Please See the Guide Here |

| For Information on Purchasing an Expert Advisor from the MQL5 Market | Please See the Guide Here |

| For Information on Running Expert Advisors and Custom Indicators | Please See the Guide Here |

| For Information on Using the Strategy Back Tester | Please See the Guide Here |

The O.G (Original Gansta) Scalper PRO (OGSP) is a Smart Fully Automated Trading System with multiple built-in Advanced Filters to maximise profits.

There is no secret to making profits in trading, it's simple, you need a reliable proven system, discipline and most importantly patience. No need to over complicate things.

The OGSP strategy algorithm is the culmination of many years of live market trading, study and development. It has proven itself over many differing market cycles and is now finally released as an established, mature product.

OGSP uses hidden levels around market rollover to dynamically place orders which have the highest probability of resulting in profit.

The strategy trades for only 2 hours per day and the main focus is on medium to long term equity growth.

OG Scalper PRO currently runs on Metatrader 5 ** (MT5). The Metatrader 4 (MT4) version is in development and will be released soon.

OG Scalper PRO MT5 Version --> <COMING SOON>

OG Scalper PRO MT4 Version --> <COMING SOON>

The EA runs on a single EURUSD,M5 chart using the One Chart Setup setting (see below).

The EA is easy to use with Automated GMT offset calculation and fully tested set files to make setup simple.

OG Scalper Pro has an Embedded Advanced Economic News Filter that is automatically availible in the strategy back tester which enables the backtesting of news events without having to manually save files ... way cool :)

It also has a prioprietary Bi-directional dynamic performance based risk adjustment system which will reduce the risk of poorly performing pairs and increase the risk of the best performing pairs based on a delta based algorithm. The algorithm works independently for both Long and Short trades which means your statistics can be based on total trades per instrument or specifically for Long and Short trade cycles.

The EA does not use any dangerous strategies such as Grid, Martingale or Averaging. Each trade has a fixed stoploss, but these are rarely hit. This is because the takeprofit level is moved dynamically in line with market conditions so its more likely that the takeprofit level is hit.

It is recommended that you run on a low spread, fast execution, low slippage at rollover, high liquidity broker such as IC Markets RAW

The EA can be used on all Major pairs, Minors and Crosses, but, of course, some pairs work better than others.

The best pairs are included in the relevant set file(s).

OGSP Current Recommended Pairs (Long Term Lower Risk):

EURAUD,EURCAD,EURUSD,USDCAD,USDCHF

OGSP Current Recommended Pairs (Long Term Medium Risk):

AUDUSD,EURAUD,EURCAD,EURGBP,EURUSD,GBPAUD,GBPCAD,GBPUSD,USDCAD,USDCHF

OGSP Current Recommended Pairs (Long Term Higher Risk):

AUDCAD,CHFJPY,EURAUD,EURCAD,EURGBP,EURJPY,EURNZD,EURUSD,GBPAUD,GBPCAD,GBPUSD,USDCAD,USDCHF,USDJPY

OGSP Full Pair List (Highest Risk, USE WITH CAUTION):

AUDCAD,AUDNZD,AUDUSD,CADCHF,CADJPY,CHFJPY,EURAUD,EURCAD,EURCHF,EURGBP,EURJPY,EURNZD,EURUSD,

GBPAUD,GBPCAD,GBPUSD,NZDUSD,USDCAD,USDCHF,USDJPY,USDSGD

NOTE: This is based on IC Markets SC RAW testing, you will get differing results from other brokers due to the difference in their data feed and liquidity pool providers.

NOTE: If you use any another broker, make sure that you run your risk at 0.01 lotsize for a period to see how each pair performs and adjust your risk as more trades are taken.

OGSP Risk Settings (for Dollar($) or Sterling(£) Broker Base Currencies ONLY!):

Lots per Balance 500 - Low Risk

Lots per Balance 250 - Medium Risk

Lots per Balance 125 - High Risk

NOTE: You can also use the max correlated trades setting (see below) to control risk. By setting the max correlated trades setting lower you can increase the Lots per Balance because you will have fewer trades in theory, but if you do this then make sure you run a strategy backtest so that you can gauge the drawdown and therefore the risk to see if it is in line with your expectations.

OG Scalper PRO Live Signal --> Here

Signal Settings:

- Broker: IC Markets SC RAW Account

- VPS: https://portal.4xhosting.com/aff.php?aff=18

- Chart: EURUSD

- Use One Chart Setup: true

- TimeFrame: M5

- Filters: News Filter (High)

- Lot Calculation Type: Lots Per Balance ((Balance/Lots Per Balance)*Fixed Lot Setting(0.01))

- Lots Per Balance: 125

- Use One Chart Setup: true

- OCS Instrument List: AUDUSD,EURAUD,EURCAD,EURGBP,EURUSD,GBPAUD,GBPCAD,GBPUSD,USDCAD,USDCHF

- Perf Stats: true (99% Reduce|Top 3 25%|25 point watermark)

- Setfile --> Once OG Scalper PRO is purchased, DM me for set file.

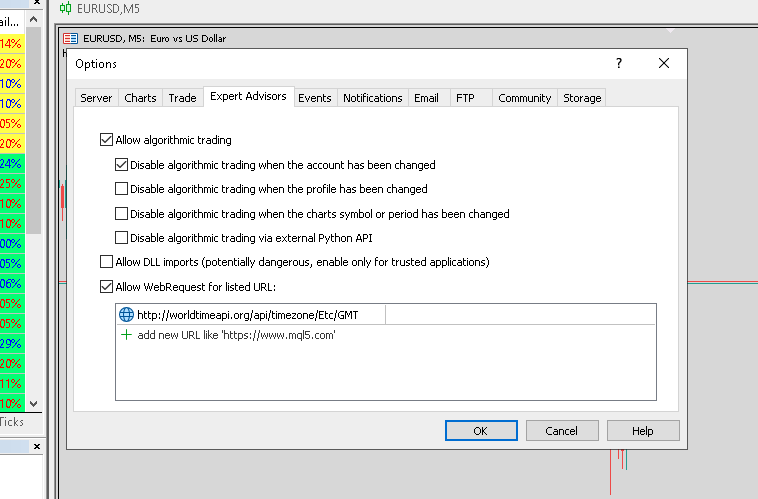

Allow WebRequest for listed URL:

You will need to allow the EA to access the WWW on a coulpe of URLs ... One is for the Auto GMT Setup and the other is for the Economic Calendar file download on MT4 (see below).

MT4 ONLY - Economic Calendar File Download:

To allow the Economic Calendar file download on MT4, you need to add the following URI into the Experts Tab ... (MT4 is not as advanced as MT5 which has an in-built Economic Calendar Functionality)

Go to "Tools --> Options --> Expert Advisors", select the "Allow algorithmic trading" and "Allow webRequest for listed URL" and then and add " https://mql5economiccalendar.s3.eu-west-2.amazonaws.com/" and hit return, then the "OK" button.

Auto GMT Setup:

To allow the AutoGMT setup to work, you need to add the following URI into the Experts Tab ...

Go to "Tools --> Options --> Expert Advisors", select the "Allow algorithmic trading" and "Allow webRequest for listed URL" and then and add " http://worldtimeapi.org/api/timezone/Etc/GMT" and hit return, then the "OK" button.

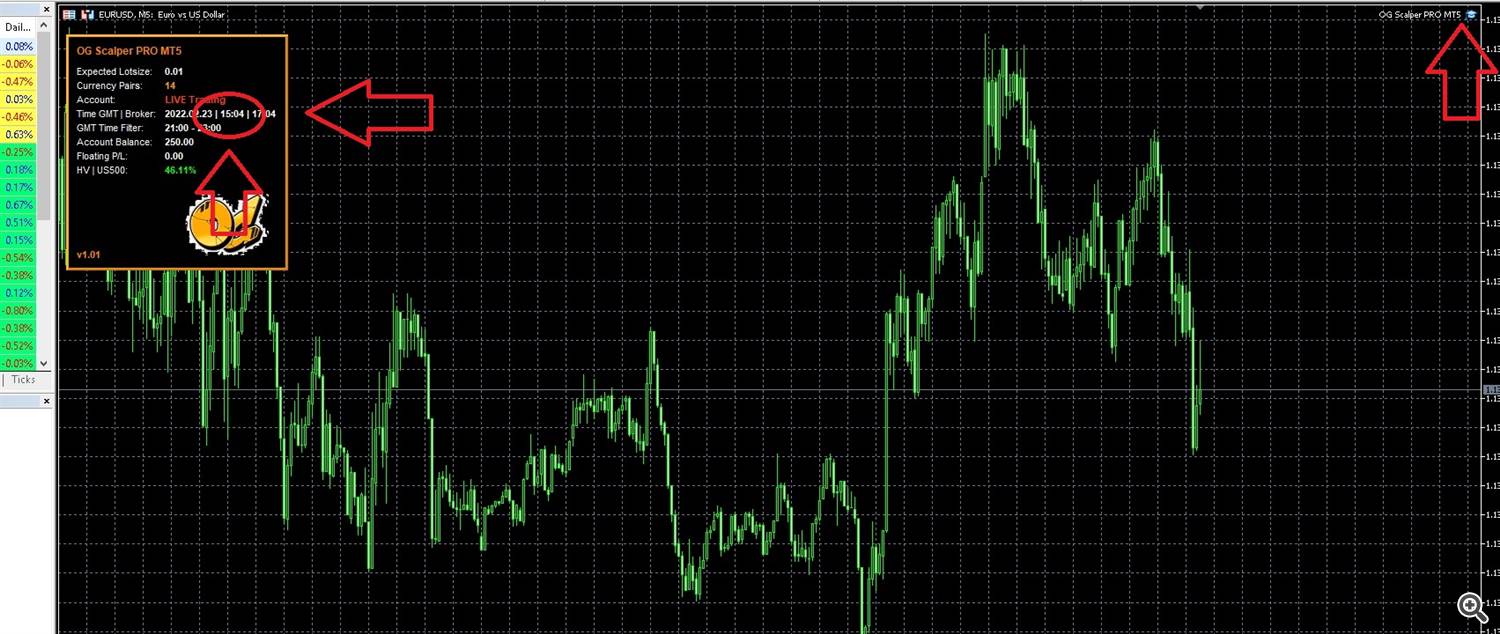

O.G Scalper PRO EA Metatrader 5 (MT5) Chart Setup:

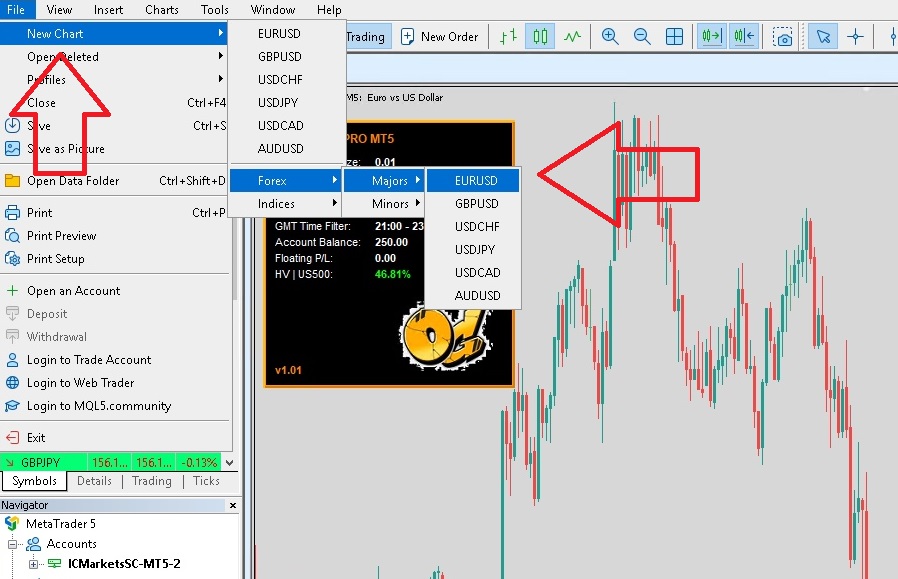

1. Click File --> New Chart --> EURUSD

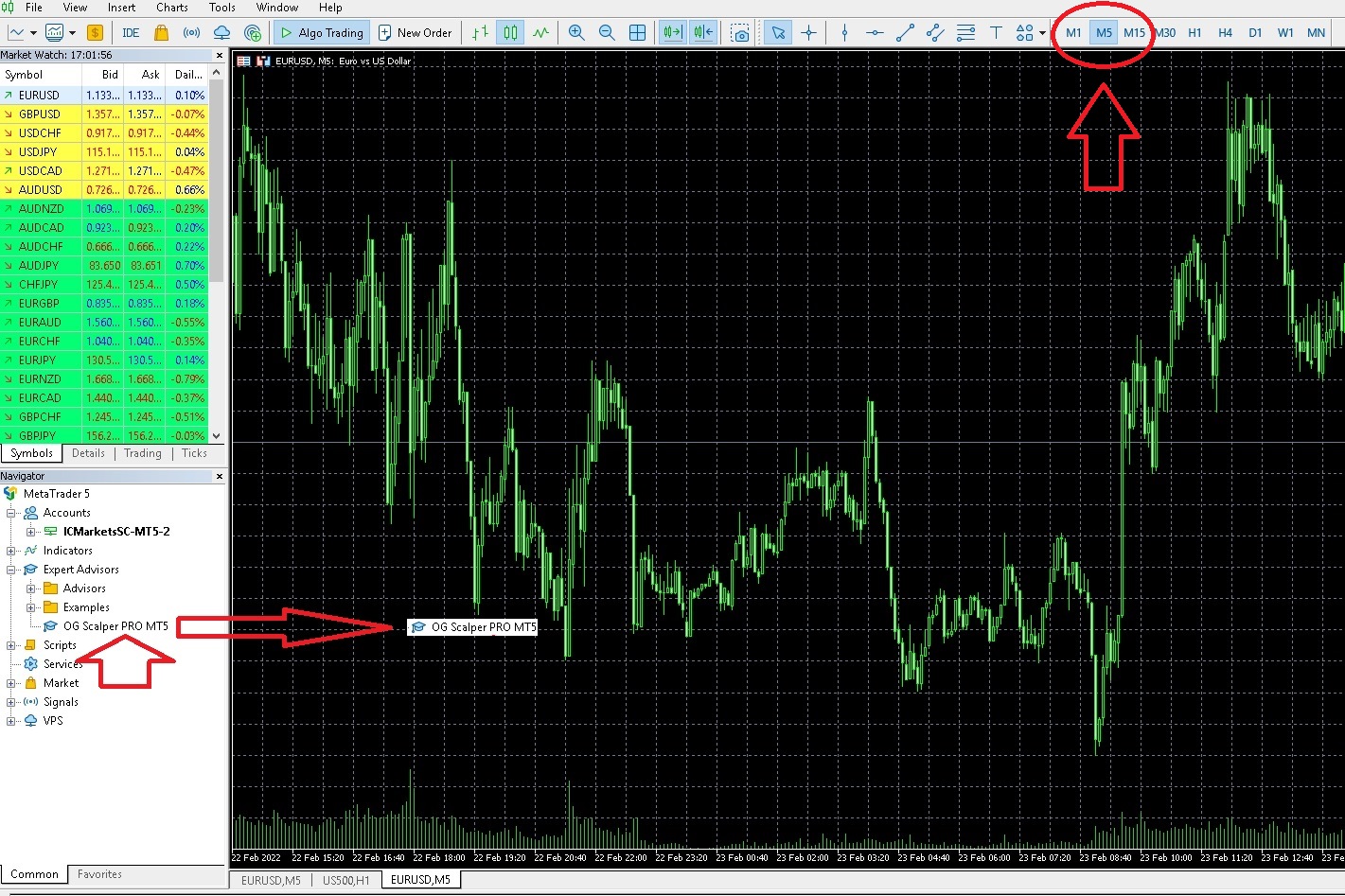

2. Set the Chart Timeframe to M5, then click and drag the "OG Scalper PRO MT5" EA from the Explorer on the left hand side of the terminal to the EURUSD,M5 chart.

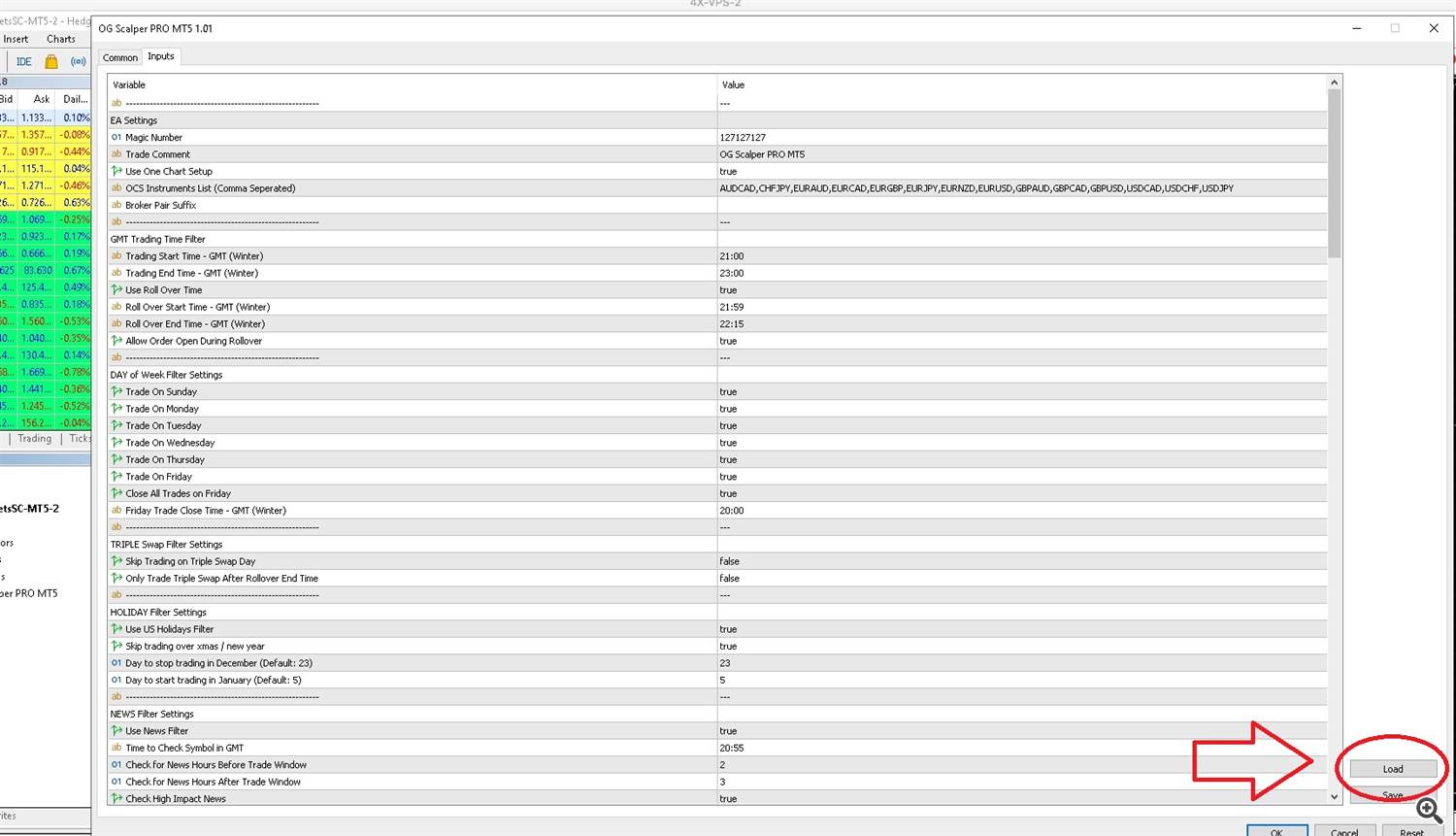

3. When the settings window appears, click on the "Load" button in the bottom right hand corner.

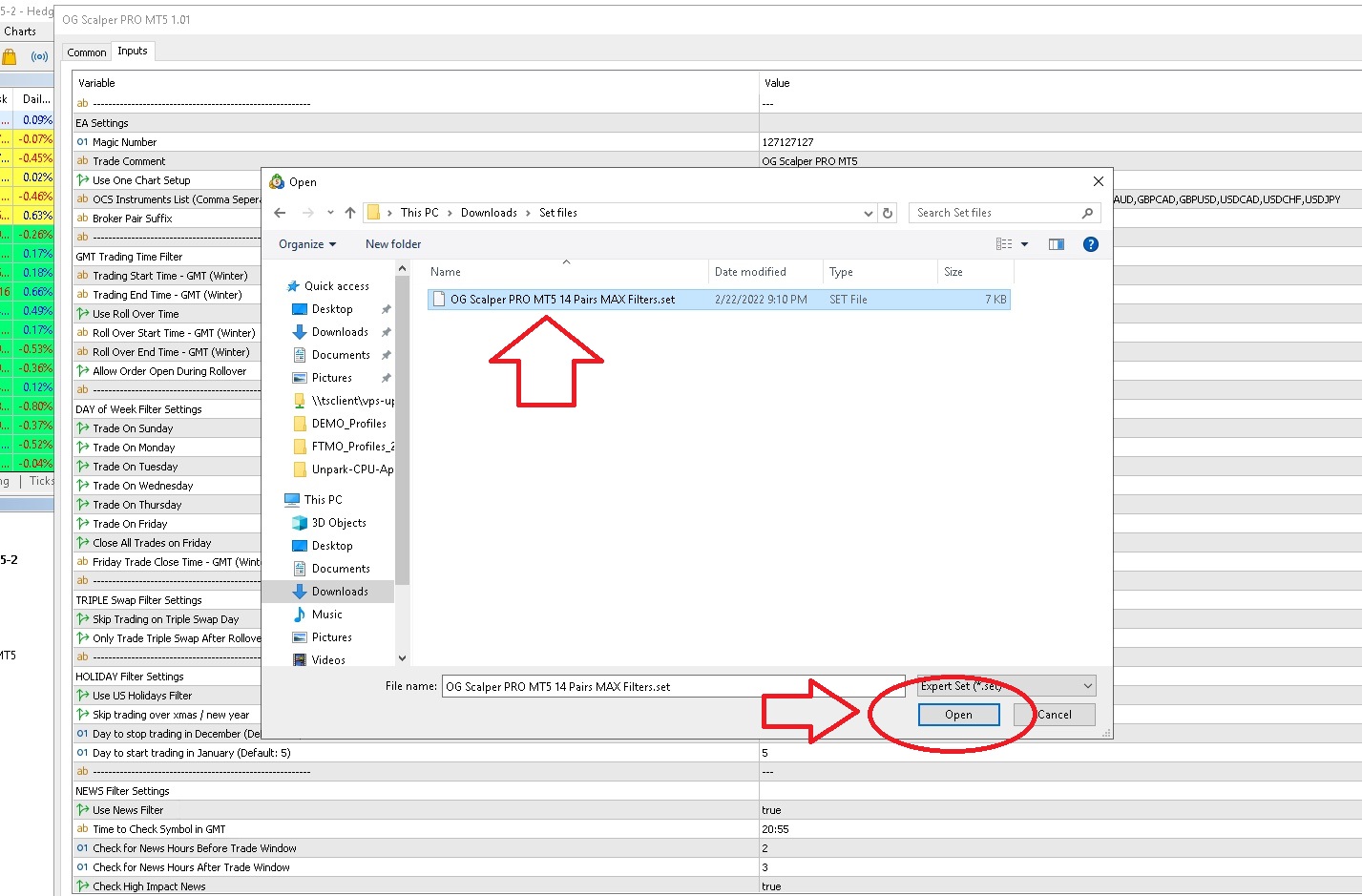

4. Find and select the relevant settings file you would like to use, in this example its called "OG Scalper PRO MT5 14 Pairs MAX Filters.set", then click the "Open" button.

5. Once the settings file has loaded, then click the "OK" button.

6. You should now see the "OGSP EA" loaded on the chart, >> check the GMT Time is correct << and >> check the hat is blue on the top right of the chart <<. This means the EA is loaded and running correctly. You should also check the "Expected Lotsize" and "Currency Pairs" to make sure they look OK.

Full Parameter List:

Here is the full parameter listing, this is for information only, please use the recommended set file listed above.EA Settings

- Magic Number - Magic number for the EA

- Trade Comment - Comment for EA trade orders

- Use One Chart Setup - Run all pairs from a single chart

- OCS Instruments List (Comma Seperated) - List of pairs to execute the EA on, comma seperated list

- Broker Pair Prefix - If you broker uses a prefix, enter it here (i.e. for ICMarkets leave this blank, but, for an instrument for example r.EURUSD then enter "r.")

- Broker Pair Suffix - If you broker uses a suffix, enter it here (i.e. for ICMarkets leave this blank, but, for an instrument for example EURUSD.pro then enter ".pro")

- Trading Start Time - GMT (Winter) - Trading start time in Winter GMT time which is 21:01

- Trading End Time - GMT (Winter) - Trading end time in Winter GMT time which is 22:59

- Use Roll Over Time - Rollover time filter, disabled by default

- Roll Over Start Time - GMT (Winter) - Rollover start time in Winter GMT time which is 21:59

- Roll Over End Time - GMT (Winter) - Rollover end time in Winter GMT time which is 22:15

- Allow Order Open During Rollover - If the rollover filter is enabled, this will enable/disable trade opening at rollover

- Trade On Sunday - Allow trades on Sunday (forex markets open 22:00 GMT (Winter) on Sunday)

- Trade On Monday - Allow trades on Monday

- Trade On Tuesday - Allow trades on Tuesday

- Trade On Wednesday - Allow trades on Wednesday

- Trade On Thursday - Allow trades on Thursday

- Trade On Friday - Allow trades on Friday (this includes Friday evening, you can stop this by setting "Close All Trades on Friday")

- Close All Trades on Friday - This closes trades on Friday (see Friday Trade Close Time)

- Friday Trade Close Time - GMT Time (Winter) - Close all Friday trades at this time

Triple Swap Filter Settings

- Skip Trading on Triple Swap Day - Disallow trades on triple swap day. Triple swap day as deifned by your broker, this is usually Wednesday night.

- Only Trade Triple Swap After Rollover End Time - If this is enabled, then trades are only allowed on triple swqap day after the rollover window.

Holiday Filter Settings

- Use US Holiday Filter - Skip trading on US Federal Holidays. (This is only the holiday where the US stock market is closed. You can check Here)

- Use UK Holiday Filter - Skip trading on UK Bank Holidays.

- Disable GBP ONLY for UK Holidays - Only disable GBP pairs for UK Bank Holidays.

- Skip trading over Xmas / New year - Skip trading over Xmas based on the days specified below (23rd December to 5th January). Historically over the Xmas period the same as most holidays there is low liquidity and higher spreads which are not ideal conditions for a night scalper.

- Day to stop trading in December (Default: 23) - Date in December to stop trading.

- Day to start trading in January (Default: 5) - Date in Junuary to resume trading.

- Use News Filter - Enable/Disable the news filter. The news filter can also be used in the strategy tester as long as the EA has been attached to a live chart before you run in thge strategy tester. This is because the news file is autiomatically downloaded once the EA is attached to a live chart and can be accessed in the common files folder.

- Time to Check News in GMT - Time to check the news, this is done once per day prior to the trading window. Set the time in the GMT WInter Time (default 20:50)

- Check for News Hours Before Trade Window - This is the number of hours before the trading window that news will be taken into consideration. So if set to 2 hours, then any relevant news up to 2 hours before the start of the trading window will be checked and the relevant pairs will be disabled.

- Check for News Hours After Trade Window - Same as above but the number of hours after the window closes to take news events into consideration.

- Check High Impact News - Check for High Impact News.

- Check Medium Impact News - Check for Medium Impact News.

- Check Low Impact News - Check for Low Impact News.

- Elevate PMI News to High - Elevate Medium PMI News to High.

- Elevate Monetary Policy News - Elevate Medium Monetary Policy News to High.

- Elevate Monetary Speech News - Elevate Medium Monetary Speech News to High.

- Elevate National Election News - Elevate Medium National Election News to High.

- Ignore All Day Events - Ignore All Day Events for example "Davos".

- Disable AUD on JPY News - If disabling on AUD news, then also disable JPY pairs.

- Disable JPY on AUD News - If disabling on JPY news, then also disable AUD pairs.

- Print News to Log - Print News events to log while running the check (can fill up the tester logs, so disabled by default)

- Print PMI News to Log - Print PMI events to log while running the check (can fill up the tester logs, so disabled by default)

- Print Monetary News to Log - Print Monetary news events to log (same again, can fill up tester logs)

- Print Speech News to Log - Print Speech events to log while running the check (can fill up the tester logs, so disabled by default)

- Print Election News to Log - Print Election events to log while running the check (can fill up the tester logs, so disabled by default)

Historical Volatility Filter Settings

- Use HV Monitor - Enable/Disable the Historical Voliatility Filter.

- Use Each Symbol HV - Use HV level from the same pair as each trade signal pair.

- HV Symbol Name - Name of the Symbol to monitor. You can Use an Index like US500, US500.cash, USTEC, or any other pair i.e XAUUSD. **Which ever symbol you use please make sure it is viewable in the Marketwatch window.

- Time to Check HV - GMT (Winter) - The time prior to the trading session window to check Historical Volatility.

- HV Upper Limit % - The upper limit in percent of Historical Volatility to stop trading for the daily session.

- HV Period - Historical Volatility Period.

- HV Shift - How many bars to shift backwards for the start of the calculation (default=0, usually this is the best option)

- HV Timeframe - the timeframe for the HV calculation.

- HV High Watermark Bar Lookback - Number of bars to look for the highest HV point (default H1:168 == 1 x week)

Entry Deviation Range Settings

- MIN Range Between Deviation in % of ATR - This is the distance in % of ATR between the upper and lower deviation channel. Increasing this can increase the percentage of profit per trade based on the distance from the entry to the exit, but, might mean you miss some winning trades. You can however cut out small wins using this.

- MAX Range Between Deviation in % of ATR - This is the same as above but it is the maximum distance allowed. You can use this to filter out volatility where the distance between the deviations is larger than you would ideally like.

- ATR Lookback - This is the ATR period to use for the calcuation (default 20).

- ATR Timeframe - The timeframe to us for the calculation (default 1 Day).

Order Entry Settings

- Max Number of Parallel Trades Across All Instruments - if you hit this number of active trade then no more trades will be allowed to open in parallel.

- Max Correlated Active Trades - This is the number of currency trades you are allowed open in parallel, for example, if set to 1 and you have EURUSD LONG, then you would not be allowed a EURCHF LONG, but you would be allowed a EURUSD or EURCHF SHORT, and if you had a USDCHF SHORT, you would not be allowed a USDJPY SHORT, but would be allowed a USDJPY or USDCHF LONG. Its about the individual currency (not the pair) and the direction of the trade. This helps with being overexposed to any one currency in any one direction.

- Max Spread for Setting Pending Order (in points) - If the spread for the pairs is higher than this in points, then the pending order is not set. This is checked once per bar.

- Max Spread at Which Pending Orders are Deleted (in points) - If you have open pending orders and the spread increasers above this level, then pending orders are deleted for the pair.

- If Order Closed (by SL or TP) Minimum number of bars before setting new pending orders - If you hit a stoploass or a takeprofit, then you can set a delay in number of bars before you set new pending orders for the pair.

- Use Stop Orders if Past Entry Point - If when the trading window opens you are past the normal entry level, then use a stop orders for entry (default false).

- Use Market Orders if Past Entry Point - if when the trading window opens you are past the normal entry point, then use markets orders for entry (default true).

- Sell N Points Below Current Price (stop orders) - For use with the stop orders listed above.

- Buy N Points Above Current Price (stop orders) - For use with the stop orders listed above.

Order Extra Settings

- Randomize Entry, Stoploss and Takeprofit in Points (0=disabled) - You can randomise Entry, Stoploss and Takeprofit levels above or below (random) the standard entry level (in points). You can use this to obfuscate the use of this EA if for example you are running on a Prop firm account and there are many other users of the EA so you do not clash with their orders.

- Close All trades after [N] bars (0=disabled) - Use this to close ALL trades and delete all pending orders after N bars. **Bar Number N[0] is the first bar of the trading window.

- Close Trades (after [N] bars -

- All Trades - Close All Trades.

- Winning Trades - Close only winning trades.

- Losing Trades - Close only losing trades.

Lot Size Settings

- Lot size calculation selection - Select the lot size calculation type.

- Fixed Size - Use a fixed lot size, set that here for example "0.01" lots. **Leave this at "0.01" if you are using "Lots Per Balance"

- Lot Per Each Balance - This is the Fixed size per balance, so if "Fixed Size" is "0.01" and "Lots Per Each Balance" is "5000" and you have a $10,000 account, then your lotsize will be (10000/5000)*0.01==0.02.

- Split Lots Into Smaller Lots Over This Size (-1=disabled) - If after calculation yours lot size is greater than this setting, then divide the lots into sub trades with an equal smaller lot size below the setting. For exmaple, if your setting is 1.0, and your lot size is 1.2, then the lots will be split into 2 x 0.6 lot trades.

- Split Lots into [N] Equal Lots (-1=disabled) - Split Lots into equal sizes unless you do not have a large enough lotsize, then it will calculate accordinlgy. For example "0.01" lots will not split into 5 x sublots! :)

Equity Protection Settings

- Draw Down Limit in % - This is the equity draw down allowed per day in percentage terms. This will close off all trades and cancel all pending orders if the daily equity draw down hits this limit.

- Profit Lock-in in % - This is the equity profit to be locked in on a daily basis. Once this is hit trading will stop for the session.

- Take Profit Type Selection - Type of take profit the system should use.

- Mean Center Line - This is the default in a mean reversion system, the return to the mean centre line.

- Opposite Deviation - Use the opposite deviation as the take profit, this would give higher profit per trade, but would not be as reliable.

- Fixed Take Profit as Points - Use a fixed take profit in points.

- % of ATR - Use % of ATR as the take profit target.

- ATR Look Back - ATR lookback period to use.

- ATR Time Frame - ATR timeframe to use.

- Delay setting TP for N bars - You can delay setting the TP for N bars.

- Delay setting TP to Median Line N bars if using “Opp Deviation” - If using the opposite deviation, you can reset to the mean centre line after N number of bars.

Stop Loss Settings

- Use Stop Loss - Enable/Disable stoploss.

- Stop Loss Type Selection - Stoploss type selection.

- Fixed Stop Loss as Points - Use a fixed stoploss in points.

- % of ATR - Stoploss is based on % of ATR.

- Fixed Points, then Reduce by N% Per Bar - As above, but then reduce the SL size by N% for each new bar.

- % of ATR, then Reduce by N% Per Bar - As above, but then reduce the SL size by N% for each new bar.

- Fixed Stop Loss as Points - If using a fixed stop loss, the number of points away from the entry to set the SL.

- % of ATR - If using % of ATR, the percentage of the relevant ATR away from the entry to set the SL.

- ATR Look Back - ATR lookback period for calculation.

- ATR Time Frame - ATR timeframe for calculation.

- % Per Bar Reduction - Reduce by N% Per Bar.

Trailing Stop Settings

- Use Trailing Stop - Enable/Disable trailing stoploss.

- TS Activation Type Selection - Selection of activation distance of trailing stoploss.

- Fixed TS Activating as Points - Use a fixed activation distance in fixed points.

- % of ATR - Activation distance in % of ATR.

- ATR Look Back - ATR lookback period.

- ATR Time Frame - ATR timeframe for calculation.

- TS Distance Type Selection - Selection of trailing distance method.

- Fixed TS Distance as Points - Trailing stoploss distance in fixed points.

- % of ATR - Trailing stoploss distance in % of ATR.

- ATR Look Back - ATR lookback period.

- ATR Time Frame - ATR timeframe for calculation.

- Use Perf Adjusted Lot Sizes - Enable/Disable performance based lot size adjustment.

- Number of Closed Trades Before Collecting Stats - How many trades needed to complete before starting the performance analysis.

- Number of Days to Limit Trade Lookback - Number of days to limit the lookback of trades for the performance calculation.

- Reduce Lot Lize by % if Avg Points per Trade < 0 - Amount in % to reduce the lotsize by if the performance of the relevant pair of average points per trade is below zero.

- Lot Size Increase to Top [N] Performers - Use this to control how many to pairs to increase.

- Min Avg Points for Top Performer Increase - On average the number of points per performer as a minimum before increasing lotsize.

- Increase Lot Size by % of Top Performers - Amount in % to increase the lotsize by of the top performing pairs.

- Split Performace by Long and Short - Whether to split performance up between long and short trades, or All trades irrespective of trade direction.

Chart Panel Settings

- Panel Title Text Color - Title text color for the chart panel.

- Panel Background Color - Panel background color.

- Panel Border Color - Panel border color.

- Panel Border Size - Panel border size.

- Panel Text Color - Text color for the chart panel.

- Panel Font Name - Font name for the chart panel.

- Panel Font Size - Panel font size.

- Panel X Offset - Panel X offset.

- Panel Y Offset - Panel Y offset.

- Update Chart Panel in Strategy Tester (default: false) - Update the chart panel in visual mode of the strategy tester.

- Use DST - Use daylight savings in the strategy tester.

- Broker Feed Uses US DST - Type of DST to use, use US DST settings.

- Broker Feed Uses EU DST - Use EU DST settings.

- Broker Feed Summer GMT Offset - Summer GMT offset for the broker feed used for the strategy test. For emaple, IC Markets summer offset is 2 hrs and they roll DST in line with the US timezone, so this is always 2.

- Broker Feed Winter GMT Offset - Winter GMT offsert for the broker feed used for the strategy test. Again, because IC Markets roll in line with US DST, this is also 2 for the purposes of the strategy test.

Being a Trader and using EAs or Algos is not as easy as just fire and forget ... you need to have a Trading Plan and Process also ...

Handling Taking a Loss and Other Insights:

- Being able to take a loss without panicking is a massive part of trading, and, if you cannot overcome this then you will not make it as a trader, its that simple.

- Respect the process and have faith in the strategy, patience is key.

- Backtest everything using your broker data feed so you know what the implications are of running the strategy on your broker. You will need to understand win rates/drawdown periods/size of losses etc.

- If you take a loss and it hurts emotionally, then your risk is FAR TOO HIGH. You need to Increase your capital and lower your risk.

- Run the strategy on demo for a period, then at minimal lots Live because you will get different results live. Demo is INSTANT EXECUTION and NO SLIPPAGE, and LIVE IS NOT, you will get execution delays and slippage ... very important you understand this.

- There is no such thing as a "CENTRALISED FOREX EXCHANGE".

- The Forex Market is made up of 1000s of Liquidity Providers (LPs) where the broker passes through via ECN/STP to the LP (and will aggregate trades if neccesary), and also brokers running Book B internal matching engines .. so your broker orders/executions will be unique to you!!

- This means that even though you use the same EA, you could get different trade executions to someone else using the same broker.

- If there is a market moving event, or, a couple of market moving events at the same time, then what does this mean for your strategy ?!? is it beneficial or detremental ? know this, understand this, because you will lose capital if you do not.

**** THE BORING BUT NECESSARY STUFF ****

**** IMPORTANT PLEASE READ THIS FIRST ****

TRADING SUCCESSFULLY IS BASED ON PROBABILITIES, THIS MEANS THAT YOU ARE RELYING ON SOMETHING THAT HAS PASSED BEFORE TO BE REPEATED.

NO-ONE CAN KNOW THE FUTURE SO THIS IN ITSELF CARRIES AN INHERENT RISK.

THERE IS NO RETAIL TRADING STRATEGY THAT WINS 100% OF THE TIME, THAT IS A FANTASY. ALL TRADING SYSTEMS TAKE LOSSES OR GO INTO PERIODS OF DRAWDOWN, >>> THIS IS NORMAL <<<

TO TRADE SUCCESSFULLY YOU NEED TO ACCEPT THAT THERE WILL BE LOSSES. I REPEAT, THERE WILL BE LOSSES, ACCEPT THIS AND MOVE ON.

TRADING SYSTEMS THAT WORK HAVE MORE WINS THAN LOSSES, ITS THAT SIMPLE.

WITH EACH LOSS COMES EMOTIONAL PAIN, THIS IS THE MOST DIFFICULT PART OF TRADING FOR PEOPLE TO ACCEPT. IF YOU CANNOT ACCEPT THIS, THEN YOU WILL NOT SUCCEED, YOU WILL GO INTO REVENGE CYCLE AND INCREASE YOUR RISK TO TRY TO COMPENSATE AND THIS IS WHERE YOU WILL BLOW YOUR ACCOUNT.

BE HUMBLE AND ACCEPTING, TEST EVERYTHING AND SET YOUR RISK PROFILE TO A LEVEL YOU CAN ACCEPT.

IF YOU FEEL EMOTIONAL PAIN WHEN TRADES ARE OPEN OR WHEN YOU TAKE A LOSS THEN YOUR RISK PROFILE IS TOO HIGH, >> INCREASE YOUR CAPITAL AND LOWER YOUR RISK <<

**** IMPORTANT PLEASE READ THIS FIRST ****

**** Caveat Lector ****

FOREX TRADING IS NOT FOR EVERYONE, AND WITH IT THERE CARRIES AN ASSOCIATED HIGH RISK. DEPENDING ON MARKET CONDITIONS YOU CAN LOSE MORE THAN YOUR INITIAL DEPOSIT. CHOOSE YOUR BROKER, STRATEGIES AND RISK MANAGEMENT CAREFULLY BY DOING YOUR OWN RESEARCH BEFORE PURCHASING. PAST PERFORMANCE IS NOT NECESSARILY A GUIDE TO FUTURE PERFORMANCE. I WILL NOT ACCEPT LIABILITY FOR ANY LOSS OR DAMAGE, INCLUDING BUT WITHOUT LIMITATION TO ANY FINANCIAL LOSS WHICH MAY ARISE DIRECTLY OR INDIRECTLY FROM USE OF OR RELIANCE ON SUCH INFORMATION EITHER PROVIDED BY MY PRODUCTS OR OTHERS THAT PARTICIPATE IN THE SERVICES PROVIDED AND MOST IMPORTANTLY, ONLY INVEST MONEY THAT YOU CAN AFFORD TO LOSE! **** ONLY PURCHASE IF YOU HAVE READ, UNDERSTOOD AND AGREE TO THE ABOVE STATEMENTS **** BY PURCHASING YOU ARE AGREEING THAT YOU HAVE READ AND UNDERSTOOD THE ABOVE STATEMENTS ****

**** HAVE FUN, AND AS ALWAYS, HAPPY TRADING! ****

**** Caveat Lector ****