For this analysis I use iPump indicator

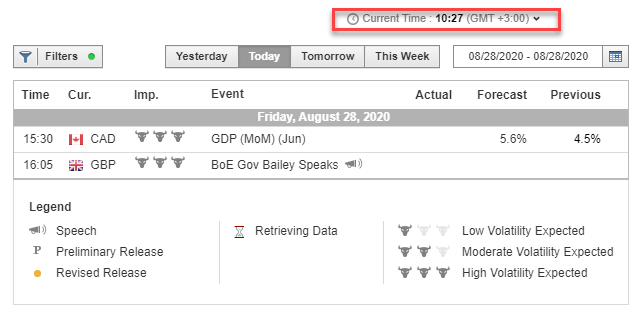

Important news for today

USD / CHF

Fundamental news

The USD / CHF pair is moderately declining amid a downward correction in the US dollar.

The situation in the United States is much more difficult, where the level of GDP in the second quarter fell to -31.7% against the background of -5.0% in the first quarter. During the month, the estimate of the indicator was revised from -32.9%, however, there was practically not a word about it at the following speech by the head of the Fed, Jerome Powell. Instead, the head of the regulator, throughout most of his speech, compared the current state of the US economy to the post-crisis recovery, ending up with the situation being much better, and nothing to worry about.

Technical analysis

Yesterday the USD / CHF pair traded in different directions in the range Chf0.9040-Chf0.9120 and closed the day without significant changes. Today the pair dropped slightly and dropped to Chf0.9065. On the hourly chart, USD / CHF is still trading below the MA line (200) H1 (Chf0.9085). The situation is similar on the four-hour chart. Based on the foregoing, it is probably worth sticking to the south direction in trading, and while the pair remains below MA 200 H1, it is necessary to look for a sell entry point to form a correction.

Resistances are at Chf 0.9120-35, Chf 0.9160, Chf 0.9195

Support levels are located at: Chf 0.9040, Chf 0.9010-20, Chf 0.8900

The main scenario for the pair's advance is a subsequent decline to Chf 0.9040 (August 27 minimum). Alternative scenario - consolidation above MA 200 H1, with further advance towards Chf0.9135 (Aug 21 high).

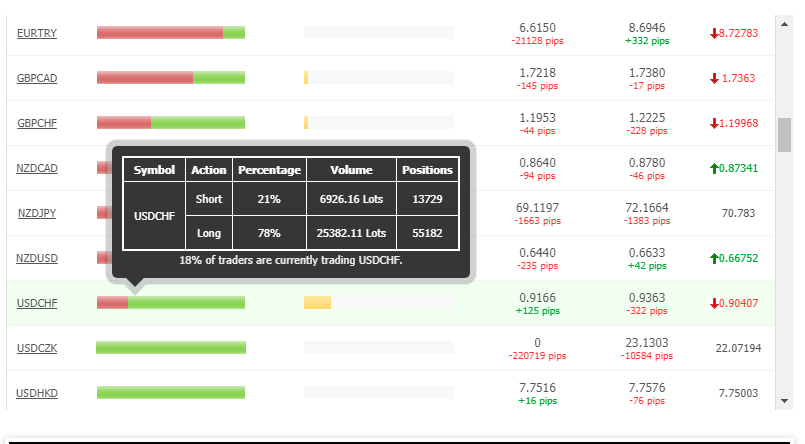

Sentiment of major currency pairs

Sentiment of market positions is the ratio of traders' positions on the Myfxbook service . We will be interested in the skew of positions from 70/30 and stronger. The point is that the minority earns in the market. If the instrument has been in a significant skew of positions for a long time, a large player can push the price in his direction.

In most cases, I consider the smaller side for opening deals, since you must understand that it is just the minority who make money in the market. + I always focus on the continuation of the trend

The entire list of the ratio of traders' positions for buying and selling can be viewed on my website in the sentiment section

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

https://www.mql5.com/en/market/product/51395

Multifunctional robot (averaging/piramiding/strategy for overclocking a deposit)

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy in the EA Long Term Strategy (fix stop loss, safe strategy)

#USDСHF28.08.2020analysis