Speaking on Tuesday, Fed Chairman Jerome Powell expressed concern about the growth of US company debt. However, he did not say anything about the Fed’s monetary policy outlook, but noted that “GDP growth rates are stable, US employment rates are quite high, while wages are rising against the backdrop of restrained inflation”.

Inflation remains the focus of Fed officials.

The central bank set a target inflation rate of 2% in 2012, and never once ensured its sustainability. Moreover, this year inflation has weakened, even against the background of strengthening economy and employment growth. The inflationary expectations of market participants and the population have also weakened, and this increases the likelihood that real inflation will not grow as the Fed leaders want.

Most of them believe that this year the rates will not be changed, and those who thought they would be raised refused this opinion. Financial markets are expecting lower rates by the end of this year.

On Wednesday, market participants will carefully study the minutes from the May Fed meeting in order to understand the intentions of the central bank management regarding monetary policy. The publication of the Fed's minutes is scheduled for 18:00 (GMT). Volatility at this time may sharply increase in the financial markets if the protocols contain unexpected statements by the Fed leaders. The harsh rhetoric of their statements regarding monetary policy will cause a strengthening of the USD. Conversely, a penchant for soft politics will cause a weakening of the American dollar.

Lowering the interest rate of the Fed is a strong fundamental factor that will have a negative impact on the USD quotes.

Nevertheless, the demand for the dollar is likely to continue in the context of the escalating US trade conflict with China and amid a slowdown in the European economy, as well as expectations of the results of parliamentary elections (May 23-26) in Europe. At the same time, the RB of Australia and the RB of New Zealand directly declare monetary policy easing.

The dollar in the current situation looks preferable to other currencies due to the greater stability of the American economy.

Technical Analysis

The increase in volatility in the USD / CAD is expected at 12:30 (GMT) in connection with the publication of data on retail sales in Canada. In March, the level of retail sales is expected to increase by 1.0% in the country (after rising + 0.8% in the previous month). This is a positive factor that will support CAD when confirming the forecast.

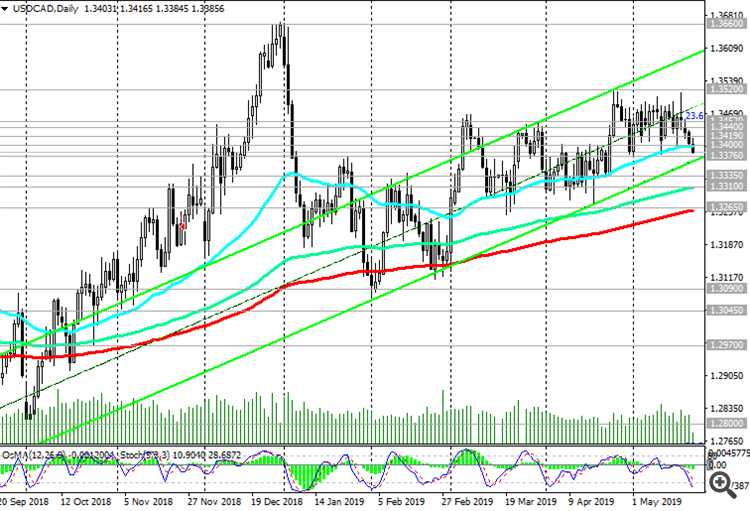

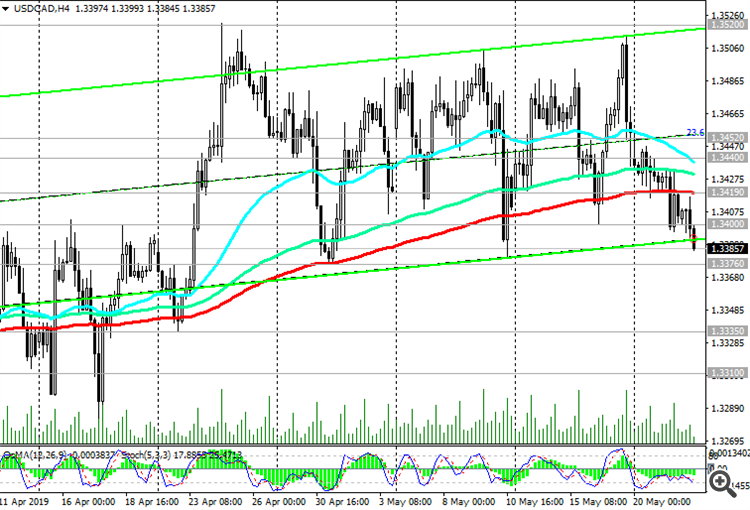

After the USD / CAD updated its 3-month high near the 1.3520 mark at the end of last month, this currency pair is being adjusted, falling on Wednesday for the 4th consecutive day.

At the beginning of the European session, USD / CAD is trading near 1.3390, below the important support level of 1.3400 (ЕМА50 on the daily chart).

The OsMA and Stochastic indicators on the 1-hour, 4-hour and daily charts turned to the short positions.

Nevertheless, USD / CAD maintains a long-term positive trend, trading above key support levels of 1.3310 (EMA144), 1.3265 (EMA200 on the daily chart).

The breakdown of resistance levels 1.3400, 1.3419 (ЕМА200 on 4-hour chart) will be a signal for the resumption of long positions.

After the breakdown of the resistance level of 1.3520 (2019 highs), the USD / CAD will head towards the resistance levels of 1.3660 (2018 highs), 1.3790 (2017 highs).

Support Levels: 1.3376, 1.3335, 1.3310, 1.3265

Resistance Levels: 1.3400, 1.3419, 1.3440, 1.3452, 1.3480, 1.3520, 1.3600, 1.3660, 1.3790

Trading Scenarios

Sell Stop 1.3370. Stop Loss 1.3435. Take-Profit 1.3335, 1.3310, 1.3265

Buy Stop 1.3435. Stop Loss 1.3370. Take-Profit 1.3452, 1.3480, 1.3520, 1.3600, 1.3660, 1.3790