Rising unemployment and low inflation increase the pressure on the RBA to lower interest rates. "During the meeting on June 4, interest rate cuts will be discussed", RBA manager Philip Lowe said on Tuesday. According to him, "new stimulating measures could help accelerate economic growth".

In the minutes from the May meeting of the RBA published today, it is stated that "the lack of improvement in the labor market situation is an argument in favor of lowering interest rates". “Without easing monetary policy in the next six months, we should expect lowering forecasts for GDP growth and inflation”, the RBA leaders concluded.

International trade conflicts, primarily between the United States and China, also pose a risk to the Australian economy. Investors estimate the likelihood of the June decline in RBA rates in more than 50% and 100% in August.

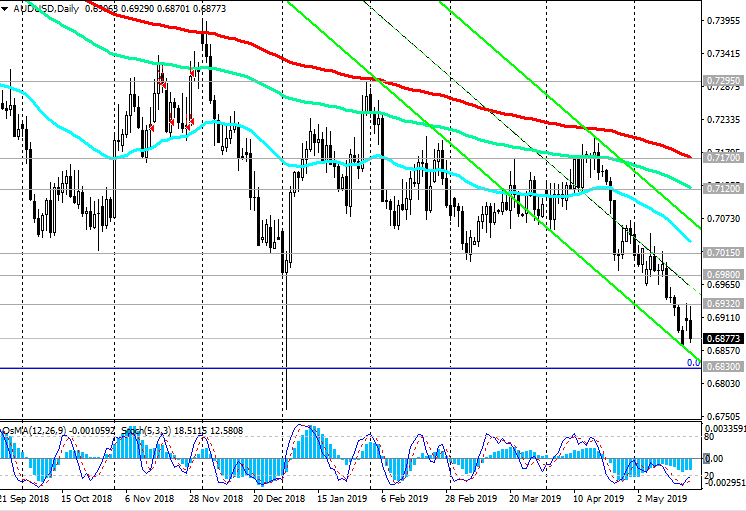

Against this negative background, the decline in AUD / USD continues. Below the key resistance levels of 0.7120 (EMA144 on the daily chart), 0.7170 (EMA200 on the daily chart) short positions remain preferable.

AUD / USD remains in a long-term bearish trend. The lows of the global wave of decline, which began in July 2014 from 0.9500, are located near the mark of 0.6830. AUD / USD may reach this level in the coming days.

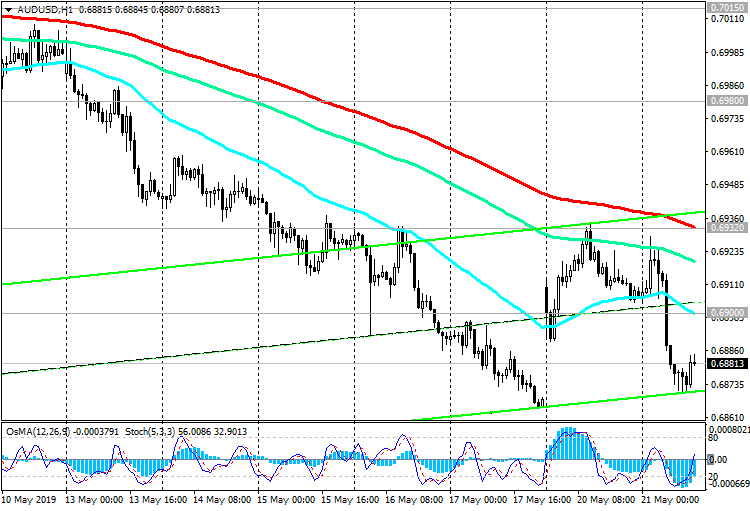

The objectives of the upward correction are located at the resistance levels of 0.7015 (ЕМА200 on the 4-hour chart), 0.7100, 0.7120.

However, for now, only short positions should be considered.

Support Levels: 0.6830, 0.6800

Resistance Levels: 0.6932, 0.6980, 0.7015, 0.7100, 0.7120

Trading Scenarios

Sell in the market. Stop Loss 0.6910. Take-Profit 0.6830, 0.6800

Buy Stop 0.6910. Stop Loss 0.6870. Take-Profit 0.6932, 0.6980, 0.7015, 0.7100, 0.7120