(19 JANUARY 2019)WEEKLY MARKET OUTLOOK 3:Postponement Likely Amid Brexit Stalemate

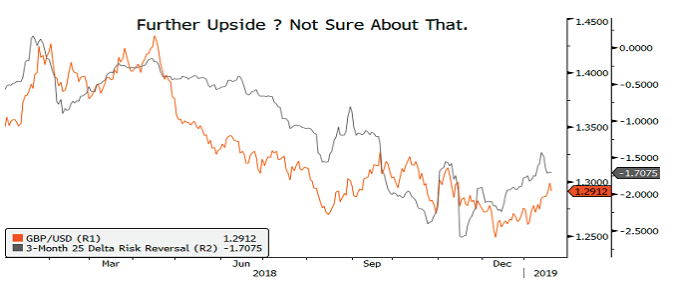

The recent development in the House of Commons has brought further uncertainty on the British economy. Last week parliamentary vote and major defeat of PM May’s camp, losing the votes by a clear 432 to 202, has been followed by apparent discontent from the side of foreign businesses and British people wishing further clarity as to the future UK – EU relation. Indeed, despite having emerged unscathed from a second vote of no confidence in a month, with a tight difference of 19 votes in its favor (prior: 83), it seems that Tory party leader is losing more and more support, thus suggesting parliamentary stalemate. Additionally, May’s opposition to Labour Party Leader Jeremy Corbyn statement supporting the idea of a second referendum or closer ties with the EU is causing problems for stakeholders, as the turn of the divorce and the future direction of the British pound remains a big unknown. Although investors are currently supporting a bullish GBP bias, as shown by the progression of GBP/USD 3- month 25 Delta Risk Reversal (difference between call and put prices) given at -1.70, it seems that the trend could rapidly change. The likelihood of seeing a largely supported plan B by Monday, which would be debated the week after, remains highly uncertain. For these reasons, the scenario of a postponement of current Brexit deadline of 29. March 2019, which would also require the validation of EU members, remains the most realistic solution for now. This would allow the UK to buy three more months until next EU elections would kick off on 23 May 2019. Therefore, it is very difficult to forecast the future direction of the dossier. However, if the new European Parliament voted in May 2019 will not show further concessions, including on the existing North Irish backstop, the events of a second referendum or even general elections in the UK are most likely. For now, it seems that long GBP trades are highly speculative, although the risk of a hard Brexit is still subdued as for now