With the opening of today's trading day, the price of gold continued to decline, and already 3 days in a row. The decrease in gold quotes occurs against the backdrop of the strengthening of the dollar, as well as the growth of yield on US government bonds, which reached 2.998% at the beginning of the European session of Monday.

Earlier, gold prices received support from political uncertainty, including the threat of escalation of the conflict in Syria, as well as prospects for trade wars between China and the United States.

Gold prices were also supported by the continuing threat of new nuclear tests and missile launches by North Korea.

Last weekend it became known that North Korea is stopping nuclear and missile tests, and also closes the nuclear test site. Earlier in the media, information appeared that North Korean leader Kim Jong-ying was allegedly ready to go to curtail the nuclear strategic program in the country in exchange for US security guarantees against North Korea and its leadership.

Reducing tension in this region of the world also contributes to the fall in the value of assets-shelters, including gold. Strengthening the dollar makes gold also more expensive for holders of other currencies. The monetary policy of the Fed, aimed at tightening, also contributes to the reduction of the value of gold. Metal does not bring interest yields, so it becomes less attractive during the period of interest rate growth. The gradual increase in inflation in the US will contribute to a more bold approach by the Fed to the issue of accelerated interest rate increases in the US.

Nevertheless, despite the current strengthening of the dollar, investors are still wary of the larger purchases of the dollar. This is facilitated by the expected increase in budget expenditures, leading to an acceleration of inflation and an increase in the federal budget deficit, as well as a growing deficit in the US foreign trade balance, coupled with a trade conflict with China, whose economy is the second largest after the US.

Half of the Fed leaders still adhere to a more cautious approach to the issue of the pace of tightening monetary policy. So, a member of the Board of Governors of the Federal Reserve System, President of the Federal Reserve Bank of Dallas Kaplan said recently that the aging of the population, the slow increase in labor resources, low productivity growth rates, and high public debt could become constraints to GDP growth in the next few years. For this reason, the Fed should raise rates "gradually and patiently", he added.

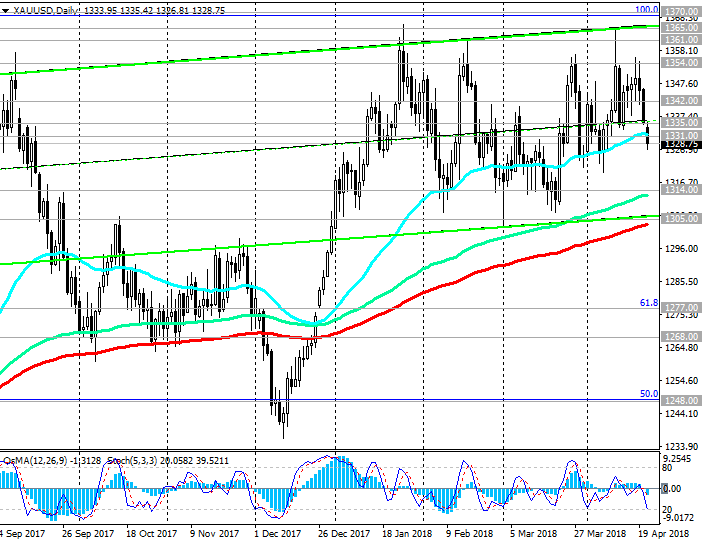

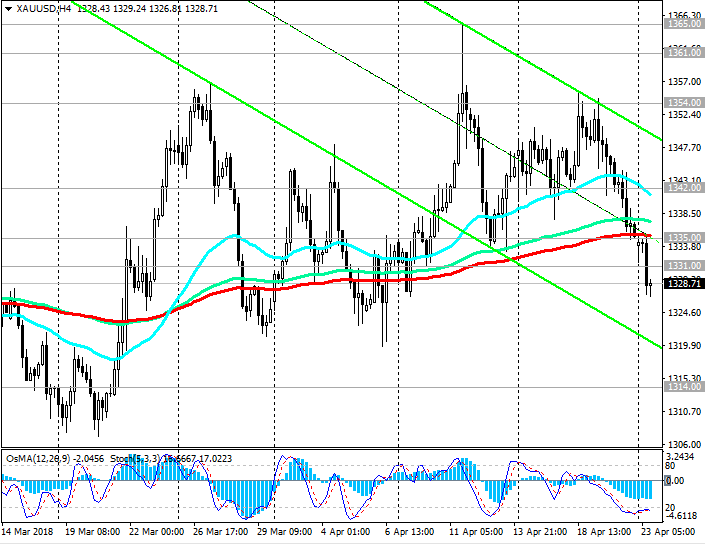

Despite the decline in quotations, the demand for gold is likely to continue in the short term. Therefore, long-term investors are likely at the moment given the opportunity to increase long positions on gold. A favorable zone for gold purchases will be the range between the levels of 1331.00, 1305.00.

The geopolitical risks associated with the prospect of the start of new trade wars will "keep in shape" the buyers of gold , and the demand for gold will continue.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1320.00, 1314.00,

1305.00, 1277.00, 1268.00

Resistance levels: 1331.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00, 1370.00, 1390.00

Trade Scenarios

Sell in the market. Stop-Loss 1333.00. Take-Profit 1320.00, 1314.00, 1305.00

Buy Stop 1336.00. Stop-Loss 1329.00. Take-Profit 1342.00, 1354.00, 1361.00, 1365.00, 1370.00, 1390.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com