S&P500: investors are nervous, US stock indices are falling

After the Fed meeting this week, investors are preparing to publishing data from the US labor market for January. Publication of data is scheduled for 13:30 (GMT). Strong data are expected. Thus, unemployment, according to economists, in January remained at the level of 4.1%.

This is the lowest value in 17 years. Moreover, many economists expect that during 2018, unemployment in the US may fall below 4%. This has not been observed since 2000.

A strong US labor market is becoming the most important factor in the growth of the US economy.

According to the US Department of Labor on Thursday, the number of initial applications for unemployment benefits for the week from 21 to 27 January fell by 1,000 and amounted to 230,000 (last year it was projected 238,000 and 231,000 applications). In January, the number of applications reached the lowest level in almost 45 years. The number of applications below the level of 300,000 has been observed for almost three years. This is the longest series since the 1970s.

Low unemployment indicates an increase in demand for labor resources for US companies, which in turn will contribute to higher wages for employees. And this will lead to an increase in consumer spending, GDP and inflation, which the Fed was so eager for.

Other articles of the report of the US Department of Labor are also expected with high efficiency. So,

hourly wages of Americans increased by 0.3% (+ 2.6% in annual terms), and the number of jobs outside of agriculture in January increased by 180 thousand (previous value is +148 thousand), which is above the average for six months 166,000.

The dollar is growing with the opening of today's trading day. The dollar index DXY, reflecting its value relative to the basket of 6 other currencies, also grows after its fall to a level of multi-month lows near the mark of 88.25. At the beginning of the European session on Friday, DXY has already risen to the level of 88.70.

It seems that investors are serious about the growth of the dollar after a strong report from the US labor market. Well, in just a few hours details of the report of the US Department of Labor for January will be known. If the data really turn out to be strong, then the dollar will continue to grow, but, according to many market participants, it will continue to be limited.

Meanwhile, US and world stock markets are declining before the publication of the monthly US labor market report and after the publication of disappointing corporate reports and the sale of government bonds. Stoxx Europe 600 in the early trading lost 0.6% after the decline in the Japanese market.

Despite the fact that US indices remain at a record level, investors are beginning to get nervous against the backdrop of the growing yield of US government bonds, which reached multi-year highs. Thus, the yield on 10-year US bonds rose to 2.796% from 2.792% on Thursday and 2.712% on Wednesday (the highest level in almost four years).

Participants in the stock markets are beginning to understand that the yield of government bonds is growing, which makes the Fed easier to raise interest rates, which is a negative factor for the stock market.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

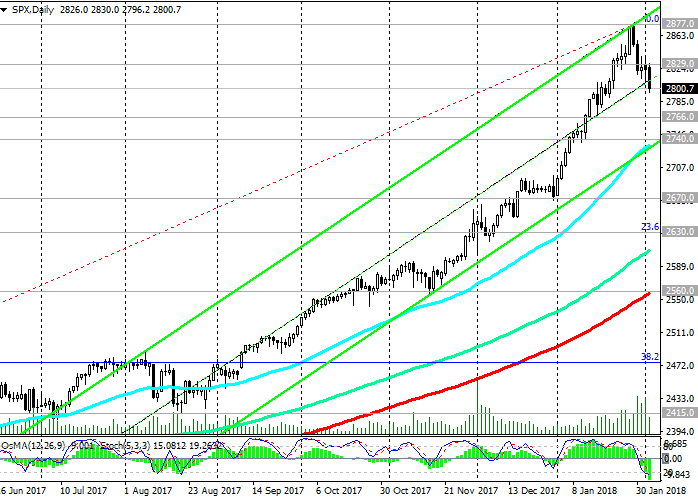

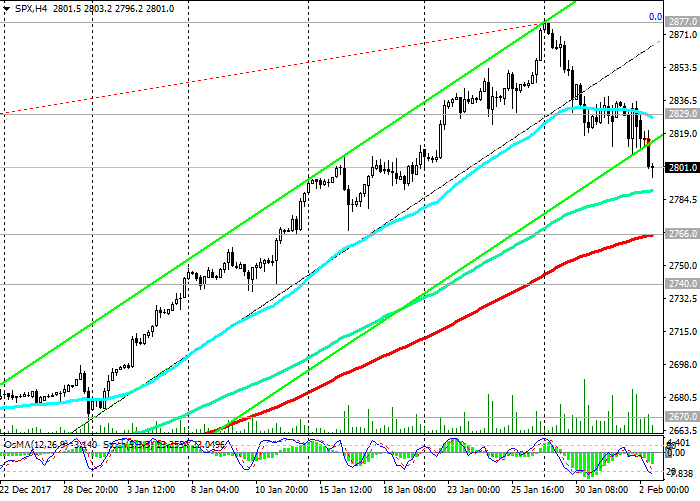

Support levels: 2800.0, 2766.0, 2740.0,

2670.0, 2630.0, 2560.0

Resistance levels: 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2790.0. Stop-Loss 2835.0. Objectives 2766.0, 2740.0, 2670.0, 2630.0, 2560.0

Buy Stop 2835.0 Stop-Loss 2790.0. Objectives 2877.0, 2900.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com