As the statistical agency Eurostat reported on Thursday, industrial production in the Eurozone rose by 1.0% in November (+ 3.2% in annual terms). The forecast of economists assumed an increase of 0.6% (+ 2.9% compared to the same period of the previous year).

Eurostat also raised the estimate of industrial production growth in the Eurozone for October.

In December, the purchasing managers' index (PMI) for the Eurozone's manufacturing sector reached its highest level in the history of such observations (since mid-1997).

The increase in investment costs of companies has contributed to the strongest growth in the Eurozone economy since 2007. The growth of industrial production at the moment is the strongest since August 2011.

It is worth noting at the same time that such a strong growth in industrial production of the Eurozone is provided, mainly at the expense of Germany, where in November industrial production grew by 3.6% compared to the previous month.

The data also show that the bullish economic trend persists in Germany. The surplus of the country's budget in 2017 amounted to 1.2% of GDP. The Bureau of Statistics Eurostat reported that Germany's GDP increased by 2.2% last year.

The euro reacted rather sluggishly to the data presented, and the pair EUR / USD is trading today in the range near the 1.1950 mark.

At the beginning of the year, the EUR / USD rose above 1.2070, however, subsequently fell to current levels. Investors are still cautious about buying euro against the dollar with EUR / USD rising above the level of 1.2000. ECB executives may fear that the strengthening of the euro could have a negative impact on the recovery of the Eurozone economy.

Market participants expect that the minutes of the December meeting of the ECB (will be published at 12:30 GMT) will demonstrate "fairly neutral" rhetoric of the ECB leaders.

If, however, the number of supporters of policy tightening in the Governing Council of the ECB grows, then it will exert increasing pressure on the ECB towards faster completion of monetary stimulus.

And this is a positive factor for euro buyers and its further growth. In general, we can say that the positive dynamics of EUR / USD remains. As far as leaders are tolerant with respect to the growth of the EUR / USD pair towards 1.2400, 1.2500, it is likely to become clearer from the published protocols.

Meanwhile, the US dollar rose on Thursday after the drop on Wednesday, when China denied media reports that Beijing could cut or stop purchases of US government bonds. This, in particular, was reported in the agency Bloomberg News.

The dollar index DXY rose by 0.2%, to 92.46. However, the cautious-negative attitude to the dollar on the part of investors remains; any upward correction in the DXY index is likely to be limited to 93.00 and used to build short positions in the dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

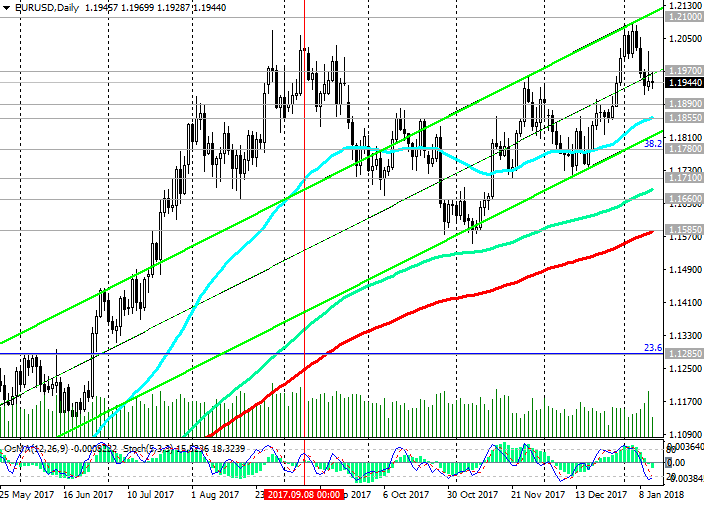

The pair EUR / USD remains positive dynamics, trading in the ascending channels on the daily and weekly charts.

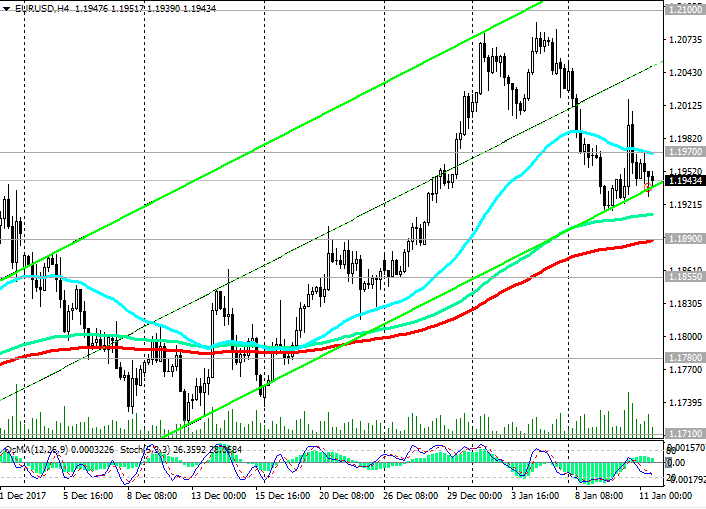

At the beginning of the European session, the pair EUR / USD is trading in the range near 1.1950, below the short-term resistance level 1.1970 (EMA200 on the 1-hour chart). The reduction to support levels 1.1855 (EMA50 and the bottom line of the upward channel on the daily chart), 1.1800 is corrective.

So far, long positions are preferable. In case of breakdown of the local resistance level 1.1970, the EUR / USD pair growth will resume with the nearest target near the resistance level 1.2100 (the upper line of the rising channel on the daily chart).

Only in case of breakdown of the key support levels 1.1660 (EMA200 on the weekly chart), 1.1585 (EMA200 on the daily chart) can we speak about the reversal of the bullish trend of the EUR / USD pair.

Support levels: 1.1890, 1.1855, 1.1800, 1.1780, 1.1710, 1.1660, 1.1585

Resistance levels: 1.1970, 1.2000, 1.2100, 1.2180, 1.2320, 1.2430

Trading Scenarios

Sell Stop 1.1910. Stop-Loss 1.1975. Take-Profit 1.1890, 1.1855, 1.1800, 1.1780, 1.1710, 1.1660, 1.1585

Buy Stop 1.1975. Stop-Loss 1.1910. Take-Profit 1.2000, 1.2050, 1.2100, 1.2180, 1.2320, 1.2430

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com