As it became known at the beginning of today's European session, the US Senate approved a reduction of taxes for 1.5 trillion dollars within the tax reform by 51 votes "in favor" and 48 "against".

On Tuesday, a package of laws providing for the most significant reform of the tax system since 1986 was passed by the House of Representatives with 227 votes "in favor" and 203 "against". All the Democrats present at the meeting, which was predictable, and 12 Republicans voted "against".

The reform implies a reduction in corporate taxes from 35% to 21% (previously 20% was assumed). This will increase the profits of companies, as well as increase the wages of hired workers at an accelerated rate. This, in turn, should stimulate the growth of inflation, which will contribute to more active actions of the Fed with regard to further tightening of monetary policy in the US. Most taxes will be reduced from January, and by February many workers will teach higher salaries.

The new tax law will accelerate the growth of the US economy. The dollar has not reacted to this information in any way. However, the main US stock indices, in general, positively took the news about the adoption of the law in the Senate and continue to grow during the European trading session.

Today is weak for the publication of important macro statistics. All movement around the dollar and the US stock markets will occur against the backdrop of information on the results of the promotion of tax reform in the US Senate. Conservatives said they are still deciding whether to support the bill on short-term expenses. As expected, the House of Representatives will vote on the bill on expenditures on Thursday.

Despite the doubts of some economists regarding the positive impact of this law on the growth of the US economy, nevertheless, its adoption can be considered a major victory for US President Donald Trump.

Most likely, in full measure the market reaction to this fact can be seen as early as next year. On the eve of the Catholic Christmas and the New Year celebration, the activity of traders and trading volumes are declining.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

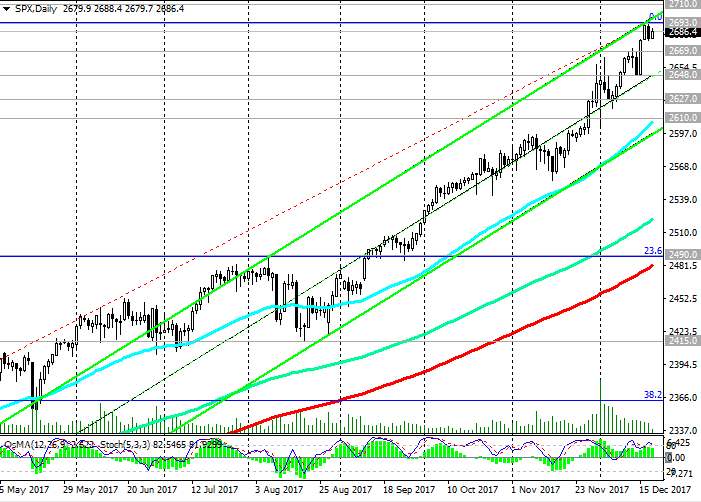

The S & P500 index remains positive dynamics, trading in the upward channels on the daily and weekly charts since February 2016. On Monday, the S & P500 index updated its absolute high near the 2693.0 mark and today, after yesterday's declining, it again traded with a rise.

The upper limit of the ascending channel on the weekly chart runs near the 2710.0 mark, which will become the nearest goal in case of continued growth.

Since May 2016, technical indicators (OsMA and Stochastic) are on the buyers’ side, and signals for the reversal of the long-term upward trend are not yet visible.

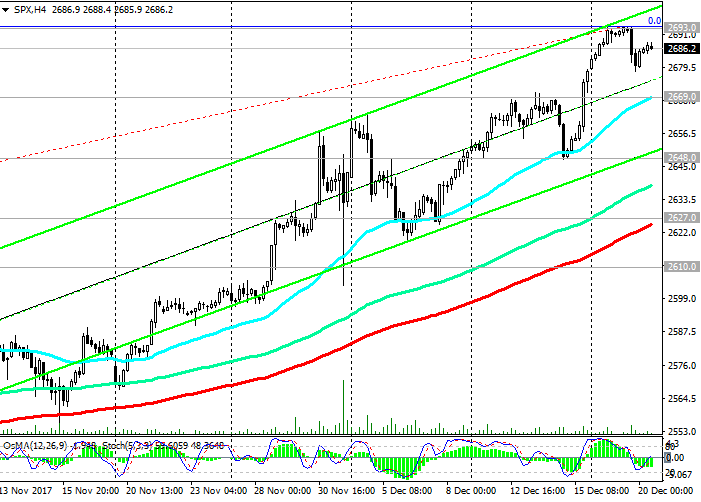

A downward correction is possible only in the short term with targets at support levels of 2648.0 (local lows), 2627.0 (EMA200 on the 4-hour chart), 2610.0 (bottom line of the upward channel on the daily chart).

The signal to the beginning of the downward correction may be a breakdown of the short-term support level of 2669.0 (EMA200 on the 1-hour chart).

While the S & P500 is trading above the key support level of 2490.0 (EMA200 on the daily chart, the bottom line of the upward channel on the weekly chart, the Fibonacci level 23.6% of correction to the growth since February 2016), long-term upward dynamics persist.

In case of breakdown of the local resistance level of 2693.0 (December and year highs), the index's growth will continue.

Support levels: 2669.0, 2648.0, 2627.0, 2610.0, 2580.0, 2500.0, 2490.0

Resistance levels: 2693.0, 2700.0, 2710.0

Trading Scenarios

Sell Stop 2677.0. Stop-Loss 2694.0. Objectives 2669.0, 2648.0, 2627.0, 2610.0, 2580.0, 2500.0, 2490.0

Buy Stop 2694.0 Stop-Loss 2677.0. Objectives 2700.0, 2710.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com