On Tuesday, France and Germany released a series of positive macro data that helped strengthen the euro and the EUR / USD pair at the beginning of the European session. Nevertheless, during the US trading session, the dollar recovered significantly in the foreign exchange market. First of all, this was facilitated by the reduction of tensions around the US president and his administration.

Yesterday, US President Donald Trump presented a draft budget for 4.1 trillion dollars, which provides for major changes in the system of social guarantees. The volume of US government spending in the next 10 years will be reduced by 4.5 trillion dollars. The reduction of taxes will help to increase the rate of economic growth.

Also yesterday, there were hearings in the US Congress on the case of possible links between President Donald Trump and his campaign headquarters with Russia. As stated in the White House, the hearing did not reveal any connections.

At the same time, as the Fed's June meeting approaches, investors are increasingly inclined toward the possibility of a rate hike. Regular verbal signals from various representatives of the Fed indicate a high probability of an increase in the rate at a meeting of the Fed on June 13-14. So, Philadelphia-Fed president Patrick Harker said on Tuesday "the rate increase in June is quite possible." Now, according to the latest CME Group data, the probability of an interest rate increase in June is estimated by investors at 83%, in July 84.4%, in September 88.6%.

Thus, the difference between monetary policies in the Eurozone and the US is again on the forefront, which makes the dollar more attractive in comparison with the euro. And this becomes the main fundamental factor in favor of short positions in the EUR / USD pair.

Today, the focus of traders will be the publication (at 18:00 GMT) of the minutes from the last meeting of the committee on open market operations at the Fed ("FOMC minutes"). If the protocols contain unambiguous signals for a rapid increase in the interest rate, the US dollar will strengthen on the foreign exchange market.

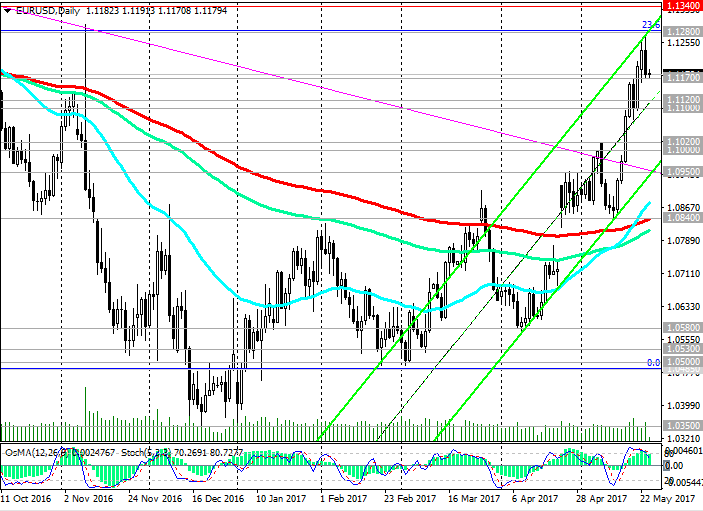

The pair EUR / USD after the strong yesterday's decline is trading today in a narrow range near the level of 1.1180. Technical indicators (OsMA and Stochastic) on the 1-hour, 4-hour and daily charts were deployed to short positions, signaling the beginning of a downward correction.

Nevertheless, the positive medium-term dynamics of the pair EUR / USD persists. The pair EUR / USD is above the short-term and medium-term support levels 1.1120, 1.0950, 1.0840 (200-period moving average on 1-hour, 4-hour, daily charts). Only if the pair EUR / USD falls into the zone below the level of 1.0840 can we speak of the end of the uptrend.

We are also waiting for today's speech (12:45 GMT) of ECB President Mario Draghi. Probably, Mario Draghi will again remind the market participants about the prematureness of the curtailment of the QE program in the Eurozone, which will put pressure on the euro, especially in anticipation of the publication of the Fed's protocols.

Support levels: 1.1170, 1.1120, 1.1100, 1.1020, 1.1000, 1.0950, 1.0840

Resistance levels: 1.1210, 1.1280, 1.1340

Trading recommendations

Sell Stop 1.1165. Stop-Loss 1.1215. Objectives 1.1100, 1.1080, 1.1035, 1.1000, 1.0950, 1.0900, 1.0875, 1.0820, 1.0800, 1.0780

Buy Stop 1.1215. Stop-Loss 1.1165. Objectives 1.1280. 1.1340, 1.1400

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.