Trading recommendations

Sell Stop 1.0920. Stop-Loss 1.0955. Objectives 1.0900, 1.0875, 1.0820, 1.0800, 1.0780

Buy Stop 1.0955. Stop-Loss 1.0920. Objectives 1.1000, 1.1020, 1.1050, 1.1100

Ambiguous macro statistics, received on Friday from the US, caused a decline in the dollar. The publication of key data on inflation and retail sales in the US in April, which turned out to be weaker than projected values, provoked a weakening of the dollar in the foreign exchange market. Retail sales in the US in April rose by 0.4% (the forecast was + 0.6%), the consumer price index rose by 0.2% and by 2.2% (with the expectation of growth + 2.3% in annual terms). Weak inflation data put pressure on the yield of 10-year US Treasury bonds, which fell to 2.331% from 2,400% on Thursday. The ICE dollar index fell below the level of 100 by 0.4%, to 99.25.

Weaker than expected inflationary indicators reduced the optimism of investors, who put on the growth of the dollar before the June Fed meeting.

For today, the economic calendar is empty. In the week, investors' attention will be focused on the publication on Friday (14:00 GMT) of data on consumer confidence in the Eurozone for May. The forecast is expected to rise to -3.0 (after falling to -3.6 in April). If the forecast is confirmed, the index will reach the highest level since July 2007.

Also, investors will closely monitor the data on the Eurozone's GDP for the first quarter (preliminary value). Publication of data is scheduled for Tuesday (09:00 GMT). The GDP is expected to grow by 0.5% and by 1.7% in annual terms.

As the ECB leaders have repeatedly stated, "it is still necessary to maintain the current significant monetary stimulus". In their opinion, the growth of the economy and inflation in the Eurozone is still very weak.

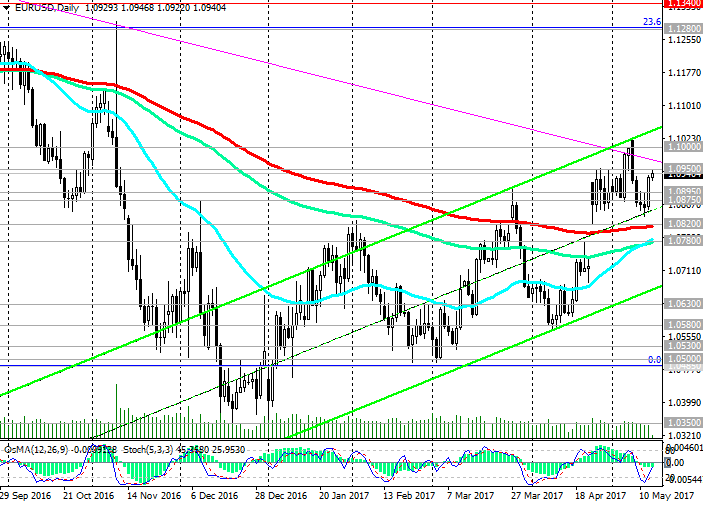

On mixed macro data from the US and the weakening of the dollar, on Friday the EUR / USD added 0.6% and today the EUR / USD pair continues to grow. The EUR/USD maintains positive dynamics above support level 1.0820 (200-period moving average on the daily chart). Technical indicators on the 4-hour, daily, weekly charts moved to the side of buyers. The EUR / USD remains within the rising channel on the daily chart, the upper limit of which is above the level of 1.1050. In the case of continuing growth, the nearest targets will be the levels of 1.1000, 1.1020, and 1.1050.

Medium-term short positions can be considered after the pair EUR / USD has fallen below support level 1.0820.

Support levels: 1.0900, 1.0875, 1.0820, 1.0800, 1.0780

Resistance levels: 1.0950, 1.1000, 1.1050

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.