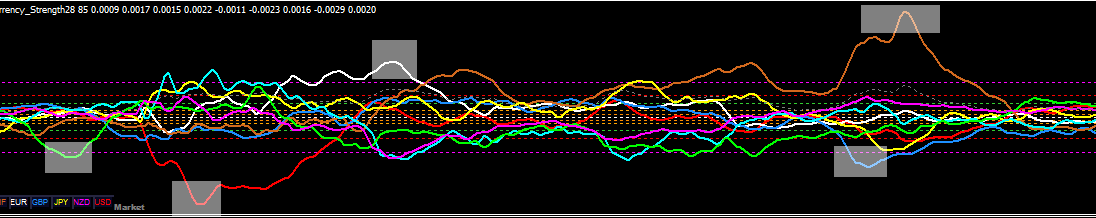

I am using Bernhard's Advanced Currency Strength28 and Speed (impulse) in a unique way - basket trading. I invite you to think outside the box. This is my experiment, not a recommendation for trading unless you test it yourself with consistent results. I want to document as many demo trades as I can to convince MYSELF so that I can trade this method live with confidence. The trade logic: If one currency shows strength and none of other currencies stands out, it is better to buy all pairs with the strong currency. Some currencies will go the opposite direction, which is great for the trades. Some currencies will move in parallel with the strong currency with less strength (less angle), those trades will end up with smaller profit or near break even. Overall basket trades make a net profit and that is the goal.

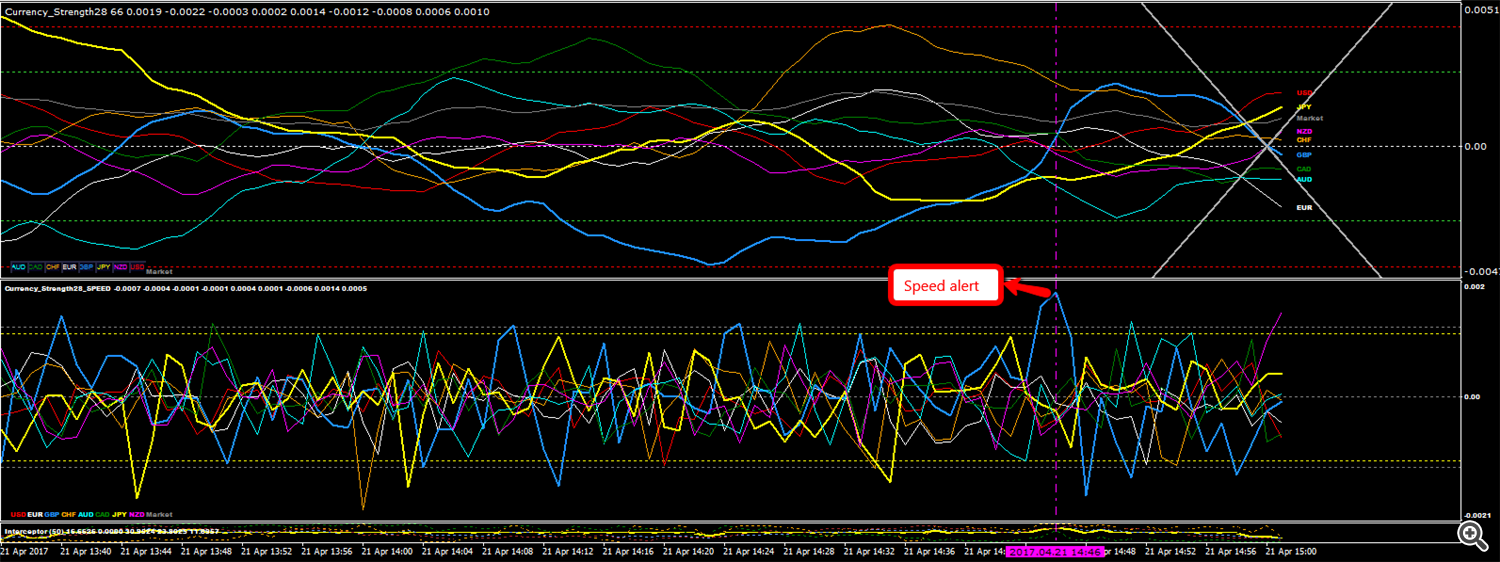

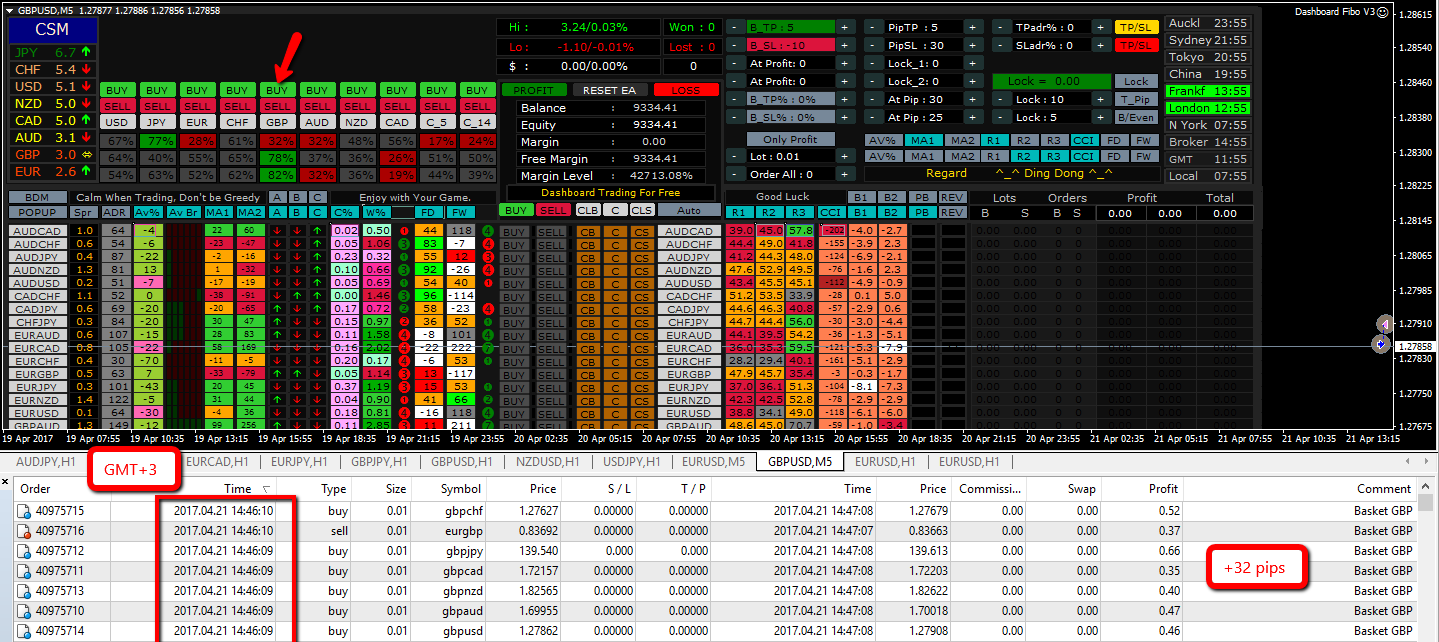

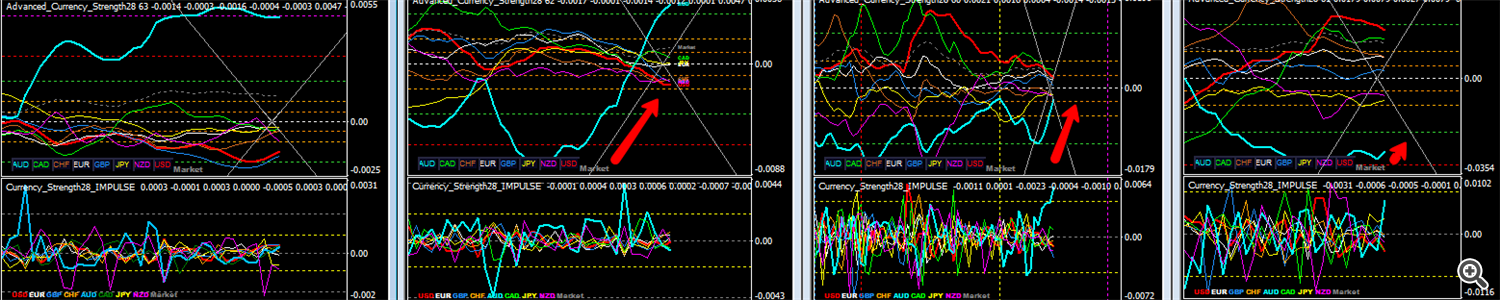

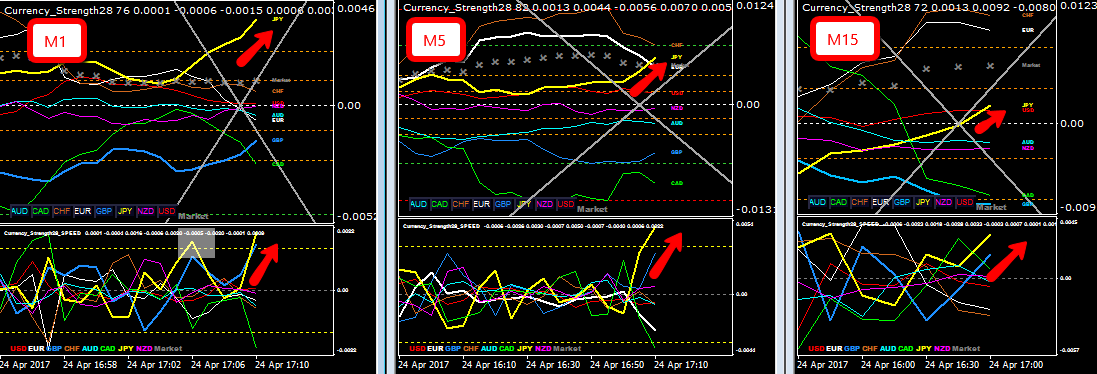

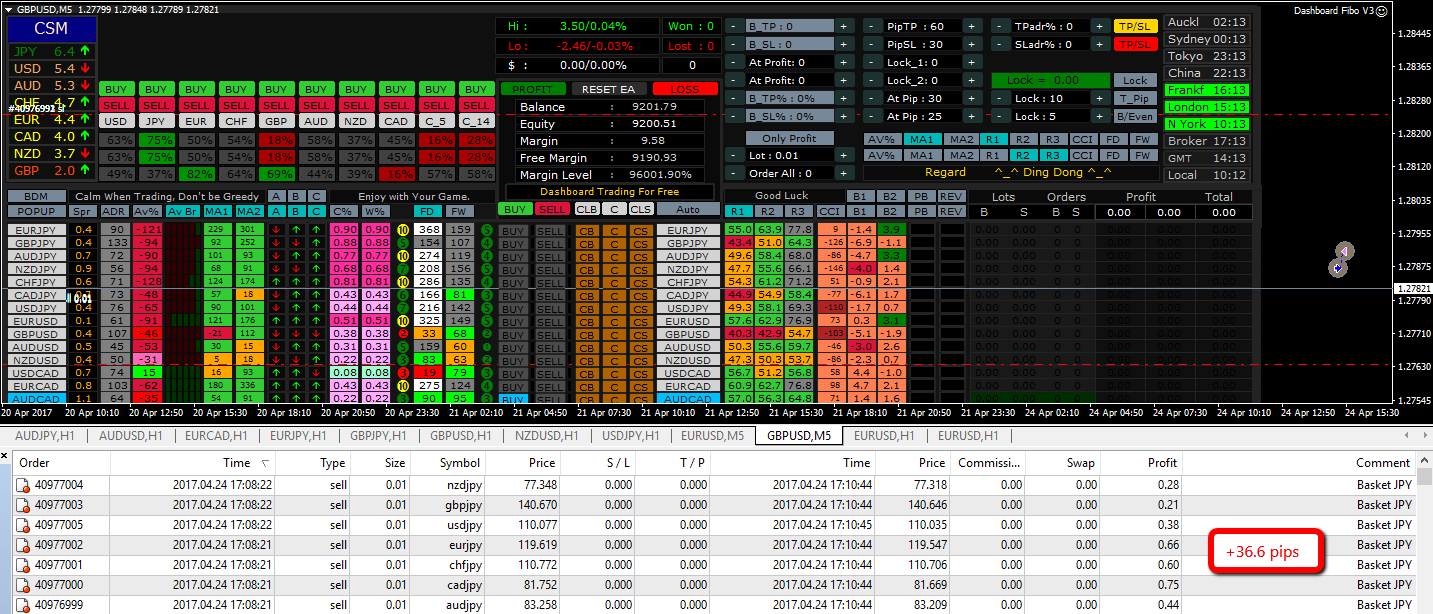

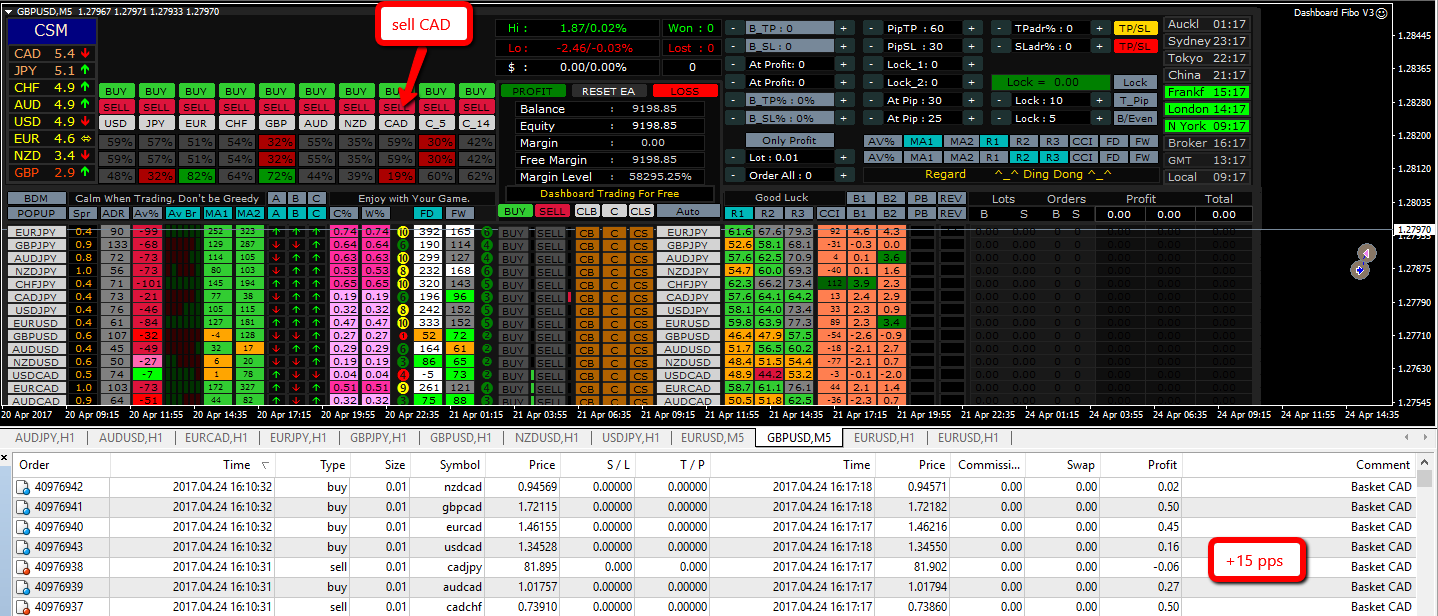

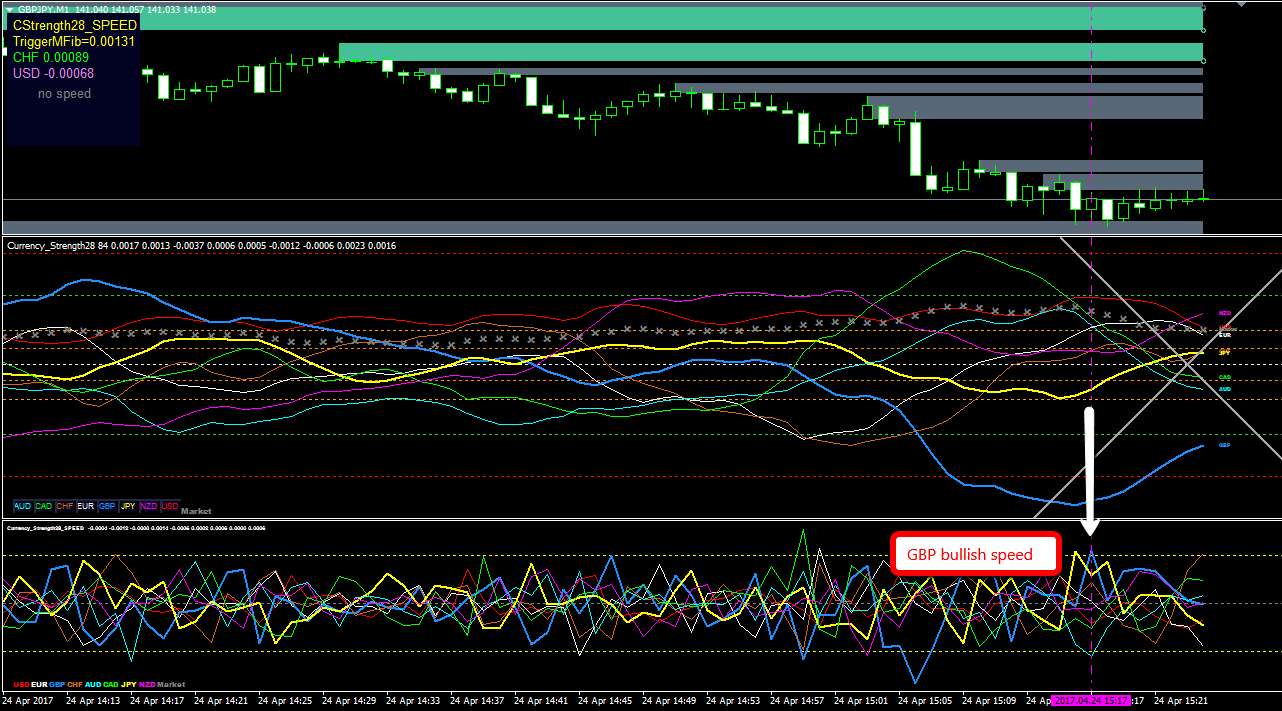

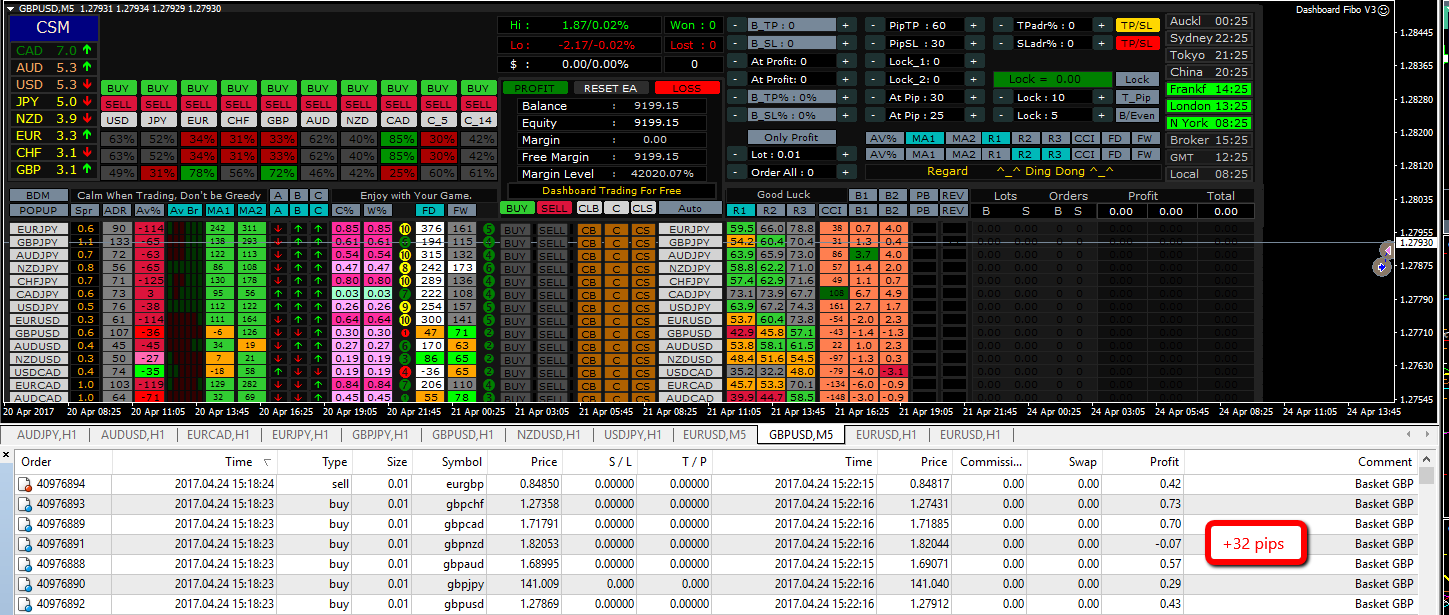

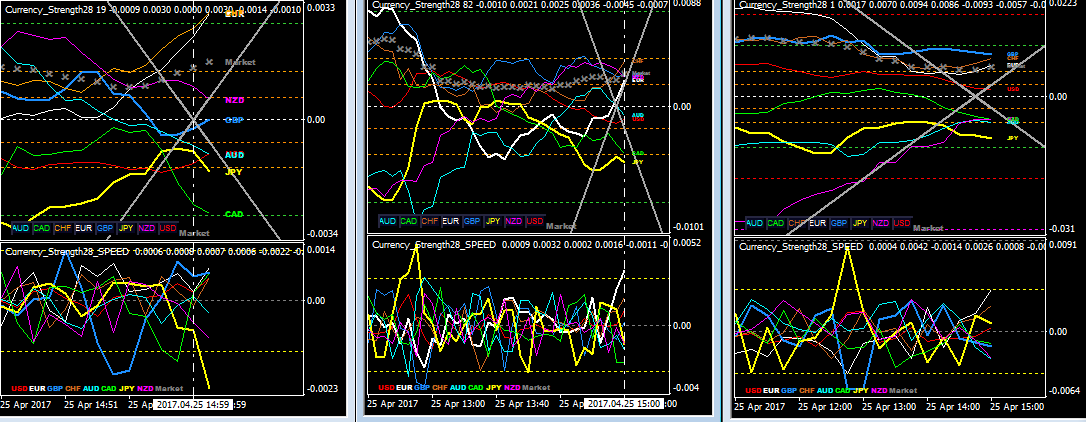

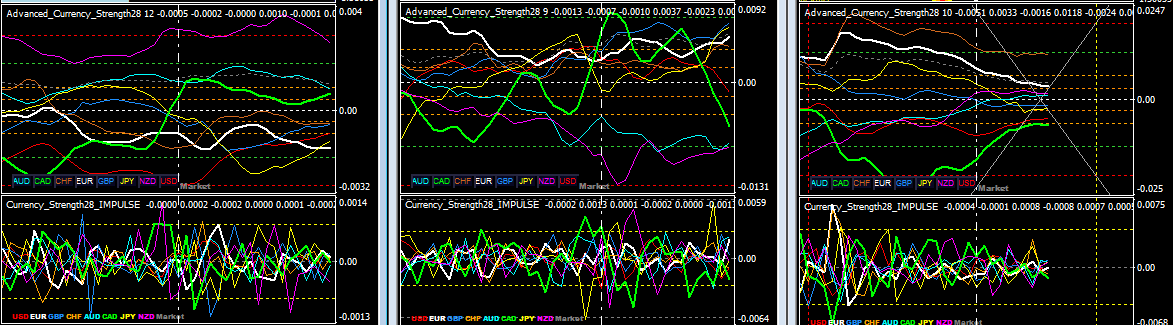

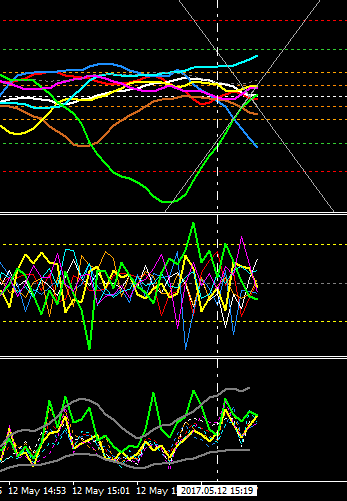

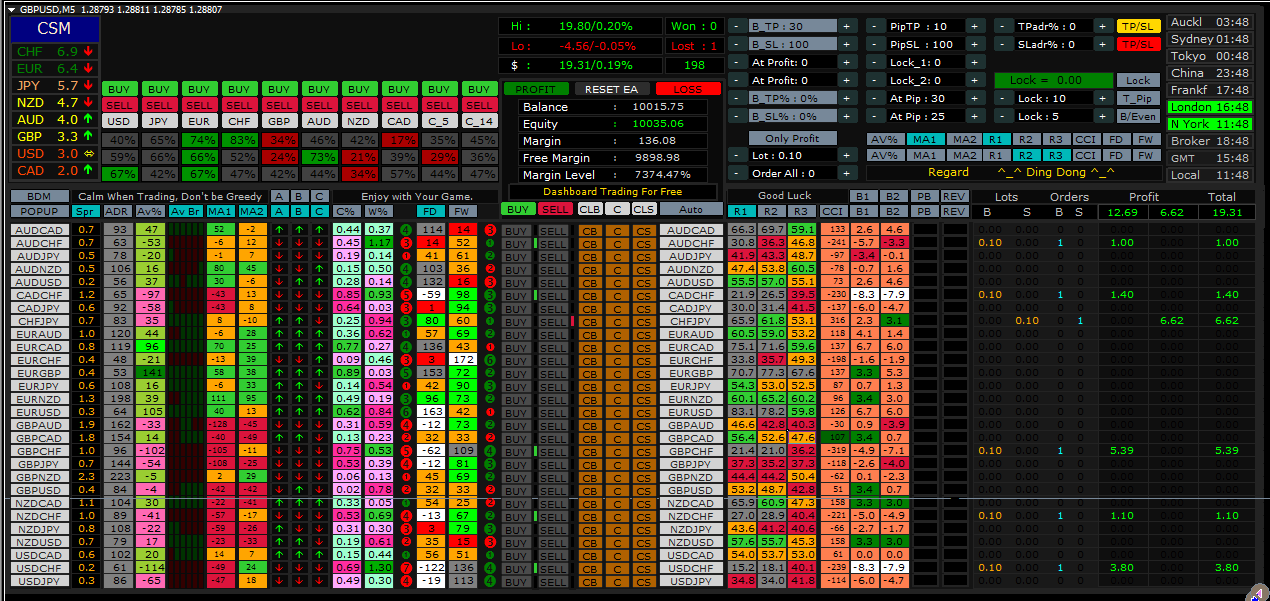

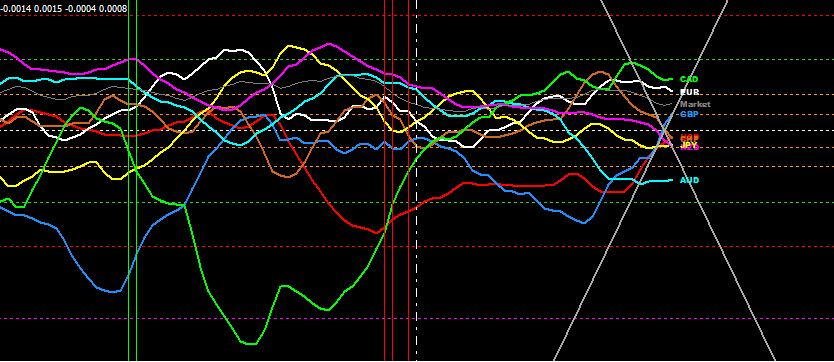

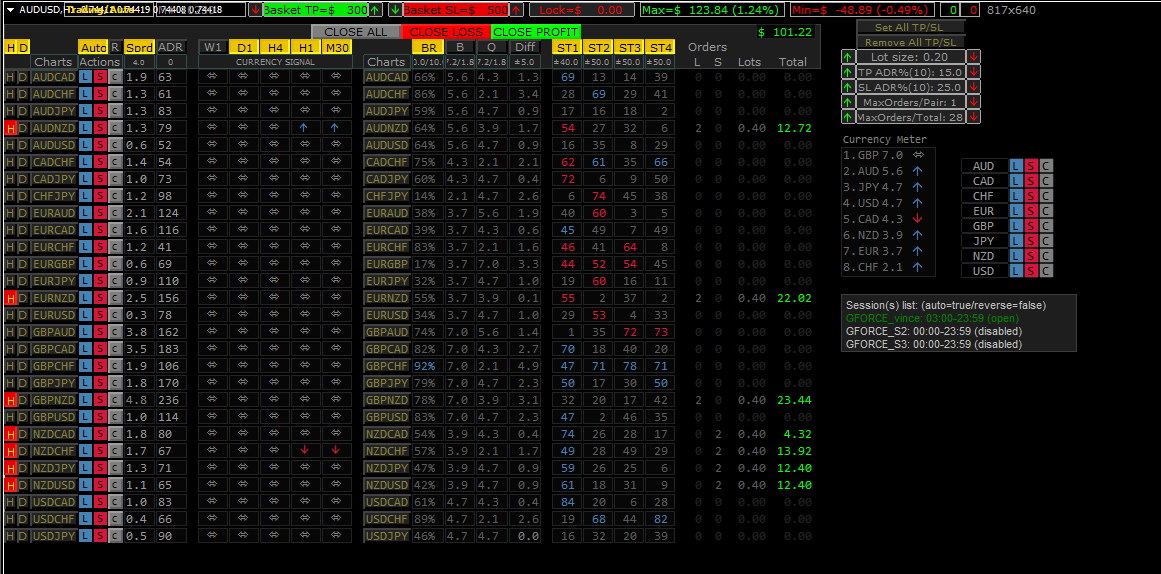

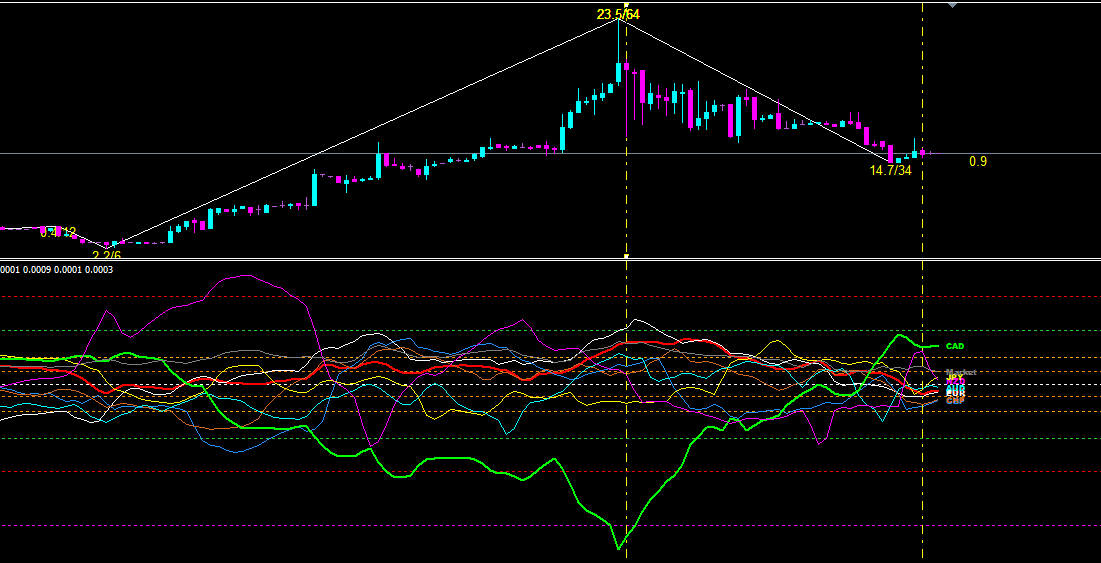

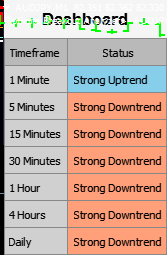

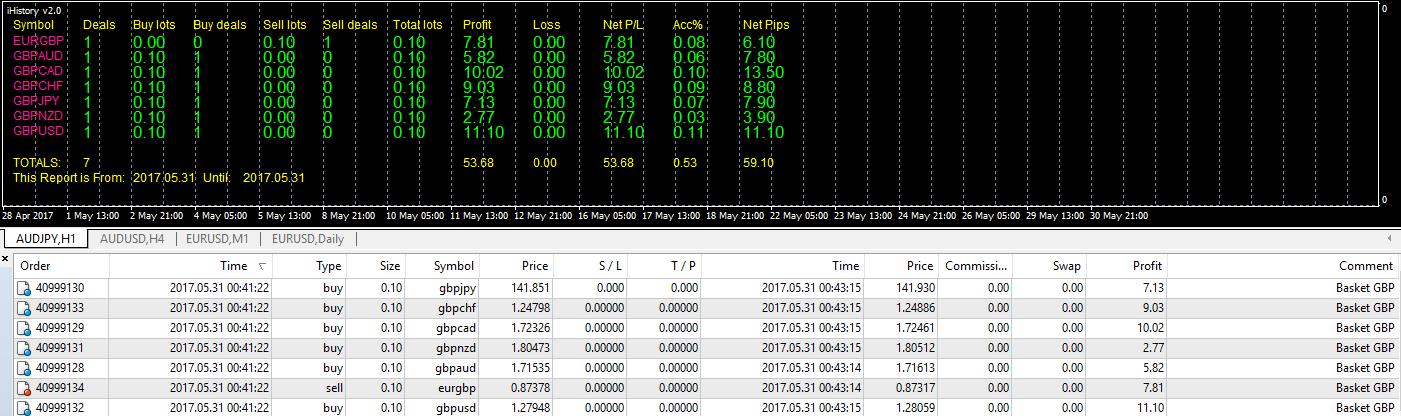

My time frame for entry is always M1 if not noted. If I am comparing time frames, they are M1, M5, M15 from left to right and sometimes with H1 added. The following trade was my 1st experiment. The SPEED shows a single sided GBP alert at the vertical line. ACS28 matched up with Golden Angle at that time. Without hesitation, buy all GBP pairs. I am using the free dashboard just for execution of basket trades. I am not using any other functions or numbers in this dashboard since I don't understand them. Still, many thanks to DingDong99 Page 972, post 19433 https://www.forexfactory.com/showthread.php?p=9714666#post9714666 (Dashboard Fibo V3)

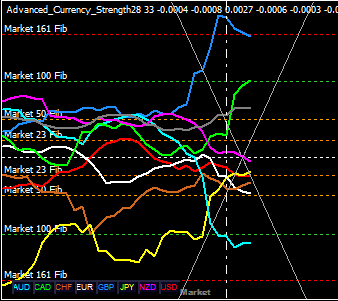

Focus on the angles. A steep angle means momentum. Read the proper way to determine the angle of the currency strength, post 23 by Bernhard https://www.forexfactory.com/showthread.php?t=584503&page=2 The big cross on my chart is Golden Angle indicator made by Kashif Javed (more info at the end). The indicator draws one line through zero to mFib23 and the other through zero to -mFib23.

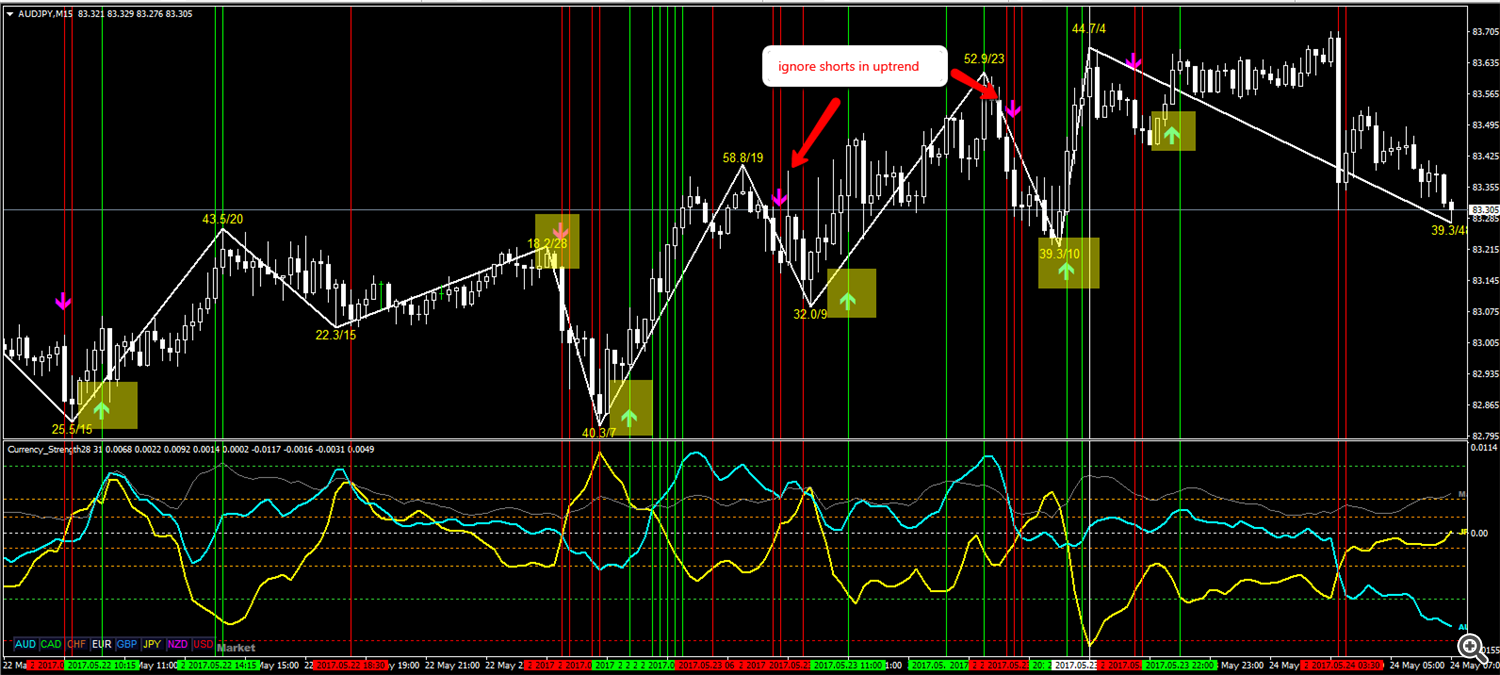

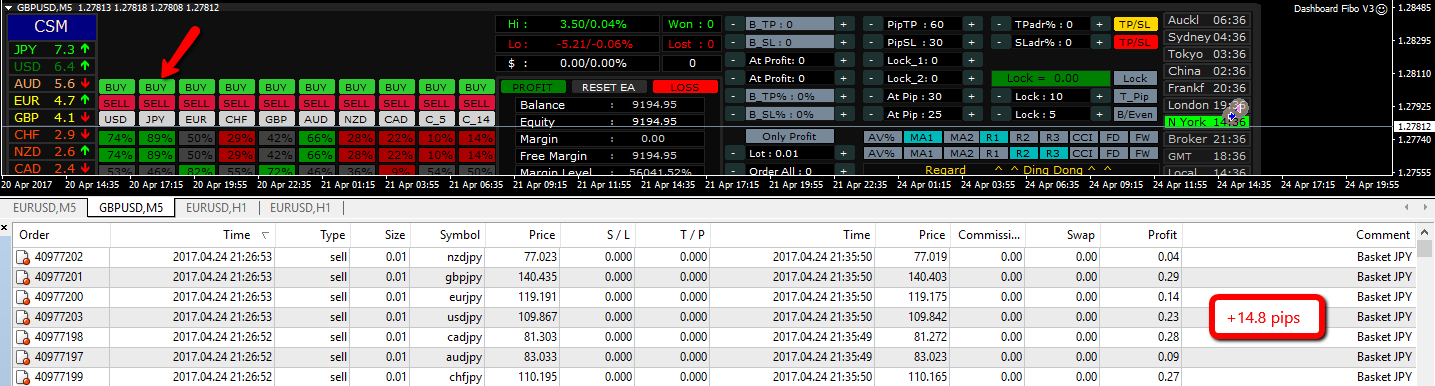

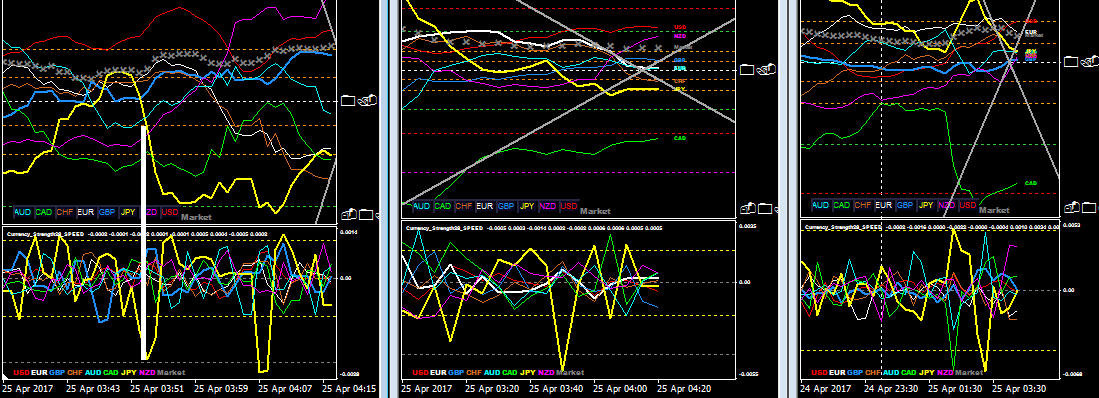

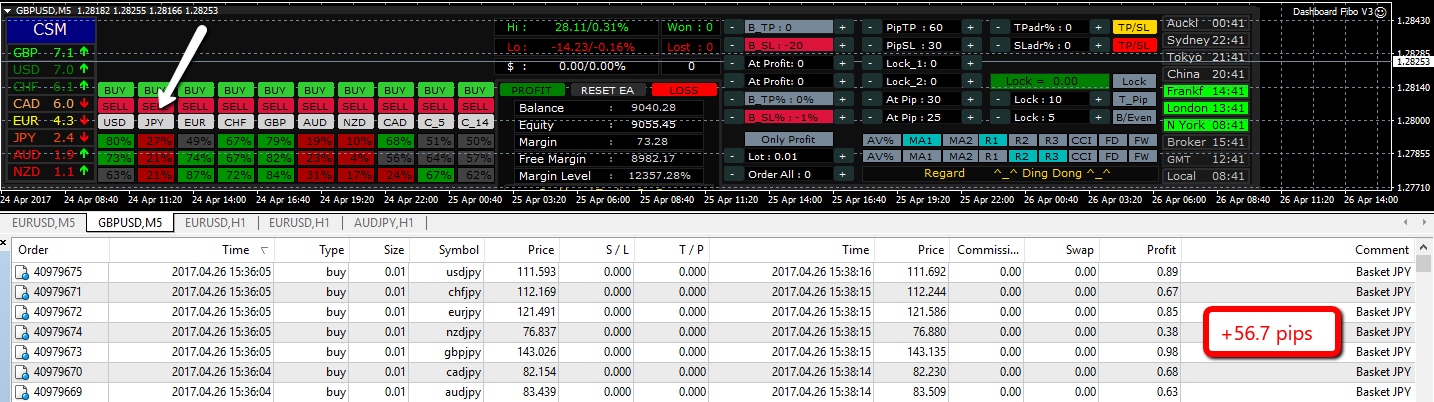

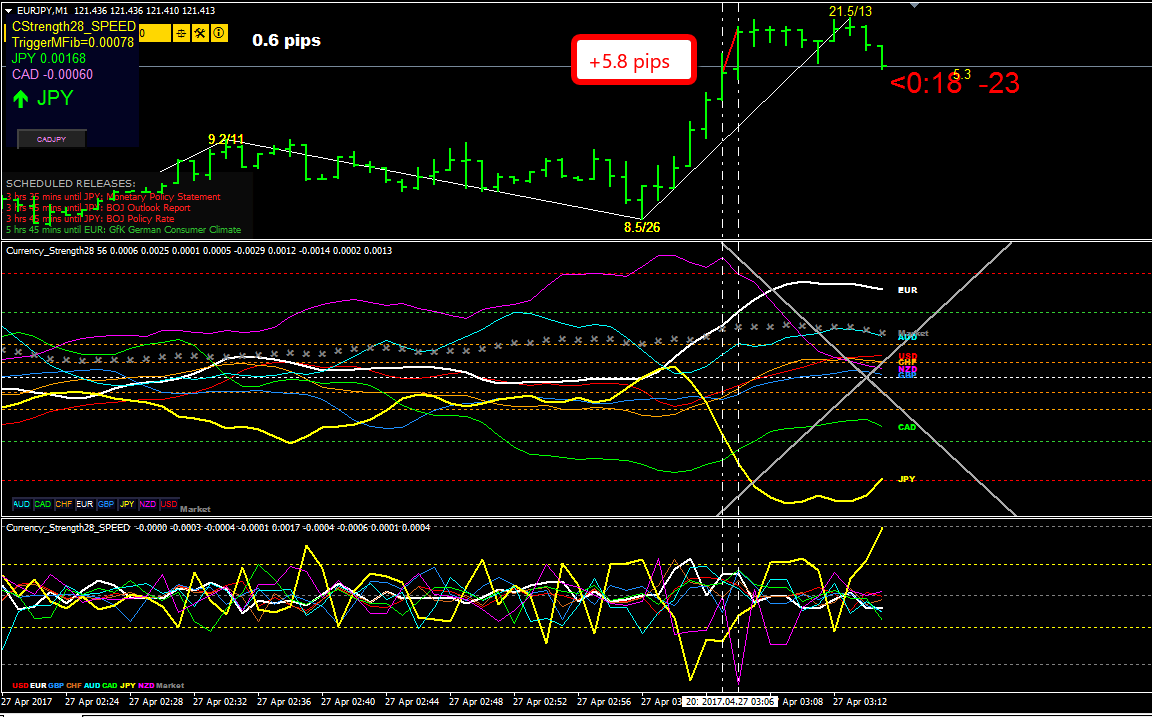

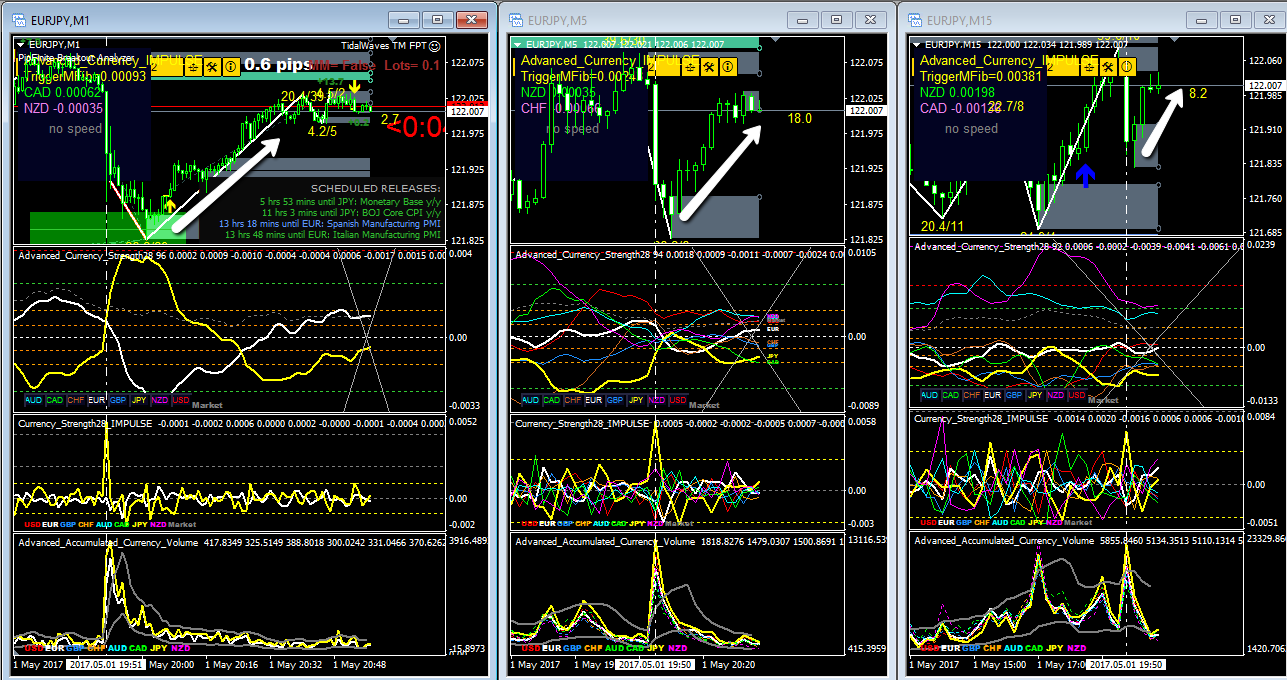

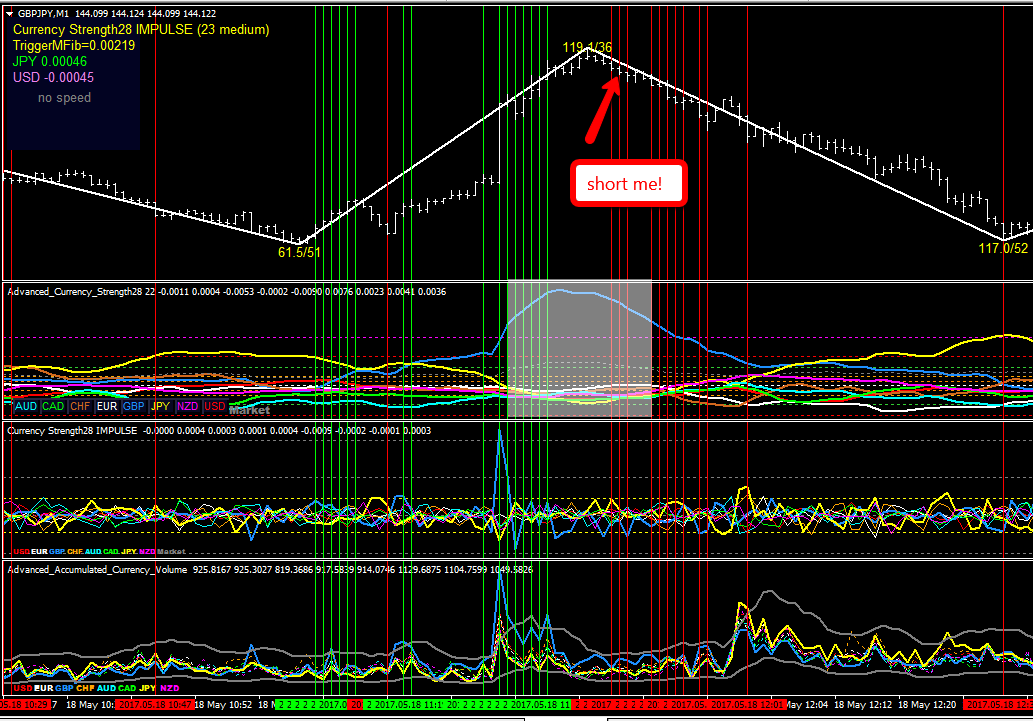

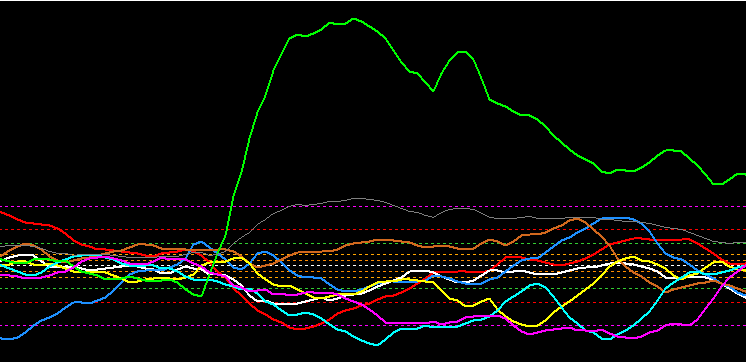

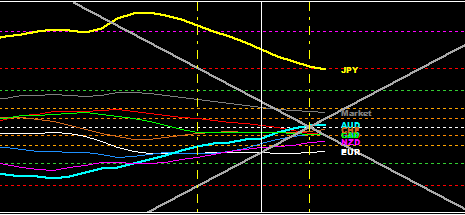

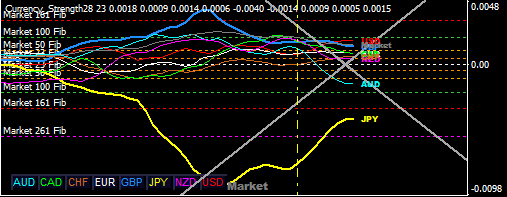

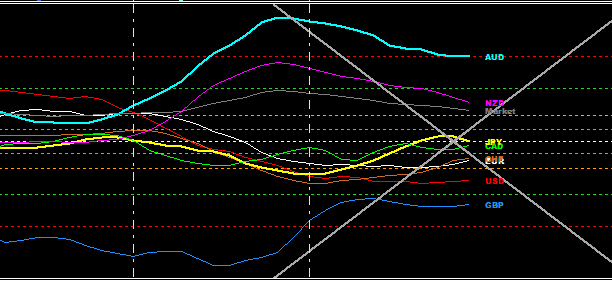

The following is a trade of JPY (yellow) long. All ACS28 angles are close to Golden Angle lines. Buy JPY basket.

Remember, bullish JPY means sell all JPY pairs.

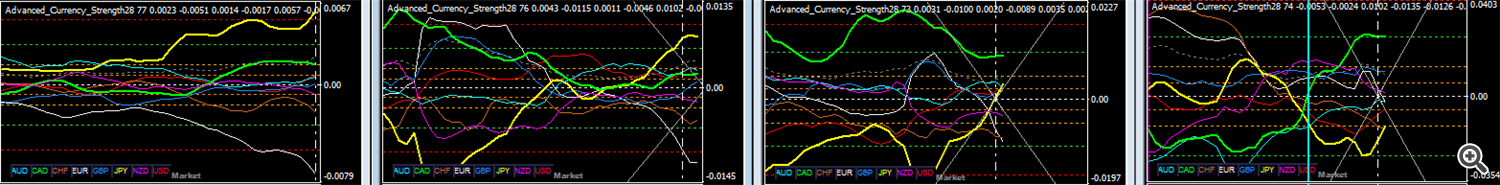

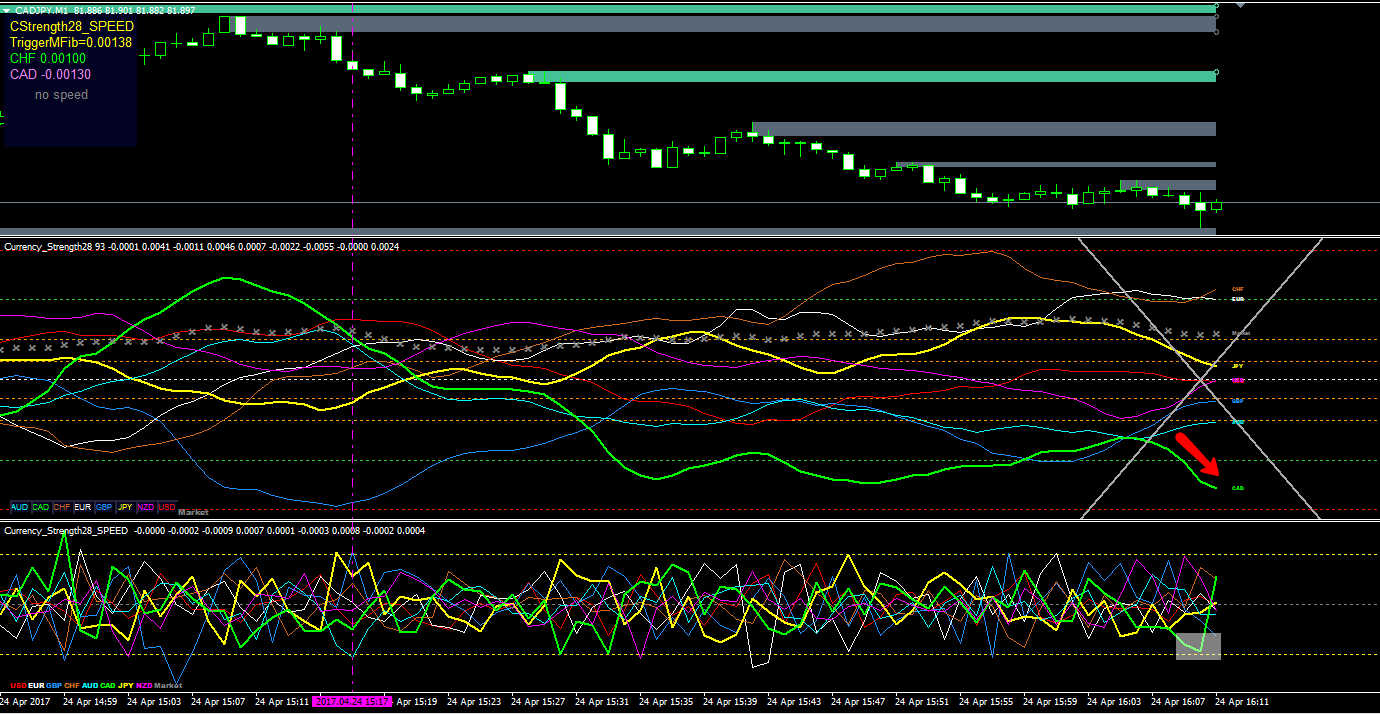

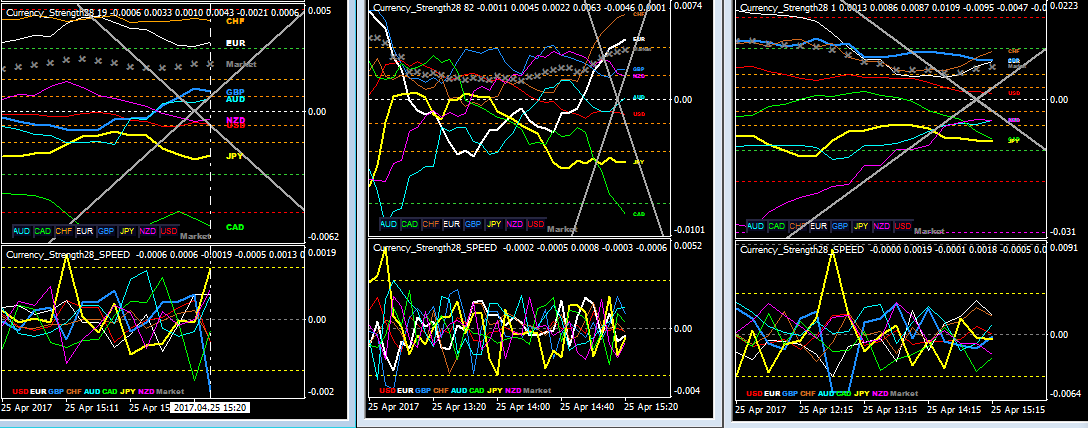

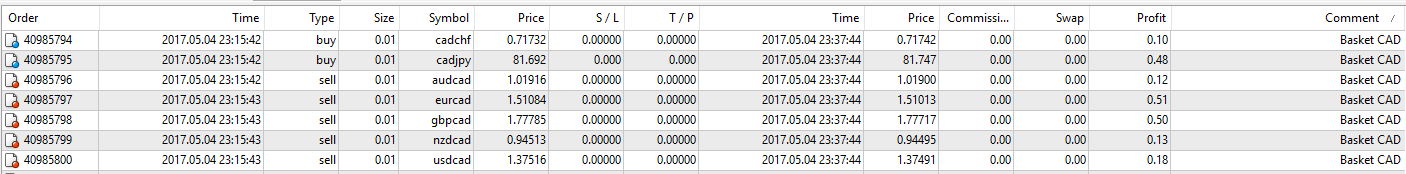

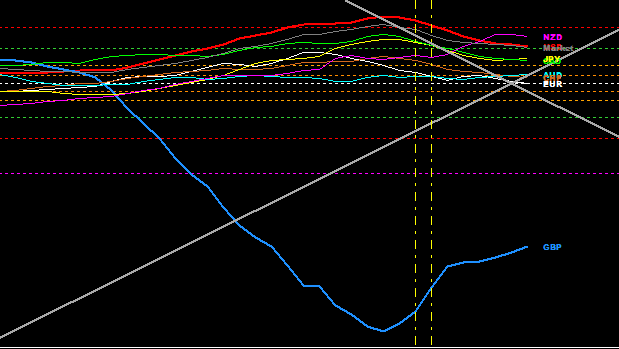

The CAD (lime) trade below was a shaky one because the ACS28 was beyond mFIB -100 already. I closed all trades fast anticipating a bounce back.

The following trade was acting on Speed. The angle in ACS28 was close to Golden Angle but not perfect. GBP was over-sold. This is an iGap type.

It turned out not so bad.

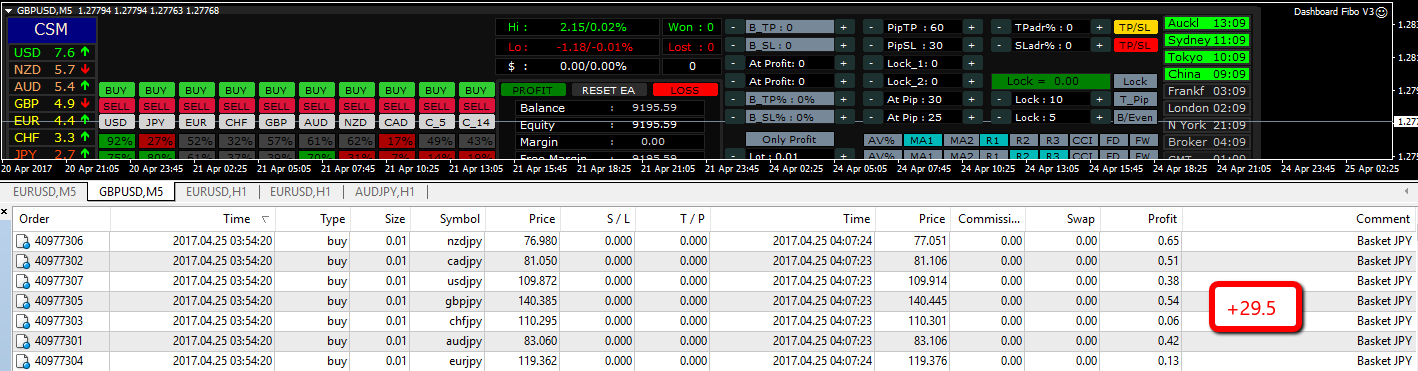

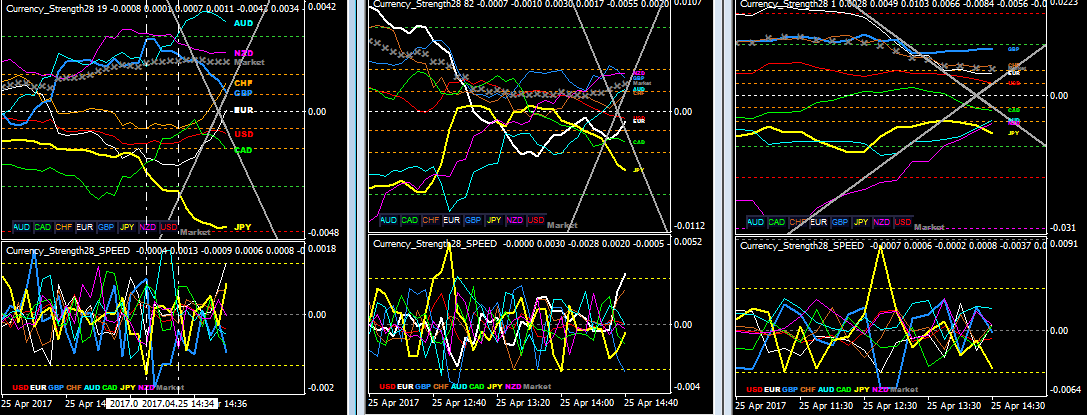

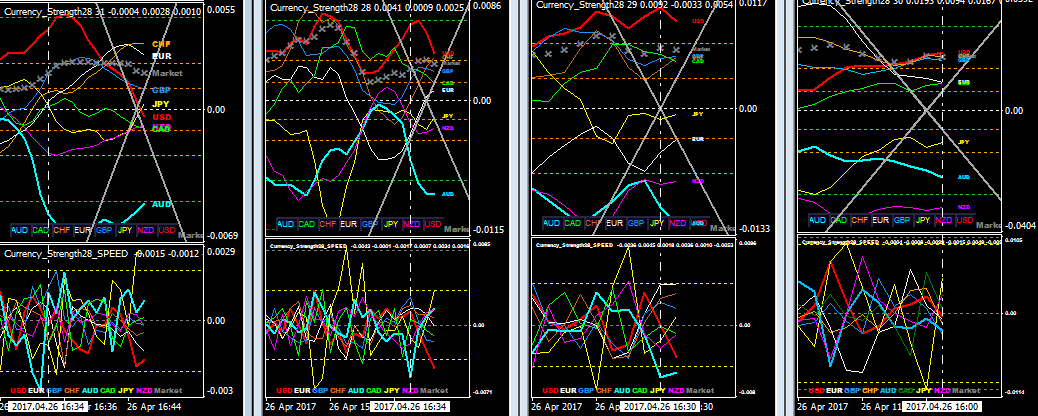

It is afternoon here New York time. Market is quiet. Let's see if Impulse can make some pips. ACS28 does not look perfect, but what the heck. Let's buy JPY (yellow).

Finished the day with +98.4 pips (not to count the losses :). Now Asian session. JPY is active. This trade is based on sharp downward angle of CS28 and a dropping Speed.

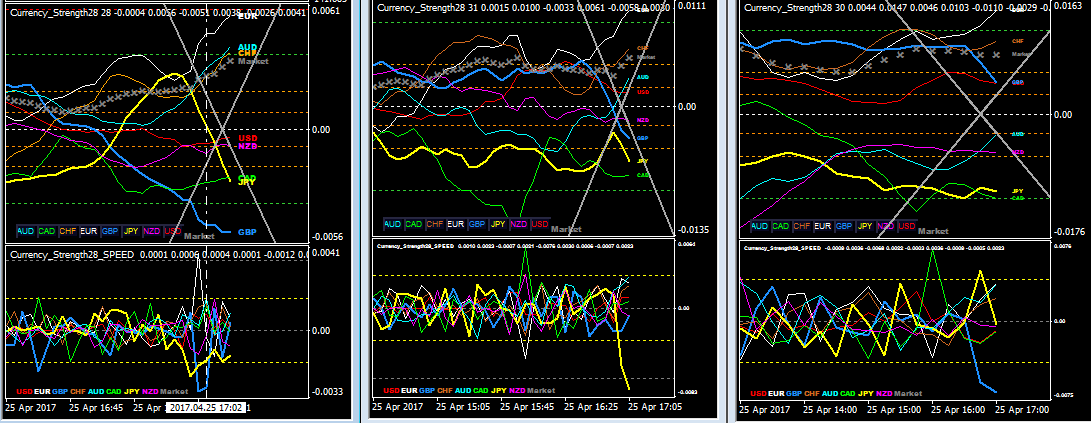

First trade in the morning here New York time. JPY (yellow) in ACS28 3 time frames was pointing down. I knew there was a limit for this move because M1 mFIB was below -100 (over-sold). Once I saw flattening in M1 I closed all trades. There was a 2nd push right after I closed the trades. +8.9 pips

The next trade was short CAD (lime) when I saw ACS28 matching the Golden Angle (vertical line). I closed trades too soon in hindsight. +18 pips.

Short CAD again. mFIB -100 exceeded. DD was more than 20 pips at times. Closed with +6 pips. Don't do it again. Rules are rules.

Nice JPY (yellow) basket short +20 pips. From here on I am using equity manager 20 pips SL and TP (1:1 RR).

Short CAD basket because of over-bought. +20 pips.

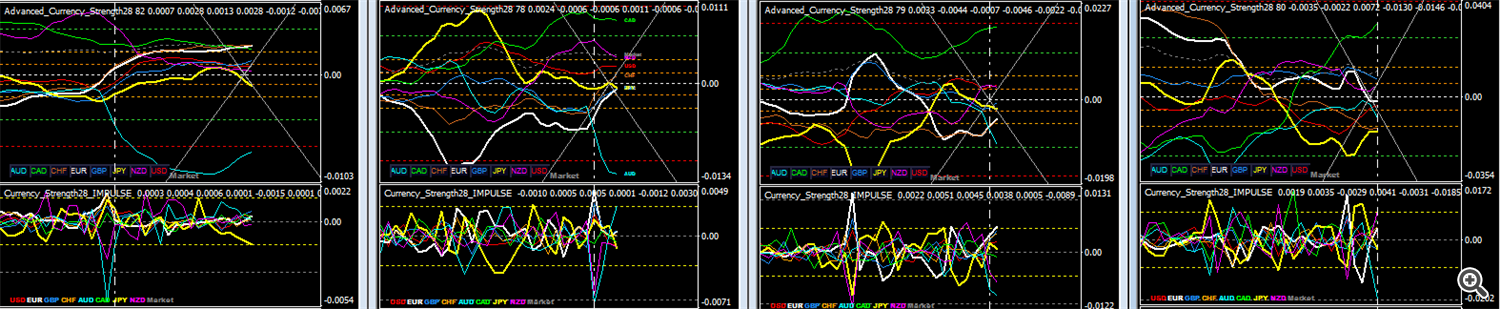

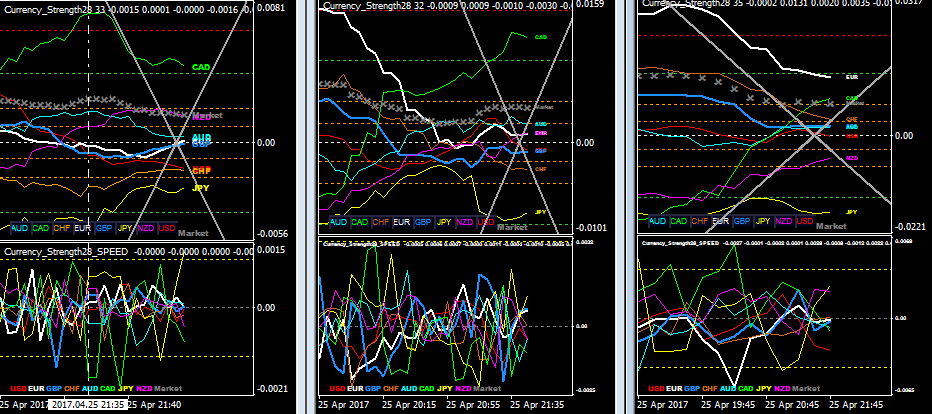

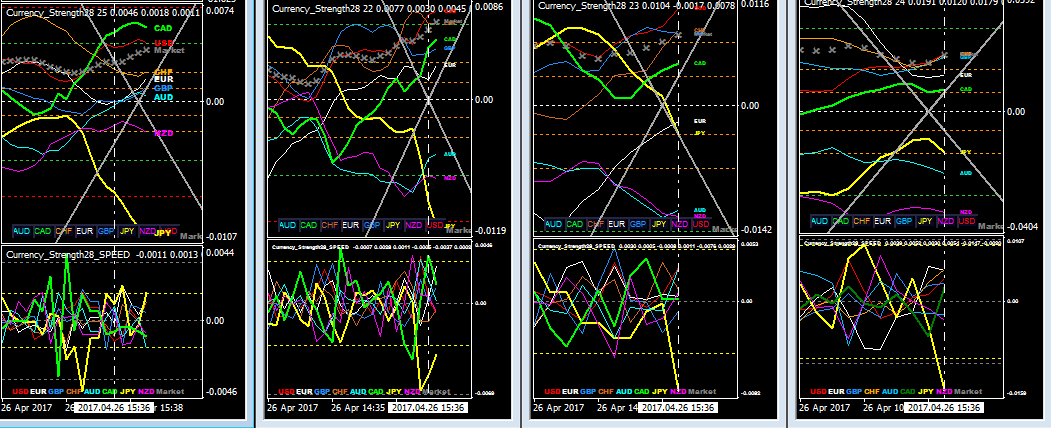

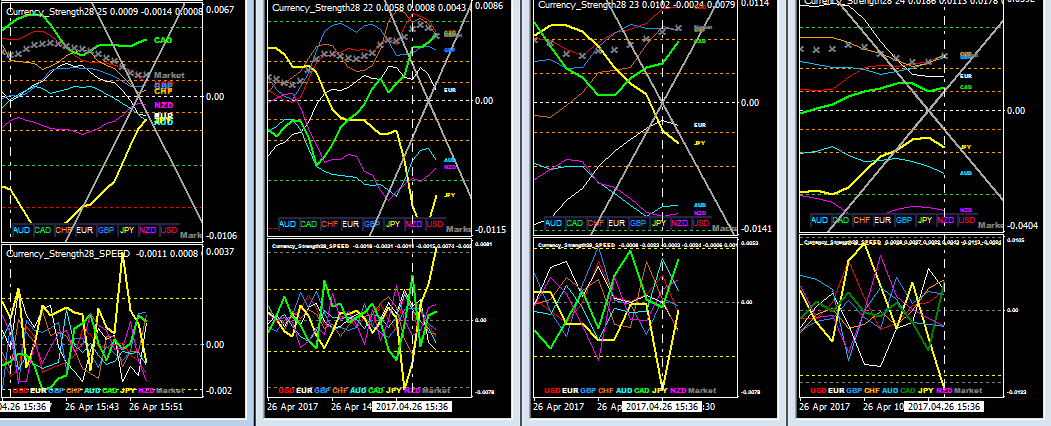

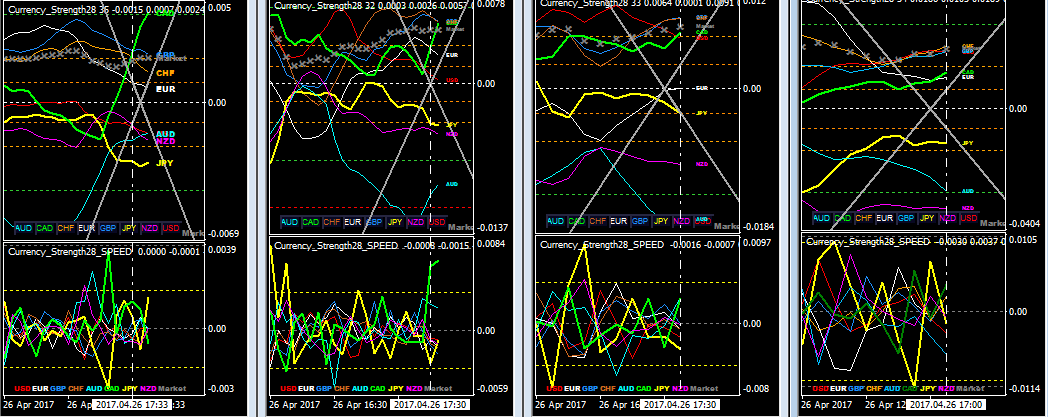

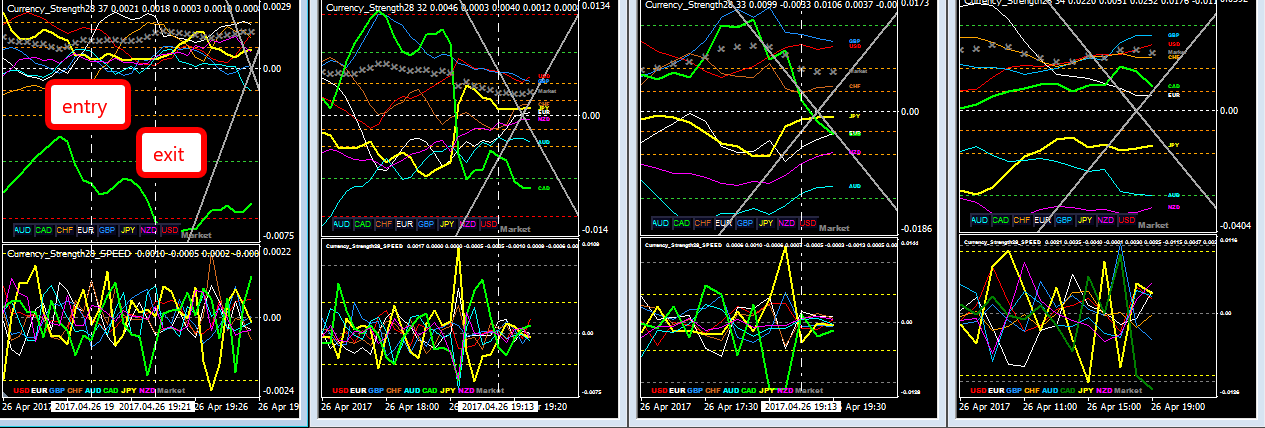

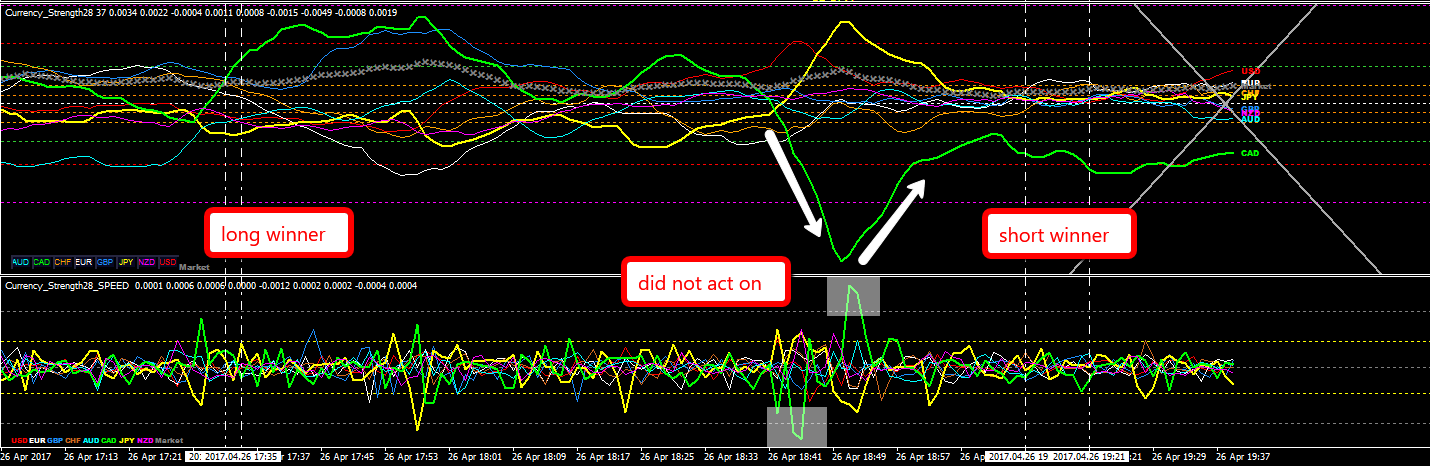

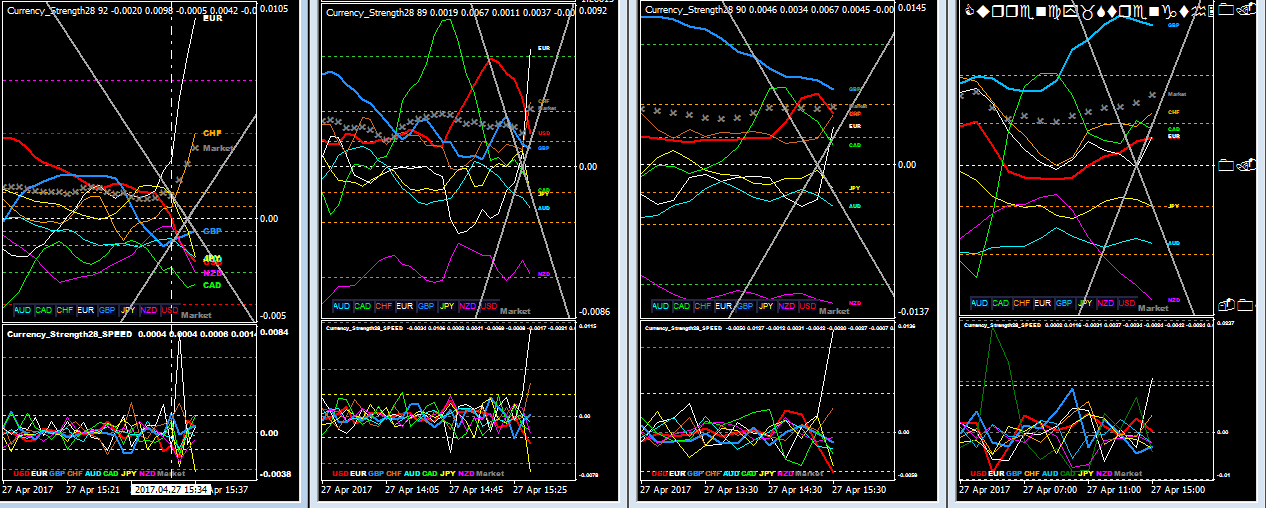

4_26 My first basket trade was a short JPY (yellow). The entry may have been a little late.

Minutes later, the picture has changed. Reversal started from the smallest time frame. Now it is too late to do anything. For short term trading (scalping), a quick in and out is the key.

Market can turn on a dime. Look at this USD (red) buy signal at the vertical line where ACS28 was up in all 4 time frames, but failed.

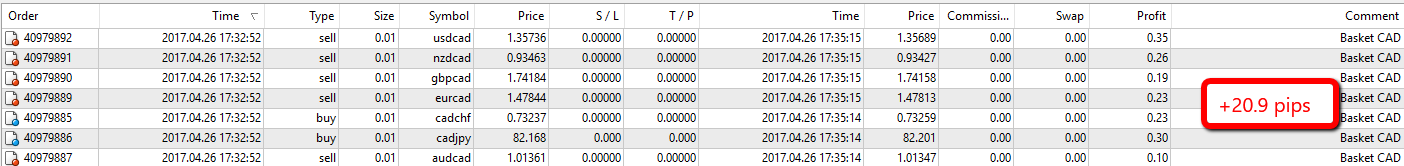

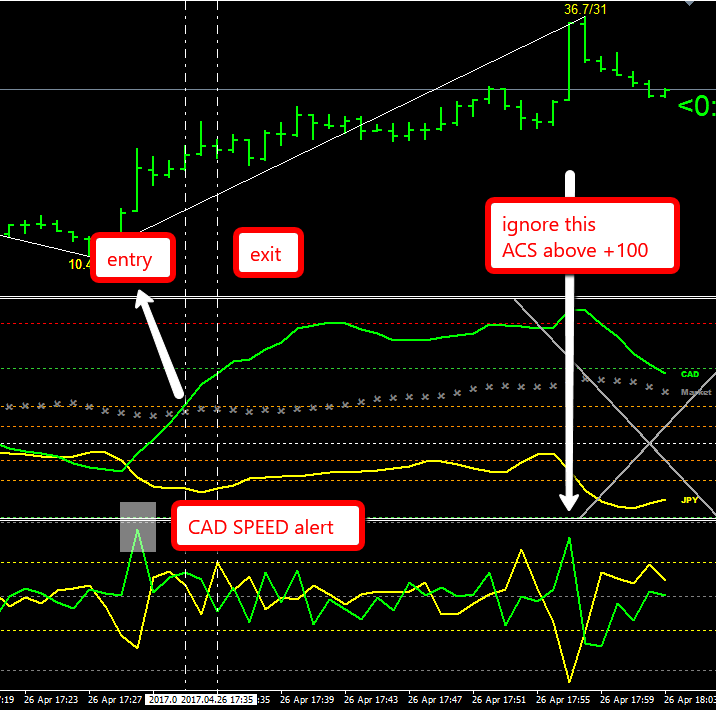

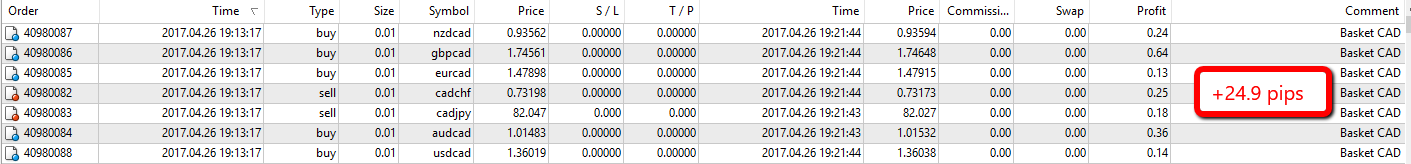

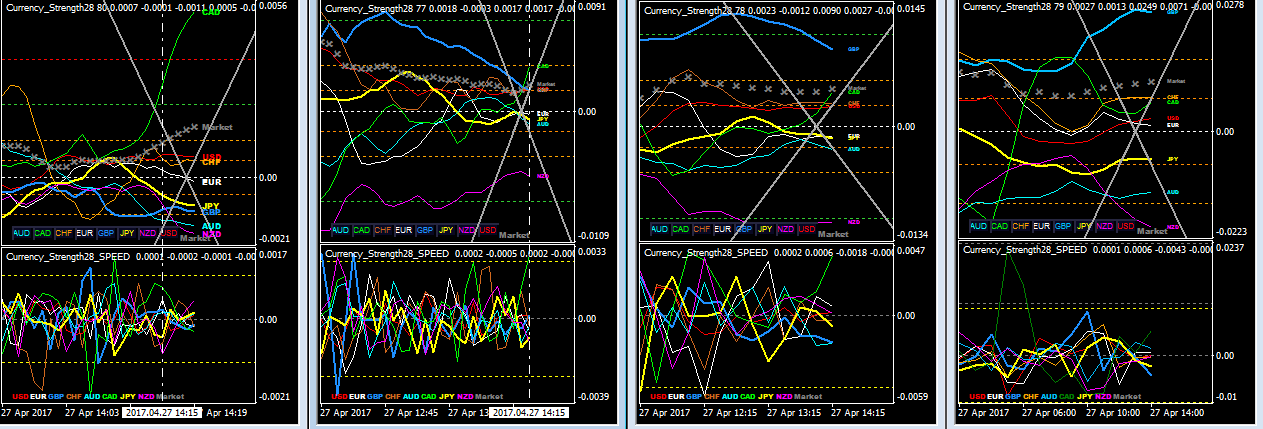

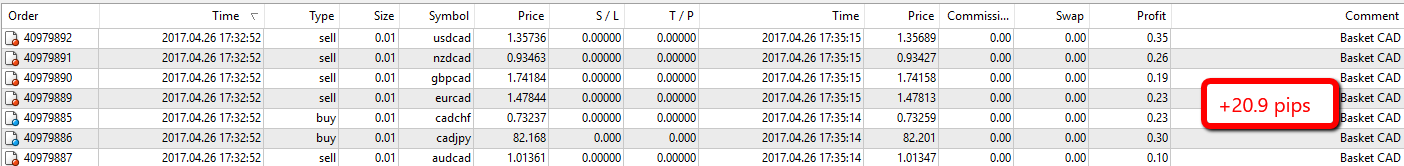

CAD (lime) looked decisively up. Buy all CAD pairs. This is a poster child ACS28 signal, very strong golden angles in at least 2 time frames. Market went up some more since trades were closed.

Game over.

Lessons: My entry in M1 was later than the CAD Speed alert. My exit was way too early at least with respect to CADJPY pair. I added a note, when ACS28 above mFib 100 the signal is often a reversal.

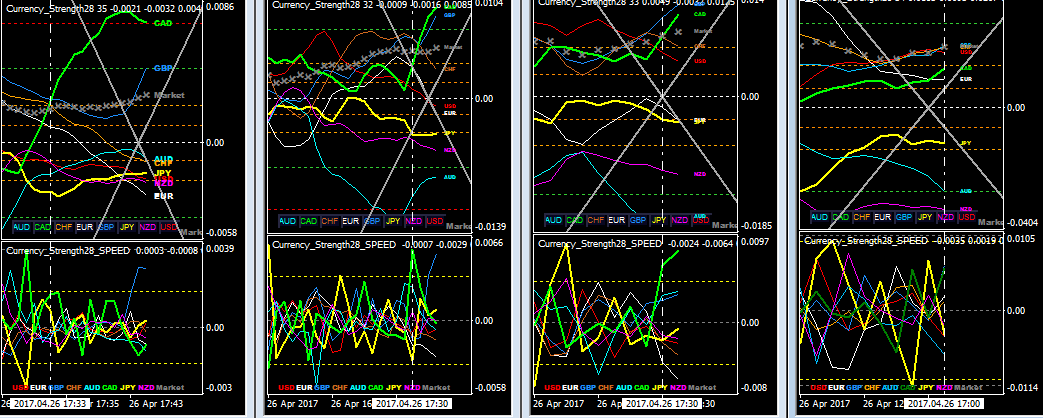

Short CAD on ACS28 further weakness (below mFib -100) Risky.

Looking back at the chart, M1 CAD (lime) had a lot of opportunities for profitable trades.

Finished the day (4_26) with 102.5 pips from winning trades. losing trades don't count because they did not follow the rules.

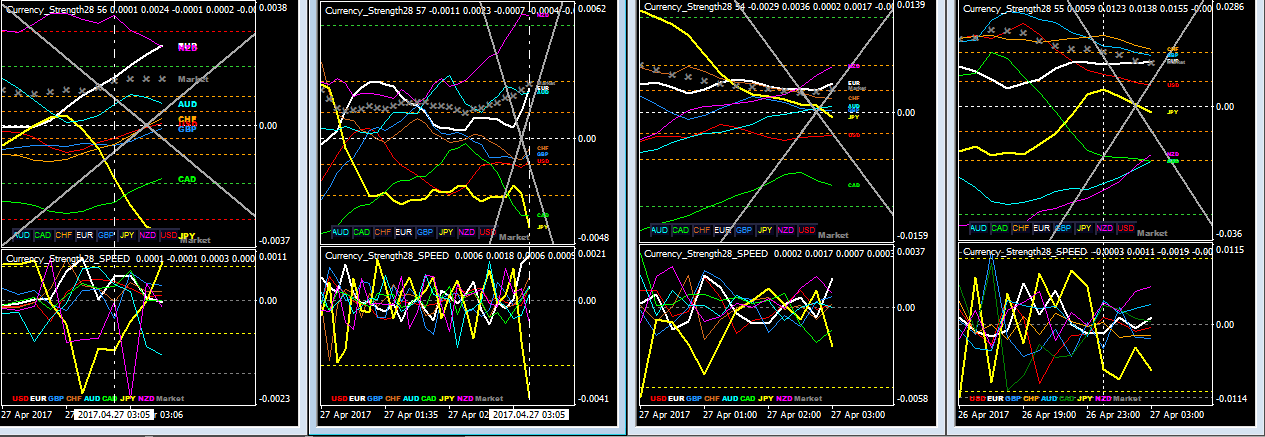

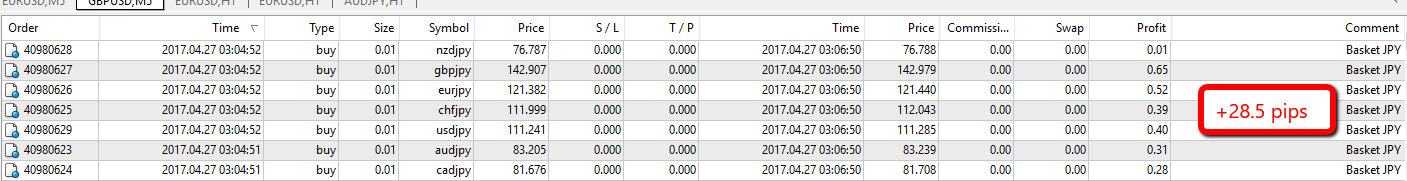

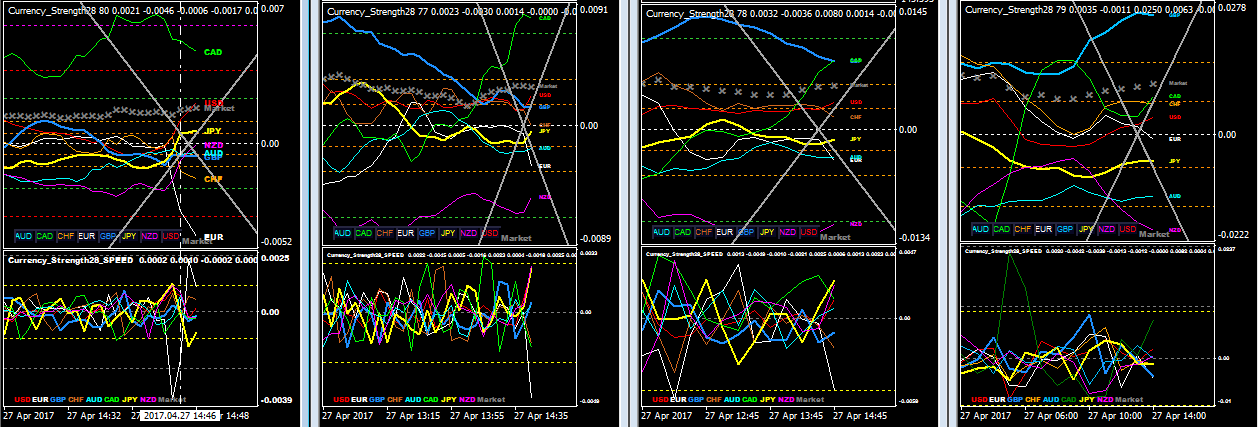

4_27 New session. JPY (yellow) looks weak. Sell all JPY pairs. My entry was 3-4 minutes later than golden angle crossing.

From the 1st pic you might think EURJPY is a better pair to short. It is in this case. Base and quote are clear. You may trade the double gap and make out good. Read my conclusions at the bottom of the blog.

CAD is decisively up, but not sure about the rest. Buy CAD basket.

I will start recording losing trades as well so that I can have some statistics on reliability of this method. I will make a note if rules are violated.

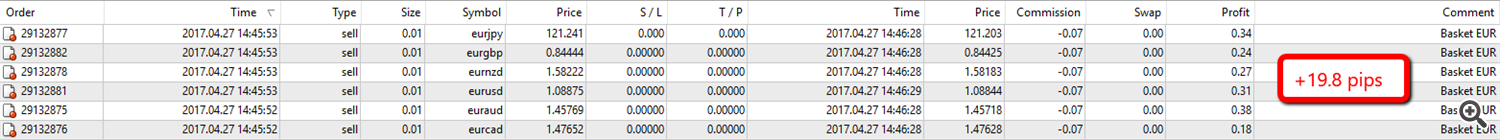

Live trades below. EUR (the white curve) is moving sharply down for unknown reason. All time frames agree. No time to sort out which quote currency to pair with. How could I? It was like picking out two spaghetti strings out of a bowl. Sell EUR basket.

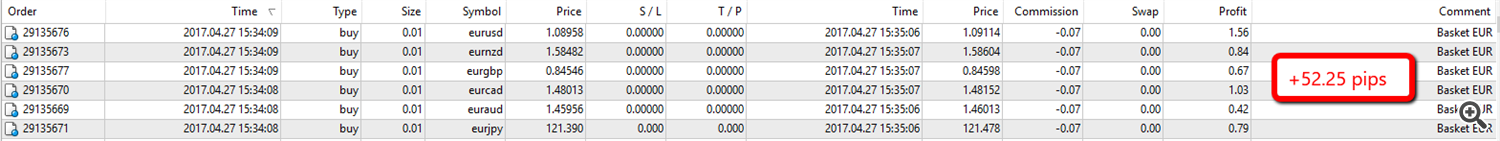

Now buy EUR (white) basket. I learned not to question the market.

When not to trust Impulse signal?

Stay tuned

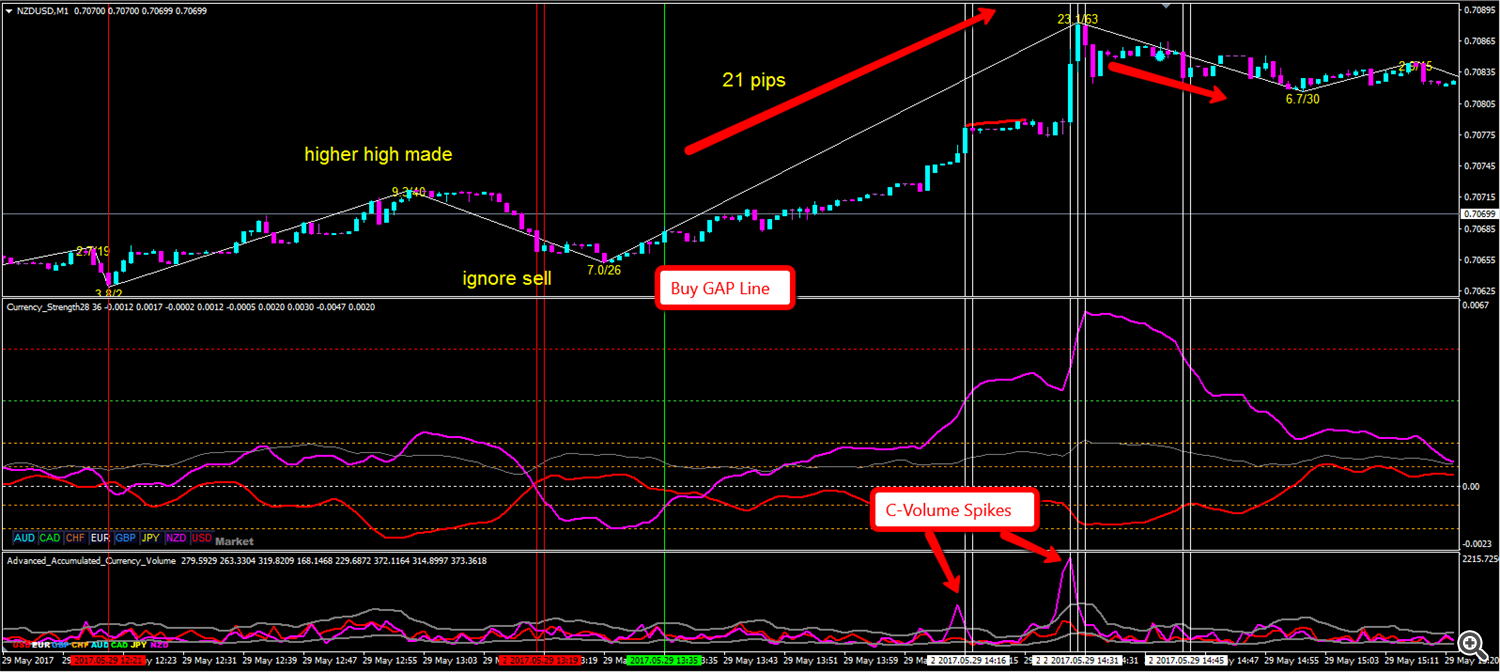

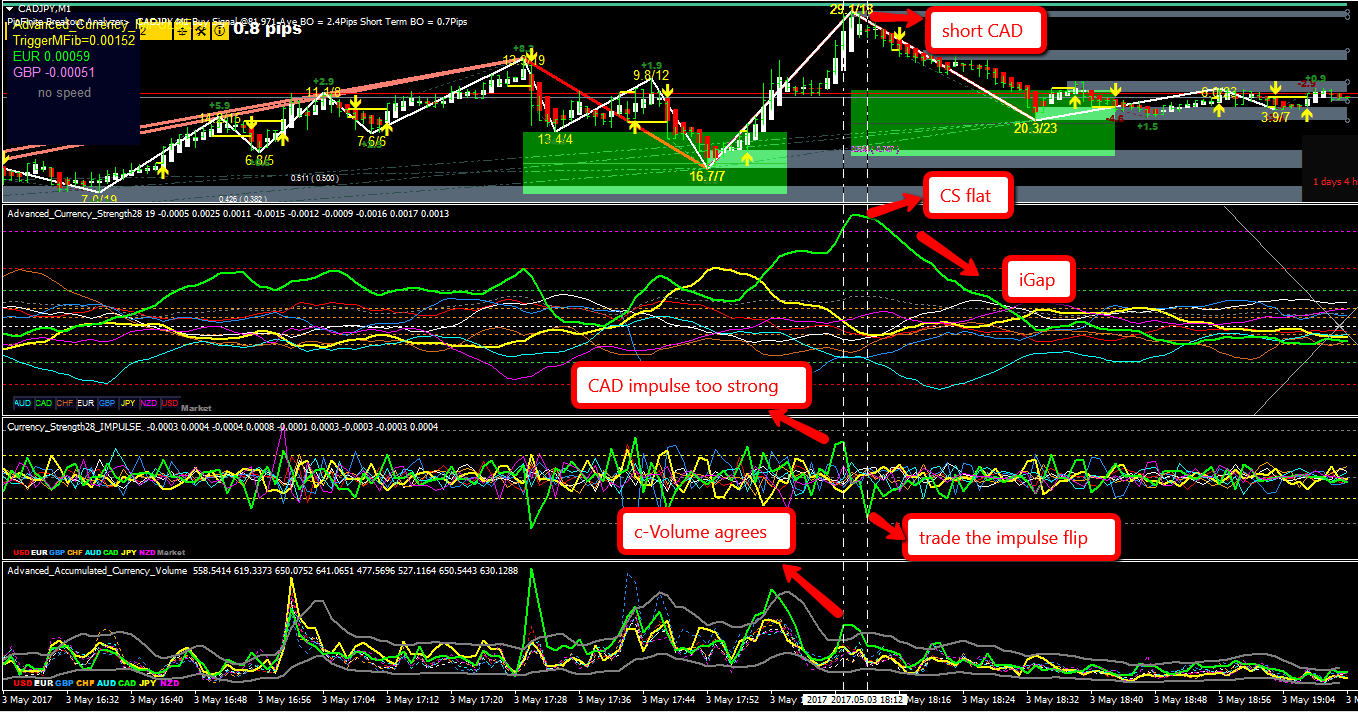

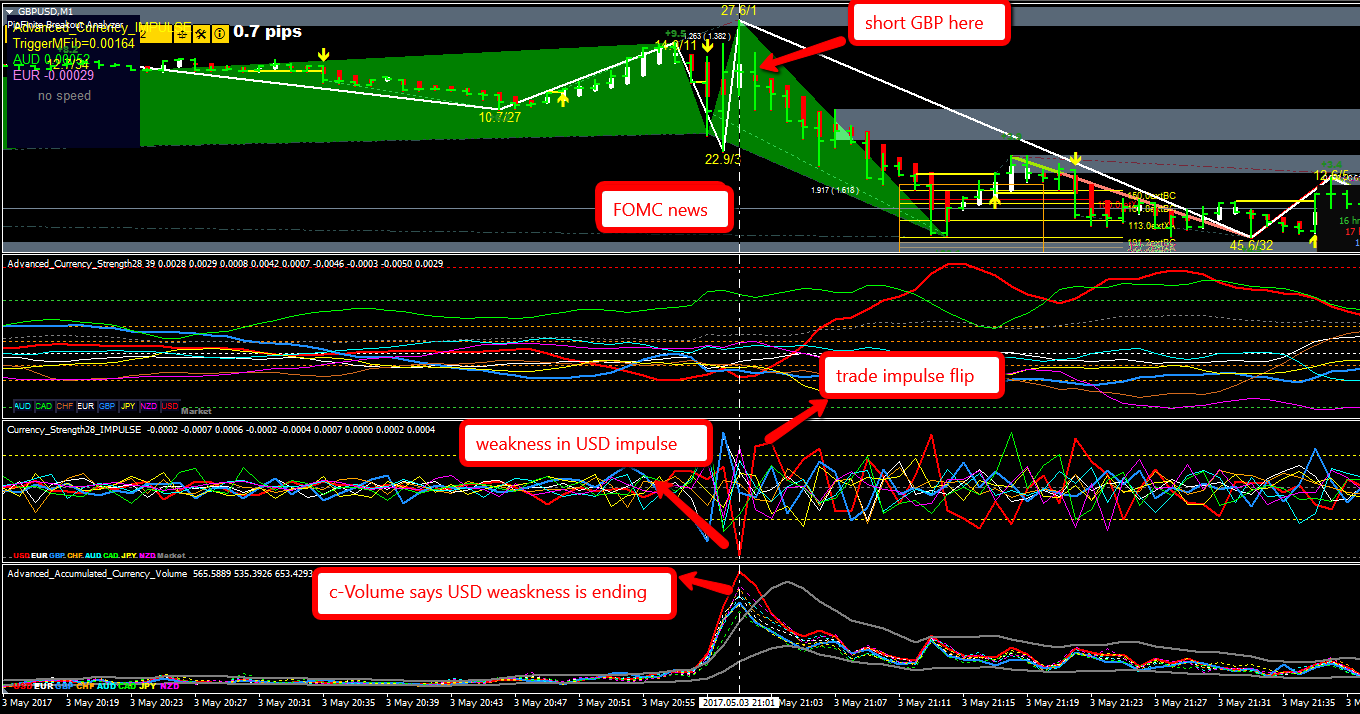

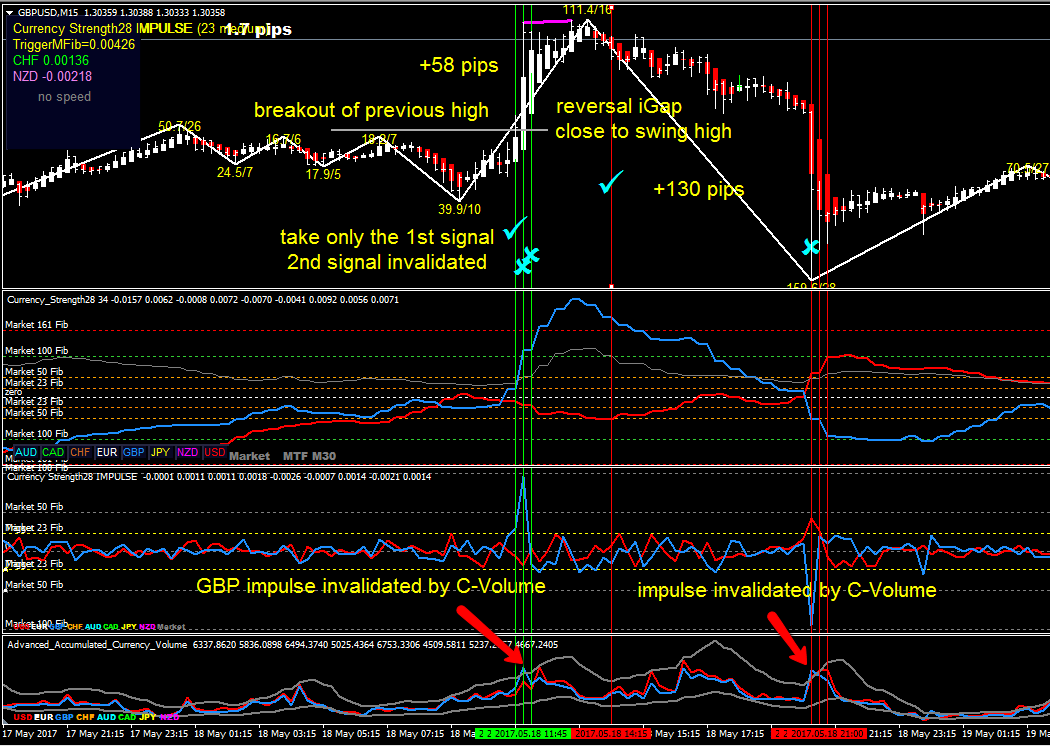

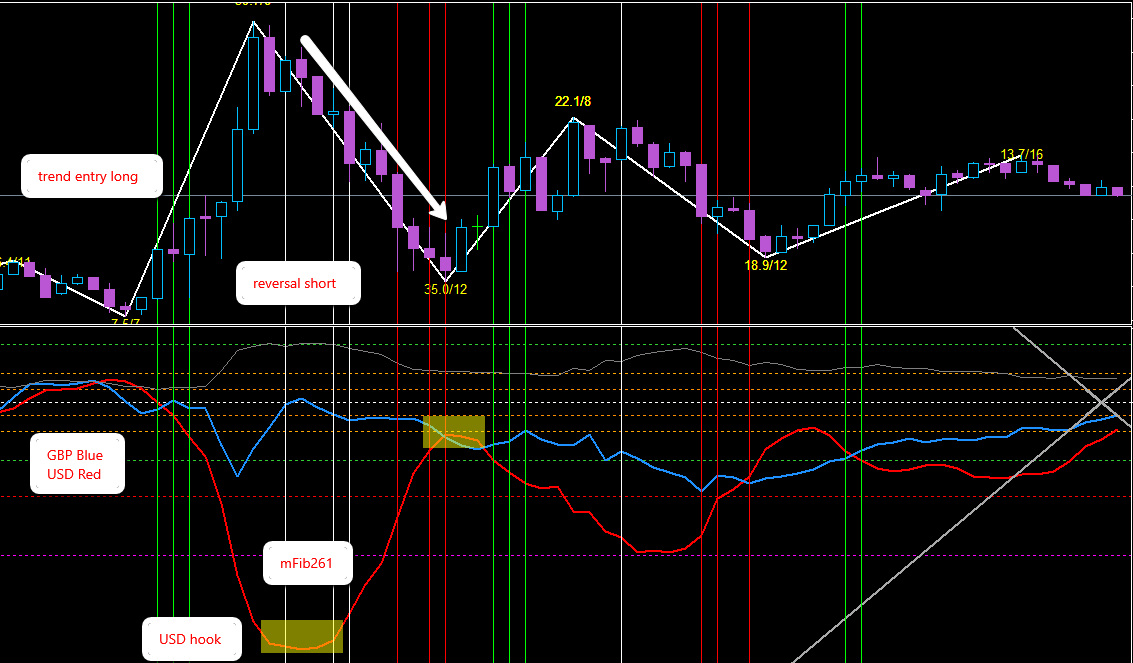

Here is an example. The Impulse showed bullish JPY (sell EURJPY right?). The C-Volume (bottom window) is outside of the normal trading range. Do not follow Impulse. Trade the reversal.

Here is some heavy stuff, working with other indicators. Are you familiar with One2One pattern? The green zone is for buy entry. The C-volume supports this pattern as well as the demand zone nicely. M5 for this illustration.

5_3 This is Self explaining, putting everything together. It's a beauty.

5_3 Asian session. Perfect iGap setup to buy AUD.

5_4 Watch CAD (lime) a quick surge with 3 time frames aligned. Buy CAD basket +26.3 pips. Although I set basket TP 20 pips, trades often closed beyond 20 pips.

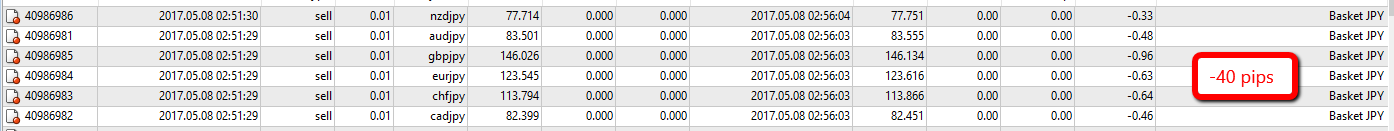

5_7 This is how to lose money. Follow the JPY (yellow) at the vertical line. Looking good for up trend, yes? It is on the outside gap above mFib100 (the green horizontal dash line). Steam soon ran out.

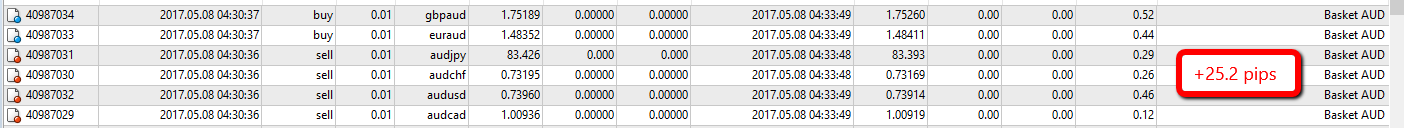

Sell AUD. Follow AUD (cyan) in Impulse.

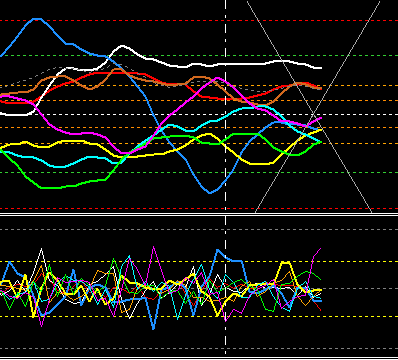

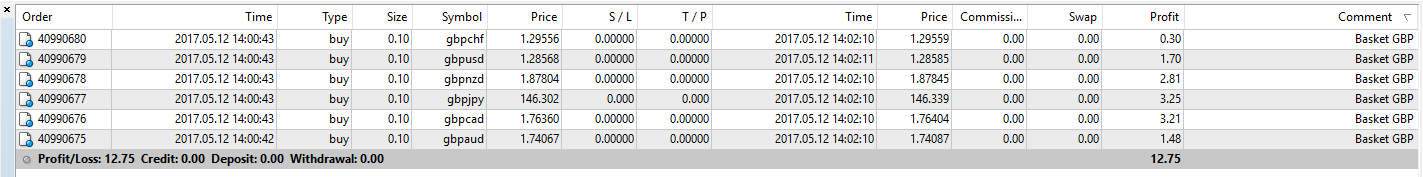

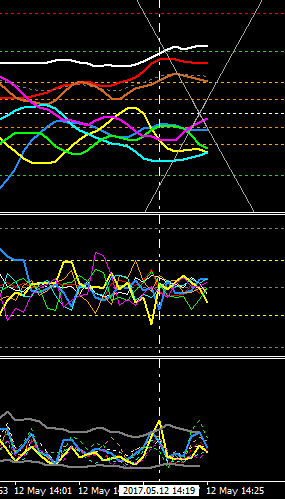

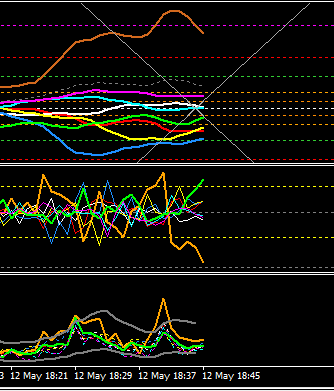

5_12 Bought GBP basket at the vertical line. No clear quote currency showed downward movement in M1.

Sold JPY (yellow) was a quick loss. The rest of the currencies did not want to move up. It was an oGap (moving away from zero). Also I did not check C-Volume for sign of reversal. This is what you do. Cut loss quick if you made a mistake.

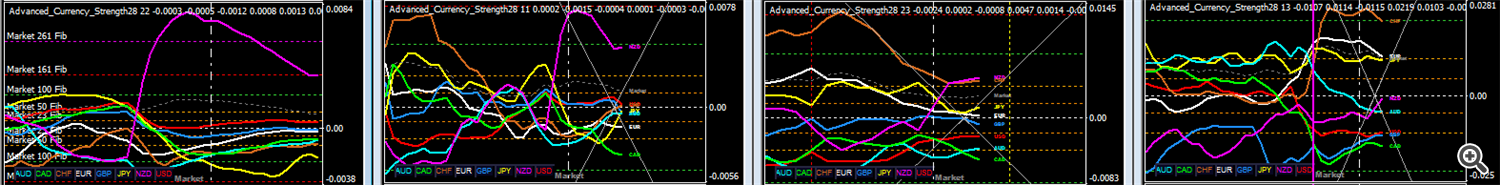

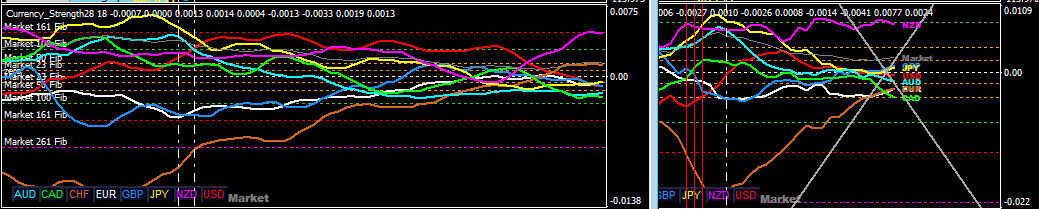

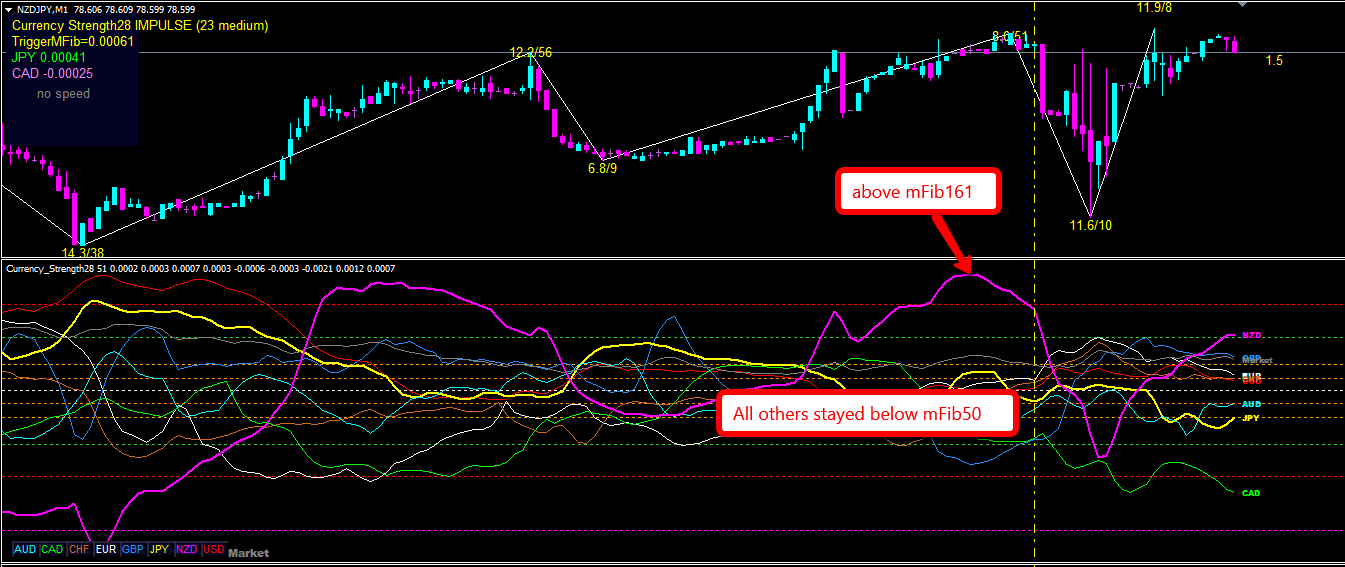

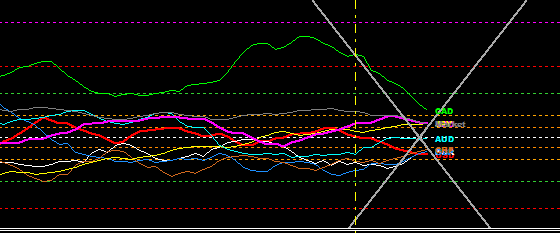

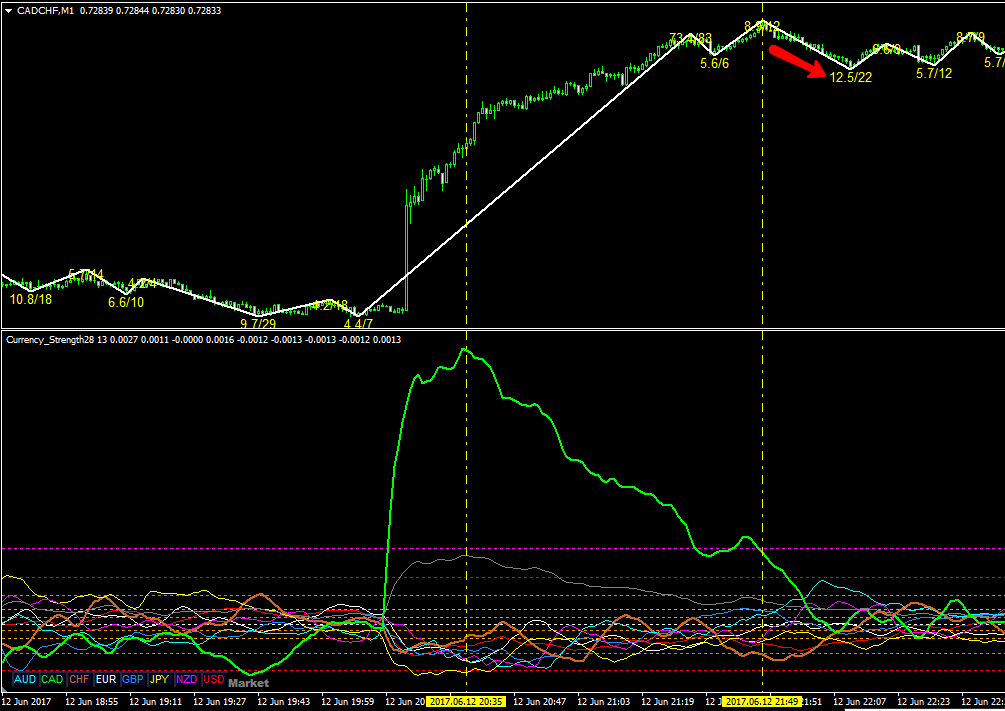

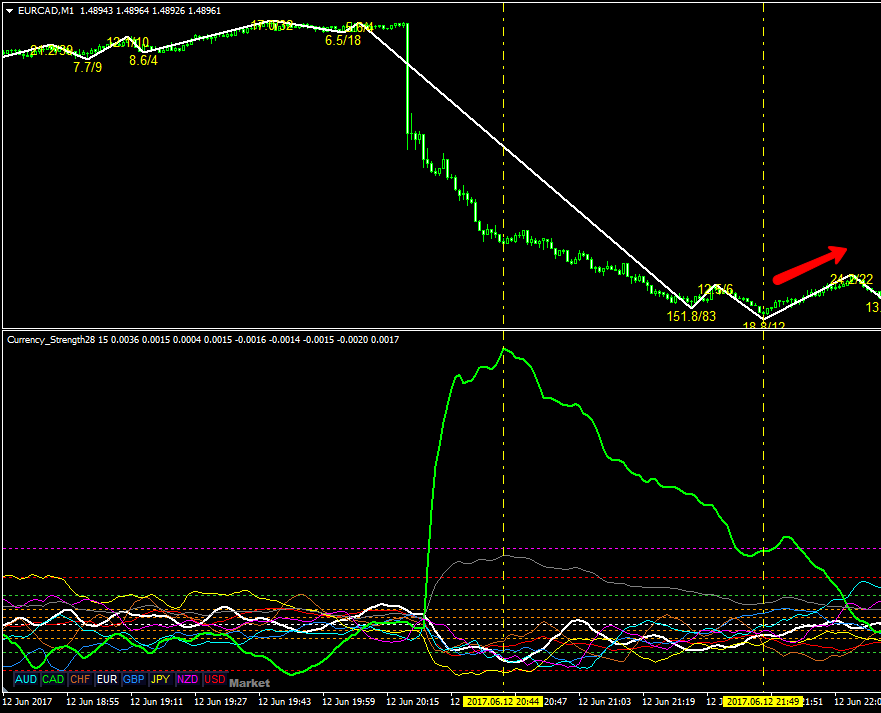

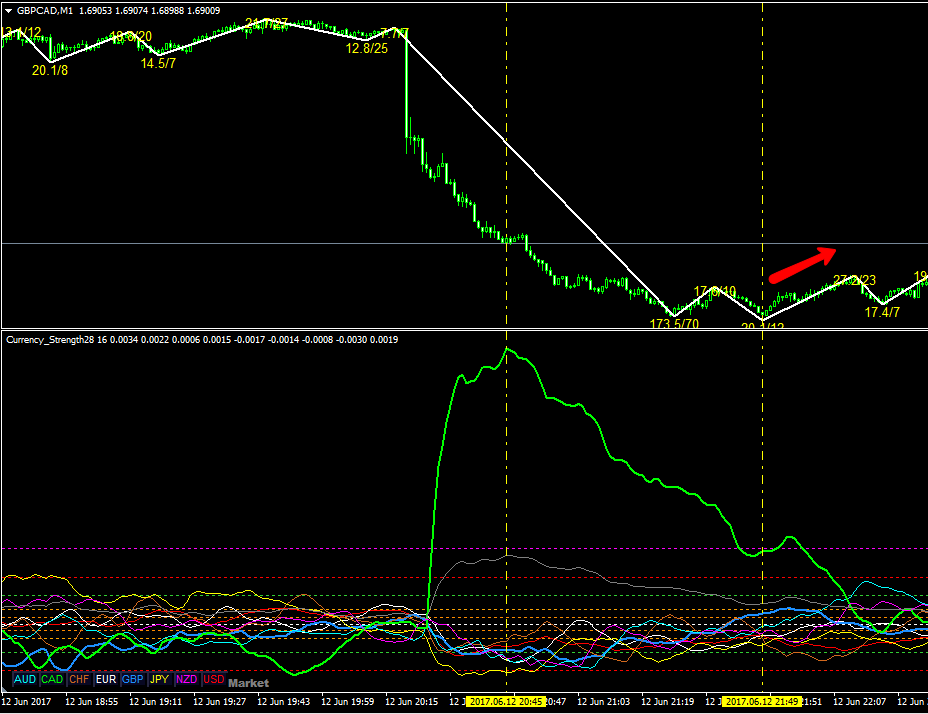

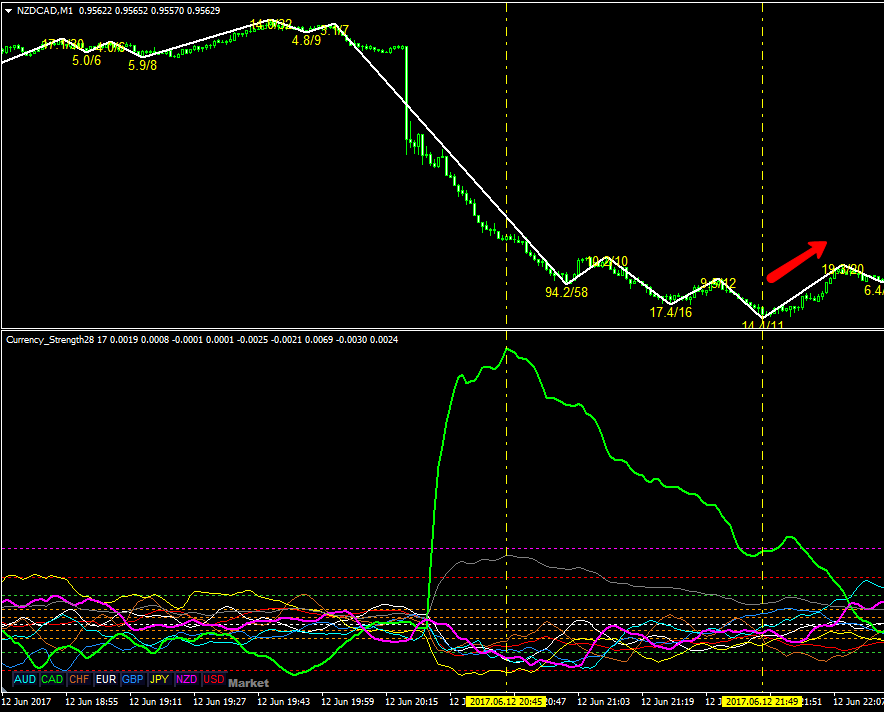

Buy CAD was a good trade. Note the setup showing a big gap between CAD (green) and the rest of currencies. Nice iGap. This is a major discovery in basket trading after so many trades have been made and tested. A much more reliable setup can be easily spotted. Now solid rules can be made: When one currency is beyond mFib161 and the rest are on the other side of mFib50, follow the Impulse or just jump in. M1 is the only time frame you need. ACS28 is the only indicator you need. [Edit 6_24: Impulse can be a very valuable tool to avoid draw down]

Not done for the day yet. This is a setup we have just seen. I call it the "No Brainer" setup. Look at the gap between CHF (brown) and the rest currencies plus the C-Volume exhaustion. iGap.

Sell CHF basket. Very quickly all pairs are in profit.

Today's basket trading setups are highlighted below in M1.

5_15 Sell NZD (purple) basket. NZD above mFib261. You can't lose.

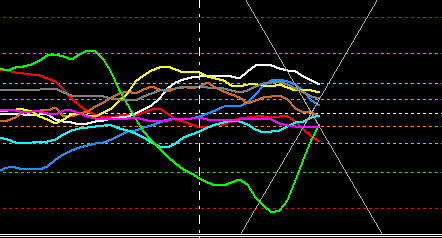

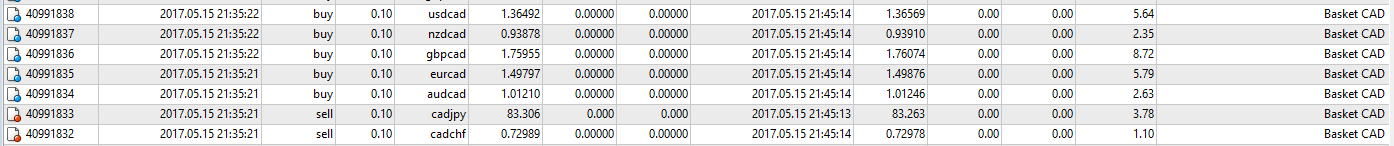

5_15 Sell CAD. It is so simple it gets boring.

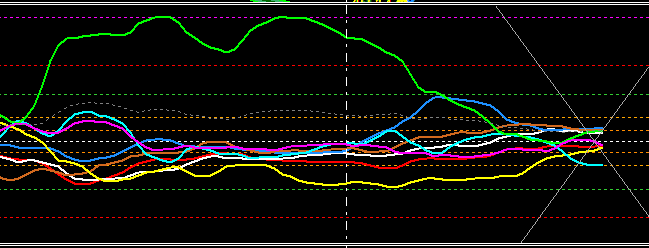

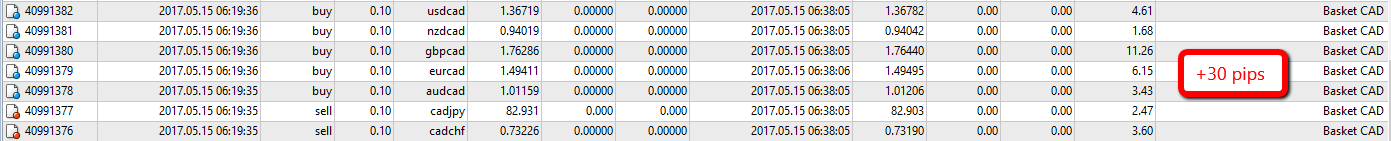

5_15 CAD was not above mFib 161 but the down move pierced through all others. Sell CAD basket. i was late. +30 pips

The currency you pick must be overbought or oversold - beyond mFib161. Sit on your hands and wait for this to show up. Don't be eager to trade and lose your money. Once you open trades the overbought or oversold currency will come back to normal.

5_15 Live You should know by now why I sold GBP basket. Not the best due to New York afternoon hours. Preferably all other currencies were sitting down below mFib50 level.

5_16

Introducing ACS28 Gap

Coded by Kashif Javed (info at the end) - This is a very useful tool that makes ACS28 much more user-friendly, not necessarily for basket trading. It marks where the Golden Angle gaps are on the price chart. It is humanly impossible to hand calculate each CS angle, compare with zero to mFib23 angle and track all 28 pairs. This indicator does all that. It is updating with the Fib levels in real time. No repaint. In this example, CADJPY buy signal and CADJPY sell signal both met the Golden Angle rules and both are iGap. Trade only the extreme iGap (>mFib 161) you just can't lose. Hmmm, yes, you can.

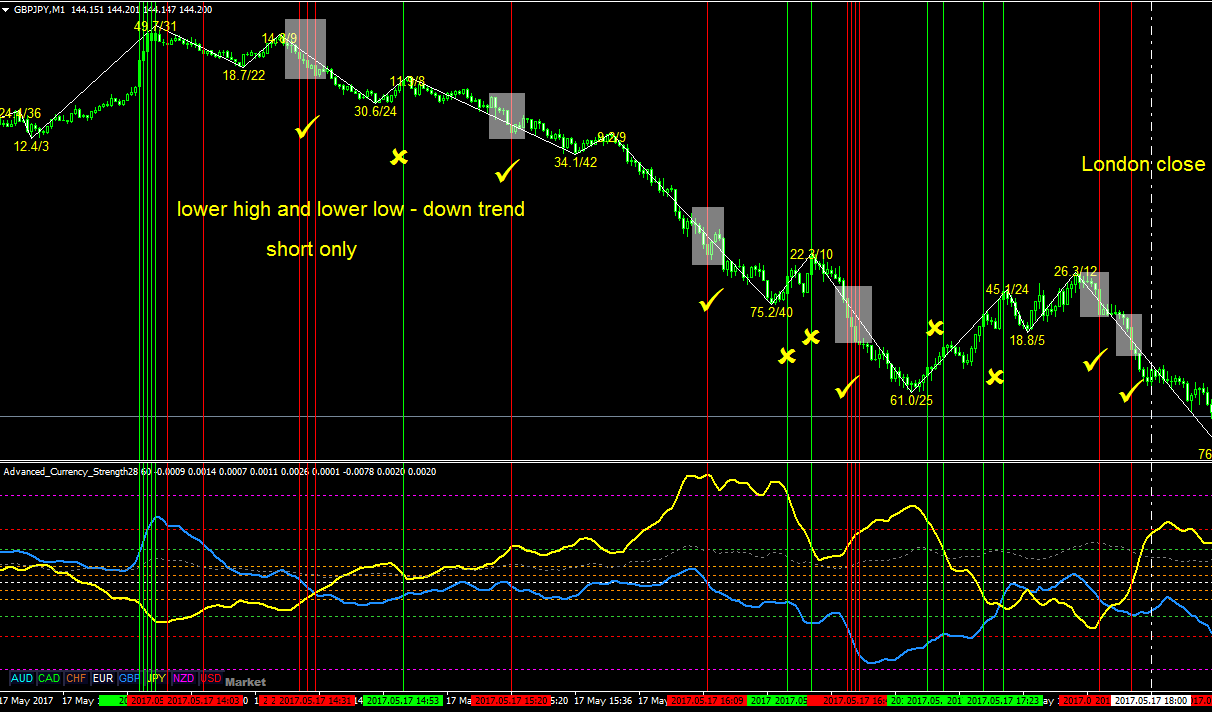

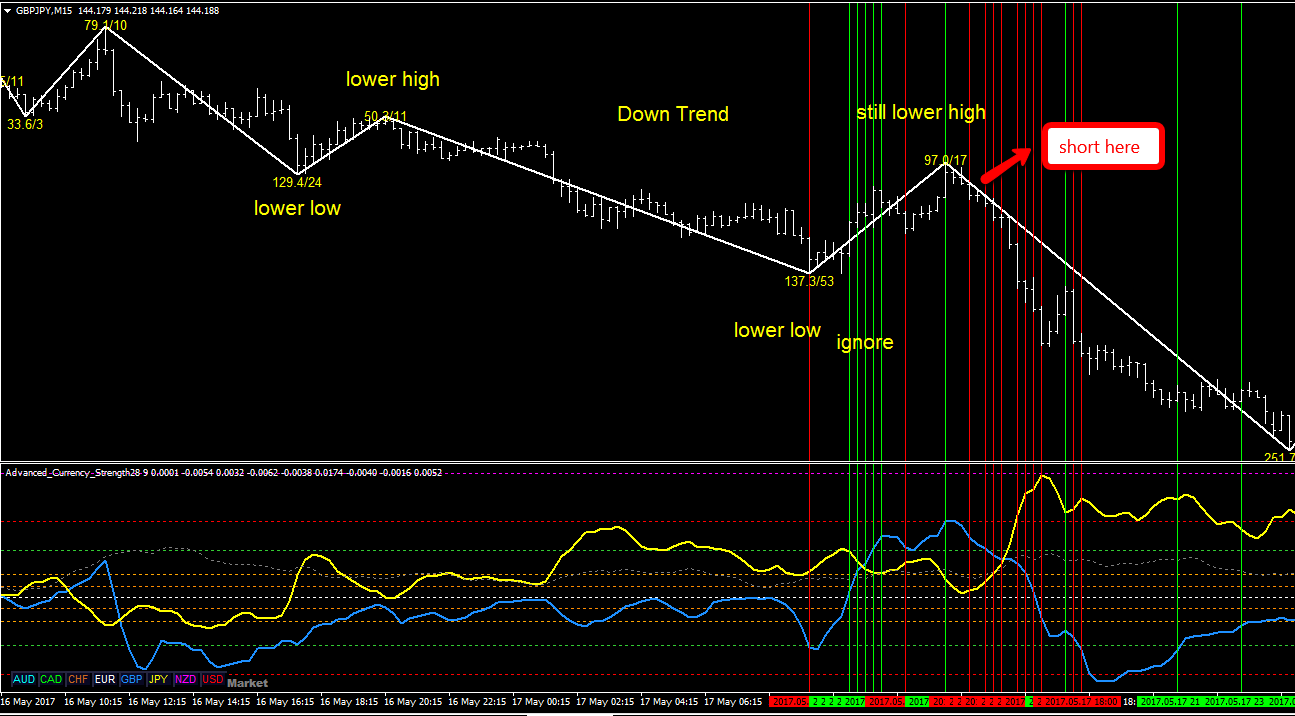

Here is an example of finding entry points in a down trend using ACS28 Gap indicator. The red lines mark the candles where ACS28 had a net angle >= Golden Angle.

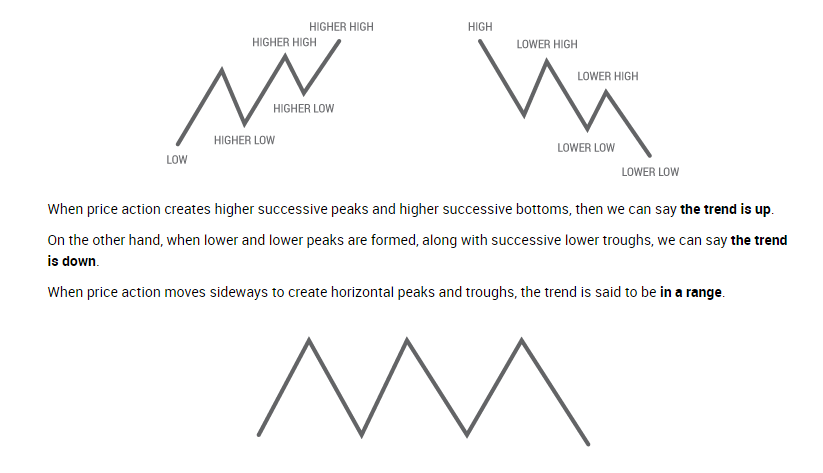

[Source: https://www.xm.com/education/chapter-2/trend ]

Now switch gear to higher time frames because some may find trading M1 is a bit nerve wracking.

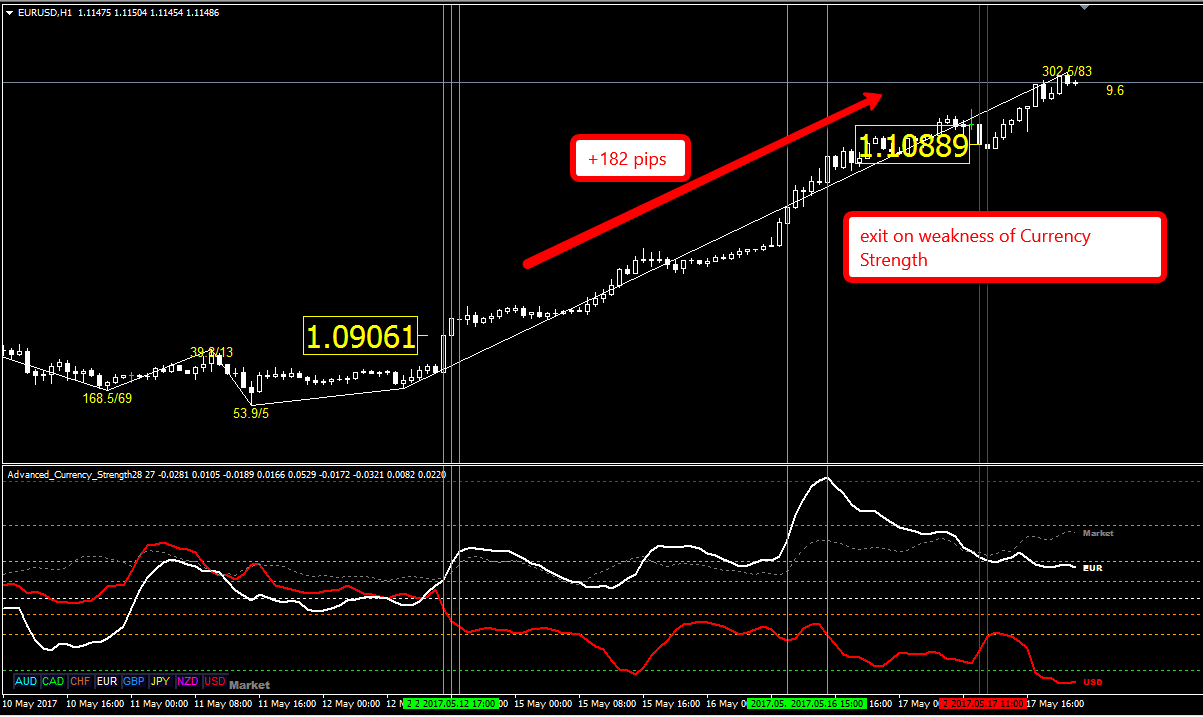

Here is EURUSD H1 using ACS28 Gap to enter and exit. Green to buy, red to sell,yes?

First trade was a long in an uptrend on the Gap green line. When a lower high is made, you are officially in a down trend. Short the first ACS Gap red line and add more if you want. Your SL is above the last swing high.

Respect the trend. Ignore buy signals in a down trend. M15

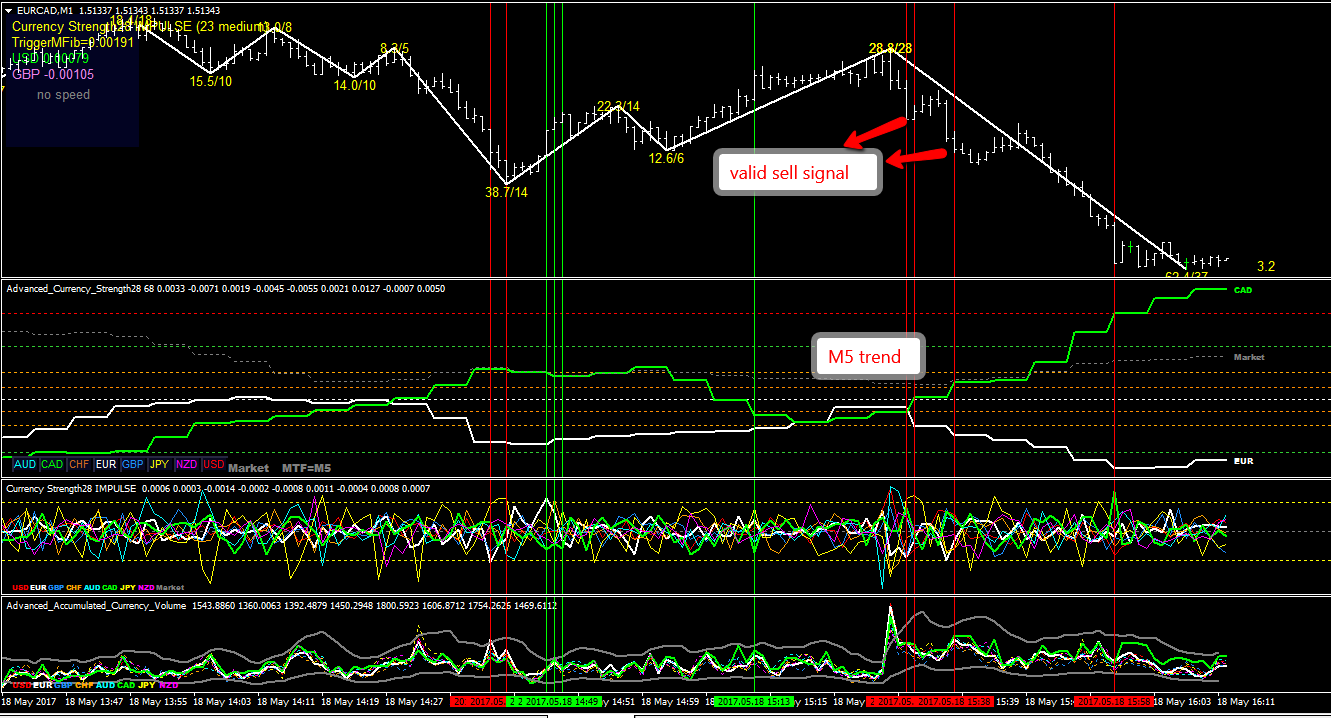

5_18 This is what I am talking about. A perfect basket trading setup now with a visual alert.

5_18 Another way to determine trend according to Bernhard is to use a higher time frame until the strength curves are smooth and clear (CAD steps higher and EUR steps lower). Sit on your hands if trend is not clear.

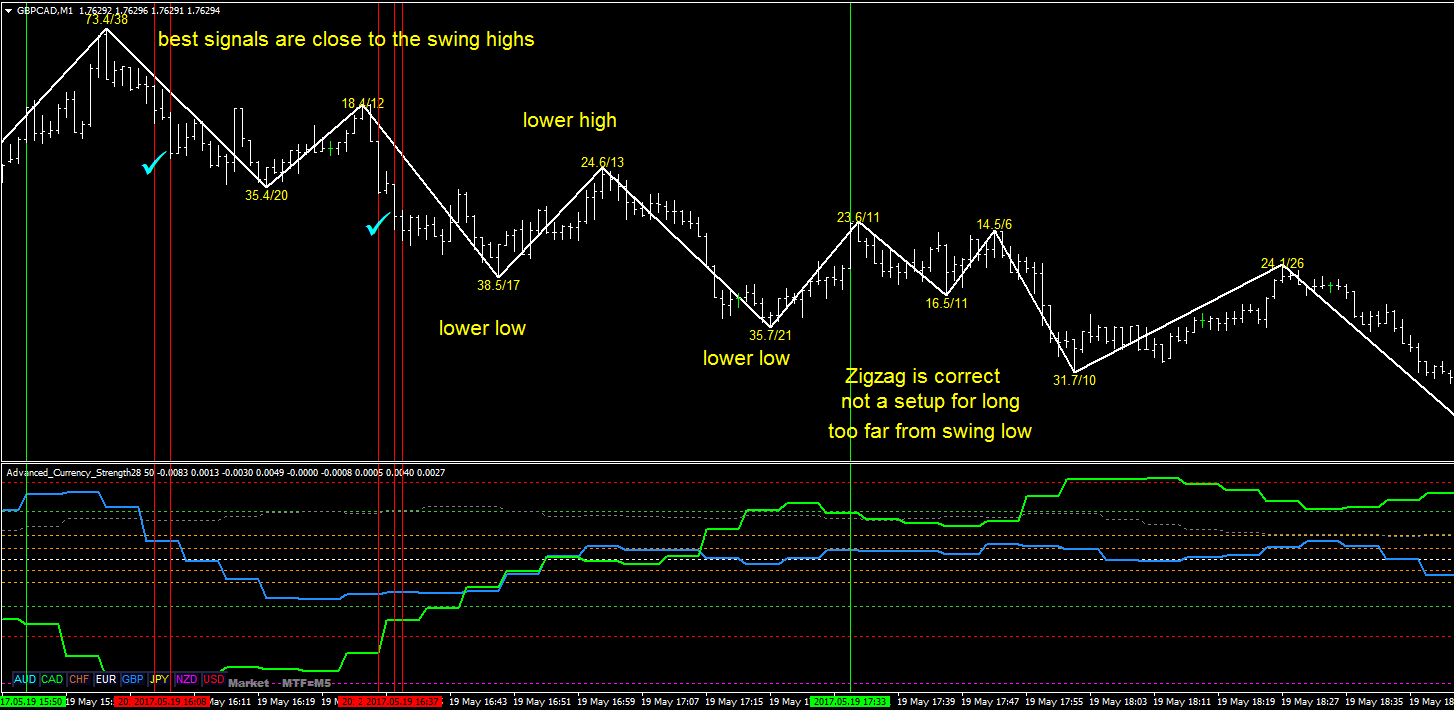

Download the attached zigzag indicator. It shows how many pips and how many bars for each zigzag leg. Remember, zigzag's last leg is unfinished and will repaint, but what has been plotted will stay plotted. We are only interested in the unchanged history of price action. I will show you some tips on selection of Gap signals. Check back here.

Download the attached zigzag indicator. It shows how many pips and how many bars for each zigzag leg. Remember, zigzag's last leg is unfinished and will repaint, but what has been plotted will stay plotted. We are only interested in the unchanged history of price action. I will show you some tips on selection of Gap signals. Check back here.

5_19 Using swing highs and swing lows is still my favorite trend determination method. But use both if you will. Take only signals closer to those swing points. Be selective.

5_21 Signal Selection Logic

What the heck. You might as well get Impulse and C-Volume. I don't see how you can do with ACS28 alone. My points in this illustration are 1) a golden Angle line signal closer to the zigzag swing points is the best to take, 2) Impulse and C-Volume can pinpoint reversal precisely.

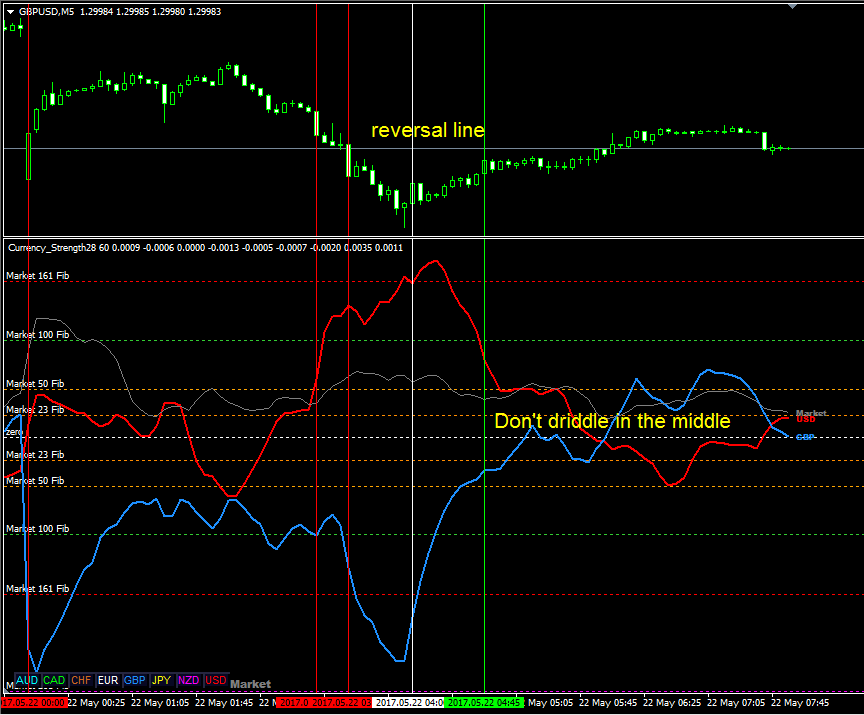

5-22 Reversal Line alert (visual or sound) New!! The Gap Angle Line on ACS28 beyond mFib161 or mFib261 deserves special attention. It will now print a line in white (normally could be red or green). Thanks to Kashif for this mod.

5_22 Hope you caught the long CHF basket trade. Same setup as I have shown before many times. It is helpful to have at least one CHF price chart open to see price action. I had CHFJPY charts in 3 time frames. Remember, it always appears that you are trading against the trend. But which trend? Don't be afraid. Force is with you. It only takes a couple of pips from each pair to reach a net 30 pips TP. You see how much further it went from my entry and exit?

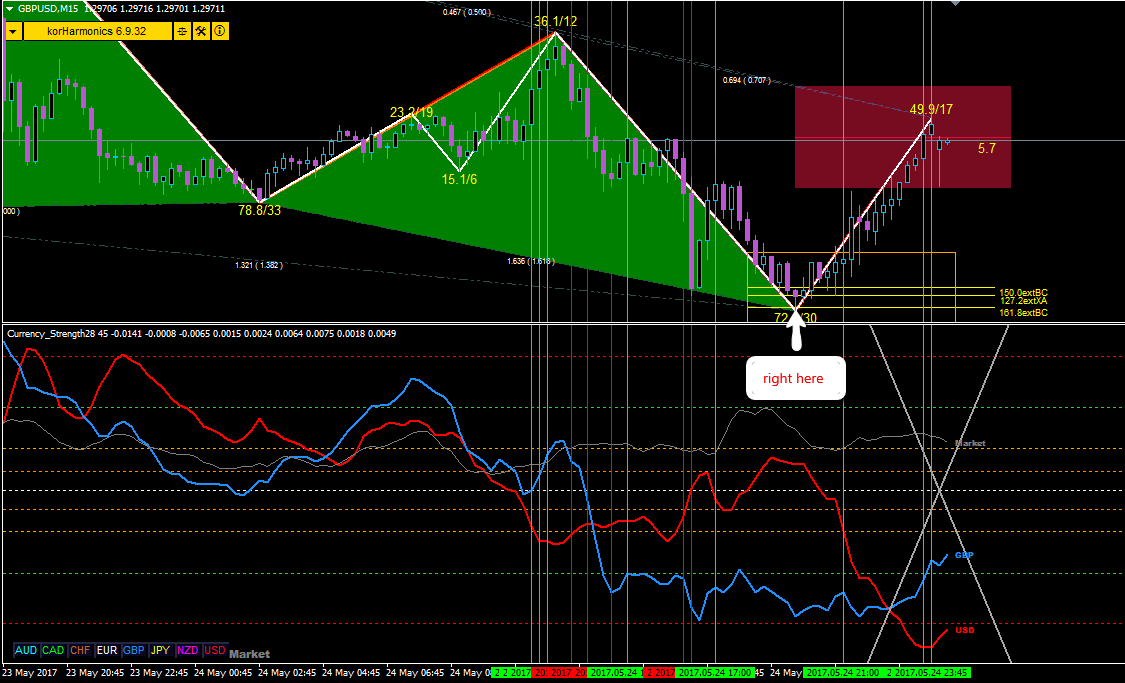

5_24 I did a sell GBP basket after 11:00 New York. Timing was bad. Entry and exit were both too early. Ended up breakeven.

I have said that take the Gap signal as close as to the swing points of the zigzag as possible. It simply means you take the early signal or you pass. Kashif made a breakout arrow indicator to help locate the early GAP signals. If the GAP signal and Breakout occur at the same time, the signal is considered EARLY and STRONG. Agree?

5_24 Don't trade basket on high impact news. I left CAD alone (overnight rate news). Lime Green.

But later, CAD was over-sold and showing strength. Buy CAD basket at the dotted line. Very late entry. You can see I missed the entry at the gap line. Demo anyway.

Missed a nice GBPUSD setup in the afternoon New York. Could be a buy USD basket, but did not act on it.

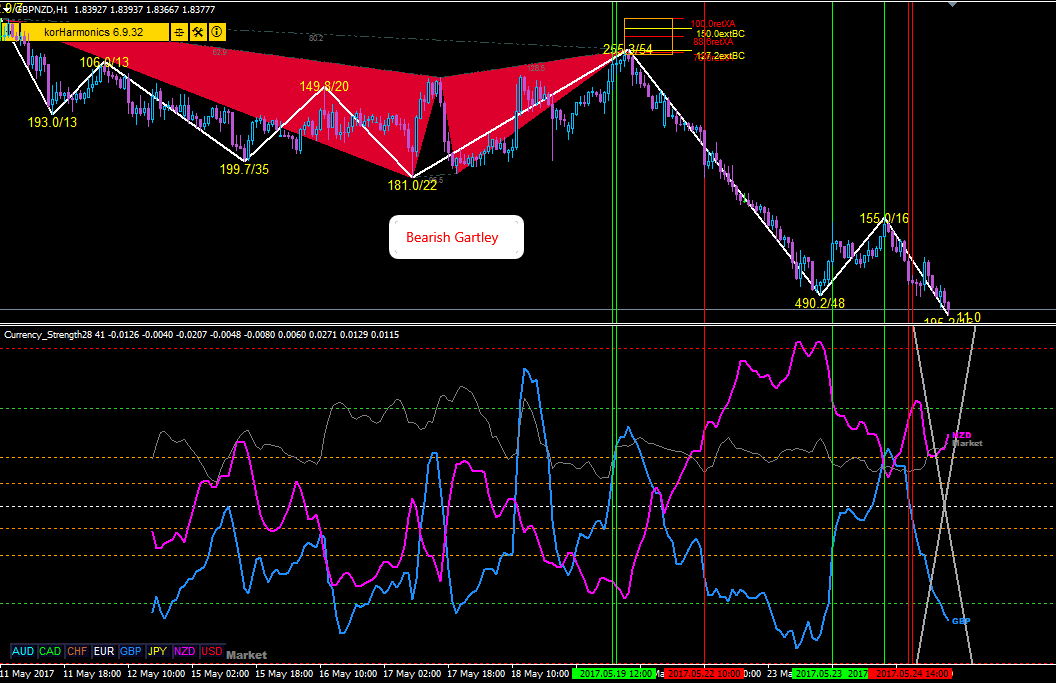

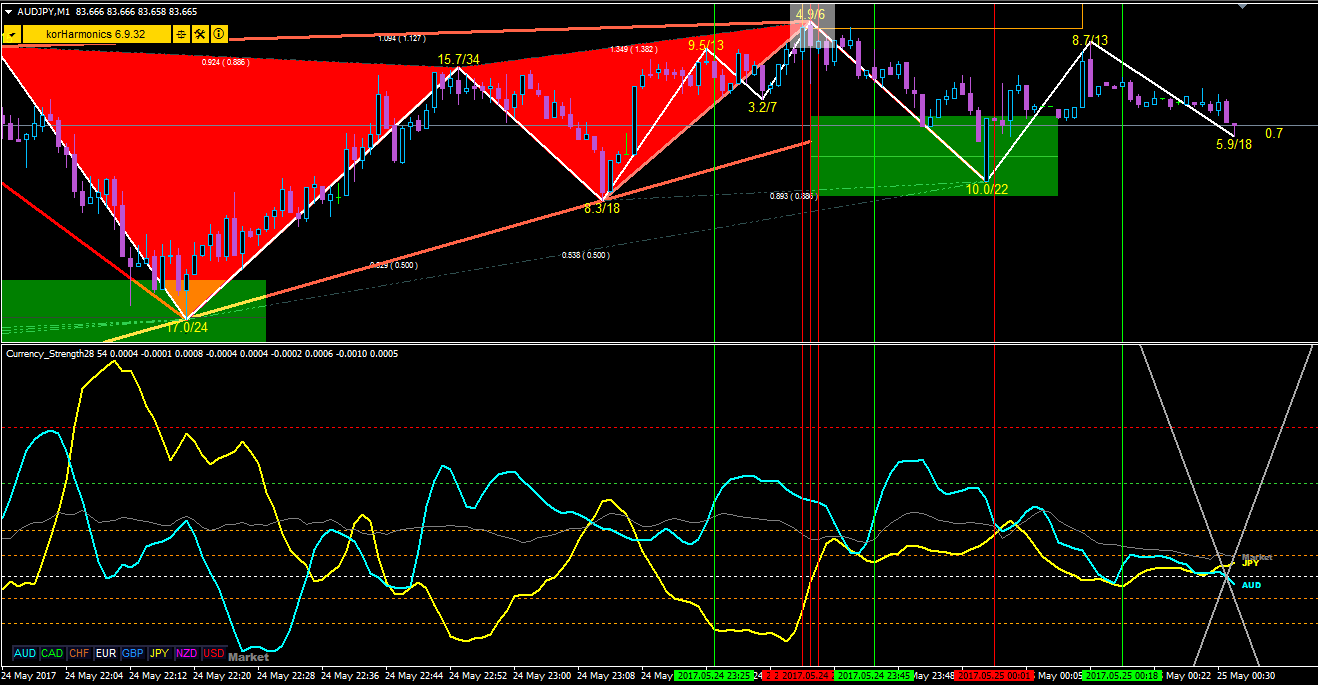

5_24 I also have Korharmonics on every chart.If you see a bearish Gartley in an uptrend, don't be tempted to long regardless how good the angles are (see the green gap lines?). For that, I am an affiliate because I like it so much. http://tools.tradingarsenal.com/?v=12

No angle? No problem. This bullish butterfly tells you when to buy.

A bearish butterfly coincides with a Sell Gap Line

Who won? I think I made my point. You can't have enough tools for checks and balances.

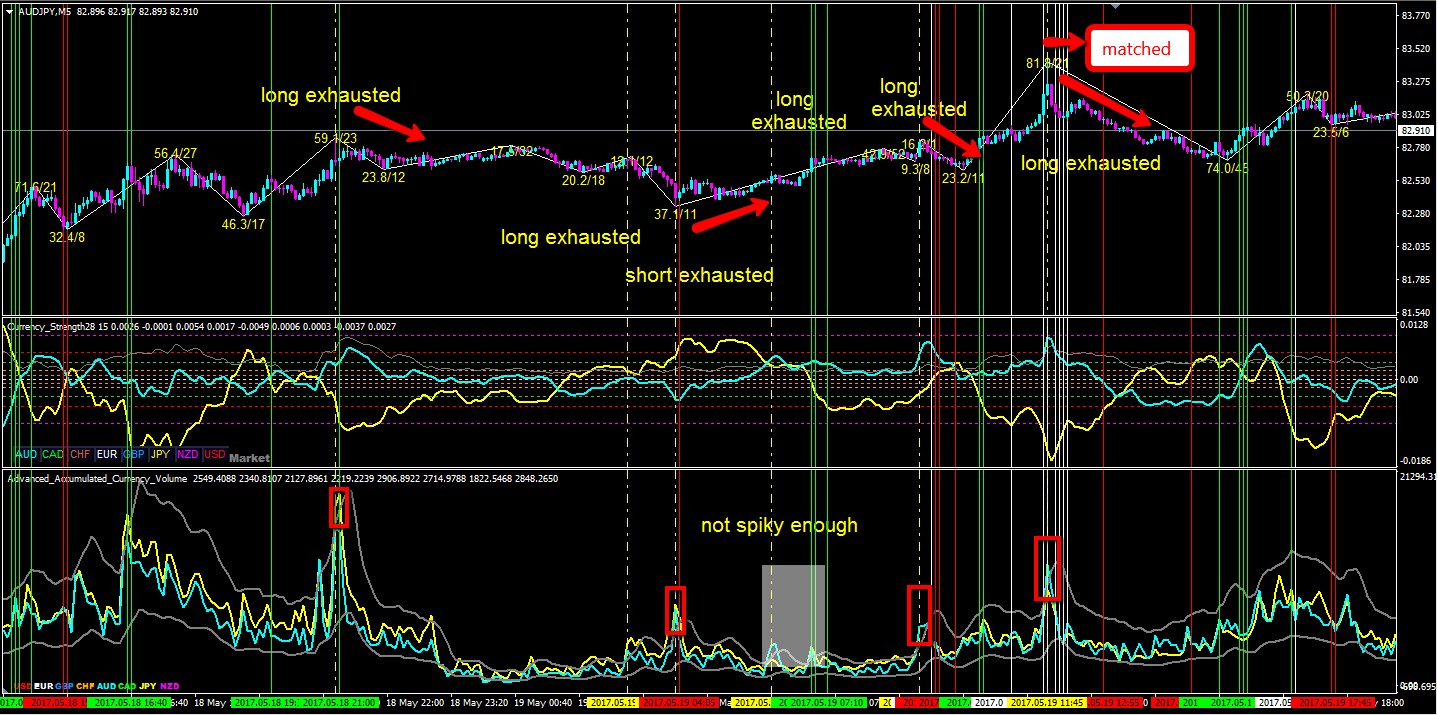

5_28 I hate the idea that you need to buy yet another indicator. If you can trade from naked charts, my hats off to you. Here is C-Volume from Bernhard. The C-Volume spikes often mark the price turning points (yellow dot-dash) due to price exhaustion. When long exhausted (no more buyer), price goes down next. When short exhausted (no more seller), price goes up next. In this chart example, there was only one area where the Gap Lines issued the same warning (White Lines) as the C-Volume spike.

5_29 I am facing this issue everyday. The general rule of thumb is that trend trading is more rewarding than counter-trend trading even with the best reversal indicator. However, in basket trading all you need from each pair is to give you 3 pips of gain to reach 20-30 pips TP. The net profit is what makes a successful basket trade. Now look at this chart example. Zigzag determined the uptrend direction. Trade the single pair in trend direction and trade the basket in counter-trend direction.

5_29 Sell NZD basket

Here is the setup and trades. You really have no time to sort out the spaghetti. Be nimble and not greedy. Game was over in 2 minutes. Approx +50 pips net.

5_29 Buy CAD (Lime green) basket

5_29 Live Sell JPY basket +21.9 pips

Trading against trend must be nimble. Entry and exit are marked with dot-dash lines. Game over in 7 minutes.

5_29 I hesitated and watched the market leaving without me.

Unlike other currency strength meters, the over-bought and the over-sold conditions in currency strength28 are quantifiable by the mFib levels. C-Volume is the icing on the cake.

5_30 Buy GBP (blue) basket. +59 pips. M1 setup:

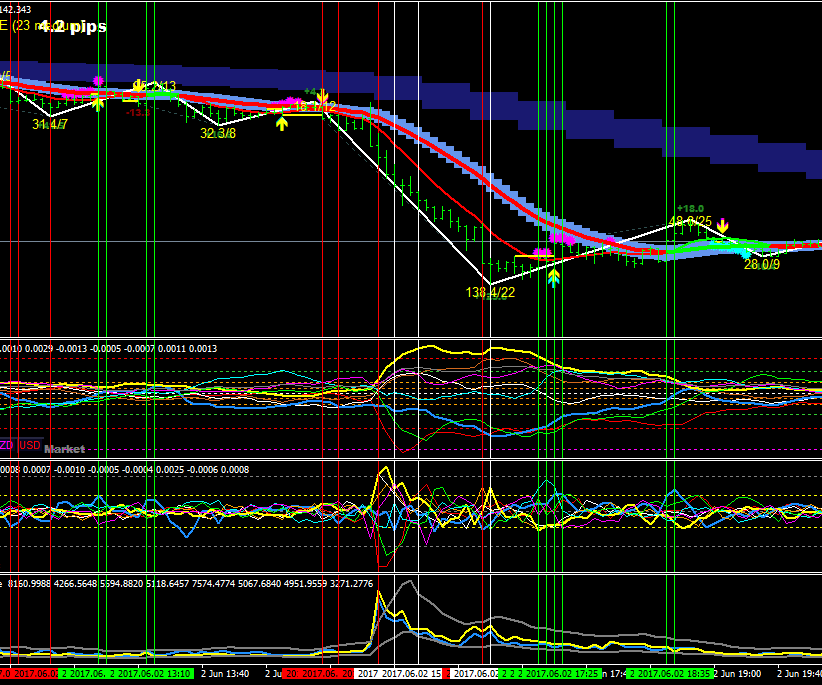

6_2 Live - Buy JPY (yellow) basket +21.6 pips. M1 setup:

6_2 Sell CAD (lime green) basket +41 pips. M1 setup:

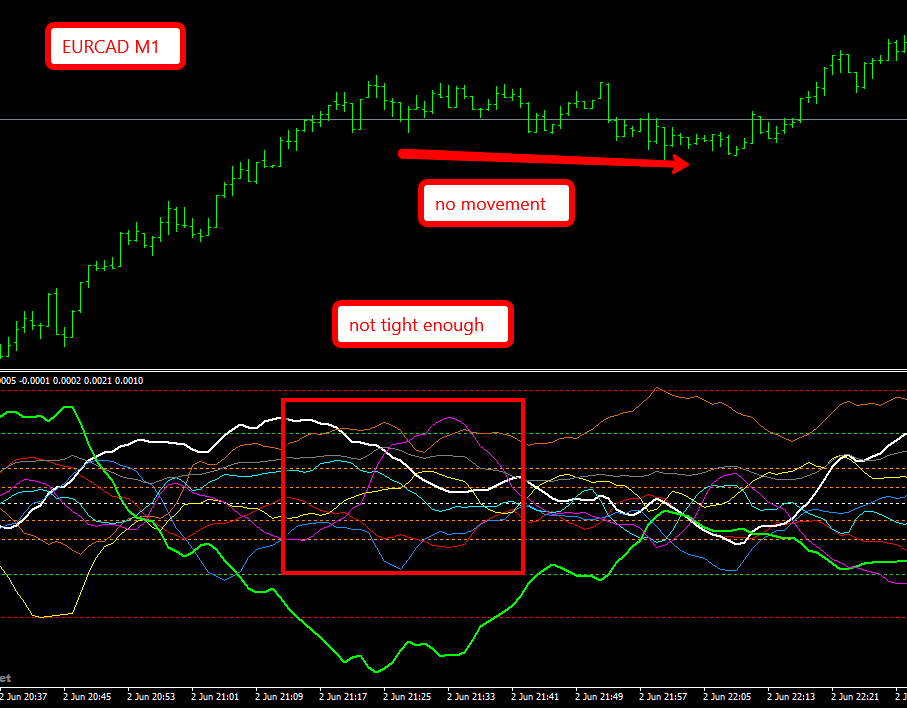

6_2 Do not buy CAD basket, not only because it is Friday afternoon 1h before closing but also other currencies are not tight and flat above -mFib50.

6_2 Introducing FX1

A system shared by Bill Young and coded by Kashif Javed. No currency strength can pick out this trade.

6_3 All in one chart. Trend cannot be clearer than this. Trade signals (short) are everywhere.

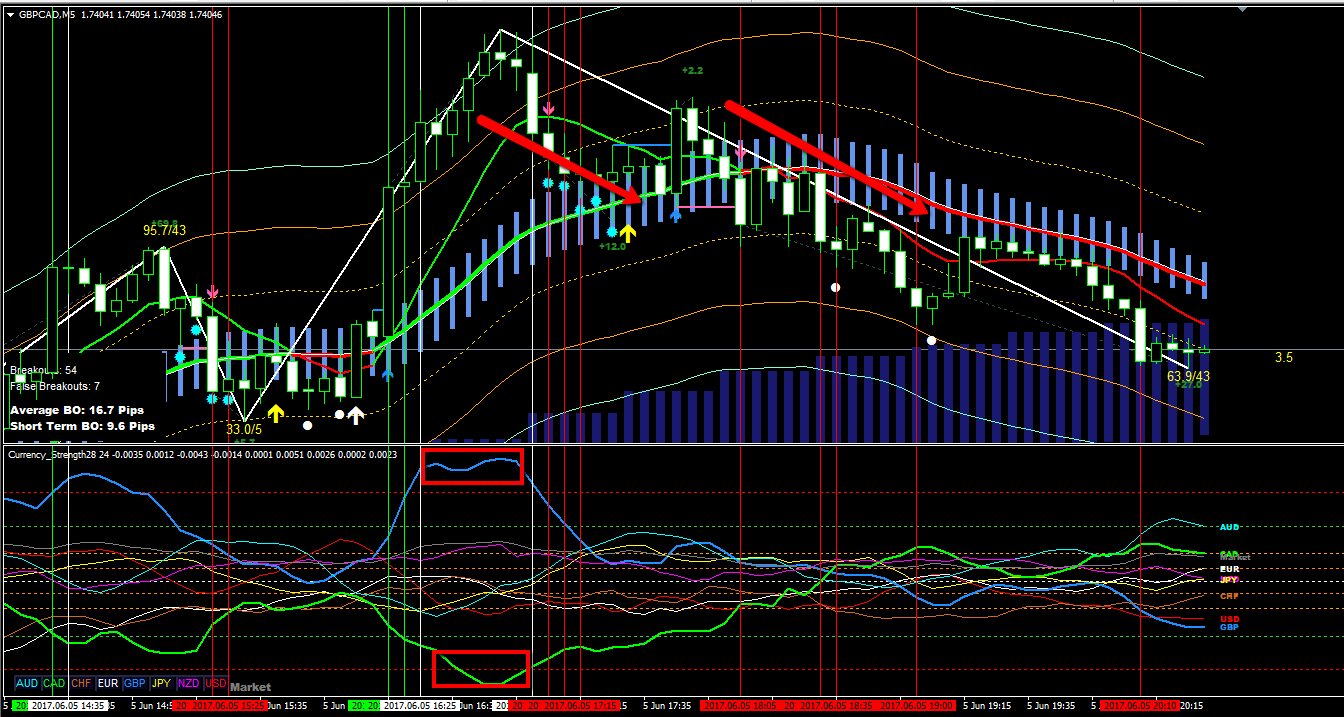

6_5 Sell GBPCAD counter trend. mFib161 is the clue, then follow the GAP Lines. This is iGap in the making. This pattern is worth waiting the whole day for.

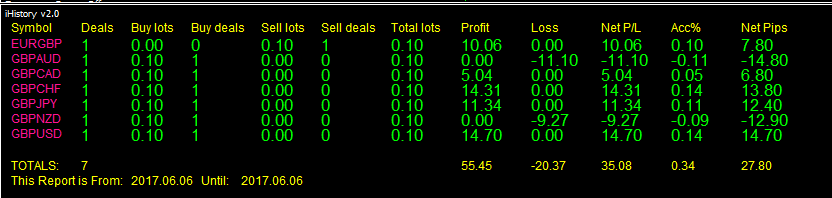

6_6 Buy GBP (blue) basket +28 pips between entry and exit dotted lines. It's like taking candy from a baby.

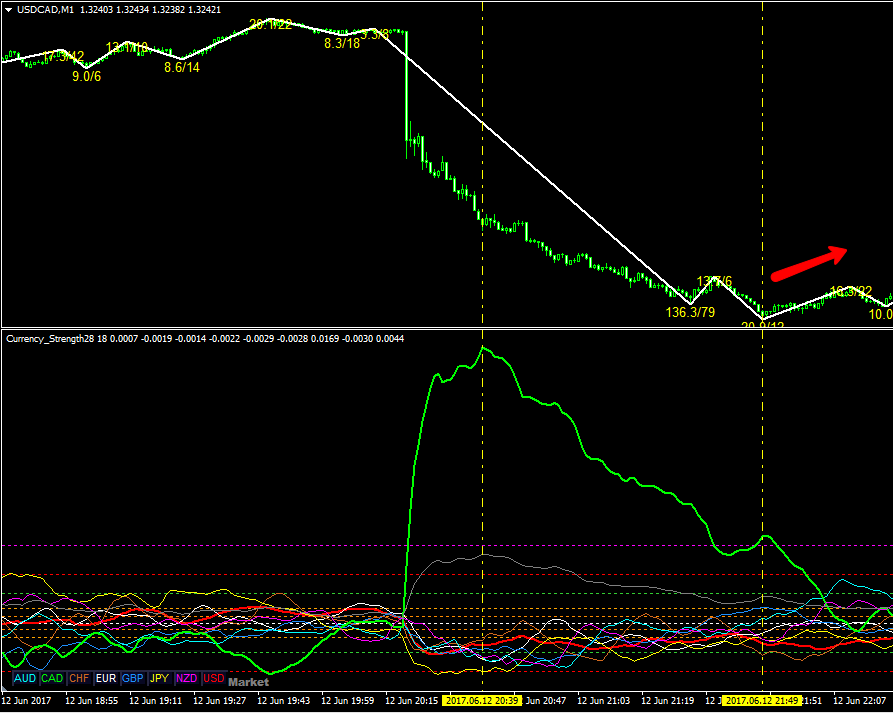

6_13 Does basket trading based on ACS28 always work? Yes and no, It depends on timing. Here is a setup for CAD basket short. As you can see, even though the CAD strength turned south from its peak, the price did not go down until much later. The CAD strength angle must be steeper than the mFib23 angle, perhaps 2x, in order to indicator a reversal move in CAD (according to Bernhard).

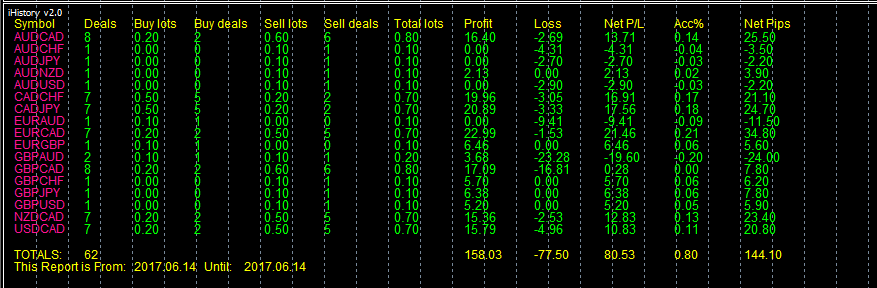

6_14

First day of testing basket EA on autotrade, up 144 pips! i will buy this EA after all the bugs are cleared.

6_15 Remember, pip value is 1 only for AUDUSD, EURUSD, GBPUSD and AUDUSD. Pip value is less than 1 for the rest of the pairs. Keep this in mind when setting basket TP in pips.

Asian hours trading plus GB monetary policy news and something else while I wasn't watching. +113 pips.

6_16

Final score for the day. Net loss!! I know what went wrong. Watching the EA real time is the only way to improve its logic. Back testing in multi-currencies is not possible - yet.

6_19

6_20 After major change in EA entry and exit logic

Let me repeat. It will take one month of demo and one month of live to see if the EA is any good. It is a slow process. I trade my live account manually as I have shown in all previous examples.

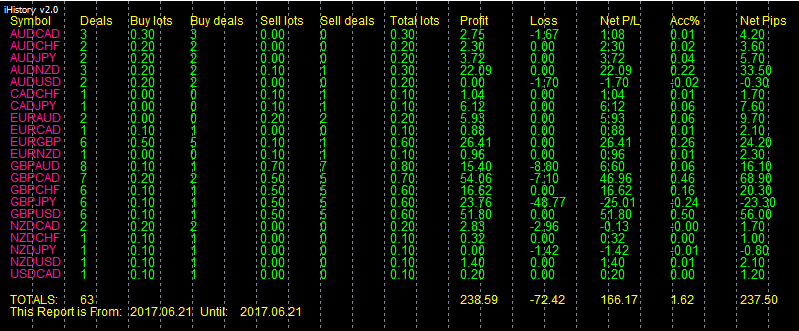

6_21 Two versions are running in the same account. There may be duplicate trades. Heavy DD at times. Exit matters.

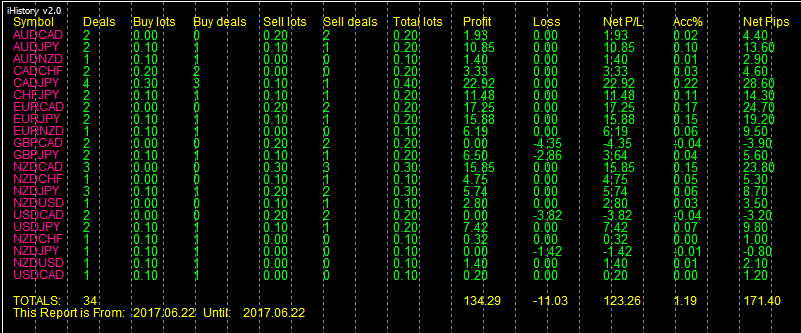

6_22

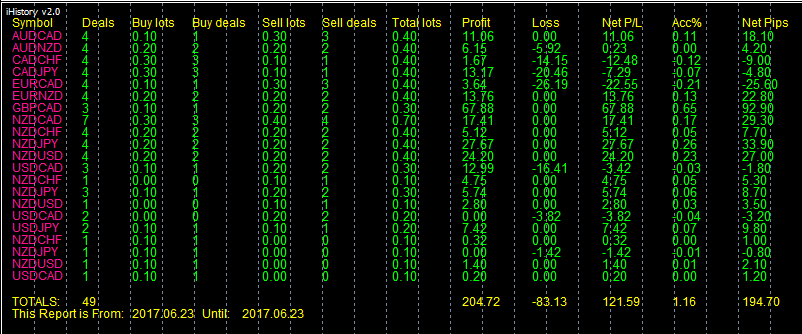

6_23 Preliminary (EA does not avoid news. CAD PPI today)

6_28 As of now, update with screen shots can not go through mql5.

Score for the day +149 pips or $110.51

7_12 Live

https://www.screencast.com/t/dquHisHnPx

7_13 EA has gone through several versions. V3 had a bug that triggered trades without following the entry rules. Because of this, the demo account suffered a heavy loss. Trades were closed manually. V4 is now being tested. So far so good.

7_14 Live

https://www.screencast.com/t/OlN7NIQHWZXh

7_31 Sorry guys. EA is not easy to develop. I am trying a different strategy in basket trading. Kashif made this indicator that shows the Net angle of one currency vs the rest of the basket currencies as one. The value below the bar is for the base currency and the value above the bar is for the quote currency. Here is a Buy CAD basket setup. A value of 6.29 means CAD angle vs the average angle of all other 7 currencies is 6.29 times of mFib23. Now we have a quantifiable criteria for basket entries for either iGap or oGap.

8_11 AUDUSD. USD tanked on PPI news. Here is what happened.

To me, double gap is a sign of strong trend and the trend will continue after some retracement. The strong oGap may not be easy to catch with a reasonable spread as brokers often widen spreads on high impact news. So, you may trade the retracement from over-bought (outside of the ATR channel) as I did and trade the resumption of the trend as I did.

https://www.screencast.com/t/4p7rXAm0

8_22 Short CAD basket. Good setup. I did live trades twice.

8_23 A Dashboard for manual trading is now available from Kashif Javed at Javedfxsolutions. I am using it. It gives me a glance of angles (in multiples of the golden angle) for all pairs and for basket currencies. Fabulous!

http://javedfxsolutions.wixsite.com/javedfxsolutions/acs28

8_24 Use the basket CS to support individual oGap trades (selective smaller basket)

https://www.screencast.com/t/U9cvWQaeu

Seconds later, selected basket iGap trades

https://www.screencast.com/t/pWnUtMjK

This is my latest precision basket trading strategy.

8_31 Tools of the trade

By now you should know that ACS28 is a unique tool, but not a Holy Grail. Here is how I use it along with other tools. If the ACS28 dashboard shows any indication of currency movement (golden angle multiples), I bring up the chart. Harmonic patterns always give me a heads up in direction bias. A picture speaks for itself.

https://www.screencast.com/t/psz40Fy1

9_22 MTF setup https://www.screencast.com/t/F3quNFbCcx3

2_20_2018 New tool: Currency Strength Deviation for reversals

https://www.screencast.com/t/btxGh9zbjW

2_22_2018

These are all reversal trades, nearly 100% profitable. On the Deviation signal (vertical dash lines) enter immediately after volume spikes. Trail profit by the ATR channel. Critical Volme replaces hook alert.

https://www.screencast.com/t/luwcL4Zgq

Live performance. After another week I will increase lot size.

https://www.screencast.com/t/4YbgTwzSdx

I am moving towards individual trades based on currency strength deviation and volume exhaustion. If many pairs have the same setup, they are all selected to trade like a baseket.

3_9_18 Update trading only the deviation reversals for a friend's account (available at http://javedfxsolutions.wixsite.com/javedfxsolutions/copy-of-acs28)

https://www.screencast.com/t/92xPjRhQ

End of Blog (no more update)

Notes:

Blindly launching a basket trading is no longer the best strategy. Selective basket trading is better. Cost averaging is also important. All the thoughts ae now in an EA. I will continue my learning and live trading using the deviation strategy and post findings in this new Blog https://www.mql5.com/en/blogs/post/717051

A new EA that trades iGap (not the oGap as in deviation reverals) is being tested in demo. Read my blog here https://www.mql5.com/en/blogs/post/717032

_____________________________________________________________________________________________________________________________________________________________________

What are my conclusions so far?

If there is an apparent strong move of only one currency in ACS28 (single gap) or Speed (single speed), trading the basket is logical and very rewarding. The risk is spread out and the profit can add up quickly once other currencies are catching up. The rule is simple, wait for one currency strength to exceed 161 Fib or 261 Fib. Buy or sell the whole basket of that currency.

If there are clear dGap (double gap), iGap (inside gap) or even oGap (outside gap) with a Golden Angle and dSpeed (double Speed) from 2 currencies, example https://www.screencast.com/t/kKxUxw1Fqq9x In that case, follow all Bernhard's rules and you will be profitable.

For both single gap and double gap setups, the lesson here is "Don't Driddle in the Middle" mFib161 and mFib261 are your best friends.

The only caveat in double gap setup is daily range. Here is what I am talking about. CHF and CAD were at the extreme (>mFib161), but the market did not result in a sizable gain. 5 pips for all that work. Small daily range of CADCHF is the problem. https://www.screencast.com/t/yejseEDbp1 I use this tool all the time for ADR and spreads https://www.mql5.com/en/market/product/21798 The 2nd factor is trading hours. I'll leave that to you to find out.

I have purchased 25 products from Mql5. Proof: https://www.screencast.com/t/F3Sq8IrdP Many are waste of money. These are on top of my to-keep list. AA is another one, but let's focus on one thing at a time.

https://www.mql5.com/en/market/product/13948#

https://www.mql5.com/en/market/product/18155

https://www.mql5.com/en/market/product/21276

________________________________________________________________________________________________________________________________________________________

Golden Angle and ACS28 Gap are game changers for all ACS28 users. They are made by Kashif Javed. Check it out under ACS28 menu here http://javedfxsolutions.wixsite.com/javedfxsolutions

______________________________________________________________________________________________________________________________________________________________________

Attached file is a "Script" to be placed in the Script folder. Asign hotkey Alt-A, all charts can be changed to one symbol.

Click LIKE if you find my blog useful.