USD/JPY: the beginning of the new fiscal year in Japan_03/04/2017

Current dynamics

The new trade week that has begun is connected with important events in the world of international finance and the publication of important macroeconomic data. One of the focus of traders will be the publication on Wednesday (21:00 GMT + 3) of the protocol from the last March meeting of the FOMC, at which FOMC raised the rate by 0.25% to a level of 1.0%.

Markets have already played this event; however, investors will be interested to see the text of the minutes of this meeting. As a rule, FOMC meetings discuss, among other things, a schedule for raising (or lowering) the basic interest rate. The Fed comments to the last rate increase in March indicated a two-time rate increase this year. If the FOMC protocols contain signals for the possibility of three or four rate increases, the dollar can receive significant support. Therefore, the importance of publishing this protocol and its impact on the dollar quotes is difficult to overestimate.

At the same time, it is worth paying attention to the fact that in Japan, March 31 ended the fiscal year. Japanese taxpayers, including export companies, which completed the annual period of repatriation of capital to Japan, for the most part have already paid taxes. In this regard, the pressure on the yen, including the active purchases on the Japanese stock market, which occur, usually at the beginning of the new fiscal year in the first half of April, can dramatically increase. The Japanese stock index Nikkey225, which has a high correlation with the pair USD / JPY, may begin to grow actively until April 15.

In this regard, it is worth being prepared for the growth of the pair USD / JPY, especially if it is accompanied by the strengthening of the US dollar in the foreign exchange market.

From the news for today, we are waiting for data from the USA. At 14:00 (GMT) will be published index of gradual acceleration of inflation, as well as the index of business activity in the manufacturing sector from ISM, which is an important indicator of the state of the US economy as a whole, for March. A number of representatives of the Federal Reserve gives a speech today (scheduled for today after 14:30 GMT). The US continues to receive positive macro statistics. Recently, representatives of the Fed sound hawkish notes regarding the plan for tightening monetary policy in the US. It is likely that today will not be an exception in the rhetoric of the representatives of the Fed. And if published earlier macro data on the US will again be positive, then the dollar will receive double support today.

Support and resistance levels

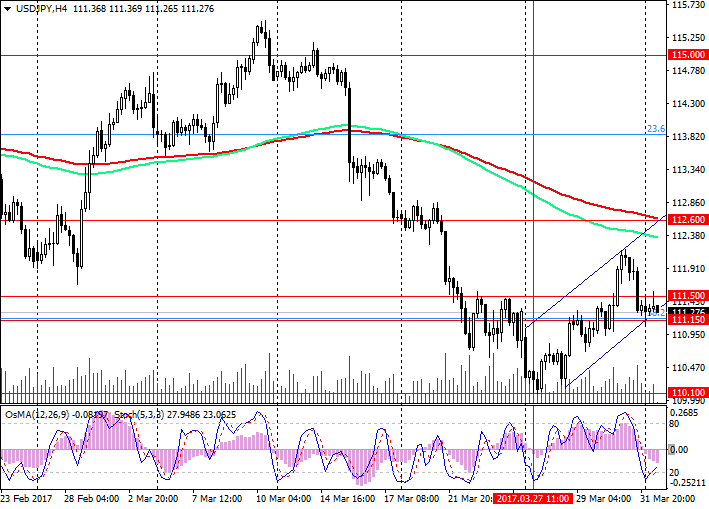

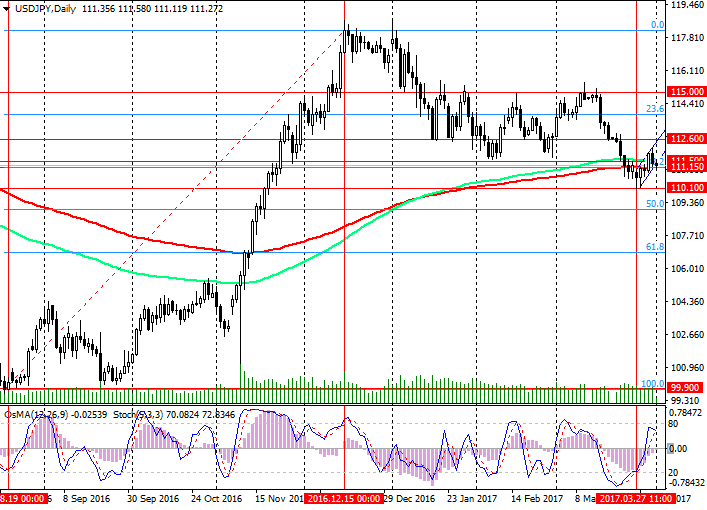

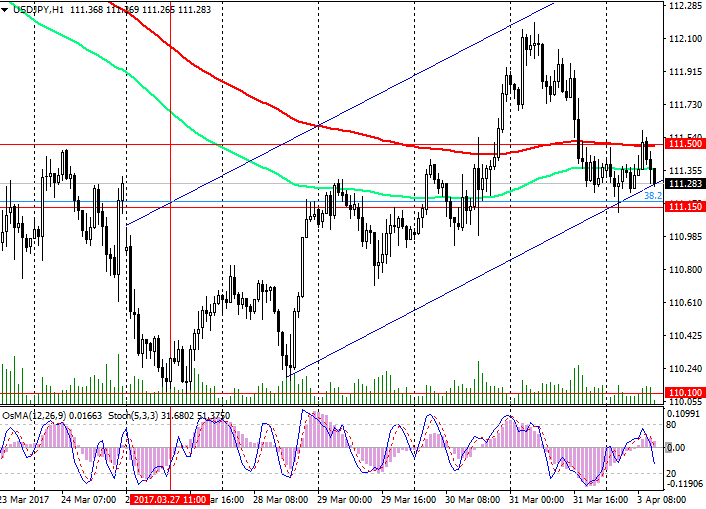

Earlier this week, the pair USD / JPY rebounded from the 110.10 support level (EMA144 on the weekly chart) and is trying to develop an upward trend, attempting to break through the short-term resistance level of 111.50 (EMA200 on the 1-hour chart).

USD / JPY managed to gain a foothold above the important support level of 111.15 (EMA200 on the daily chart). The pair is growing in the rising short-term channel on the 1-hour chart and is currently near the lower border of this channel.

On the daily chart, the OsMA and Stochastic indicators shifted to the buyers’ side. In case of breakdown of the resistance level 111.50, the pair USD / JPY may continue to the resistance level 112.60 (EMA200 on the 4-hour chart and the upper limit of the rising channel on the 1-hour chart). In case of consolidation of the pair USD / JPY above this level, the risks of further growth of the pair to the 115.00 level will increase.

The reverse scenario is related to the breakdown of the support level at 111.15 (EMA200 on the daily chart and the Fibonacci level of 38.2% correction to the pair growth since August of last year and the level of 99.90) and the resumption of the decline. The nearest target is level 110.10.

We follow the dynamics of the index of the Japanese stock market Nikkey225. The growth of the index on the background of active purchases at the beginning of the new financial year will pull the yen's sales, including in the pair USD / JPY. Positive dynamics of the pair USD / JPY is maintained, while the pair is above the support level of 111.15.

Support levels: 111.15, 110.10, 109.00

Resistance levels: 111.50, 112.60, 113.80, 115.00

Trading Scenarios

Buy Stop 111.50. Stop Loss 111.10. Take-Profit 112.00, 112.60, 113.80, 115.00

Sell Stop 111.10. Stop Loss 111.50. Take-Profit 110.80, 110.10, 109.00, 108.25, 106.50