USD/CAD at Risk for Further Losses Sub-1.33

Talking Points

- USD/CAD Responds to slope support- Strength to be sold sub-1.33

- Updated targets & invalidation levels

.

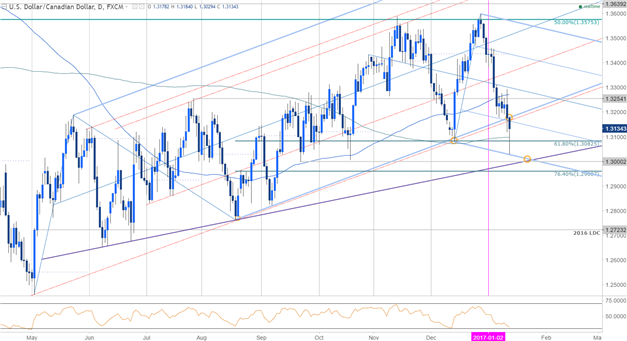

USD/CAD Daily

Technical Outlook: USDCAD posted an outside-day reversal yesterday with the subsequent break below a key support confluence around 1.3164/80 keeping the immediate short bias in play while below this level. Note that this region is defined by the lower median-line parallel extending off August low, a longer dated trendline support extending off the late-2014 low (red) and the 50-line of the current operative descending pitchfork. Broader bearish invalidation is eyed at the weekly highs, which converges on the median-line around 1.3295.

USD/CAD 240min

Notes: A closer look at price action highlights a sharp reversal today at the lower parallel (blue), just ahead of confluence Fibonacci support at 1.3015/25. Bottom line: the focus heading into the close of the week is on this range into 1.3164/80, with the risk weighted to the downside while below the highlighted resistance zone. A break lower targets subsequent support objectives at 1.2658 & 1.2884-1.29.

A breach above near-term resistance would suggest a larger recovery is underway & invalidates the near-term short-bias. Such a scenario eyes targets at 1.3247 & the median-line / weekly high at 1.3294-1.3314- areas of interest for exhaustion / short-entries. A quarter of the daily average true range (ATR) yields profit targets of 27-30 pips per scalp. Added caution is warranted tomorrow with US Advanced Retail Sales & the University of Michigan confidence surveys likely to fuel added volatility in the dollar crosses.

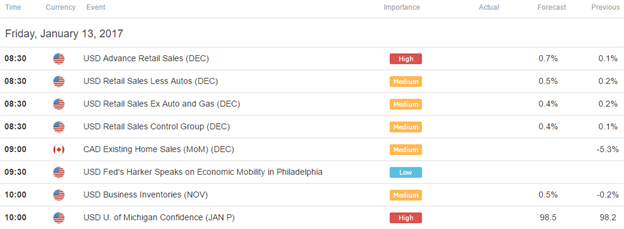

Relevant Data Releases