NZD/USD: on the background of falling global supplies of dairy products

Trading recommendations

Sell in the market. Stop-Loss 0.7210. Take-Profit 0.7100, 0.7085, 0.7055, 0.6975, 0.6930, 0.6900, 0.6860

Buy Stop 0.7210. Stop-Loss 0.7170. Take-Profit 0.7240, 0.7275, 0.7380, 0.7485

Technical analysis

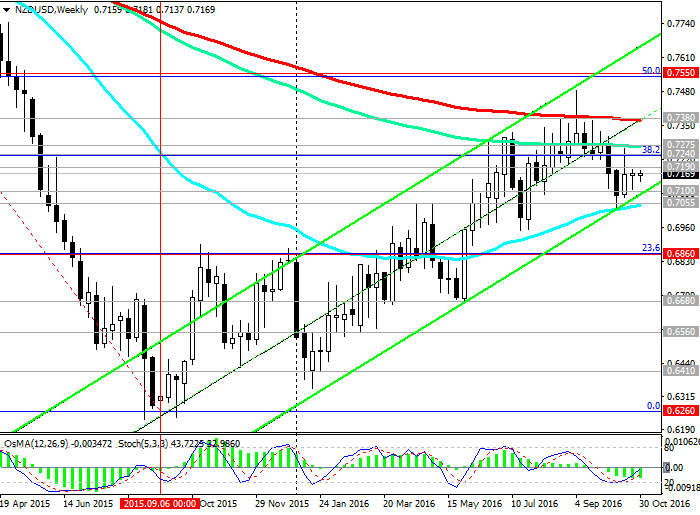

With the opening of today's trading day the pair NZD / USD is growing and remains in the rising channel on the weekly chart, the upper limit of passing above the resistance level 0.7550 (50.0% Fibonacci level of upward correction to the global wave of decrease in pair with the level of 0.8800, which began in July 2014 of the year).

The pair rebounded from the support level 0.7100 (the lower boundary of the rising channel on the weekly chart), 0.7055 (EMA50 on the weekly chart) and develops an upward movement to the nearest resistance levels 0.7240 (38.2% Fibonacci level), 0.7275 (EMA144 on the weekly chart), renewing previously failed rises above resistance level 0.7380 (EMA200 on the weekly chart). The correction to the support level 0.7055 (EMA200 and the lower boundary of the rising channel on the daily chart) was 5.7%, or 400 points.

Indicators OsMA and Stochastic on the 4-hour and daily charts went over to the buyers.

In case of breaking the resistance level of 0.7190 is possible to revert to the long positions to 0.7380 (EMA200 on the weekly chart). Break of 0.7380 resistance level will increase the risk of further growth of pair within the rising channel on the weekly chart. While the pair NZD / USD is above the support level of 0.7055, the pair rising dynamics preserved.

In the case of the breakdown level of 0.7100 the immediate goal will be the level of 0.7055. The breakdown of this important support level may lead to further bearish movement to the support level 0.6860 (23.6% Fibonacci level).

Support levels: 0.7100, 0.7085, 0.7055, 0.6975, 0.6930, 0.6900, 0.6860

Resistance levels: 0.7190, 0.7240, 0.7275, 0.7380, 0.7485

The growth of the Australian dollar and sparked the growth of other commodity currencies against the US dollar, including the New Zealand dollar. As already known, the RBA left interest rates today in Australia unchanged at 1.5%. In a statement, the RBA stated that "taking into account available information and, after easing monetary policy at meetings in May and August, the bank's board considered that the preservation of the old policy at this meeting would correspond to the sustainable economic growth and achievements since the inflation target." Strengthening New Zealand dollar also contributed to today rising commodity prices. So, today published the price index for raw materials RBA, which is considered a leading indicator of changes in the export prices, showed a 16% growth in October (in annual terms). Price changes directly affect the GDP of countries with economies dependent on exports of commodities and exchange rates in these countries. New Zealand also belongs to the category of such countries as the most important export article of the country is dry milk and other dairy products.

The New Zealand dollar is supported by improving the terms of trade in New Zealand against a background of falling global supplies of dairy products and almost inevitable rise in prices of dairy products, the main export product of New Zealand.

Interest rates in New Zealand also remain relatively high, despite the likelihood of further decline. Current interest rate in New Zealand is at the level of 2%, remaining one of the highest in the world among countries with developed economies. And it attracts investors to purchase New Zealand almost a safe currency, income, as well as traders who use «carry-trade» strategy, when a more expensive currency is bought at the expense of cheaper.

Despite the fact that the Reserve Bank of New Zealand is likely to again reduce the official interest rate in November (RBNZ meeting is scheduled for November 9) and, possibly, in the 1 st half of 2017, the New Zealand dollar retains its position in the foreign exchange market, and the pair NZD / USD is in a steady uptrend.

From the news today forward data from the US. Between 17:00 - 18:00 (GMT + 3) will be published on the block US major macroeconomic indicators for October (the index of gradual acceleration of inflation from the ISM (estimate 54), the index of business activity in the manufacturing sector ISM (forecast 51.5)) .

If data will be weaker than forecast, it will give an additional impetus to the pair NZD / USD.

Otherwise, if the US data come out stronger, the US dollar quickly regains lost ground.

In the period after 18:00 the index is published on dairy product prices, which usually causes a spike in volatility in the New Zealand dollar trade. The last two weeks before the auction of dairy products have a slight increase in world prices for dairy products. The price index for dairy products, prepared by the Global Dairy Trade, came out with a value (1.4%). The main export article of the country is just milk. Regular price cuts will put pressure on the New Zealand currency, and vice versa.

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.