Hi everyone! Let’s update our forecasts for May. The broader "risk-on" trend is still in play, which means the USD is likely to keep weakening against other currencies.

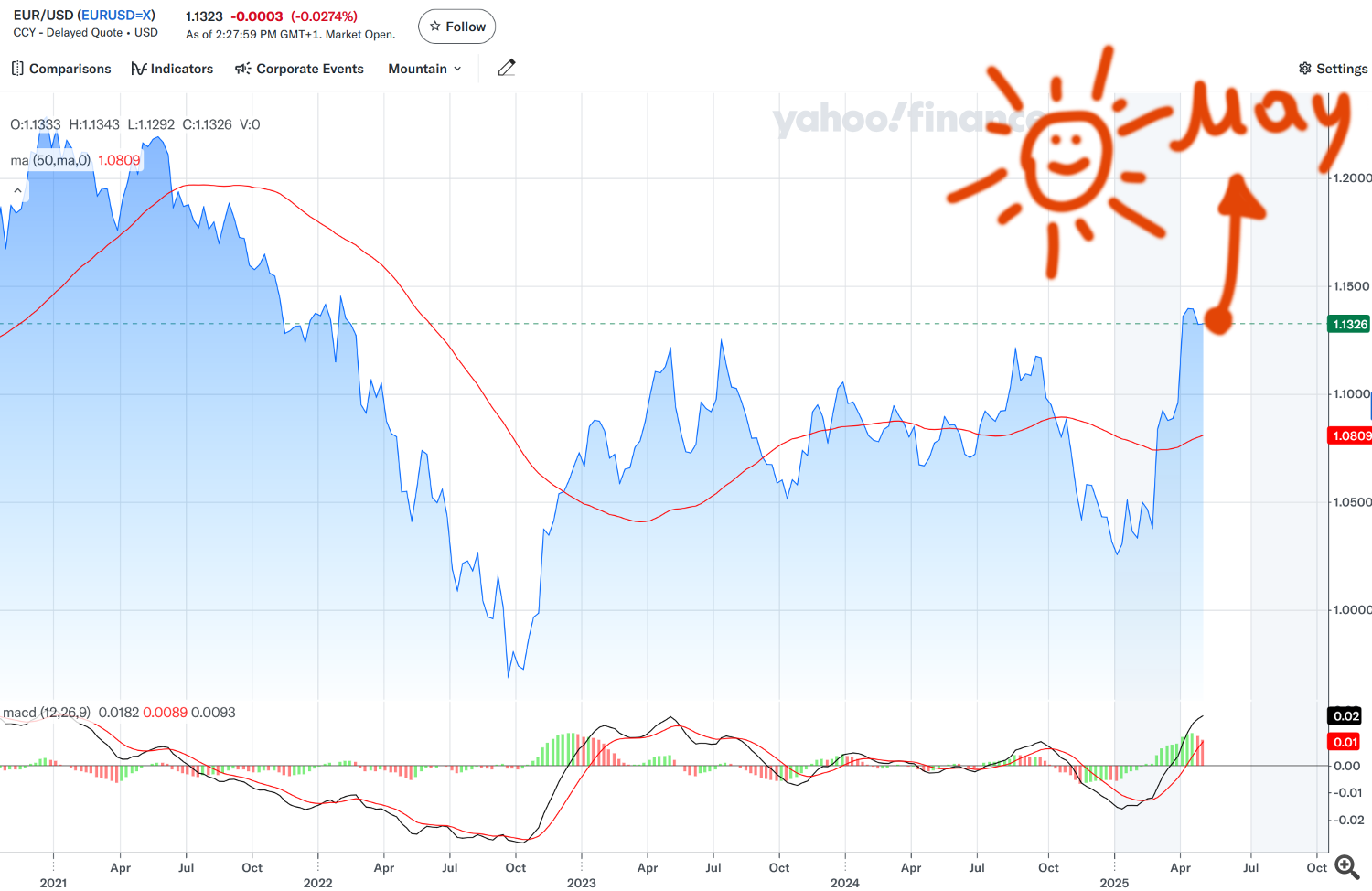

EurUsd:

Last time, I called the April rally correctly — and EurUsd is still in a strong position, eyeing that big 1.20 target. As for the trade war chatter that was supposed to be a big deal in Trump’s agenda… well, who even knows at this point? It might be off the table entirely since negotiations are happening. Meanwhile, stocks are rallying again, which supports EurUsd’s uptrend. My take? It’s heading to 1.20 in May.

GbpUsd:

The key level here is 1.40, and it’s within striking distance (just ~600 pips away). But there’s a catch — we’re seeing a double top forming on the chart. These patterns are rare and tend to mess with traders’ heads because everyone expects a mirror-image drop. Could GbpUsd pull back to 1.28? Absolutely! The market has already priced in all the drama — conflicts, trade tensions, Trump uncertainty — so there’s no fresh catalyst. That said, I still think GbpUsd will push higher in May and make a run for 1.40.

Gold:

If you bought Gold in the early 2024, congrats — you’re sitting on a massive gain! But seriously, have you just been watching it skyrocket this whole time without taking profits? I’ve been warning about a pullback since March, and April finally delivered a dip after that insane 3,500 peak. Now, I expect Gold to test the first psychological 3,000 level in May.