Every now and then entrepreneurs have the opportunity to leverage new technology.

The internet gave entrepreneurs a global reach in the late 90's.

Trading Forex gave entrepreneurs the freedom to operate their business on the road... and creating a massive opportunity for savvy entrepreneurs. I believe this is the most exciting time to be alive because it's never been easier to start a business or leverage your skills to create an additional income stream... And currency trading is leveling the playing field in a way we haven't seen since people started using the internet for e-commerce.

We'll go through the basics and see dozens of scenarios happening right now, and how a strict rule-based methodology can help you to be on the right side of the market trading with the big investors.

- Learn to trade like professional traders do

- Learn and apply a strict methodical rule based on Currency Strength strategy

- Works for scalping, intraday and swing trading

- Learn how the markets works with only one chart

- Methodology ideal for those who work full time. Use live alerts send to your email. Never miss one opportunity again.

Thousands of hours have been spent and many research to perfect these formulas and levels. It truly is our passion to develop new alternative trading strategies! To get verified statistics thousands of trades have been analyzed with automated forward testing.

29 winners in a row.

35 pip TP

35 pip SL

Risk: Reward ratio 1:1

Something must be right!

A winning strategy

The 28Pairs Currency Strength Trading System - also known as Double-GAP Strategy - is our primary trading philosophy and is based on exploiting individual currency strength and weakness.

The principle idea is buying strength and selling weakness. This is a fundamental strategy for investors in all marketplaces. Most amateur retail traders in Forex either ignore this winning strategy or are unaware of it.

With this strategy, we look at individual currencies rather than currency pairs and then buy the strong currency and sell it against the weak currency. This will give your trading a real edge.

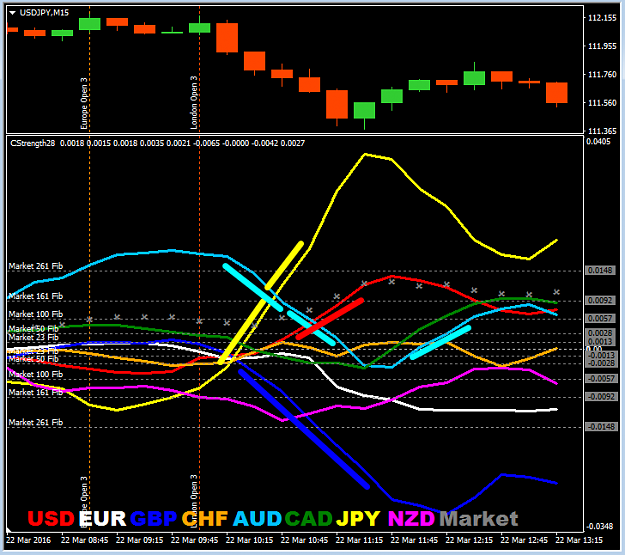

When we refer to the Market we mean THE 8 main currencies and the 28 FX pairs that are derived from those 8 currencies.

The market has to be seen always in equilibrium. If one currency is bought some other(s) must be sold. This we could call her money flow. (We may use terms in a different way as they are used usually on this site).

When we analyze the market we look at the whole market which to us is 8 currencies and 28 pairs. (Exotic pairs are not included for now.)

When most traders look at a chart to find a trade setup they would need to check 28 charts to understand what the Forex market is doing. When you use the Currency-Strength28 strategy you only look at currencies, not pairs, and for that, we need to check only ONE CHART! Do you understand now the edge?

So lets first have a look at the 8 main currencies which are:

US Dollar, Euro, Yen and Pound, these are the most important because they have the largest trading volume, then there are Swiss Franc, Australian, Canadian and New Zealand Dollars.

Each single currency belongs to a single economy. Some currencies are trending up some currencies are trending down, this information you can not see from a single pairs chart. For example: if the EURUSD pair is trending up you do not know why from looking at a single chart. Maybe the Euro is strong and the USD is flat or the Euro is flat and the USD is weak or even both are strong and the Euro is just stronger. Remember in any chart there are two currencies they are called the BASE and the QUOTE currency.

To maximize your wins and minimize your losses you need to know what an individual currency is doing in the context of the whole market. Staying with our EURUSD example: an EURUSD chart will show you only 1/28th of the market so you only have a small amount of information to base your trading decision on. Given that each currency can be paired with 7 other currencies you should be basing your trade decision on the information that all 14 pairs give you. By using the CStrength28 indicator you can get all that information from just the one chart.

Now you may know all of that already but stay put we will add new kind of technical analyses!

The goal of the strategy is to find out the sentiment of the market and which pair is good to trade and which pair is not. As a trader, you should know if a currency is trending, consolidating or reversing as this will give you information on how to trade. Do we look for continuation or do we look for pullback/reversal? This is THE most important information you need to trade and this strategy will give you the answer!

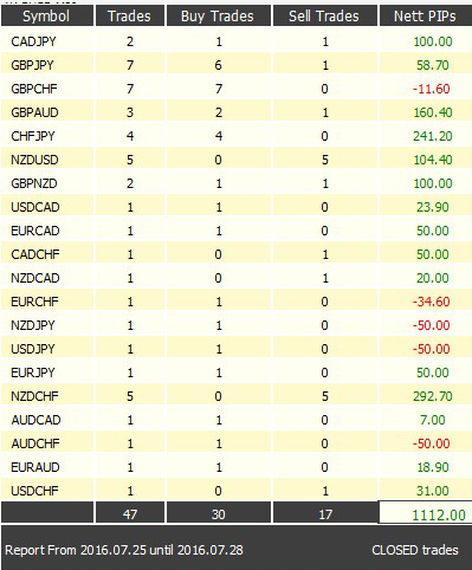

1112 pips winner!

With 1 lot trade size, it will pay about $10 per pip depends slightly on the pair.

WILL BE CONTINUED...

Scan all 28 Forex pairs with only ONE chart...

Info: currencystrength28@gmail.com

The CURRENCY GAP

Terms I will be using in this blog may be different from usual.

CS=Currency Strength Line, GAP=(currency up or down), sGAP=single GAP, dGAP=double GAP, iGAP=inside GAP, oGAP=outside GAP, iDir=inside Direction, oDir=outside Direction, MaMom=Market Momentum, MFib=Market Fibonacci level.

Now we will go to some examples for illustration. I prefer a graphical demonstration.

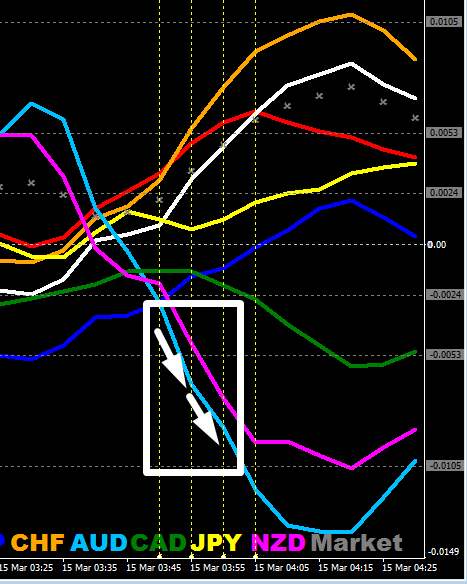

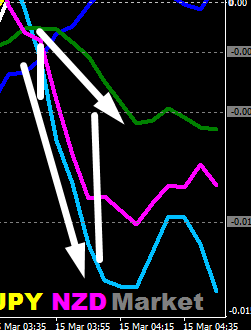

The Currency GAP is used for a move of single Currency (up or down after candle close for the last 2 or 3 bars in a defined angle)

sGAP or single GAP (CS weak against weaker)

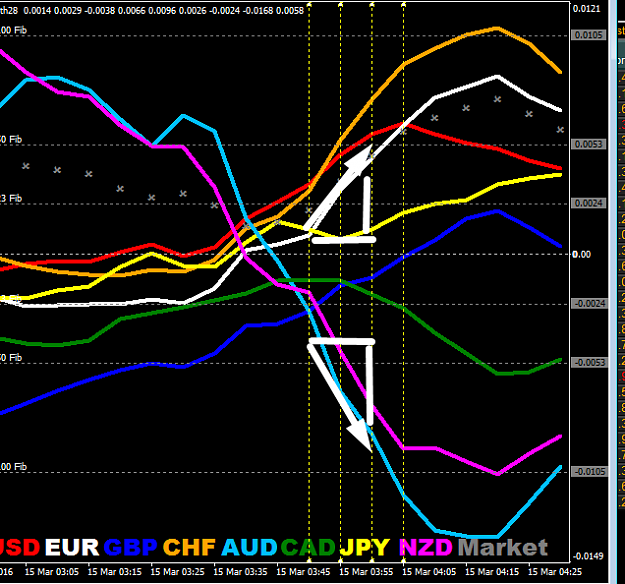

dGAP or double GAP (2x GAP in opposite direction)

Definition of double-GAP how it is used here:

We need 2 separated Currency GAP's to get one double GAP:

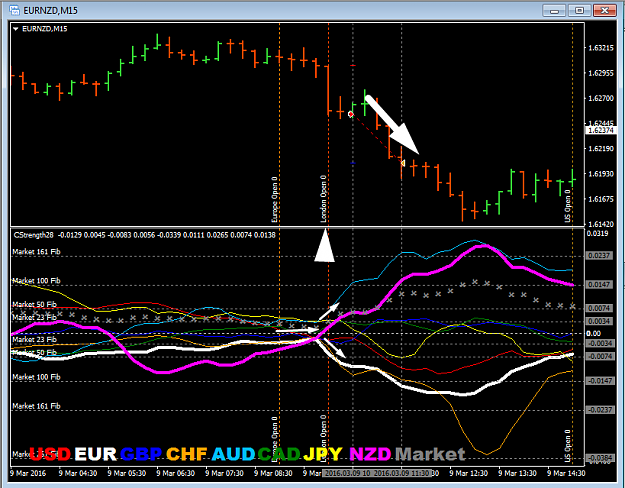

Example EURNZD:

We check after a candle closed:

Take the currency strength of EURO and compare it 2 candles back to get the EUR GAP

Take the currency strength of NZD and compare it 2 candles back to get the NZD GAP

IF EUR GAP is down and NZD GAP is up = sell EURNZD

This is a double GAP!

The double-GAP (dGAP) is always a currency move in the opposite direction. It is the separated currency strength change of the base and the quote currency.

The single GAP:

After we have seen the double GAP (dGAP) we need also understand the simple GAP (sGAP) which is often used. It is the currency strength change between the base and the quote currency. A double GAP is always a simple GAP too but a simple GAP is not always a double GAP.

A simple GAP can be:

Currency A is weak and currency B is WEAKER

Or currency A is flat and currency B is stronger

Or currency A is little weak and B is stronger

And those are weak trades and vulnerable to pullbacks.

A double GAP means 2 separated triggers so we look at quote and base currency separated:

Currency A is weak and currency B is strong

Or currency A is strong and currency B is weak

This applies to every time frame (analyses in multi-timeframe we will see later!).

A specialized indicator is used Advanced Currency Strength28 Indicator.

ACS28 Version 9+: https://www.mql5.com/en/blogs/post/697384

Additionally, we've recently developed the Dynamic Forex28 Navigator, which offers even more insights for traders. You can explore it here: https://www.mql5.com/en/blogs/post/758844

It works on all time frames.

Again back to the GAP.

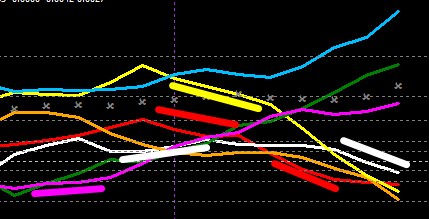

To define a currency (CS) is weak or strong I look at the slope (angle) of at least the last 2 bars or periods (because the currency line is not a candle should be called over 2 periods).Those GAPs are to flat

Those are nice CS angles

THIS BLOG WILL BE continuously be UPDATED !! So check again.

READ ALSO THE NEXT 20 COMMENTS.