Check July Performance and all Active Positions here.

USDCAD Short Setup

USDCAD has entered into a corrective move with the current rally having the form of an a-b-c which suggests that a new low below 1.30 might be on the table. With Crude Oil inventories scheduled for today, and crude in its lowest levels (also oversold), there are high chances of a bounce in the commodity which would take USDCAD to lower levels.

Entry = 1.312

Stop Loss = 1.3252

T1 = 1.3047 / T2 = 1.2926/ T3 = 1.2870

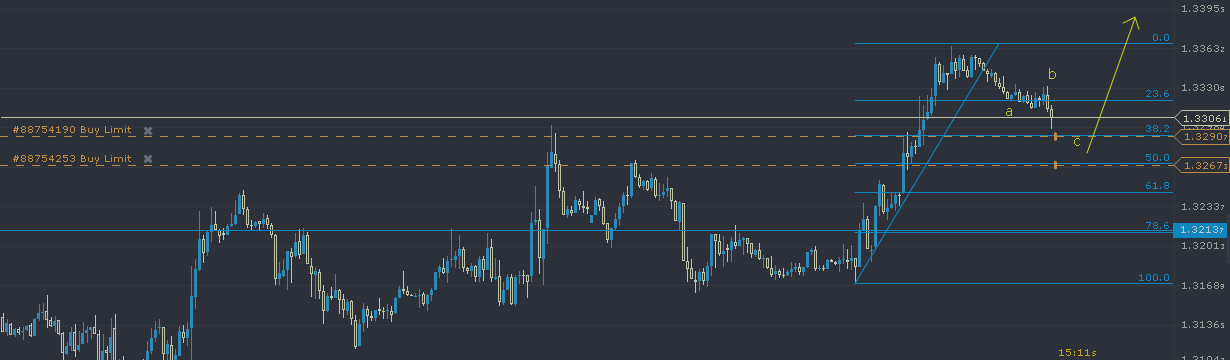

GBPUSD Long Setup

We stated on our last GBPUSD signal when it was trading on 1.31 that the pair needs to go higher around 1.34 level. That is exactly what happened, and now we are looking to buy the pullback around 38% Fibonacci as GBPUSD needs to make a new high if the 1.3213 level is not tested again.

Entry = 1.329 & 1.327

Stop Loss = 1.3213

T1 = 1.3365 / T2 = 1.34

US500 Long Setup

S&P 500 is currently trading in oversold levels while a 5 move down was completed. We expect a bigger recovery of an a-b-c move as indicated in the chart with the targets. This is a counter-trend trade, however the risk reward is very favorable at these levels and the probability of this scenario is high.

Entry = 2150 & 2146

Stop Loss = 2141

T1 = 2155/ T2 = 2161/ T3 = 2170

USDJPY Long Setup

It appears as if USDJPY is refusing to break the previously established low consolidating at 101 levels. We might experience a short covering rally given that RSI indicates oversold levels. The risk reward ratio is favorable however given the setup, it is recommended for traders to open minimum size positions.

Entry = 101

Stop Loss = 100

T1 = 102 / T2 = 103.3

Check July Performance and all Active Positions here.

For analyses on Commodities, Indices/Futures and Equities visit http://www.impulsivewavetrading.com/