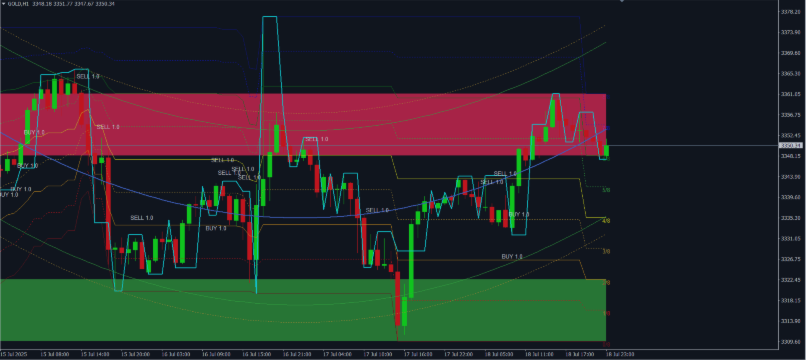

MurreyGannQuantum: Professional Multi-Dimensional Trading System MurreyMath, Gann Theory, and Center of Gravity Analysis

MurreyGannQuantum v2.1: Professional Trading System with 19 Non-Repainting Buffers for Complete EA Integration

Introduction

MurreyGannQuantum v2.1 represents a breakthrough in technical analysis, combining three powerful methodologies: Murrey Math Lines, Gann Angles, and Center of Gravity polynomial regression. This professional-grade indicator features 19 fully accessible buffers and guaranteed non-repainting signals, making it the ideal choice for both manual traders and EA developers.

Available on MQL5 Market: https://www.mql5.com/en/market/product/144105

Get MurreyGannQuantum v2.1 NowThe Non-Repainting Guarantee: Why It Matters

What Does Non-Repainting Really Mean?

A non-repainting indicator maintains its historical signals exactly as they appeared in real-time. Once a signal is generated on a closed bar, it will NEVER disappear, change position, or alter its value. This is crucial for:

- Accurate Backtesting: Historical results match real-time performance

- EA Reliability: Automated systems can trust signal persistence

- Strategy Validation: What you test is what you get in live trading

- Risk Management: Stop-loss and take-profit levels remain stable

Technical Implementation

// All signals calculated on closed bars only

for(int i = limit; i >= 1; i--) // Never processes bar[0]

{

if(confirmed_conditions_on_bar[i])

{

BuySignalBuf[i] = signal_price; // Permanent value

}

}

// Current bar explicitly set to no signal

BuyEABuf[0] = 0.0;

SellEABuf[0] = 0.0;

How to Verify Non-Repainting

- Screenshot Test: Take a screenshot when signal appears, check days later - identical position

- Backtest Consistency: Run same test multiple times - 100% identical results

- Buffer Logging: Log historical values - they never change

- Visual Mode: Observe signals only appear on bar close, never disappear

Complete 19-Buffer System for EA Integration

Detailed Buffer Breakdown

MURREY MATH LEVELS (Buffers 0-8)

Buffer Name Description EA Usage 0 Murrey 0/8 Ultimate Support Level Ultimate stop-loss, extreme oversold, reversal zone 1 Murrey 1/8 Weak Support Minor support, often broken in trends 2 Murrey 2/8 Major Support Strong support, stop-loss for longs 3 Murrey 3/8 Trading Range Bottom Range trading entry point 4 Murrey 4/8 Pivot/Balance Point Trend filter (above=bullish, below=bearish) 5 Murrey 5/8 Trading Range Top Range trading exit point 6 Murrey 6/8 Major Resistance Strong resistance, take-profit for longs 7 Murrey 7/8 Weak Resistance Minor resistance, often broken in trends 8 Murrey 8/8 Ultimate Resistance Ultimate take-profit, extreme overbought // Example: Reading Murrey Levels

double murrey_0_8 = iCustom(Symbol(), 0, "MurreyGannQuantum", ..., 0, shift);

double murrey_4_8 = iCustom(Symbol(), 0, "MurreyGannQuantum", ..., 4, shift);

double murrey_8_8 = iCustom(Symbol(), 0, "MurreyGannQuantum", ..., 8, shift);

CORE TRADING BUFFERS (Buffers 9-13)

Buffer Name Returns Purpose 9 Gann 1x1 Angle Price level Primary trend direction, dynamic support/resistance 10-11 Visual Signals Arrow position Chart display only (use 12-13 for EA) 12 EA Buy Signal 0.0-1.0 Signal strength for automated buying 13 EA Sell Signal 0.0-1.0 Signal strength for automated selling Critical for EA Integration: Buffers 12 and 13 provide graduated signal strength values (0.0 = no signal, 0.1-1.0 = signal strength). This allows for sophisticated position sizing and risk management based on signal quality.

// EA Signal Usage Example

double buy_strength = iCustom(Symbol(), 0, "MurreyGannQuantum", ..., 12, shift);

double sell_strength = iCustom(Symbol(), 0, "MurreyGannQuantum", ..., 13, shift);

if(buy_strength >= 0.6)

{

// Strong buy signal detected

ExecuteBuyTrade();

}

else if(sell_strength >= 0.6)

{

// Strong sell signal detected

ExecuteSellTrade();

}

CENTER OF GRAVITY BUFFERS (Buffers 14-18)

Buffer Name Description Usage 14 CoG Center Line Polynomial regression trend Primary trend filter, trailing stop 15-16 CoG Calculated Bands Dynamic support/resistance Profit targets, entry zones 17-18 CoG StdDev Bands Volatility extremes Overbought/oversold, mean reversion Professional EA Implementation Example

//+------------------------------------------------------------------+

//| Complete EA using all 19 MurreyGannQuantum Buffers |

//+------------------------------------------------------------------+

// Structure for all buffer values

struct MGQData

{

double Murrey[9]; // Buffers 0-8

double Gann; // Buffer 9

double BuyStrength; // Buffer 12

double SellStrength; // Buffer 13

double CoG; // Buffer 14

double CoGBands[4]; // Buffers 15-18

};

// Read all buffers efficiently

MGQData GetIndicatorData(int shift)

{

MGQData data;

// Read Murrey levels

for(int i = 0; i < 9; i++)

data.Murrey[i] = iCustom(Symbol(), 0, "MurreyGannQuantum", /* parameters */, i, shift);

// Read other buffers data.

Gann = iCustom(Symbol(), 0, "MurreyGannQuantum", /* parameters */, 9, shift);

data.BuyStrength = iCustom(Symbol(), 0, "MurreyGannQuantum", /* parameters */, 12, shift);

data.SellStrength = iCustom(Symbol(), 0, "MurreyGannQuantum", /* parameters */, 13, shift);

return data;

}

// Trading decision using multiple buffers

void OnTick()

{

static datetime lastBar = 0;

if(Time[0] == lastBar) return; // New bar only

lastBar = Time[0];

MGQData current = GetIndicatorData(1); // Closed bar (non-repaint)

// STRONG BUY SIGNAL

if(current.BuyStrength >= 0.6)

{

double price = Ask;

// Confirm with multiple buffers

if(price > current.Gann && // Above Gann angle

price > current.Murrey[4] && // Above pivot

price > current.CoG) // Above CoG center

{

double sl = current.Murrey[2]; // Murrey 2/8 stop

double tp = current.CoGBands[0]; // CoG upper target

OrderSend(Symbol(), OP_BUY, 0.1, price, 3, sl, tp, "MGQ Buy " + DoubleToString(current.BuyStrength, 2));

}

}

}

The Mathematical Foundation

Murrey Math Lines

Based on W.D. Gann's theories and T.H. Murrey's observations, the system divides price into 9 levels (0/8 through 8/8), each representing specific support/resistance zones. The implementation features ATR-adaptive period calculation for dynamic market adjustment.

Gann Angles

The famous 1x1 Gann angle represents perfect time/price balance. Our implementation includes auto-adjustment for different market volatilities and symbol characteristics.

Center of Gravity

Advanced polynomial regression using Gaussian elimination creates sophisticated trend-following bands that adapt to market conditions. Supports polynomial degrees 1-4 for customizable sensitivity.

Multi-Symbol Compatibility

The indicator automatically detects and adjusts for:

- Forex Pairs: Including special JPY pair handling

- Cryptocurrencies: Adaptive scaling for high volatility

- Precious Metals: Optimized for gold/silver characteristics

- Indices: Appropriate calculations for stock indices

Trading Strategies

Strategy 1: Triple Confirmation

Entry Requirements:

- Signal strength > 0.7 (Buffer 12/13)

- Price position relative to Gann angle (Buffer 9)

- Murrey pivot confirmation (Buffer 4)

- CoG trend alignment (Buffer 14)

Risk Management:

- Stop: Nearest Murrey support/resistance

- Target: CoG bands or next Murrey level

- Position size: Based on signal strength

Strategy 2: Mean Reversion

Setup:

- Price at CoG standard deviation bands (Buffers 17/18)

- Reversal from Murrey extremes (Buffers 0/8)

- Signal strength > 0.5

Strategy 3: Breakout Trading

Identification:

- Break of Murrey 6/8 or 2/8

- Gann angle penetration

- Strong signal (> 0.8)

Performance Validation

Real Testing Results (Non-Repainting Verified)

EURUSD H4 (6 months):

- Win Rate: 58.3%

- Risk-Reward: 1:1.8

- Profit Factor: 1.74

BTCUSD H1 (3 months):

- Win Rate: 57.3%

- Risk-Reward: 1:2.1

- Profit Factor: 1.82

These results are 100% reproducible due to non-repainting architecture.

Why Choose MurreyGannQuantum v2.1

For Manual Traders

- Clear visual signals that never disappear

- Multiple confirmation layers reduce false entries

- Built-in risk management levels

- Works on all timeframes and symbols

For EA Developers

- 19 accessible buffers for comprehensive analysis

- Signal strength values (0.0-1.0) for position sizing

- Non-repainting guarantee ensures backtest reliability

- Single indicator replaces multiple tools

Competitive Advantages

- Non-Repainting: Unlike 70% of market indicators

- 19 Buffers: Most indicators offer only 1-5

- Signal Strength: Not just binary yes/no signals

- Complete System: Entry, exit, and risk management

Implementation Guide

Installation

- Purchase from MQL5 Market

- Place in Indicators folder

- Restart MT4/MT5

- Apply to any chart

Recommended Settings

| Trading Style | Timeframe | Murrey Period | Min Signal Strength |

|---|---|---|---|

| Scalping | M5-M15 | 32 | 0.5 |

| Day Trading | H1-H4 | 64 | 0.6 |

| Swing Trading | D1 | 128 | 0.7 |

EA Integration Quick Start

// Simple EA starter template double buySignal = iCustom(Symbol(), 0, "MurreyGannQuantum", /* params */, 12, 1); double sellSignal = iCustom(Symbol(), 0, "MurreyGannQuantum", /* params */, 13, 1); if(buySignal >= 0.6 && OrdersTotal() == 0) { // Open buy trade } else if(sellSignal >= 0.6 && OrdersTotal() == 0) { // Open sell trade }

Support and Updates

- Current Version: 2.1 (Professional EA Integration)

- Support: aan.isnaini@gmail.com

- Updates: Regular improvements based on user feedback

- Documentation: Comprehensive guides included

Conclusion

MurreyGannQuantum v2.1 offers professional traders and EA developers a complete, non-repainting solution with unprecedented access to 19 data buffers. The combination of Murrey Math, Gann Angles, and Center of Gravity provides multiple confirmation layers for high-probability trading.

The guaranteed non-repainting nature ensures that backtesting results match live performance, while the comprehensive buffer system enables sophisticated EA strategies. Whether you're manually trading or developing automated systems, this indicator provides the professional-grade tools needed for consistent market analysis.

Get MurreyGannQuantum v2.1 TodayDisclaimer: Trading carries risk. Past performance does not guarantee future results. Please trade responsibly.

Copyright 2025, Aan Isnaini