AynGannRand / Profile

Proprietary Equities Trader

at

SFG Trading

Friends

31

Requests

Outgoing

AynGannRand

Market finally confirmed the end of a micro correction (wave 4) these first days of 2017 and has established a bullish 1-2 setup for the next leg up towards 2285-2300...

Share on social networks · 3

283

AynGannRand

Market Update: January 03-06; Futures, Commodities & ETFs!

2 January 2017, 22:31

Author: Favio Poci In this weekly market update you will see charts, wave counts and Fibonacci targets on the following instruments: E-Mini, SPX Dow E-Mini (YM), IWM (Russell ETF) Gold, GLD & GDX...

AynGannRand

Yesterday market broke important support and put an end to wave i of 3 (of our Primary Analysis) and stopped right at 162% extension level. Both our 3 short-term targets were met: 2157, 2153 and 2145. Previous Article - E-Mini, SPX: Is the Market Topping...

AynGannRand

Crude has continued its downward journey and yesterday went near 50% Fib retracement level. Downside structure is complete and needs to reverse soon. In the next charts, we will see what levels need to be breached to signal a bottom Previous Article - Crude Oil: Needs a New Low but...

AynGannRand

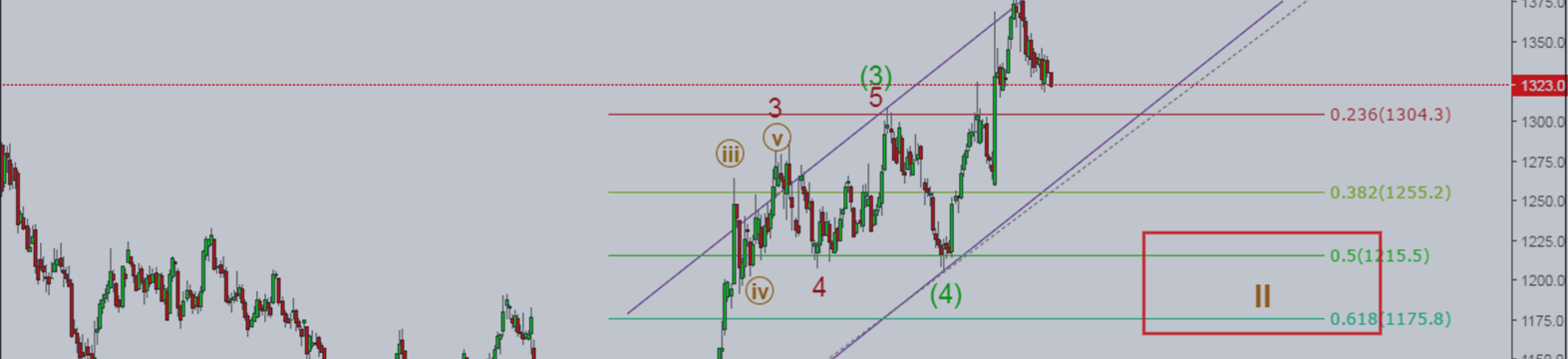

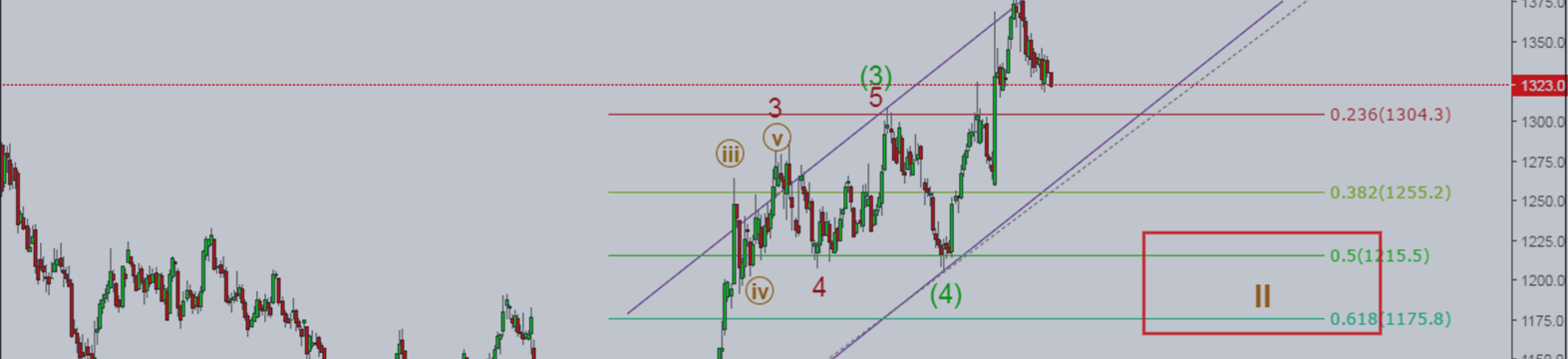

Commodities Performance-All Trades . This past week has been one of the best for Gold which has followed a strong bullish trend with minor pullbacks. The last update on gold was published 1 week above when it was trading on $1325 level while we had upper targets...

AynGannRand

E-Mini made a new high on Monday during Asian hours and followed the last ED wave to complete wave v and wave 1. Last Friday, we expected that market would made a higher weak high because two important levels did not breach on the downside (2151 and 2143.50 - September Contract...

AynGannRand

The primary view on gold has not changed and this is a daily complementary analysis for shorter term trades. Gold is entering into a deeper correction which initially targets 23.6% retracement of the 2016 rally and lower levels later on...

Share on social networks · 1

380

1

AynGannRand

The bigger picture for Gold remains the same with a deeper correction on the table. However, hesitation to break EMA 20 on the daily chart might be an indication of a temporarily recovery ahead. The temporary bullish scenario is even more likely because shorter term charts indicate the same trend...

Share on social networks · 1

271

AynGannRand

Last week, E-Mini reached our initial target at 2162, made a high at 2168 and entered into a wave 4 that seems to be complete today in Pre-Market trading...

AynGannRand

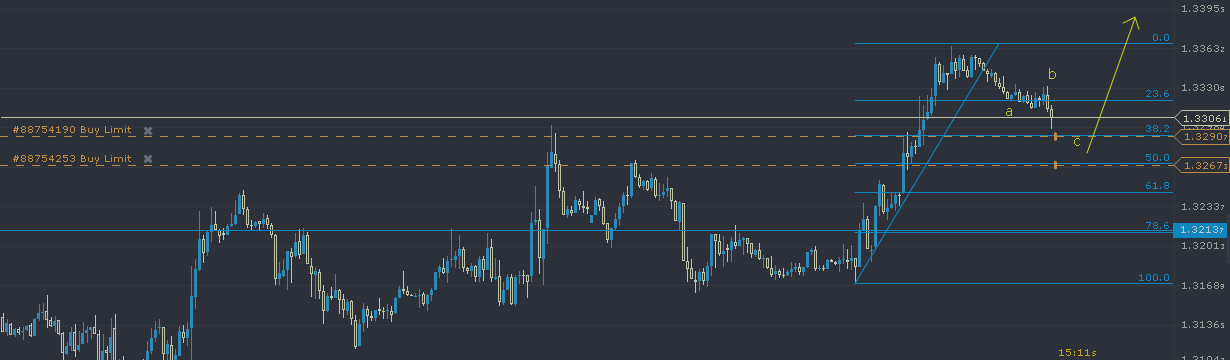

Yesterday we posted our weekly analysis of USDCAD which you can review here. We stated that 1.265 should not be breached and as expected USDCAD bottomed right above that level at 1.267...

AynGannRand

USDCAD Daily Chart - June 22, 2016 In the above daily chart, we expect USDCAD to test 1.33 - 1.35 price area in order to complete the intermediate corrective red (B) wave. Immediately after the end of red wave (A), USDCAD rallied from 1.25 to 1.32 with 3 inner waves, completing blue wave (a...

AynGannRand

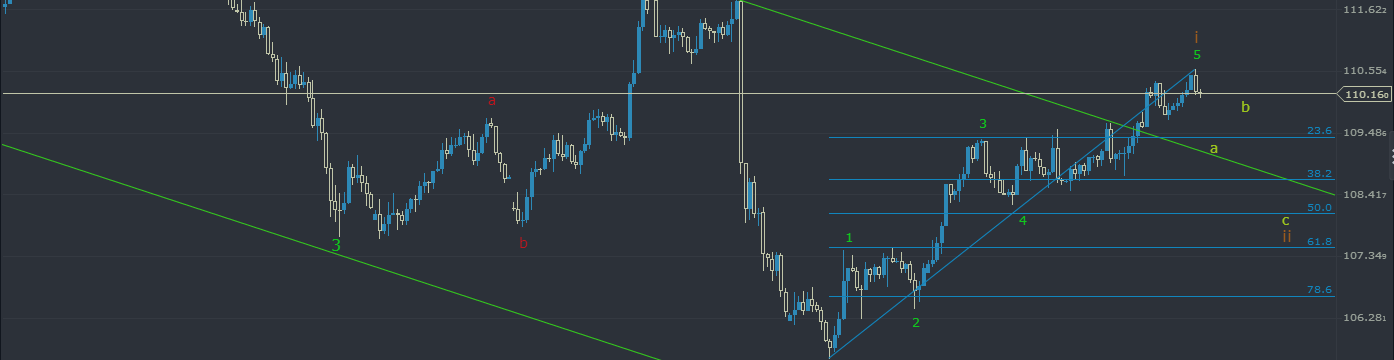

In our last update regarding USDJPY: Easy & Difficult – Update! we stated that USDJPY needed to hold above 106.7 in order for the bullish scenario to be considered...

AynGannRand

USDCAD Daily Chart - May 30, 2016 USDCAD is going according to our analysis and on the longer term we expect price to reach in the (B) target, anywhere inside the box where price ranges from 1.35-1.38...

AynGannRand

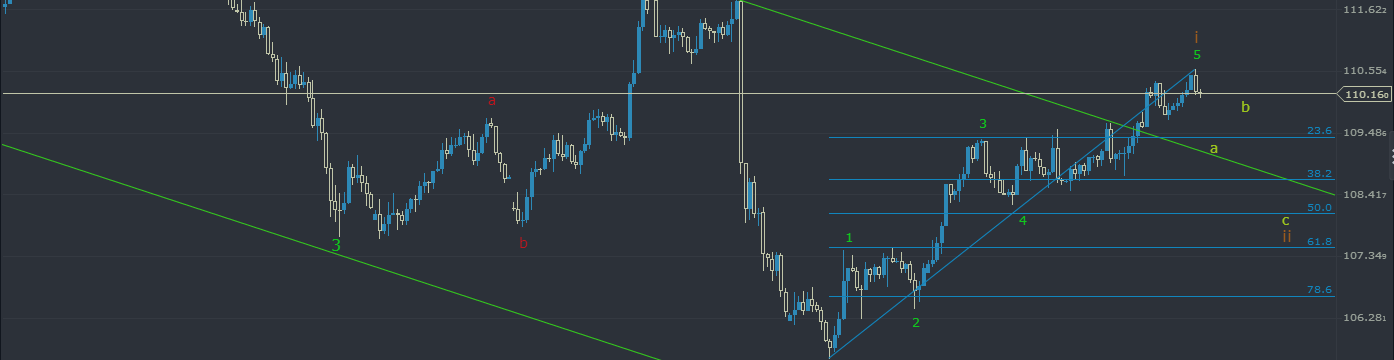

In our last article here, we discussed the potential move that USDJPY needed to make towards new highs, especially a jump over 110 by targeting more than 110.40. Also, USDJPY broke above the bearish upper-bound that we were expecting to see in order to confirm this bullish rally off the lows...

AynGannRand

In our last article on ES-Mini, ES-Mini: 2000 on the way, IF...!, we discussed our short-term outlook for the market and alerted for a short position...

Share on social networks · 1

190

AynGannRand

As stated in our March 9th analysis on EURUSD, this rally is a corrective wave 4 and even though we expected EURUSD to reach 1.17-1.18 levels, recent action has put a question mark on that event. A break of 1...

AynGannRand

Prerequisite Reading: USDJPY: What Are We Looking for Our Short Swing! USDJPY bounced in the level we called, and what we have seen up to now has been an impulsive wave up, which will be confirmed only if a new high is made (above 109.4...

Share on social networks · 1

125

AynGannRand

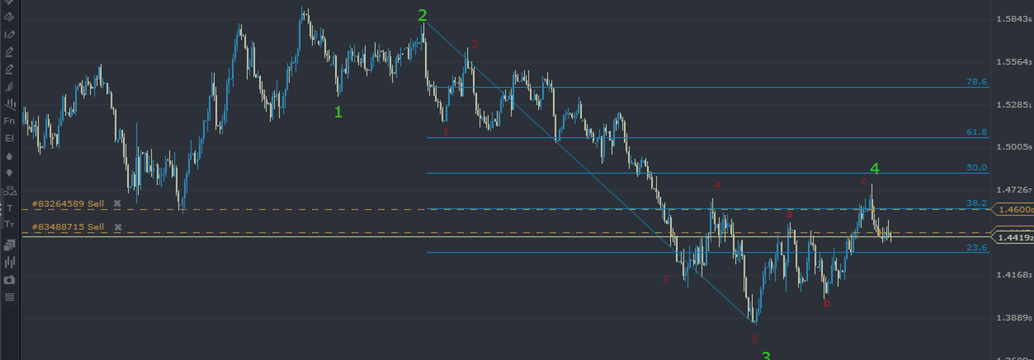

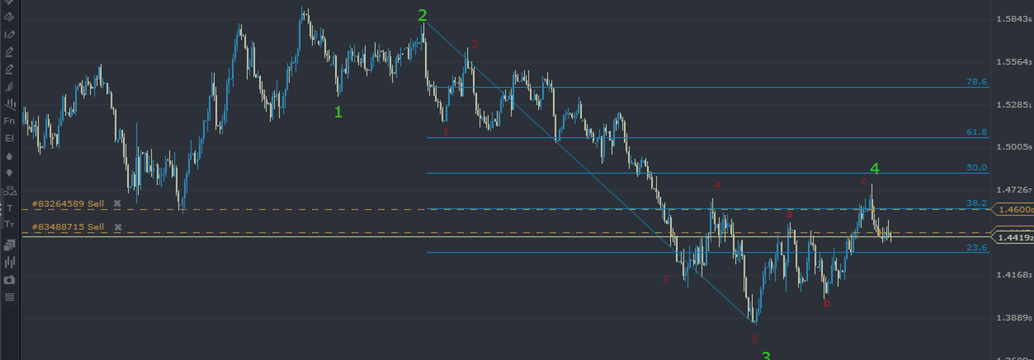

All the traders that follow our signals know that we have been calling the long setup of GBPUSD from 1.413 (article here) and that we took profits at 1.460 (article here...

Share on social networks · 1

210

AynGannRand

"We bought at 106.42 with a stop-loss at 106.15 and target 1 at 108 (100% extension level) and target 2 at 109.00 (162% extension level)." - USDJPY: We Bought...

Charles Blair

2016.05.11

did you send this out as a email? by the time i saw this post the entire trade was finished.

AynGannRand

2016.05.12

Yes I know this signal was delayed. The trade was opened 10th May 16:00 and the email was sent yesterday 12:07 CET (+1).

I was busy trading and lost track of time :(

Sorry you missed it

I was busy trading and lost track of time :(

Sorry you missed it

: