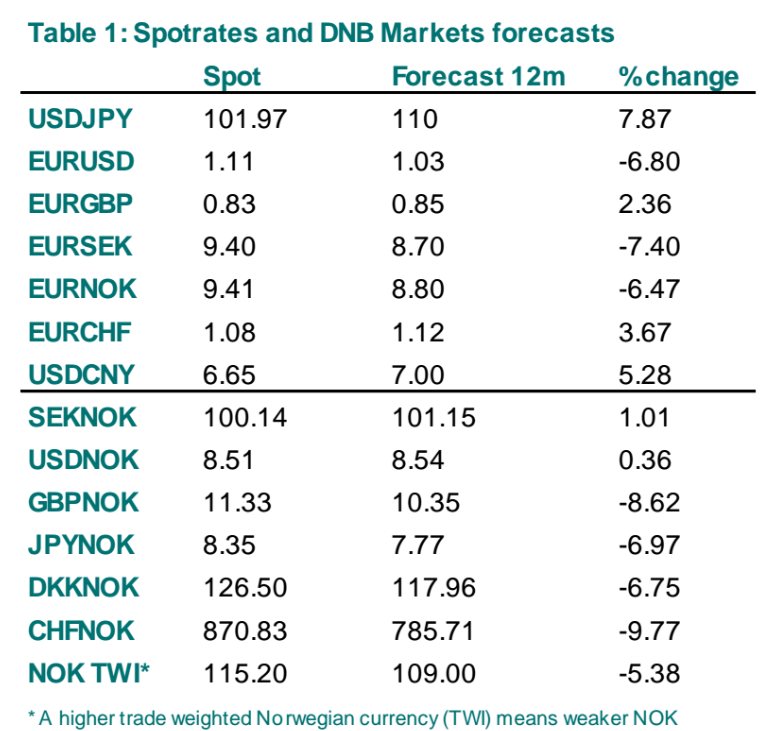

DNB Markets have updated their foreign exchange forecasts for the new post-Brexit world and the dollar and Scandis are the big winners.

DNB Markets forecast the dollar to strengthen, the euro to fall, the pound to continue its post-Bexit down-trend a little further, Scandi’s to rise and safe-havens to give back their Brexit risk premiums.

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105

DNB’s Magne Ostnor and Camilla Viland expect the pound to continue its down-trend, falling to 0.85 (EUR/GBP) to the euro over the next 12 months, a move of 2.36%.

0.85 EUR/GBP equates to 1.1765 in GBP/EUR.

Commenting on the UK economy and the pound, the two analysts say:

“Growth will slow due to increased uncertainty, negative trade effects and tighter financial conditions. The BoE will respond by an interest rate cut to -0.25%. The policy will remain at this low level to 2019. GBP (sterling) will recover when uncertainty abates and fears of a severe negative economic shock reduce.”

They also see sterling falling by -8.63%, versus the Norwegian Krone (NOK), reaching 10.35 in 12 months’ time.

They are bullish NOK, which they view as undervalued:

“When volatility eases, we expect appetite for the NOK to pick up again, helped by steadily higher oil prices. We still believe the NOK is undervalued.”

The safe-haven yen and franc are expected to fall in value as uncertainty subsides. USD/JPY is expected to rise to 110, from its current 101.97 level, and EUR/CHF to 1.12 from the current 1.08 in the next 12 months.

Dollar to rise and Euro to Fall

Their view on the dollar is that overall it will rise despite lower interest rate expectations.

In relation to this is their noteworthy forecast of EUR/USD falling to 1.03 in the next 12-months.

In relation to this they say:

“Dollar demand picked up after Britain’s Brexit decision. EURUSD has seems to have stabilized around 1.10 -1.11.”

Followed by:

“Concerns regarding negative economic and political consequences following the Brexit decision has weighed on the euro.”

They further point out that Treasury bond yields fell to such a low level following Brexit that they actually showed a higher chance of the Fed cutting rates in 2016 rather than raising them as previously thought.

The yield on the German Bund also reached mega-lows of -0.17% meaning investors have to pay for the privilege of lending the German government money!

DNB’s forecasts for 1,3 and 12 months is 1.09, 1.08 and the previously mentioned 1.03.

As far as monetary policy goes, DNB see the Federal Reserve and the ECB most likely doing the following:

“Diverging monetary policy indicate a stronger USD. We see a next Fed hike in December and three hikes in 2017. The ECB is likely to cut the deposit rate to -0.6% and increase its asset purchases.”

Immediate developments

Analysts see news from the post-Brexit EU summit this week as critical in framing the road-map for the UK’s exit.

Important data from Norway is released in the week ahead, including Retail Sales (Wed) and Registered Unemployment (Fri).

The rate meeting for the Swedish central bank or Riksbank as it is called, is on the 4th July.