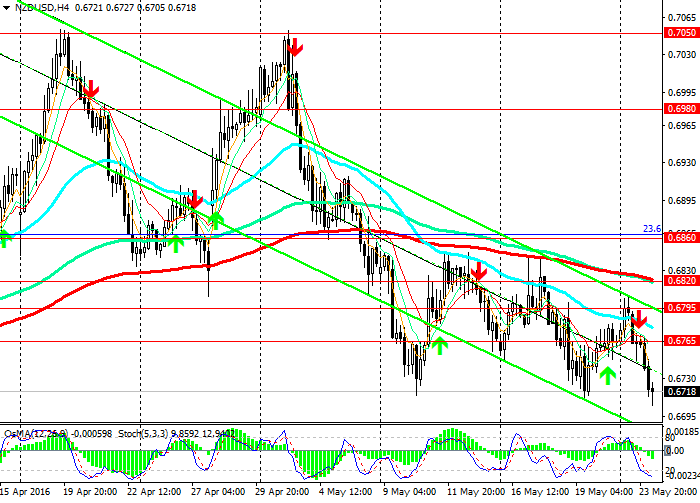

NZD/USD: To the Level of 0.6560. Technical Analysis as of 24.05.2016

NZD/USD: To the Level of 0.6560. Technical Analysis as of 24.05.2016

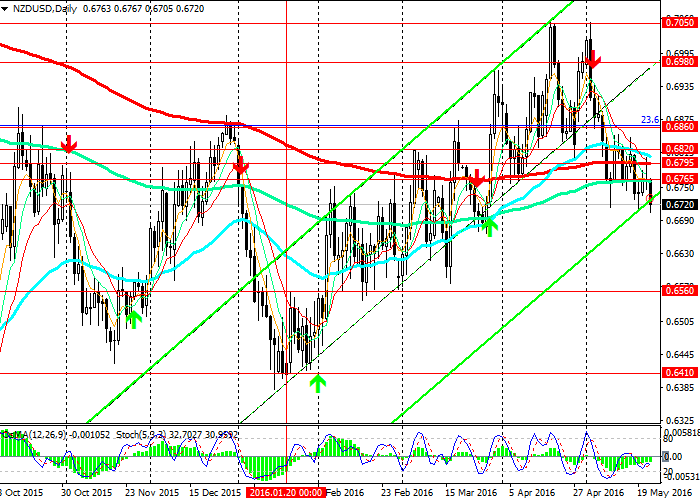

Review and dynamics

By mid-April the pair NZD/USD had reached the highs at the level of 0.7050. At the beginning of May the pair returned to this level and then started to decline. The fall in the pair was caused by the total rise in the USD and downward dynamics in the NZD, caused by weak macro-economic data of New Zealand and adherence of RBNZ to the soft monetary policy.

The pair NZD/USD fell by 5%, from the level of 0.7050, breaking out important support levels of 0.6860 (Fibonacci 23.6% to the decline in the pair from the level of 0.8800, which started in July 2014 and ЕМА50 on the weekly chart), 0.6795 (ЕМА200 on the daily chart), 0.6765 (ЕМА144).

Our opinion

On the daily, weekly and 4-hour charts the indicators OsMA and Stochastic give signals for opening short positions. The pair is likely to decline to 0.6560 (lower line of the ascending channel on the weekly chart).

Breakout of this level may trigger further decline with the target of 0.6400 and 0.6300 (lows of 2015).

As an alternative scenario the pair can breakout resistance levels of 0.6860 and continue to rise in the ascending channel on the daily chart with the upper limit at the level of 0.7240 (Fibonacci 38.2%) and the nearest targets of 0.6980, 0.7050 (highs of April and May, ЕМА200 on the monthly chart).

Support levels: 0.6725, 0.6700, 0.6610 and 0.6560.

Resistance levels: 0.6765, 0.6795, 0.6820, 0.6860, 0.6910, 0.6980 and 0.7050.

Trading tips

Sell on the market. Stop-Loss: 0.6770. Take-Profit: 0.6700, 0.6650, 0.6610, 0.6560 and 0.6400.

Buy Stop: 0.6820. Stop-Loss: 0.6780. Take-Profit: 0.6860, 0.6900, 0.6980, 0.7000, 0.7050, 0.7100 and 0.7240.

In the descending channel

Breakout of the important support levels